Chris Stott: what's hot, what's not

The pace of the pandemic recovery has caught many investors off-guard, including 1851 Capital's Chris Stott, but the manager’s rapid bear-to-bull transformation has paid off.

Having opened to investors in February, just as coronavirus first breached China’s borders and began wreaking global havoc, it’s been a wild nine months for the fledgling fund overseen by industry veterans Stott and his portfolio manager Martin Hickson.

“But the domestic economy is recovering out of recession at a much faster rate than anyone had expected earlier in the year,” Stott said in a recent investor webinar.

As the last days of Australia’s Spring unfolded, the S&P/ASX200 was back at pre-COVID levels; mortgage lending activity and house price growth was picking up faster than major banks expected; and the unemployment rate was lower than many had tipped.

By the time 1H2021 reporting season rolls around in February, Stott expects the recovery to be in full swing. “We think results are going to look pretty spectacular; balance sheets are in terrific shape…and companies are performing a lot better than they thought they would be,” he said.

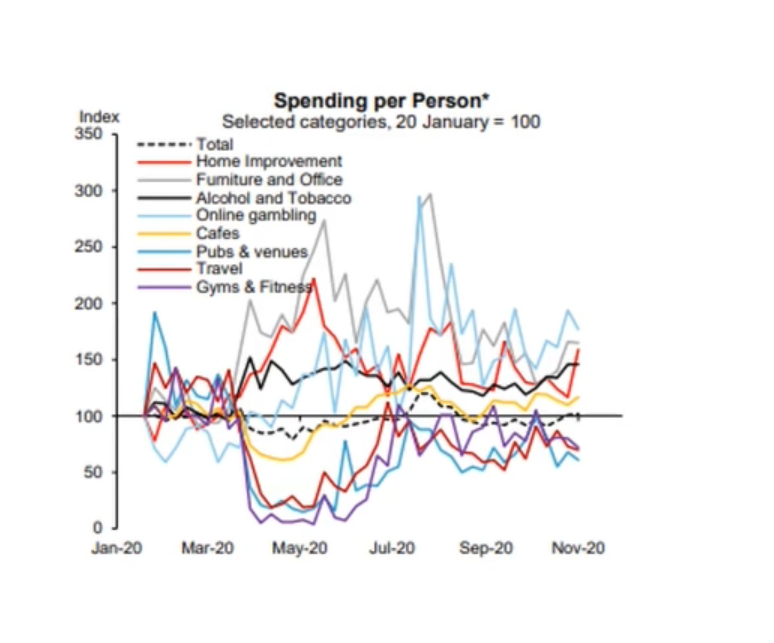

Source: Macquarie

Stott and Hickson managed the “extraordinary period” since February by staying nimble – something easier for a smaller fund like the 1851 Capital Emerging Companies fund than its larger peers.

“We’re a strong believer that size is your enemy as an asset manager…we were quite active in selling our more illiquid micro-cap positions, moved away from retail stocks, financials and other sectors we thought would struggle if we went into a long recession like some were forecasting,” Stott said.

A couple of prominent retail names, homewares merchant Temple & Webster (ASX: TPW) and online electronics marketplace Kogan (ASX: KGN), were big beneficiaries in the thick of the pandemic lockdowns.

“They performed very well, but I think the market was assuming that growth rate would continue forever, and that clearly won’t be the case,” said Hickson.

“We’ve since seen significant falls in those two companies, which we don’t currently own, and there will be a swing back toward some of the other retail names.”

But while avoiding such names has helped the fund’s performance – which ranks in the upper quartile among small cap peers rated by Morningstar – selling other stocks too soon detracted from returns. Hickson cites non-bank lender Money3 (ASX: MNY), online clothing retailer City Chic (ASX: CCX) and novated vehicle leasing firm Eclipx (ASX: ECX) as examples. Dropping these names was a decision made on a base-case assumption back in March – one shared by innumerable others – that the recession was going to be prolonged. “We learned on the back of that. We think they’re good companies, but we just sold them at the wrong time, because we thought they’d be some of the hardest hit,” said Stott.

But clearly the opportunities thrown up have outranked the risks, as they’ve scooped up many other high-quality names at bargain prices. The portfolio has expanded from the lower end of its target of between 30 and 80 stocks to around 73 stocks as of mid-November.

“Over the last six to nine months, we’ve seen some of the best buying opportunities in more than a decade,” said Stott, singling out property portal Domain (ASX: DHG), whose valuation is up around 150% over the last eight months as another other successful pick. And Stott sees many other opportunities into 2021 and beyond, including:

Mining services

Currently trading on a single-digit PE ratio versus the S&P/ASX Small Ordinaries Index’s PE of 20-times, Hickson and Stott's conviction in the sector saw the fund buy into Emeco Holdings (ASX: EHL) back in October. “This performed quite well in this November rotation that we’ve seen in equity markets globally,” Stott said.

Advertising and media

Outdoor advertising firms oOh!media (ASX: OML); Here, There & Everywhere (ASX: HT1); and WPP (ASX: WPP) have also been added to the portfolio. “As the world and the economy normalises, a lot of companies will start re-engaging and starting to spend again on advertising and marketing…to go out and start fighting for customers again,” said Hickson.

Travel and entertainment

While this sector isn’t expected to rebound as quickly as others, Hickson and Stott expect markets will increasingly “look through” the next six to 12 months and start pricing in a recovery. In line with this, they’ve bought a small holding in theme parks, cinemas and hotel company Event Holdings (ASX: EVT). “Looking at its property portfolio, if you mark to market you get a share price of $12 versus the current share price of $10,” said Hickson.

The pair also discussed a few of their top holdings, with the largest five positions collectively comprising around 20% of the total portfolio. The largest position is in online property and car sales portal developer Frontier Digital (ASX: FDV). Having recently raised $60 million in cash, Hickson expects this will drive new investment which will in turn see the share price re-rate in 2021.

The fund’s second-largest holding is workforce management company People Infrastructure (ASX: PPE). The stock’s valuation has tripled since the fund first bought it in April, “but we still think it’s significantly undervalued,” said Hickson. He believes the firm’s free cashflow of between $80 million and $90 million, if deployed, could boost earnings by 60%. “With a current share price of $3.50, we think as they deploy that capital over the next 12 to 18 months the share price can rerate to north of $4.50.”

Diagnostics and medical imaging business Capitol Health (ASX: CAJ) is benefiting from a healthcare sector that has held up better than the market was expecting, said Hickson. With a new CEO pursuing cost-out along with improving revenue, “we see significant operating leverage and earnings growth for this business over coming years.”

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a like.

2 topics

16 stocks mentioned

2 contributors mentioned