Cheapest versus most expensive ASX mining stocks

We’re very lucky at Livewire to receive research reports from the biggest and most respected brokers and research houses that cover Australian and global financial markets. Among these reports are many regular series that might fly under the radar for some because they show only incremental change and are not buy-hold-sell specific.

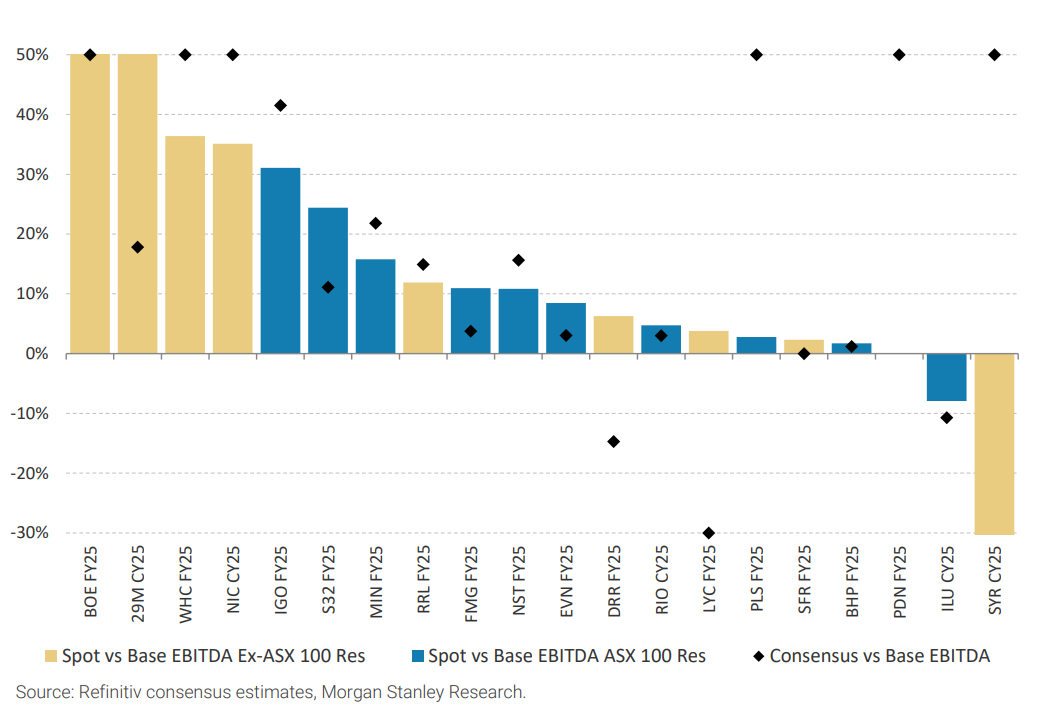

One such regular series which I personally find fascinating, is Morgan Stanley’s “Spot Base Consensus” report. In this report, Morgan Stanley compares its latest base case valuation for 20 of the biggest ASX-listed mining stocks (i.e. “Base”) with these stocks’ valuation at current spot prices (i.e., “Spot”), along with the prevailing consensus valuation among the other major brokers (i.e. “Consensus”).

What we are left with is a fascinating insight into how Morgan Stanley’s and the rest of the broking and research industry views ASX mining company valuations against current spot prices. The graphic below is the regular centrepiece of the Spot Base Consensus report, and it summarises each of the three key valuation metrics.

How to read Morgan Stanley’s Spot Base Consensus Graphic:

- Blue bars = Larger capitalisation ASX mining stocks that are constituents of the ASX 100 Resources Index (XTR)

- Beige (hey – beige-ish!) bars = Smaller capitalisation ASX listed mining stocks that aren’t of the XTR.

- Up bar = Potential valuation upside for a stock in percent should the current spot price of the commodity it produces prevail over the long term (i.e., beyond 2031).

- Down bar = Potential valuation downside for a stock in percent should the current spot price of the commodity it produces prevail over the long term (i.e., beyond 2031).

