Chart of the week - giddy index investors

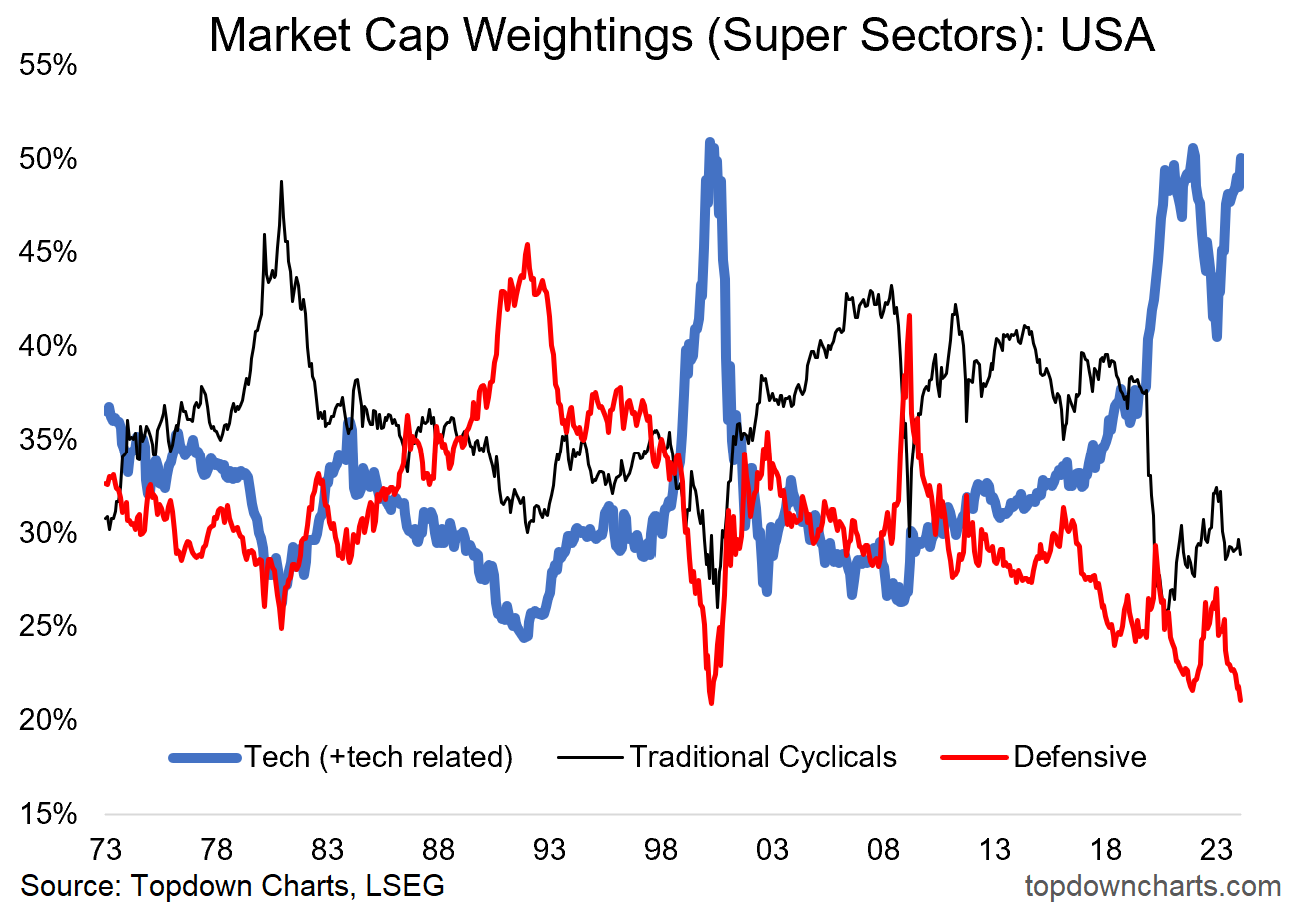

This chart may come as a surprise — maybe a shock — to those chilling in index funds.

Before we dive into the detail and implications of the chart, the key thing to remember is that index investing is not passive, it is an active strategy administered by index companies where in the case of a market cap-weighted index, the *strategy* is to “just buy the biggest stocks“.

Given the cheap cost (and success) of this simple strategy, it has become the most popular way of investing in stocks by fund investors (with passive funds taking the dominant share of total funds under management and net new flows).

It’s a strategy that works well in winner-take-all trending market regimes (e.g. the rise and rise of big tech), as it automatically skews investors into the bigger winningest sectors and stocks, and out of the losing sunset stocks and sectors.

The side-effect?

The chart below says it all.

Index investors in a typical market-cap weighted US equity index have almost a 50% exposure to tech and tech related sectors*.

Meanwhile, the index has become far less defensive than usual (almost a record low cap weighting to utilities, consumer staples, healthcare).

This makes an index investor all the more exposed to any downside in tech stocks by having both a greater weighting to that sector and smaller weighting to defensive sectors (which typically fall less or sometimes even hold ground during a downturn; hence the term defensive).

There’s also the much smaller weight than usual to traditional cyclicals (like energy, materials, industrials, financials) — which means the US will gain less in a more traditional goods and hard activity based economic upturn (p.s. Global ex-US is over 50% traditional cyclicals).

As a minimum this chart should make investors pause to think about sector allocations and implications in terms of exposure to risk — but also think more carefully about asset allocation. The lower defensive weight could be offset at the portfolio-level by defensive asset allocations (e.g. bonds, gold, other lower/non-correlated assets), or even tactically raising allocations to defensive equities (something I talked about in the latest report for clients).

An interesting, perhaps surprising chart — with important implications.

Key point: Index investors are heavily exposed to tech, and relative to history are significantly underexposed to defensives.

*n.b. I have added Consumer Discretionaries [which has Tesla + Amazon in it now: over 40% cap], and Communication Services [which has Meta/Alphabet/Netflix in it now: over 55% cap] to the traditional Technology sector to correct for the 2018 GICS changes which spun a bunch of tech stocks out of the Tech sector — Hence the term Tech (+tech related) for the tech super sector.

5 topics