China v US: Where should you put your money?

It is, without question, the geopolitical quandary of our time. The US has led the global hegemony for more than two centuries. However, China's economy has grown at a breakneck pace (at least by official figures) since 2008.

According to estimates from Britain's Centre for Economics and Business Research, even if China's GDP growth slows to an annual pace of around 5%, it will still overtake the US by 2030.

To combat Beijing's rise, various US administrations have placed a series of economic sanctions. These include, but are not limited to:

- Tariffs from the ongoing Sino-US trade war

- Ongoing allegations of currency manipulation

- Bans on US companies selling "nationally sensitive" technology to Chinese firms

- Chinese firms being delisted/removed from US stock exchanges

In turn, the Chinese have implemented nationalist policies around manufacturing and state investment. They have also tightened the rules around what firms can list on public exchanges overseas.

All throughout, Australia and Australian investors have been left in the middle. This piece, our first in the deglobalisation series, will take a look at the ongoing battle for economic supremacy. We'll also chat to two fund managers for their opinion on where you should invest and why.

Before we go on, please note that this is part one of a new three-part collection. Be sure to subscribe to my colleagues Glenn Freeman and David Thornton who will bring you parts two and three.

Context on the battle so far

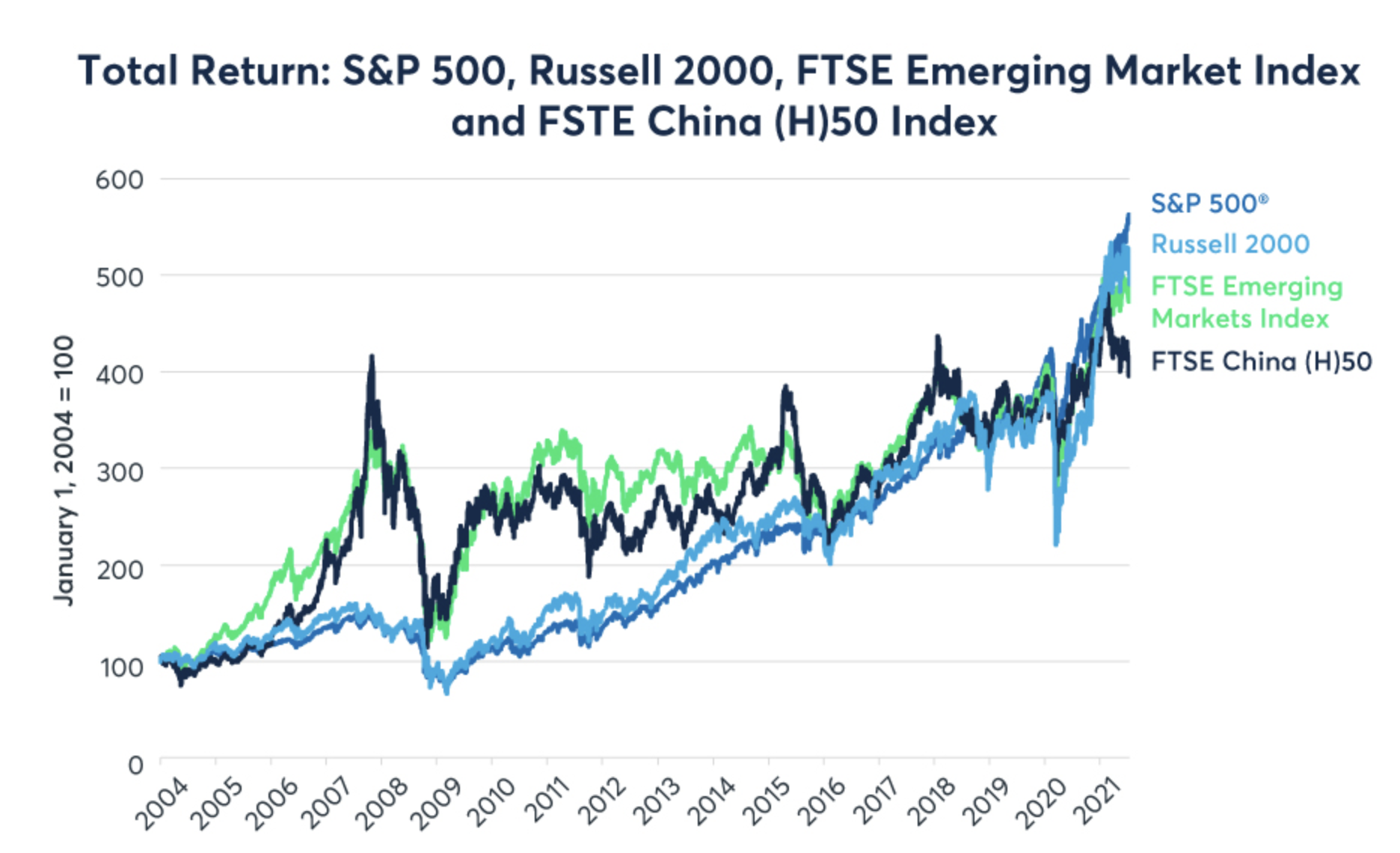

The case for US investments over Chinese alternatives has been easy to make for over a decade. In the 2010s, the benchmark S&P 500 gave you an average annual return of 13.1%. In contrast, the CSI 300 traded in a 500-point range throughout the same timeline.

