China's economy is a house on fire, and this time it can't build its way out of the mess

While the rest of the world struggles to rein in inflation, China is slipping into a state of deflation.

The country's GDP grew just 0.8% quarter on quarter in Q2, vs 2.2% in Q1. While it has a growth target of 5% in 2023, Nomura is now projecting growth of 4.6% while Citi is slightly more optimistic at 4.7%. PMIs, meanwhile, are back in contraction after falling to 49.2 in July from 50.5 in June.

This reality leaves the People's Republic of China in a bind.

"They have been deflating bubbles for nearly 2 years and they don’t want to go back to it," says Mathan Somasundaram, founder and CEO of Deep Data Analytics. "They can’t build more nor can they make more as there is no demand for it either."

It's a fire on multiple fronts. The property market is tanking, consumer sentiment is falling, youth unemployment is rising, the yuan is under pressure, and US-China relations are nearing boil-over.

The following wire will address each of these issues in turn.

Property

China's property market, long a key driver of domestic demand, is on the ropes.

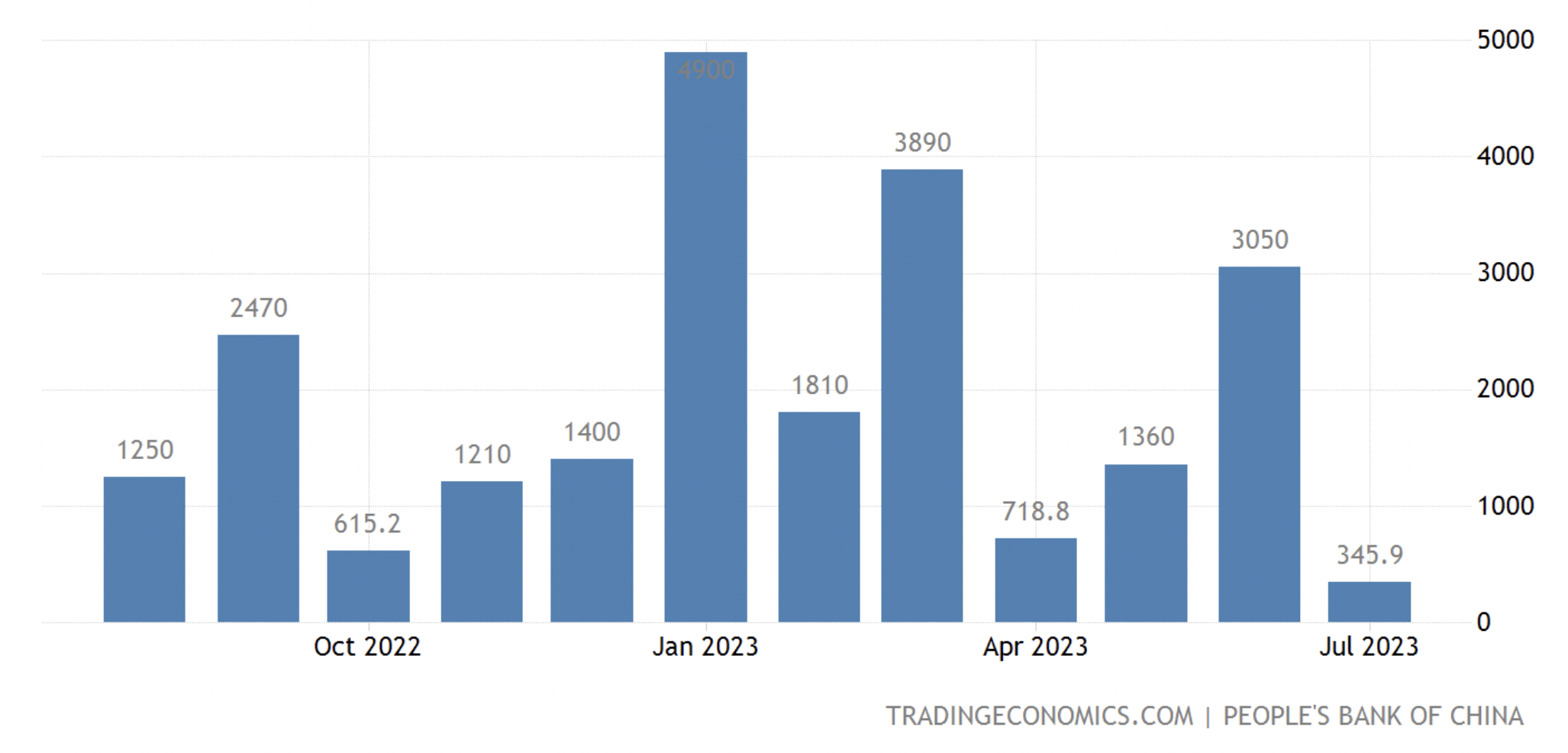

According to Trading Economics, China's banks extended CNY 345.9 billion in new yuan loans in July 2023, the least since November of 2009 amid the Global Financial Crisis.

