Charts and caffeine: Goldman's top three ASX healthcare stocks

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session plus share the best of our insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,750 (-3.89%) - Friday's closing level was considered by some to be a year-end target for the index. This morning's closing level puts the SPX back into (technical) bear market territory and at its lowest level since January 2021.

- NASDAQ - 10,807 (-4.69%)

Tesla and Netflix both finished more than seven percent lower. Meta, Boeing Airlines, Moderna, Disney, and Intel all breached 52-week lows in the session. One small bright spot in the after-hours trade was Oracle due to a beat on Q4 revenues and cash flows. Whew.

- CBOE VIX - 34.90 (+25.77%)

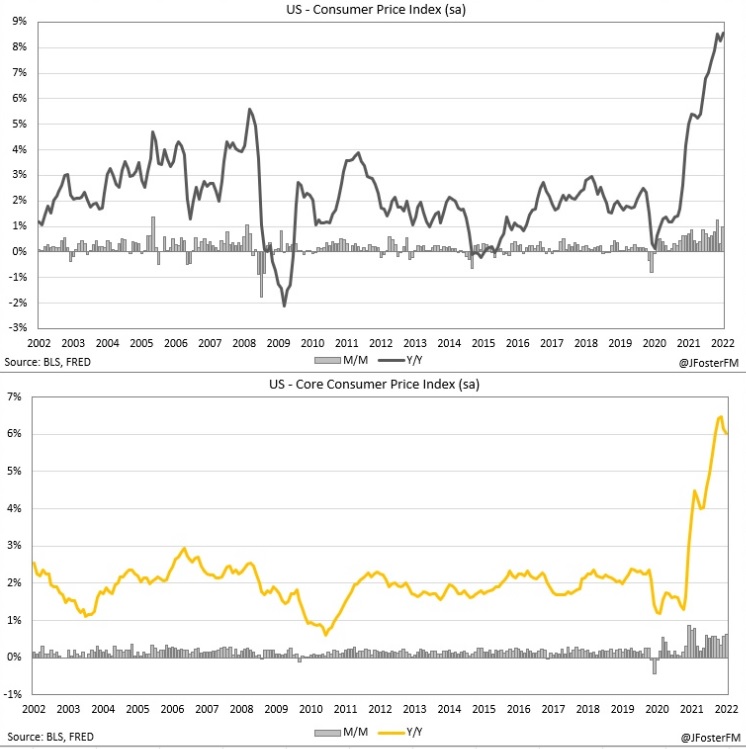

This all comes as US May inflation came in hotter than expected. The headline rate saw an 8.6% month-on-month increase, well above economist expectations. Core inflation, which some dared to say had peaked, also came in hotter than expected.

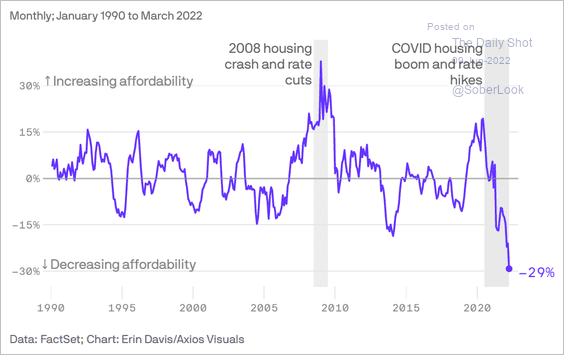

The move now puts some serious pressure on the Federal Reserve to ramp up rate hikes. Market pricing, per data from Bloomberg, now suggests traders expect 1.75% in rate hikes through to September. That includes at least one 75 basis point rate hike - and it could come as early as this week.

Gennadiy Goldberg of TD Securities wrote this in a preview late last week and it really sums up the immediate future for investors quite beautifully.

While some components of inflation should start to cool later this year as consumer spending moderates and supply chain issues start to get resolved, an upside surprise could keep the Fed keep beating the hawkish drum. Risk assets could also struggle amid worries that the Fed will need to be more aggressive in brandishing their inflation-fighting credentials.