The battle lines are usually drawn around technology stocks on a more sector-specific level. Last month, data compiled by Bloomberg showed the Golden Dragon index (i.e. Chinese stocks listed in the US) staged its best month since early 2019.

But there is also no doubt that the FANMAG names are given that acronym for a reason. Alphabet is up 143% in the last five years, while Alibaba's Hong Kong-listed shares are actually down 41% over the last five years.

So why the divergence?

Some argue that Washington's pro-business stance and China's ongoing shift away from fixed-asset investments will keep the tiger economy at bay for a while yet.

Others look at the anti-trust regulation issue, with specific reference to the failed ANT Group IPO. Originally pegged as the first, great spinoff from tech giant Alibaba, the company has since been held up in legal issues due to concerns over how the new entity might be regulated.

The same issues around regulation and control could also be said for Evergrande and the Chinese property sector. The country's real estate crisis has hit tens of companies - and led to several high-profile defaults.

In both the tech and property sectors, reports suggest there is either stimulus or rewritten legislation on the way.

But the biggest issue has to be sentiment around the country's zero COVID policy. The lockdowns of Shanghai and Beijing really shook overseas investor sentiment. As of writing, that zero COVID policy is still very much in effect. Some have gone so far as to argue that China is uninvestable as a result.

It's a view that is also shared by Anthony Srom at Fidelity International:

Any such easing of mobility restrictions may result in a material stock market rebound.

