Chart of the Week - Disinflation desire

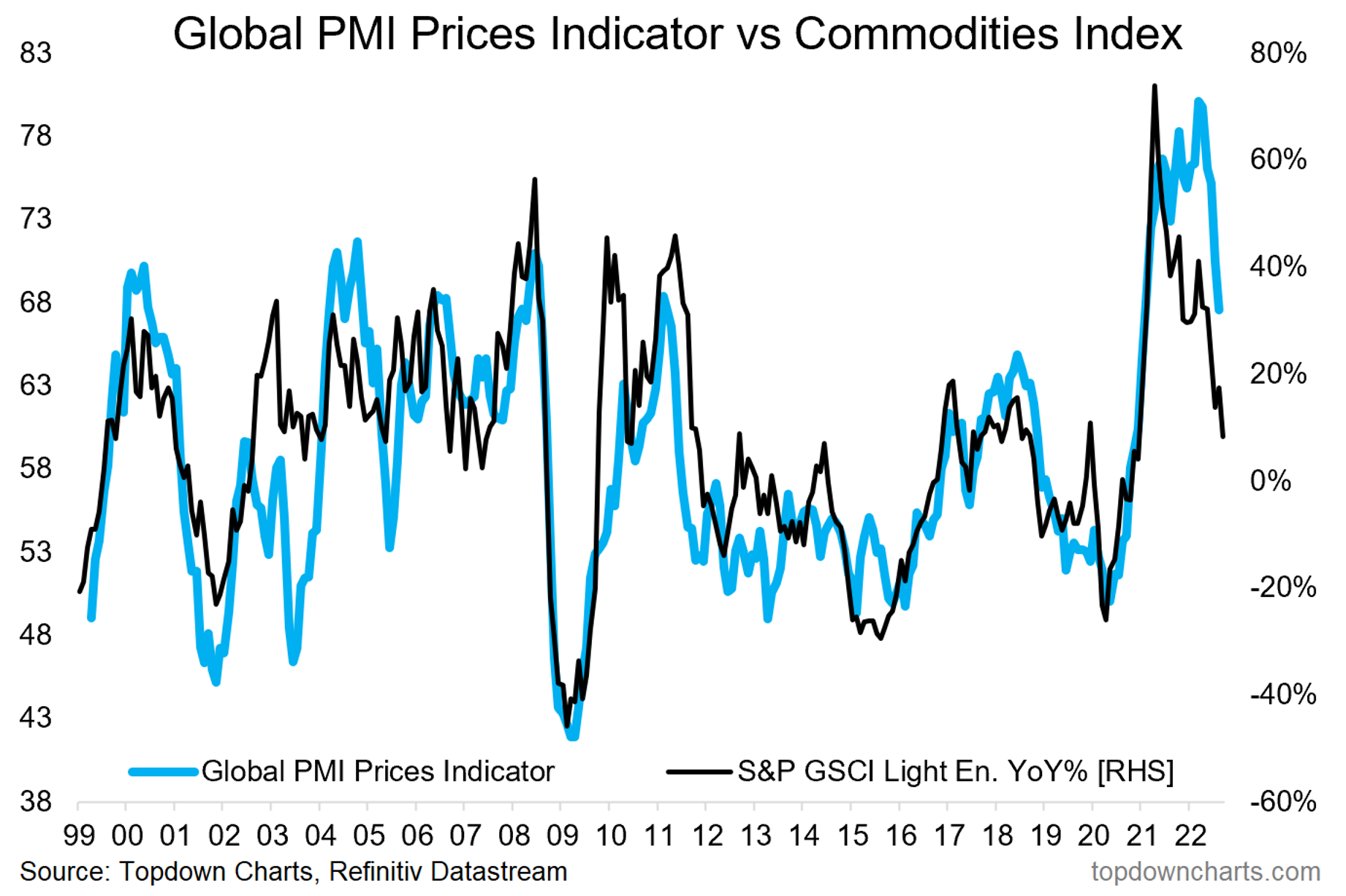

Pricing Pressures Peaked (Piqued?): The global PMI pricing pressure indicator peaked earlier this year, and if past correlations hold we should expect further easing of pricing pressures as commodity disinflation takes hold.

A key reason why the apparent correlation in this chart “works“ is because firstly commodity prices have a direct impact on costs, but also a key driver of marginal demand for commodities is the actual business cycle itself.

General demand levels go up = general pricing pressures go up (“ceteris paribus“).

On that note, the increasing downside risks to global growth that we are seeing (weaker data, downward sloping leading indicators) will likely weigh further on commodity prices and further contribute to easing of price pressures.

Indeed, this is all part of the monetary policy plan: tighten policy, crush growth, send inflation lower.

And that’s one reason why we still can’t get excited about a potential policy pivot or even a pause just yet. Astute observers will note that while the PMI pricing pressures index has come down, it is still at the upper end of the range of the past decade.

So if your job KPI’s are to bring down inflation and to avoid anchoring inflation expectations higher, then you’re going to stick to that monetary policy plan: tighten policy, crush growth, send inflation lower…

Key point: Pricing pressures peaked thanks to commodity disinflation.

NOTE: this post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

3 topics