- FTSE 100 - 7,205 (-1.53%)

- STOXX 600 - 412.72 (-2.36%)

- US 2YR - 3.337% - US 2s/10s briefly inverted for the second time in just a matter of months. Cue even more recession talk.

- AU 10YR - 3.681%

- USD Index - 105.21 (+1.02%) - the classic safe-haven trade was the only green on my macro watchlist.

In related macro news, the Japanese Yen hit a 20-year low against the US Dollar. For those who follow that particular economy, it's been a disaster in government-speak with seemingly nothing working in the Yen's favour. The Bank of Japan currently has an "unlimited" bond-buying program in place - that is not expected to change when it next meets on Friday.

THE CALENDAR

If you thought me banging on about the Reserve Bank and the European Central Bank were not enough, I've got some bad news. We have two even bigger, more important central bank meetings this week (three if you include the Bank of Japan, as mentioned above).

The Federal Reserve (Thursday morning AEST) and the Bank of England (Thursday evening AEST) will both meet.

Other than those, we get another key measure of inflation stateside (producer prices this time, not consumer prices). We'll also get retail sales from the US and China (the latter obviously an insight into lockdowns).

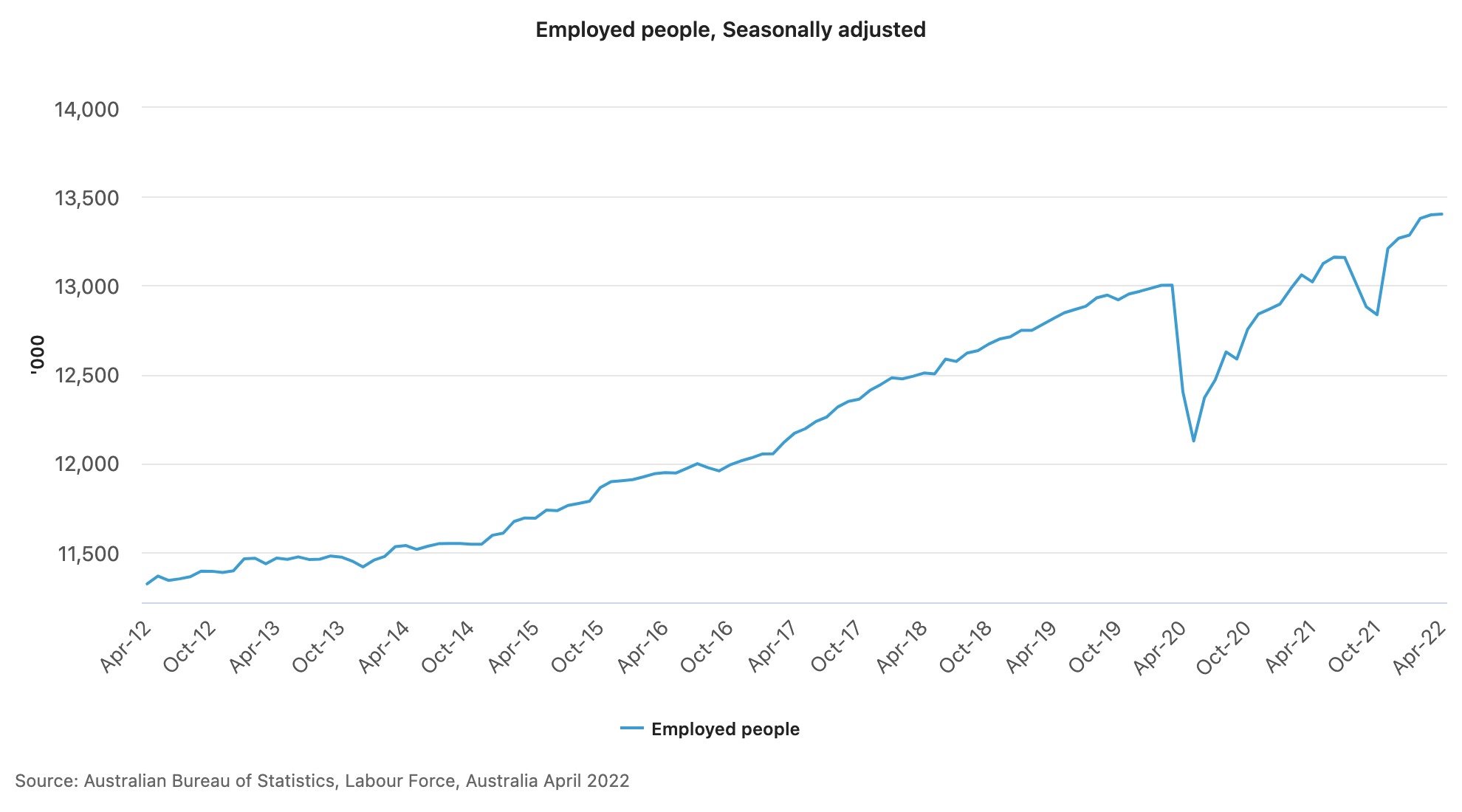

In our neck of the woods, we will get Australian jobs data and New Zealand's latest quarterly GDP print. The former will be instructive only because the consensus call (as of writing) is +4K. To put it another way, we might actually see a contraction in the labour market.

STOCKS TO WATCH

Today, I thought we would take a close look at the ASX healthcare sector - and namely, Goldman Sachs' report on the opportunities in health beyond the COVID recovery/beneficiary storyline. Analysts Chris Cooper and Bosco Feng say the sector could provide some strong portfolio protection despite the market being less willing to pay for duration at multiples that still remain elevated by historical standards.

They have named three buying opportunities on more than just valuations - Resmed (ASX:RMD), Cochlear (ASX:COH) and Integral Diagnostics (ASX:IDX).

- RMD presents a "generational opportunity" to capture share from a competitor still reeling from a major product recall. While it has been constrained by component shortages, recent data suggests there could be an acceleration in June/July allocations.

