China economy’s strong start to 2024 deals blow to “over-pessimism” but recovery hangs on property market

The Chinese economy could finally be turning the corner according to both technical and fundamental factors, and this could have major ramifications for the local economy and stock market.

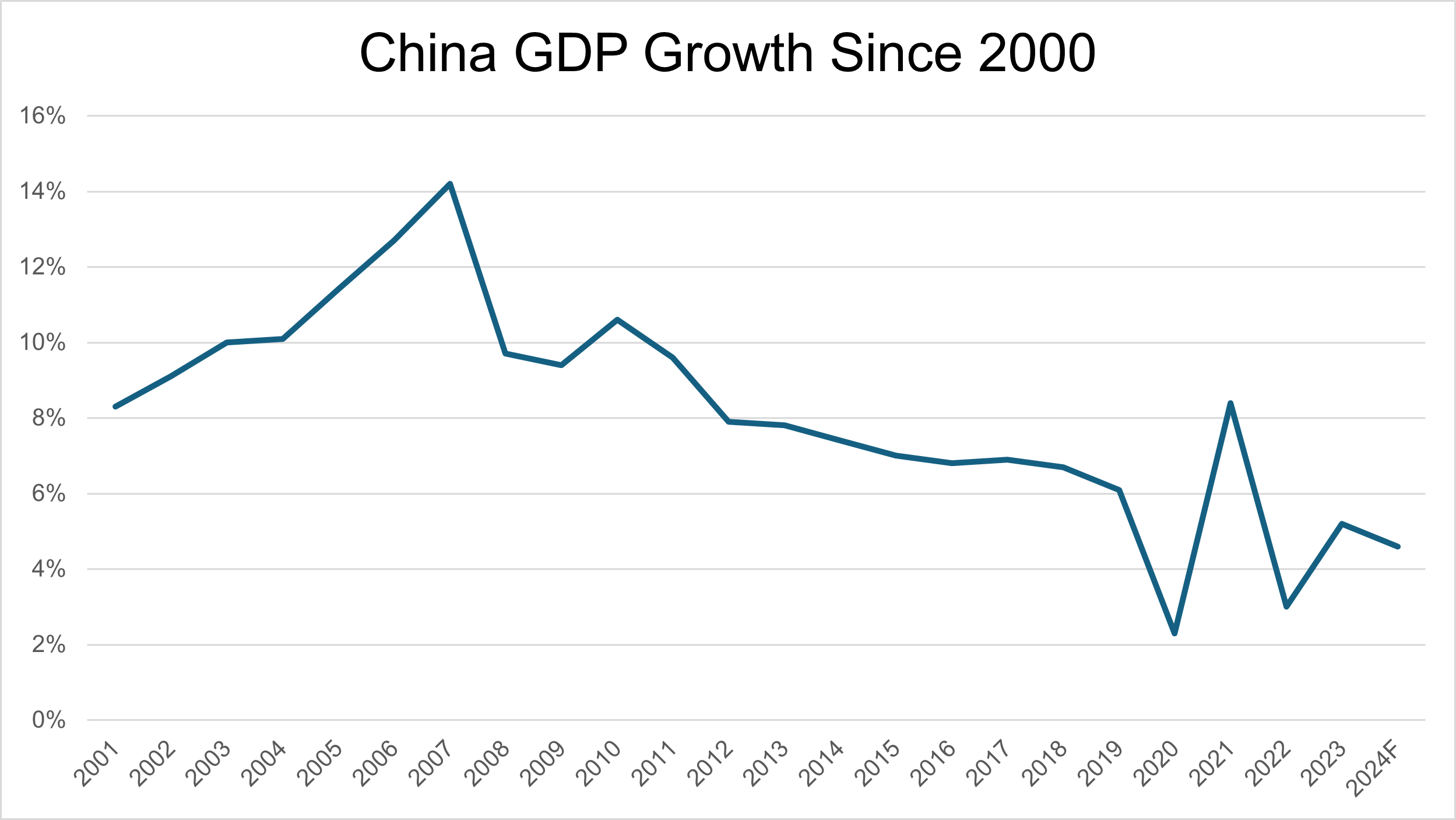

We’re a long way both in time and magnitude since the double-digit growth rates enjoyed by the Chinese economy between 2000 and 2010 – a period of growth that was at the time often referred to as miraculous. Chinese economic growth has moderated in recent years, partly due to Beijing’s extended period of zero-tolerance COVID-19 policies, but mainly due to a withering decline in the nation’s property market.

It’s easy to get negative on the prospects for Chinese growth given the above chart and considering the challenges facing its heavily indebted property sector, which still accounts for roughly one-third of the country’s growth.

It’s important, however, to consider that while Chinese growth is slowing, the growth it’s likely to achieve is occurring over a massive base. According to data from the World Bank, China's $18 trillion economy accounted for 16.9% of global GDP in 2023, making it the world's second-largest economy after the USA.

Given the size of China’s economic base, growth around 2023’s 5.2% is arguably still good for Australia. Anything better would likely have a massive positive impact on both local and global economies, and therefore stocks. Further, given recent negativity towards the Chinese economy, stocks likely aren’t priced for the better-than-expected case scenario.

This is pertinent given major broker Citi has just released a research report investigating the latest Chinese economic data that relates to the start of 2024. Citi suggests this data shows the Chinese economy “managed to strike a solid opening to 2024”.

Let’s investigate the ramifications of the data on growth expectations in 2024, and also take a look at the charts of China’s major stock indices which are typically considered to be excellent forward indicators of a country’s growth prospects.

A solid start amid continued property downturn

Looking at the recent “data dump”, i.e., the usual monthly simultaneous release of several key Chinese economic factors, Citi concedes the Chinese property sector “is still in deep downturn”. The data shows property investment declined by 9% in the January to February period, slightly better than the 9.6% drop during the corresponding period last year. Housing starts fell 29.7% year on year, and completions were down 20.2%.

