Childcare investing for stable income returns

Fawkner Property

When investors think about commercial real estate investment opportunities, asset classes such as office, retail and industrial typically spring to mind - understandably given these assets form the majority of commercial real estate investment funds.

However, investors looking for secure income streams from property aren’t always best placed to look at the typical investment classes. Fawkner Property focuses on Essential Services assets which tend to be more recession resilient and in turn, underpin a reliable income stream.

Childcare assets probably aren't top of mind for investors when commercial property is mentioned. But this doesn't mean it's a bad investment opportunity. Childcare assets are strong real estate investments as they have the following attributes:

- Long-leases: Typical leases are between 15-20 years, protecting your rental income stream for the long-term;

- Strong fixed rental increases: Typically these rise by between 2.5% and 3%, which provides an inflation hedge;

- Tenants: Large ASX listed tenants such as G8 Education (ASX: GEM) or groups like Goodstart Early Learning provide great income security; and

- Yields: These assets can offer yields of 5.5% to 6% which is more than assets like prime office or industrial, which typically offer yields of between 4% and 4.5%.

Today, childcare is considered a fundamental pillar of the Australian economy.

Over time, the industry has grown from its origins as a child-minding service for working parents to be an essential labour supply mechanism to the Australian economy, employing an estimated 150,000 staff members and supporting more than a million working families.

It has also become an important extension of the primary education system as it provides significant learning benefits to young children.

The childcare industry

There are multiple types of childcare services for children under 12 years of age which can be approved by the Department of Education. These services receive and pass on the relevant government childcare subsidies. The three main types of childcare are:

Centre-based day care

The majority of childcare real estate assets are tenanted by centre-based operators under current classifications. Centre-based daycare includes long day care (LDC) and occasional care, as well as pre-schools and kindergartens in some states. Care is provided across centres either all day or on a part-time basis and may offer educational or development programs as part of their services.

Family day care

Family daycare is provided in an approved educator’s home either all day, part-time, occasionally, before and after school and during school holidays. Family day care centres are often located in regional areas where fewer long daycare centres are available.

Outside school hours care

This includes care provided to school-aged children, before or after school during the school term. Vacation care is also included, providing care services during school holidays.

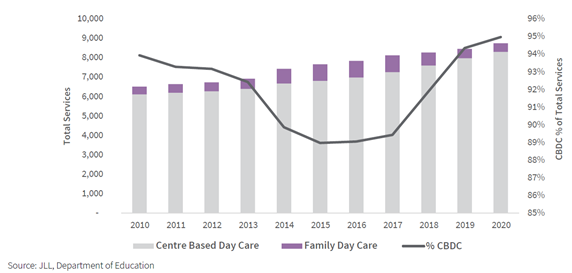

The number of family day care services has decreased rapidly over the past few years, decreasing from 858 in 2017 to 440 in 2020. Preference remains for centre-based childcare services which still dominate the market, accounting for around 63% of all approved services nationally.

Total Australian child care services by service type, 2010-2020

Several tailwinds assist the sector

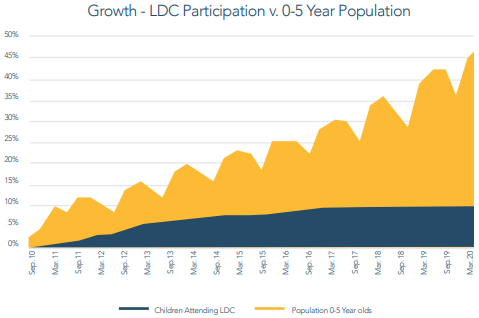

Demand for childcare services has been largely supported by three key demographic factors:

- Growth in the number of children aged 0-4

- Rising female participation in the workforce

- Growth in the number of two-working-parent families

Source: Peak Equities

Over the next decade (2021 to 2031), this age group is expected to grow by 1.4% per annum, equating to an increase of around 240,000 children. It should be noted that some uncertainty remains around Australia’s international border re-opening and the impact on migration-driven growth.

Childcare in the COVID-19 crisis

The COVID-19 pandemic has brought about significant economic uncertainty and continues to influence global economic policy. Notwithstanding this heightened level of uncertainty, activity in the Childcare investment market increased markedly in the latter months of 2020.