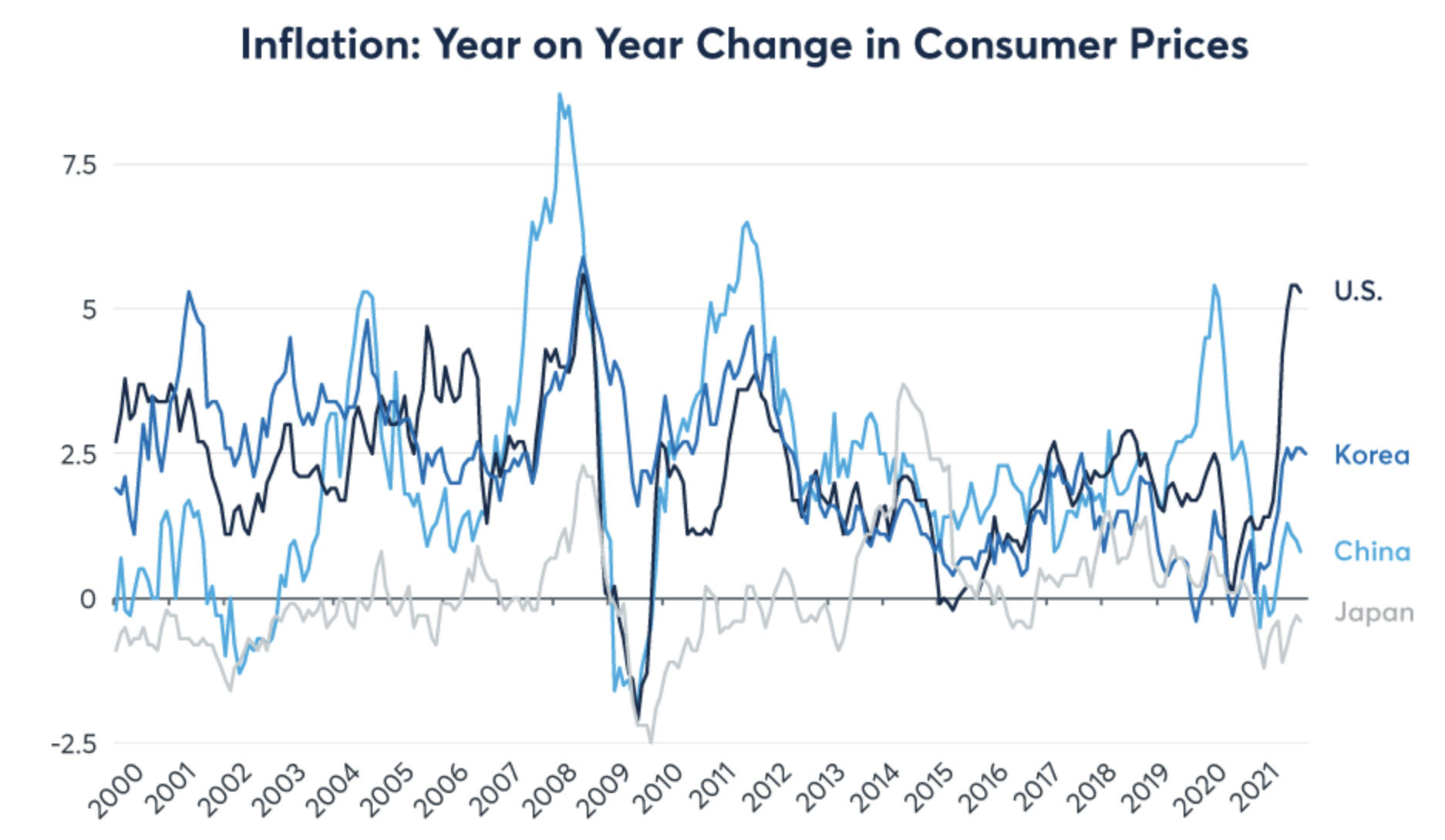

The one thing that China does not have that the US has a lot of? Inflation. While US inflation is at 50-year highs, Chinese inflation is far, far more subdued. In fact, as this chart shows, it's actually trending downwards towards rival economy Japan.

This, along with stimulus measures from the Chinese central bank, has created a situation where mainland stocks are actually a whisker away from a bull market.

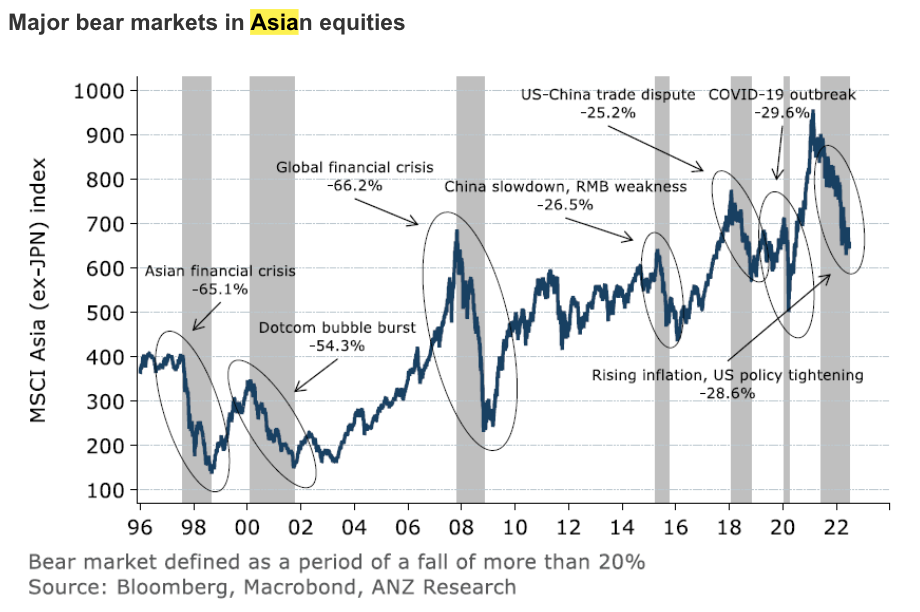

Jefferies is one of those that have turned bullish on Chinese stocks. Others, like ANZ Research's Khoon Goh see it differently. His chart argues that Asian equities - including Chinese names - are not ripe for the rebound.