A more forward-looking indicator for property sector activity, sales, also suffered a “deep decline”, dropping 20.5% year-on-year while the value of property sold fell a more significant 29.3%.

Despite the ongoing slowdown in the property market, Citi notes investment in the Chinese economy was “way higher than consensus”. Fixed asset investment (FAI) was 4.2% in January to February, better than the broker’s 4.0% estimate, and well ahead of the 3.2% forecast by other economists. It also increased from December’s 4.0% rate.

The bulk of the investment is being directed in areas of China’s economy away from property, in particular, manufacturing and infrastructure. Manufacturing investment rose an impressive 9.4% in the first two months of the year, well up from 6.5% recorded in the same period last year, while infrastructure investment grew 6.3%, up from 5.9%.

Much of this is deliberate, notes Citi, as Beijing has actively encouraged investment in manufacturing and infrastructure to help offset their reluctance to further boost investment in the overheated and over indebted property sector.

Just as important, suggests Citi, is a “moderate recovery” in consumption. The broker notes that retail sales grew 5.5% in January to February year on year. This was below their 6.0% forecast, but closer to the consensus estimate of 5.6%. Growth in consumer services “remained robust”, growing 12.3% year on year in the first two months, and it has been a powerhouse of Chinese economic growth, expanding 20% in 2023.

Goods consumption was mixed, however. Auto sales improved 8.7% year on year, while property-related items “showed signs of broad-based recovery”, picking up 2.1% year on year compared to the 7.5% decline in the same period last year.

Finally, industrial production “showed its resilience again” rising 7.0% in January, beating market expectations for a 5.2% gain. Again, manufacturing led the way, while property segments lagged.

In conclusion, notes Citi, the data “confirmed a solid start of the Chinese economy despite the de-property transition”. Combined with low rates of inflation within China at both wholesale and consumer levels, the data implies there’s less reason to be pessimistic about the Chinese economy. It “could help to ease over-pessimism”, says Citi.

Still, the broker warns the recent data “could still fall short of reviving confidence”. The major issue remains the “deep contraction” in the housing sector, and the “unbalanced” and “bumpy” nature of the recovery.

Watch these 3 factors says Citi

Citi concludes Beijing is ultimately responsible for the future direction of the Chinese economy this year and beyond. Further policy efforts are “much necessary to solidify the recovery”, they note.

Citi believes markets are going to focus on how policy is implemented in the wake of the recent National People’s Congress (NPC). The NPC, which concluded earlier this month, saw Beijing commit to a GDP target of 5% for 2024. This is considered ambitious by the analyst community which is predicting just 4.6% growth.

According to Citi, in order for these two points to converge, analysts will be assessing three major items going forward for the Chinese economy:

1. The pace of fiscal policy deployment:

Particularly with respect to infrastructure spending

But high levels of local government debt could stymie efforts here

2. Details of equipment upgrade and trade-in programs for durable goods:

Market is waiting on details of implementation, funding source, and scale

3. Monetary policy:

“Additional monetary policies are necessary” notes Citi

Expecting the first 0.10% cut to the 1-year medium-term lending facility (MLF) to occur in the second quarter of the year

Leading indicator: The Chinese stock market is turning up

The chart below shows how closely China’s stock market as measured by the SSE Composite Index has tracked its GDP growth rate. It has been a bumpy ride, but after a brief recovery following the easing of harsh COVID-19 restrictions in late-2022, it’s been a steady decline for Chinese stocks.

Until February, that is. Around the start of February, Beijing began to take steps to curb the selling of Chinese stocks by financial institutions, reduced some margin requirements for investors, and more generally started jawboning their support for the ailing stock market. Hopes of further fiscal and monetary stimulus have also helped.

From a technical perspective, the rally is starting to look like more than just a bounce. The short term trend has swung back to up and it’s also providing dynamic support to price, and the price action is back to rising peaks and rising troughs. Both factors imply a shift in market sentiment to a “buy the dip” mentality – which is completely at odds with the prior “sell the rally” mentality.

Candles are almost entirely white since the February low, which is a good indication of programmed buying support.

Most importantly, for me, the long term trend ribbon, which was for so long an area of reliable dynamic resistance, appears to be now acting as an area of dynamic support. It’s also transitioned from down to neutral.

In conclusion, there’s plenty of evidence in the technicals to suggest the Chinese stock market has moved back to an environment of excess demand. This bodes well for further Chinese stock market appreciation.

There remains one sticking point, though, and it’s the same sticking point Citi identified in their fundamental analysis: The Chinese property market. The chart below of the CSI Mainland Real Estate Index shows the long term downtrend in Chinese property stocks is very much still intact. Worse, the flat short term trend isn’t reflecting the strong uptrend of the SSE Composite.

The price action is falling peaks and rising troughs, and candles are mixed between black and white. Both factors confirm there’s much indecision in the demand-supply environment for Chinese property stocks.

A close above historical supply at the 26 January peak of 2828 would provide a welcome return to higher peaks and higher troughs, and also likely transition the short term trend to up. Still, it’s hard to get too excited about a meaningful turnaround here until the index closes above the long term downtrend ribbon, likely to occur above the 3200 level.

In conclusion, a promising rally in the “everything else” of the Chinese stock market could be severely undermined by continued underperformance of Chinese property stocks, particularly if the CSI Mainland Real Estate Index closes below historical demand at the 5 February trough of 2405. However, if property stocks can recover, it could solidify the broader Chinese stock market rally and potentially even commence a new bull market in Chinese stocks.

This article first appeared on Market Index on Tuesday 19 March 2024.

5 topics