Choppier waters ahead

The start of 2018 has been anything but ‘business as usual’. Markets were buffeted first by inflation concerns and then trade protectionism. Equities fell and bond yields rose significantly as a result. So is it the beginning of the end for this long bull market cycle or is it the end of the beginning? We think it’s the former. Although we are sanguine about macroeconomic fundamentals, they are starting to peak and roll over. From now, markets could see more divergence between sectors and asset classes, indicating that investors may be best served by taking a more discerning, nuanced approach, away from the ‘beta trade’ of simple market exposure which has worked well until recently.

Global equities

Equity markets are returning to more normal levels of volatility, but even ‘normal’ has come as a shock to investors who have been cushioned by a long period of unusually calm conditions. We think we are entering the end of the cycle, but this stage could be drawn out given healthy fundamentals.

Developed market growth has been cooling a little but its recent trend has been robust and supportive for equity markets. In addition, emerging markets continue to grow strongly. Similarly, concerns about rising inflationary pressure have eased since the beginning of the year, when stronger than expected US wage growth jolted markets.

Investors’ main concern is that key central banks are shifting towards tighter monetary policy and the US Federal Reserve may be less inclined in future to act to support equity markets. It is unclear how central banks’ unwinding of monetary stimulus will affect economies, and indeed what level of withdrawal is feasible in practice given its magnitude.

We believe that even small interventions by central banks can have a significant impact on sentiment-driven markets that are near the top of the cycle. Similarly, unexpected shifts in macroeconomic data could rock markets because of the dependence on momentum - this is typical late-cycle behaviour.

These factors reinforce our opinion that the current economic cycle still has some life but that the beginning of the end is coming into view, with a market turn perhaps 6-18 months away.

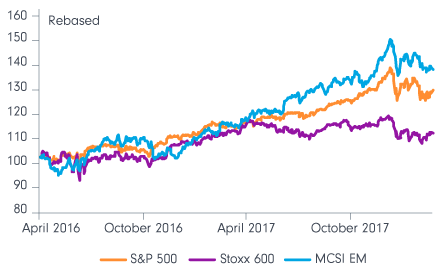

Chart 1: Equity markets will remain more volatile this year

Source: Datastream, April 2018

Sectors and regions

Although the ‘Goldilocks’ economic scenario of above-trend growth and below-trend inflation remains intact, recent company earnings reports show the effects of increased wage inflation and some pressure in distribution and transportation costs from a higher oil price, particularly in the US. This strengthens our view that cyclical sectors will not be able to maintain their outperformance over defensives and we note recent signs that this is, indeed, reversing. In this environment, being more selective about where and how you take risk is prudent.

In the US, FAANG stocks remain highly valued and, unusually, the group led into, as well as out of, the market corrections in February and March. This could partly be due to the influence of the US tax breaks. The FAANG’s strong performance has led to a concentration of US market returns, which creates risk - but also opportunities for re-rating in the underappreciated parts of the US market.

In Europe, markets have a broader base of support, which makes us more positive on the region. In China, we expect the economy to slow gradually but this has largely been priced into markets, and the Chinese government has historically been able to carefully manage the economy. Japan could prove volatile given its high exposure to global trends.

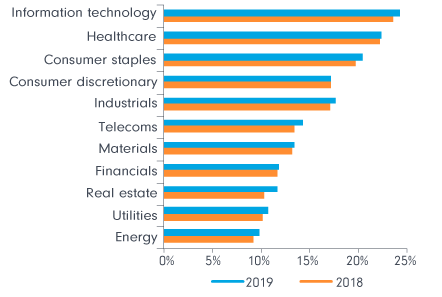

In terms of sectors, we are cautious on consumer discretionary.

In particular, we are concerned about auto stocks, where profits are peaking and finances are deteriorating, and retailers, which face headwinds from more restrained consumer spending. These industries constitute a significant part of the sector, leading to our negative view on consumer discretionary. In energy, prices should be range-bound and we do not expect undersupply or oil price shocks, and given that the oil majors have de-rated, there is scope for upgrades in the sector.