- COH's guidance has the best upside surprise potential for years - and analysts put that down to a long-awaited improvement in plasma

fundamentals in spite of elective surgery dynamics remaining unstable.

- IDX saw a sharp deterioration in the operating environment through the first half due to

surgery restrictions, changes to patient mobility, and staff shortages. But analysts are betting these headwinds are slowing down. Plus, there's an opportunity for M&A down the line.

For what it's worth, Nanosonics (ASX:NAN) and ProMedicus (ASX:PME) are rated sell. Notably, CSL (ASX:CSL) is simply not rated because, as Rudi Filapek-Vandyck pointed out to me, it's most likely because the broker is acting on behalf of the company in some form - say on the company's mega Vifor Pharma acquisition!

THE CHART

THE STAT

592: The number of SPACs looking for a merger target - a sign time could be running out for the blank cheque firms that have been helping companies IPO. (Source: SPAC Research/CNBC)

The "time" in question is the regulatory crackdown that is coming from the SEC. Plus, SPACs typically have a two-year deadline to find a friend to buddy up with or return capital to its investors. What a time to be alive.

If you'd like to read more about the "coming to public" phenomenon, check out my new article on the platform evaluating the aftermath of 2021's IPO rush.

THE TWEET

BEST READS IN BUSINESS NEWS

Canada’s oil sands: why some of the world’s dirtiest fuel is now in hot demand (FT): The chart that's in this piece absolutely blew my mind - more than half of America's oil imports now come from north of the border. The only problem? The Trudeau government has been back and forth about how to build oil pipelines but not run them through another province bent on curbing climate change - British Columbia. There are lessons in here for Australia as well, just because we don't produce as much crude oil.

Russian assets: freeze or seize? (The Economist): More than 100 days into the war in Ukraine, the biggest sanctions programme ever imposed on a major economy is still being tightened. But this article argues why that could be a big mistake - and yes, just like the last article, there's an oil theme here.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

8 stocks mentioned

1 contributor mentioned