China property is turning, time to investigate ASX copper and zircon stocks?

China’s ailing property market is finally showing some tentative signs of firming, says major broker Morgan Stanley in their latest global mining sector research report titled “DataDig: Completions?”. Notice I used the word “firming” and not “turning”. It’s an important distinction – it’s difficult to arrest a multi-year nose-dive in just a few weeks.

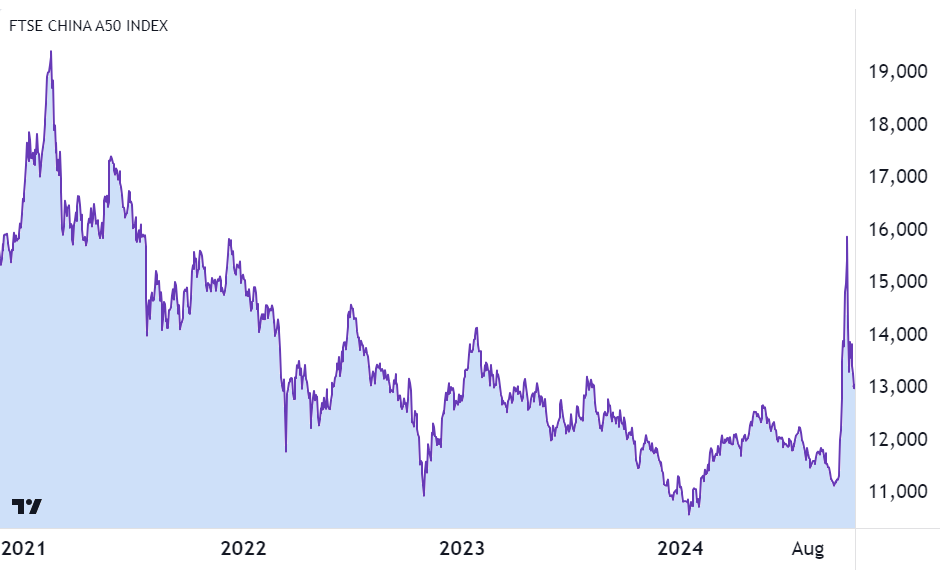

In “just a few weeks”, China’s stock market has had a rocket put under it following the announcement by the People’s Bank of China (PBOC) that it would cut several of its key benchmark rates. This was soon followed by promises by several major economic and finance-facing bureaucrats of impending sweeping fiscal measures that would boost consumption, support heavily indebted local governments, and jump-start the ailing Chinese property market.

Fix the property market and you fix the property sector – a massive employer and presently swimming in debt. You’ll also likely fix consumption via the wealth effect, therefore helping the broader economy. In short, we could be at the most critical juncture for the Chinese economy in a generation.

Needless to say, a recovery in the Chinese property sector and the broader Chinese economy could be very good for Australia. We have plenty of the natural resources they need to literally build the next phase of China’s economic growth story. But some sectors are going to benefit sooner than others, suggests Morgan Stanley, who identifies two interesting segments of the ASX mining sector that investors might want to investigate first.

Show me the stimulus!

Morgan Stanley’s China property team have observed the following improvements in the Chinese property market so far this month:

- A pickup in property sales – Golden Week (October 1 – 7) sales are up 39% compared to last year and would likely contribute to “mid-double digit” growth on a monthly basis. Despite the improvement, sales are still likely to be down in October on an annual basis, however.

- Visitations to sales centres and property agencies are up

- Home sellers are raising listing prices in high tier cities

- Some developers have begun to reduce discounts

All of the above is just the tip of the iceberg and much more needs to be done to set a full-blown recovery in place, suggests Morgan Stanley. Their China property team believes only a “concerted policy implementation and macro recovery will be key for a sustainable improvement in sales/housing”. So far, we are yet to see any concrete (pun intended!) fiscal stimulus measures to back up Beijing’s rhetoric – and perhaps this explains the recent pullback in Chinese stocks as per the China A50 Shares Index chart above.

Investigate copper and zircon first

While it’s still early days, let’s find out which ASX mining sectors could benefit the soonest if the Chinese property sector begins to turn. Morgan Stanley tips the first key metric to improve will be property completions. According to an August report from Bloomberg Intelligence there are at least 48 million homes in China that have been sold and not completed.

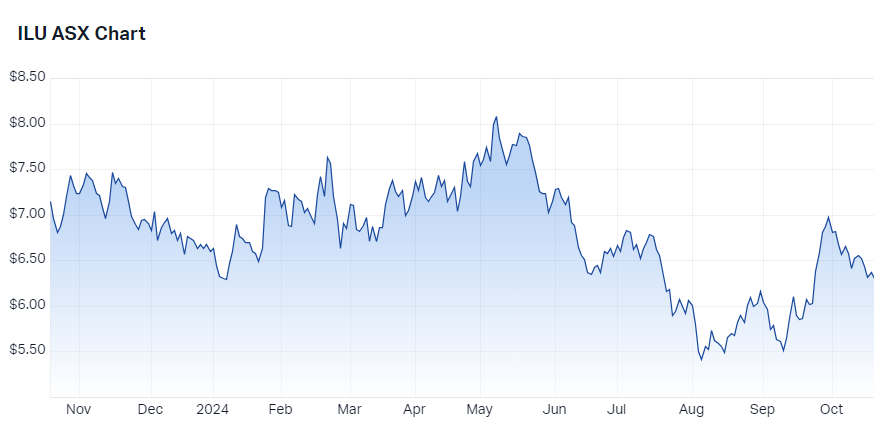

This is a massive pool of work and if property completions do pick up, this would likely benefit “late property cycle commodities” the most, says Morgan Stanley. The two commodities the broker expects will be in most demand in a property completion recovery are zircon and copper. “Zircon volumes usually follow completions in Tier and 2 cities with limited lag”, notes Morgan Stanley, who identifies critical minerals miner Iluka Resources (ASX: ILU) as one potential beneficiary.

%20chart%2018%20October%202024.png)

As for copper, Morgan Stanley points out that around 24% of Chinese copper demand comes from its property and broader residential markets. It’s not just pipes and plumbing, the broker notes, it’s also the increase in the manufacturing of whitegoods that homeowners tend to buy and upgrade when they move into their new homes.

Morgan Stanley identifies the two ASX copper stocks it thinks stands to benefit the most in the event of a pickup in property completion as junior miner 29Metals (ASX: 29M) and major producer Sandfire Resources (ASX: SFR) – but the broker says it prefers 29M to SFR.

%20chart%2018%20October%202024.png)

%20chart%2018%20October%202024.png)

This article first appeared on Market Index on Friday 18 October 2024.

5 topics

3 stocks mentioned