Chart 2: Sector returns expected to hold up

Source: Fidelity International, April 2018

Global fixed income

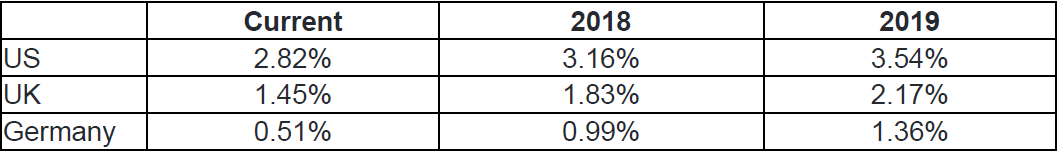

10y government bond yield forecasts

Source: Bloomberg, Fidelity International, 12 April 2018. The above forecasts are market implied.

Despite the volatility in US treasuries, global government bonds actually ended the first quarter higher on a hedged basis, primarily supported by the strength of Eurozone peripheral debt. Importantly, government bonds benefitted from a flight to quality as geopolitical risks reignited in March.

In the US, treasury yields are caught between opposing secular and cyclical forces. With US growth tracking at around 3 per cent, policy is continuing to normalise, driving yields cyclically higher. But the secular trends of lower growth and higher debt should keep terminal rates low and longer-term yields anchored. Against this backdrop, the Federal Reserve will continue to raise rates if conditions remain conducive to tightening but are unlikely to surprise with more hawkish commentary. We expect three rate rises this year, in line with market consensus.

For 2019, we note that markets are currently pricing only 1.5 rate increases versus the three rises implied by the Fed Open Market Committee’s ‘dot plot’.

We suspect that slowing growth may prompt a slower pace of tightening from the Fed next year than FOMC members currently project.

A tight US labour market and strong business surveys point to a risk of higher inflation ahead, and we see core CPI drifting up to around 2.7 per cent by late summer. In the short term, the upward pressure on US treasury yields remains in place, with markets continuing to test the 3 per cent mark. However, the perceived safety of US government bonds in a world marked by geopolitical risks should cap yields.

The recent flattening of the yield curve in Europe has somewhat reduced the attraction of euro duration, prompting us to reduce our exposure. The curve remains relatively steep and we still see some value, particularly in core eurozone government bonds. On peripheral countries we have moved to neutral after spreads tightened following buying by European banks and a relatively sanguine news flow.

In the UK, macroeconomic data is pointing to underlying weakness in the economy, and the prospect of a second quarter interest rate rise by the Bank of England is diminishing. Although the BoE may surprise the market and hike before the summer, over the long term the economy is not strong enough to withstand higher interest rates. Brexit uncertainty still lingers in the background and could become a meaningful driver for all UK assets once again.

Overall, across the fixed income universe, security selection is becoming increasingly important as markets grow more volatile: simply buying beta in fixed income may not lead to the kind of returns in has generated in the recent past.

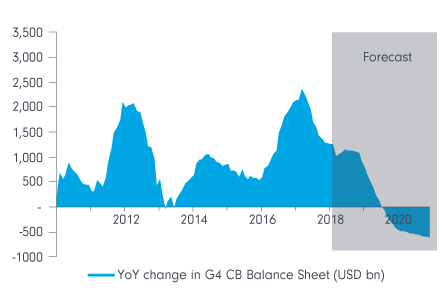

Chart 3: Policy support fading precipitously in 2018

Source: Fidelity International, Bloomberg, December 2017. Assuming €30bn per month in ECB support (PSPP) from January to September 2018, dropping to €15bn per month from October to December 2018; Fed balance sheet shrinking at $10bn per month from October 2017, increasing $10bn per quarter to a maximum of $50bn; and BoJ purchases slowing at a rate of 0.25 per cent year-on-year.

Chart 4: Global curves continue to flatten

Source: Fidelity International, Bloomberg, 31 March 2018

Sectors and regions

We are increasingly comfortable about credit markets, especially compared with six months ago, given the global economy is strong and corporate fundamentals across all regions are solid. However, investment grade spreads have widened as volatility picked up and issuance, particularly in euros, rose. We see more opportunity in European investment grade than the US or Asia because of strong credit fundamentals and ongoing support by the European Central Bank which is at least two years behind the Fed on its monetary path.

High yield has outperformed investment grade but we remain cautious towards the asset class , which continues to be highly correlated with equity markets, and is less attractive on a risk-return basis than investment grade debt or leveraged loans. The macroeconomic backdrop has supported high yield to date, with good earnings and low default rates. However, we do note signs of distress in US retail and telecoms sectors. In Europe, geopolitical risks have returned, whether that’s risks posed by the prominence of populist parties following the recent Italian elections or by ongoing tensions between Russia and the US following the latest round of sanctions.