- Black diamond = Consensus forecast valuation upside or downside from Morgan Stanley’s base valuation

Spot Base Consensus Graphic – Company Valuations and Spot Prices

Morgan Stanley notes that the graphic aims to “display spot price scenario outcomes” in order to “provide context for current equity and commodity prices”. By this, the broker is implying that spot commodity pricing is volatile, and may differ from the broker’s base-case assumptions over their look-forward period. When spot and base prices do differ, they create the potential for valuation upside and downside as per the graphic.

It’s important to remember Morgan Stanley isn’t labelling these stocks cheap (in the case of an up bar) or expensive (down bar), because the broker assumes spot pricing will eventually converge to their long run forecasts. But, if the reader has a different view on whether a particular commodity’s spot price can be maintained in the long run, then we can see how much Morgan Stanley thinks this will impact a particular stock’s valuation.

Stocks currently undervalued by >20% against current spot price:

Boss Energy (ASX: BOE), 29Metals (ASX: 29M), Whitehaven Coal (ASX: WHC), Nickel Industries (ASX: NIC), IGO (ASX: IGO), South32 (ASX: S32).

Stocks currently undervalued by >10%-20% against current spot price:

Mineral Resources (ASX: MIN), Regis Resources (ASX: RRL), Fortescue (ASX: FMG), Northern Star Resources (ASX: NST).

Stocks currently undervalued by >0%-10% against current spot price:

Evolution Mining (ASX: EVN), Deterra Royalties (ASX: DRR), Rio Tinto (ASX: RIO), Lynas Rare Earths (ASX: LYC), Pilbara Minerals (ASX: PLS), Sandfire Resources (ASX: SFR), BHP Group (ASX: BHP).

Stocks fairly valued against current spot price:

Paladin Energy (ASX: PDN).

Stocks overvalued against current spot price:

Spot Base Consensus Graphic – Company Valuations and Rest of Market Consensus

Here, Morgan Stanley notes it’s not the only research house on the block. It shows us what the proverbial “Rest of the Market” thinks about a particular stock. We can infer from the black diamonds which stocks Morgan Stanley thinks the rest of the market is too optimistic about (in the case of black diamonds with positive values), and too pessimistic about (black diamonds with negative values).

Stocks where consensus valuation is >20% higher than Morgan Stanley:

BOE, WHC, NIC, IGO, MIN, PLS, PDN, SYR

Stocks where consensus valuation is >10%-20% higher than Morgan Stanley:

29M, S32, RRL, NST

Stocks where consensus valuation is >0%-10% higher than Morgan Stanley:

FMG, EVN, RIO, BHP

Stocks where consensus valuation is the same as Morgan Stanley:

SFR

Stocks where consensus valuation is lower than Morgan Stanley:

DRR, LYC, ILU

Conclusions

If we prefer to own mining stocks that are trading at a discount compared to current spot pricing and also that the rest of the market is too pessimistic about, then we should at the very least be looking for up-bars with black diamonds below the tops of those up-bars, but preferably for up-bars with black diamonds below zero (i.e. consensus forecasts below Morgan Stanley forecasts).

Sorry, there aren’t any! But this shouldn’t be too surprising – as there are no free lunches in markets! It does appear that for the most part that black diamonds generally hover around the extent of an up/down bar, that is, higher spot prices have generally been factored into a stock’s share price (and note here that Morgan Stanley is choosing not to bite on those higher spot prices!).

Possibly, however, up-bar stocks like 29M, S32, FMG, EVN, DRR, LYC are to some degree underappreciated by the rest of the market. This is the group I suggest comes out the best in this analysis.

On the other hand, stocks like WHC, NIC, IGO, MIN, RRL, and NST are moderately over-appreciated by the rest of the market, and one could argue that stocks like PLS, PDN, and SYR are substantially over-appreciated by the rest of the market.

This article first appeared on Market Index on Wednesday 16 October 2024.

5 topics

20 stocks mentioned