Announcements from both the Federal Government and the opposition highlighting a bi-partisan commitment to long-term financial support for the Childcare sector beyond the duration of the COVID-19 crisis brought about elevated competition for high-quality childcare from both private and institutional investors. Recent sales in 2Q21 have demonstrated the strength of the market, with initial yields averaging 5.33% nationally.

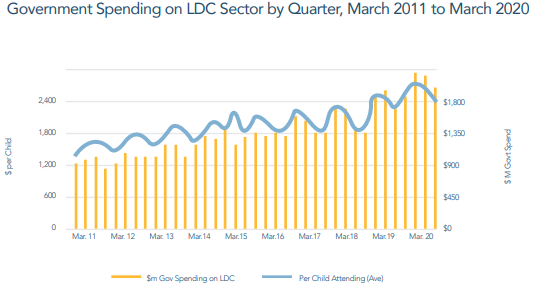

In 2020, the Australian Government offered financial assistance of more than $1.5bn to all Childcare operators with the Early Childhood Education and Care Relief Package which provided free childcare for families. Despite the increase in funding to the sector in 2020, Federal Government spending has increased steadily over the last decade as shown in the below chart:

Source: Peak Equities, ACECQA & Dept. of Education, Skills &

Employment 2009-2020. LDC = Long Day Care.

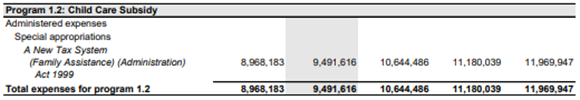

With Australia’s anticipated post-COVID economic recovery to be supported by an increase in workforce participation, it is therefore likely that an increasing utilisation of LDC Childcare services will be a key focus of the government in subsequent years. The Federal Government’s commitment to increasing its Childcare spend over the next three years can be seen in the below chart, highlighting the financial support the sector can expect to receive in the medium term:

Source: Dept. of Education, Skills & Employment, Portfolio Budget Statements

2021-22.

Other Supporting Investment Fundamentals for Childcare

In addition to the growing demand for Childcare services driven by population growth and the increase in the utilisation of Childcare services, there are several other tailwinds supporting the investment case for quality Childcare assets:

The sector is supported by government policies

The Australian Government announced changes to the childcare subsidy as part of the 2021-22 Federal Budget, with changes coming into effect in July 2022. The changes will increase subsidy amounts (percentage claimable) for families with more than one child in care under the age of six and remove the annual cap on the total amount claimable. The package will provide an additional $1.7bn in support to the childcare industry over a five year period.

Long leases to tenants

Major operators are typically seeking 15 to 20-year leases with further 15 to 20-year options. New lease terms under 10 years are becoming less common with operators investing more capital into quality fit-outs. For investors, this provides long term income security and reduced vacancy risk.

Favourable incentive structures for landlords

Tenants’ desires for long and secure lease terms largely eliminate the need to offer lease incentives, which can often dominate other classes of commercial property where onerous incentives impact heavily on cash flows and asset values.

Labour supply & productivity

Changing societal dynamics over 2020 have seen the emergence of a hybrid-working model and a higher proportion of people working from home. While this evolution will likely negatively impact demand for outside-school-care or care for older children, demand is anticipated to remain strong for the larger 0-4 age group in LDC that requires substantial hands-on care throughout the day.

Business value is bolstered by underlying leases

Long lease terms add significant value to the Goodwill of Childcare businesses. Regulations, licensing and planning controls greatly limit the prospects of re-location of the LDC Centre at the expiry of the lease term.

The Outlook for Australian Childcare

Increased investment into childcare real estate bodes well for the evolution and growth of the childcare sector, with landlords likely to increasingly focus on the quality of their assets, ensuring they remain competitive and are able to maximise occupancy.

Private investors are likely to remain the dominant buyer cohort while the sector remains in the early stages of institutionalisation. However, childcare assets are anticipated to attract a broad range of investors looking to diversify their real estate holdings with the share of larger investors likely to increase.

ABS, Estimated Resident Population 1982-2019 & Dept of Education, Skills and Employment 2020

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.