Emerging market bond fundamentals remain solid, but we see little opportunity for further spread compression in hard currency government bonds this late in the cycle. Economic growth across emerging markets is currently strong but recent data have turned weaker, with the Purchasing Managers Index (PMI) decelerating. There are pockets of value in countries with higher yields and improving economic profiles such as Ecuador, Argentina and Angola. Better opportunities lie in the local currency debt space. Emerging market inflation-linked bonds look particularly attractive, given that inflation has troughed while real yields remain elevated compared to developed markets.

Chart 5: 10y inflation breakeven rates indicate rising inflation expectations

Source: Fidelity International, Bloomberg, 30 March 2018

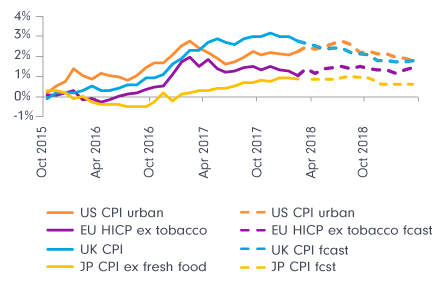

Chart 6: Fidelity inflation forecasts do not project a lasting pickup

Source: Fidelity International, Bloomberg, 30 March 2018

Alternatives: Commodities

Commodities have seen a mixed start to 2018. A strong beginning to the year in markets was offset by higher risk aversion as volatility rose across February and March. More recently, several commodities markets have been affected by geopolitical tensions, with oil prices benefiting from tensions in the Middle East, and aluminium prices spiking higher as the US announced new sanctions against Russia.

Chart 7: Spot the sanctions-related price move

Source: Datastream, April 2018

While geopolitical concerns cloud the outlook for commodities such as oil, the fundamentals for the energy market remain positive. OPEC and Russia have succeeded in restricting oil production, with excess oil inventories falling globally and the alliance now within sight of seeing oil inventories return to their five-year average. Strong demand growth has also helped, with the demand for oil growing by around 1.6 million barrels per day (b/d) in 2017, and forecast to grow by another 1.53 million b/d in 2018.4

China accounts for around 50 per cent of global demand for many industrial metals, making the outlook for the sector closely related to the health of China’s economy, which has been resilient over the past six months given tighter credit conditions which are weighing on growth. Import data for March suggests strong industrial demand and indicates that China isn’t the reason for the recent moderation in European and Japanese data. It also points to the global economy remaining robust for now.

Although fundamentals remain supportive for commodities overall, a stronger dollar could act as a headwind. Provided the global economy ex-US continues to grow strongly, any dollar strengthening should be limited. But if the rest of the world decelerates and the US continues to grow strongly, potentially boosted by late-cycle fiscal stimulus, then the Federal Reserve could be forced to tighten monetary policy more than expected, enabling the dollar to appreciate and causing negative effects for a wider range of assets than just commodities.

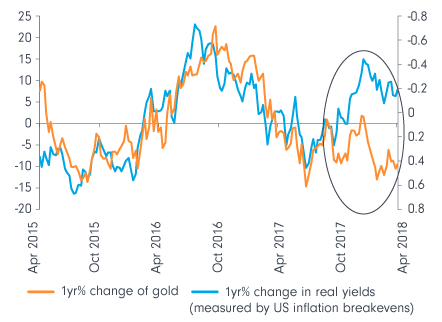

Similarly, a reversal of geopolitical tensions might see some of the risk premia that have been built into commodities such as oil, fading. For gold, reduced political tensions would be negative, particularly considering its decoupling from the direction of real rates in recent months. Over the medium to long term, real rates are the major driving force behind gold, so the precious metal’s recent divergence could close sharply if geopolitical concerns dissipate.

There is some evidence to suggest that markets are becoming desensitised to tweets from President Trump.

If that’s the case, oil might serve as a better political hedge than gold around geopolitical tensions, particularly given the influence of the situation in Syria, Iran and Yemen on prices.

Chart 8: Gold has diverged from real yields in recent months

Source: Datastream, April 2018

Further Insights

For more detailed analysis from the team at Fidelity, including the full Quarterly outlook, please visit our website