So do you go with the flow or do you back the traditional outperformed? Two fund managers will now follow with the case for each country.

Antipodes' Jacob Mitchell: The case for China

Jacob says that investors who call China "uninvestable" are simply referring to its assets, which have underperformed relative to the US. But the tiger economy is different - and that also applies to its economic approach.

We think China is an attractive opportunity to build exposure to great companies at attractive valuations that will act in a generally non-correlated manner to portfolio exposures sensitive to Western economic outcomes.

Jacob also makes an important point - China’s economy has been weak because policy has been tight. Unlike the West, China doesn’t have an inflation problem to the same extent. In fact, the People's Bank of China has been looking for ways to stimulate the economy in the post-COVID world.

Jacob says this post-zero-COVID outcome has not been priced in yet by the markets - making these assets all the more cheap and attractive.

In our view, the market is yet to price a full reopening, or the potential upside from policy change that’s currently occurring, into current equity prices.

On the core concept of deglobalisation, Jacob highlights that despite the rising prominence of this theme, the world remains highlight “globalised”.

While localisation is happening on the margin, driven by political priorities, the inconvenient reality is that China actually took market share of exports throughout the COVID-19 period and that is in spite of US tariffs – and now the US is looking to roll back some of those tariffs to fight inflation.

Jacob emphasises the fact that it’s easy for the world to fragment politically, but not so easy for nations to disengage economically - other than the extreme example of economic sanctions on Russia.

It will pay to watch technology supply chains closely. That’s where the US is most tempted to cut China off and is constantly weighing this up against the economic and political consequences.

So what’s a play in a period of reshoring supply chains in a politically fragmented world? Jacob makes the case for German industrial and technology conglomerate, Siemens (ETR: SIE), a long-term Antipodes holding.

A company like Siemens stands to be a significant beneficiary of any reshoring efforts globally, principally through their Digital Industries business which is the world's largest and arguably most complete offering for discrete factory automation.

Speaking of technology, Jacob says the Antipodes team has a "comfortable" underweight position on US equities. This is especially true for the FAANG names - where Jacob says multiples still remain too high.

German multinational software company, SAP (NYSE: SAP) is one company highlighted by Mitchell as a compelling alternative to some of the better-known US tech stocks.

Forager's Steve Johnson: The case for America

If a US recession is the noise, then Steve says US corporate responses will be the signal. In arguing his case for American companies over Chinese counterparts, he argues there is more transparency and tangible results to be found stateside.

For every stock we own, we want to know how much cash it is going to generate and how and when that cash is going to be returned to shareholders.

Those two questions can be hard to answer in most countries. But in China, whether you are ever going to get any money back is clearly a heightened risk.

In contrast to Jacob's point of view, Steve argues that deglobalisation is in the middle of a multi-year trend. While sheer labour is a clear advantage in China, Steve looks for companies that can make its processes efficient.

We are focused on finding businesses that will be bigger, more profitable and in a better competitive position on the other side of a recession.

Both countries have their own geopolitical risks and challenges. But Steve argues that China's "wide berth" is also reason for why he'd be happy to pay up the bigger multiples for US earnings.

In general, though, you have much better legal protection and a culture of value realisation that works in your favour in the US.

So, all other things equal, I would absolutely be willing to pay a higher multiple of earnings for a US company than a Chinese one.

Besides, Steve says there are plenty of reasonably priced large companies in the US. Perfect example? Google owner Alphabet trades at just 21 times last year’s earnings.

Outside of tech, Steve also nominates Zebra Technologies (XNAS:ZBRA) as a US-listed business with the right tailwinds to make it big.

Finally, at the sector-level, travel is one of those that Steve says is "offering asymmetric payoffs at the moment."

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed-income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

5 topics

3 stocks mentioned

4 contributors mentioned