Evergrande, once China's second largest property developer, filed for Chapter 15 Bankruptcy in the US last week following a trading halt since last year.

Its downfall was well-telegraphed.

In 2021, Chinese authorities placed borrowing limits on developers in order to throttle a frothy property market. Evergrande was unable to roll over its debt and in September of that year defaulted on some of its estimated US$300 billion debt.

Then, in August this year, it announced a loss of US$81.1 billion over the past two years.

It's not just Evergrande under pressure. Earlier this month, stock and bond prices of Country Garden Holdings went into freefall after scheduled coupon payments on its bonds failed to materialise.

For more on that story, check out this great piece from my colleague Hans Lee.

And for an in-depth dive into China's property situation, head over to this piece published last week by Chris Watling from Longview Economics.

Chinese consumer

So much of China's trouble today is borne of a weak consumer sector.

Unlike in the West, the Chinese government has been unwilling to put a floor under the consumer through direct fiscal support.

Instead, The National Development and Reform Commission, has so far sought to stimulate demand through measures such as removing car purchase limits, improving infrastructure, and promoting social festivals.

"But it hasn't been enough to turnaround confidence," says Janu Chan from Bitesized Economics.

"What's obvious is that the measures to date do not provide a direct tangible boost to incomes. The measures try and encourage consumers to spend more by telling them to, instead of directly boosting incomes."

The question is whether more stimulus will come, and to what extent it will support consumers.

"Unfortunately, there is reason to be sceptical that this form of stimulus will come at all, as direct handouts to consumers would likely mean funds are diverted away from other areas of the economy which are higher on the pecking order. Of course, that also means that the economy is at risk, because increasingly the government can no longer turn to infrastructure to boost economic growth," Chan says.

It's also important to avoid attributing slowing consumer demand to China's COVID-zero policy alone.

Structural cracks in China's economy predate the pandemic, with household balance sheets and household income have both been in decline since about 2012.

Youth unemployment

You know things are bad when the PBOC decides to stop printing a data point.

Well, it's stopped printing the youth unemployment rate, which rose above 20% in June for 16-24 year olds.

Sectors where young people have typically found work are now under pressure due either to economic fundamentals, policy shifts, or both.

"If you think about where these young graduates go, and there are tens of millions of them a year, they go into the financial sector, which had outsized wages compared to other sectors," says Frances Lim, Head of Asia Pacific Macro at KKR.

"They cut wages [in the financial sector] up to about 50% in some cases. They attack the property sector, which is another sector where youth go, they attack the education sector, again, a sector where traditionally the youth would go once they graduate."

Depreciating Yuan

The Chinese Yuan has fallen 12.5% since February last year, due in part to falling Chinese bond yields relative to US bonds.

Nomura China economist Ting Lu and a team stated in a report last year, quoted by CNBC, that Chinese leadership want to put a floor under the Yuan for two reasons:

“First, in a year of the once-in-a-decade leadership reshuffle and with elevated US-China tensions, Chinese leaders especially care about RMB’s bilateral exchange rate with USD because they believe RMB/USD somehow reflects relative economic and political strength.

“Second, a big depreciation of RMB/USD could dent domestic sentiment and speed up capital flight.”

Fast forward to today, and that floor is under construction, but it's not getting built in the way one might expect - using the US$3.2 trillion it has in foreign reserves to buy yuan.

Rather, it's been widely reported that China's state-owned banks have been busy selling US dollars to buy yuan.

Why the authorities have chosen to manipulate the yuan that way, instead of using more traditional central bank plumbing, is an open question. But in the end it may not matter - the net effect remains the same.

Geopolitics

Relations between the US and China haven't been this strained since US President Nixon and Secretary of State Henry Kissinger paid Chairman Mao and Premier Zhou Enlai respective visits in 1972, out of which came the Shanghai Communiqué designed to normalise relations.

Since then, US-Sino relations have been in varying states of détente and cooperation.

Tensions have escalated in recent years as the spectre of war in Taiwan intensifies. The PRC is ratcheting up the rhetoric around its territorial claim to the island. The US, in an act of geopolitical wordplay, doesn't support independence but does "oppose any unilateral changes to the status quo."

On the trade front, the US has become increasingly protectionist, especially vis-à-vis China, as it seeks to reshore foreign investment.

Most recently, the Biden Administration made moves to prohibit US investment in China in semiconductors, quantum information technologies, and artificial intelligence; all under the rubric of national security.

Officially, this is all part of a US policy of "peaceful coexistence" with China.

“The goal here is not containment, it’s not a new Cold War,” says US National Security Advisor Jake Sullivan.

“It is rather a favourable disposition in which the US and its allies can shape the international rules of the road on the sorts of issues that are fundamentally going to matter to the people of our country and to the people everywhere."

3 topics

4 contributors mentioned