Chris Watling: Recession is not a "slam dunk" but bear market may endure

After hitting a peak of over 4,700 at the end of last year, the S&P 500 has since corrected by more than 20% placing it in a technical bear market (again). In between, there have been small rallies - but none have really convinced the bulk of analysts that we're out of the worst. Least of all, Morgan Stanley's Mike Wilson who said recently that the upside seen a fortnight ago was not all that convincing.

We remain firmly in the bear market camp but relief rallies can happen at any time, and it appears we are now in the midst of one.

Wilson was vindicated late last week when a scorching inflation print sent stocks far south and yields far north (especially at the front end of the maturity curve.)

Given those moves and all the uncertainties that are on the horizon, pundits and investors alike all think a recession is likely on the cards - and equity markets are cratering at the possibility.

Unless you're Chris Watling. In two exclusive interviews, Watling told me that recession is not his base case but that the risks are piling up. He's also not convinced we've experienced an official "bear market rally" but does admit there may be lower to go for equity markets. Finally, we'll delve into his argument that we're not in a recession - just a temporary cost of living crisis.

Editor's Note: This wire includes excerpts from an original interview conducted on Friday, June 10th, and Wednesday, June 15th. The piece was originally going to be published earlier this week but following the US May inflation print and the ensuing market selloff, Chris and I agreed to a second interview for an update on his views.

The fast guide to bear market rallies

First things first - just as there is no strict definition for a bear market, there is no strict definition for a bear market rally. Rather, the term describes the trend of investors who assume prices may have bottomed out when the gains are, in actuality, only temporary before prices decline again. The "20%" which is bandied around in markets is purely a reference figure rather than a lynchpin.

As recently as two weeks ago, Charles Schwab's Liz Ann Sonders responded to a question on Yahoo Finance Live about the presence of bear market rallies, saying they were a presence "for now".

How that call has changed.

An unwind, not an unravelling

Fresh off a webinar hosted by Watling and Fidante Partners, he told me that we are at the end of stage two of what he calls a "three-stage" downtrend process for equity markets. The overexuberance was hit by a shock (in this case, the war in Ukraine) and has led to some troubling, multi-month price action.

Then, the big surprise. US core inflation had not rolled off as expected while headline inflation hit a searing 8.6%. The alert sent equities, bonds, and Chris' base case into a tailspin.

"I still think inflation is peaking out," Chris says. "It's just the problem is it's not going to peak out as fast as we all want, and it won't give the Fed a chance to breathe."

"It's a very unusual time and there are lots of explanations as to where the market is going," he says. But he argues that the price action is not the tipping point of a great unravelling - rather, it's the unwind of a long-standing groupthink.

"What's really going on is the beginning of the unwind of the TINA thesis," Watling says.

The perfect example, in Chris' view, is US big tech. In 2015, "no punters" wanted to buy in and there wasn't even a FANG+ Index to highlight the disparity big tech share prices had in comparison to the rest of the NYSE.

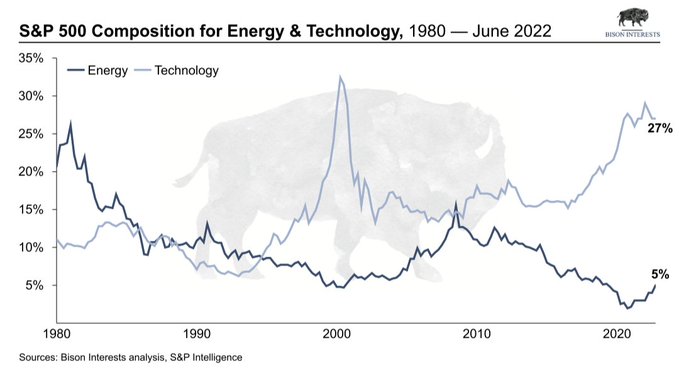

Today, the information technology space makes up more than 25% of the S&P 500.

The trend was only accelerated by the pandemic, encouraged along by an "easy to craft" story. Having said this, Chris continues to be amazed by the amount of extrapolation in investment markets.

"I think markets have fashions, and the funny money accentuated tech and growth," he says. "I think a lot of what we've done in the last five, six months is really a major rotation and shift in global sector leadership. Tech is done and we're now moving elsewhere."

The price is (not) right

To quote a former teacher of mine, it's always best to do the right thing and not the easy thing. Watling argues the same goes for the bear market rallies that pundits talk so much about.

"I'm personally not convinced it's a classic bear market rally, and I'm not convinced we're in a bear market," Watling argues before adding that an uptrend's resumption is still possible except in US equities.

"The sentiment is so bad, fear levels are so high and the conviction of a bear market is so high - it all adds to the argument that you could get a very long bear market rally or a resumption of the uptrend."

Before last Friday's selloff, Chris told me the fear premia in markets is presenting buying opportunities for the right sectors and the right breed of investors (namely short-term traders) like derated, quality tech stocks.

"Some of it is actually quite attractive," Watling says. "There's quite an attractive bull case for a lot of tech".

Post selloff, he thinks that the market is now on line for far more downside to come.

"We're taking another leg lower," Chris says. "Sentiment was beaten up a week ago - and it still is."

He also argues that European equities (including the FTSE 100) and the Australian equity market are not in bear market territories. One thing he does note is not to look for a winning sector to hold onto into these unusual times as a lynchpin for the start or end of a rally - mostly because there is nothing distinguishable.

Watling also argues this time is not different from 2008 or even 2020. He argues the composition and the principles are the same - whatever is hit the hardest also bounces the most.

The one chart that counts

Chris has two key questions he wants every chart to answer right now.

- How much will inflation persist?

- What is economic growth doing?

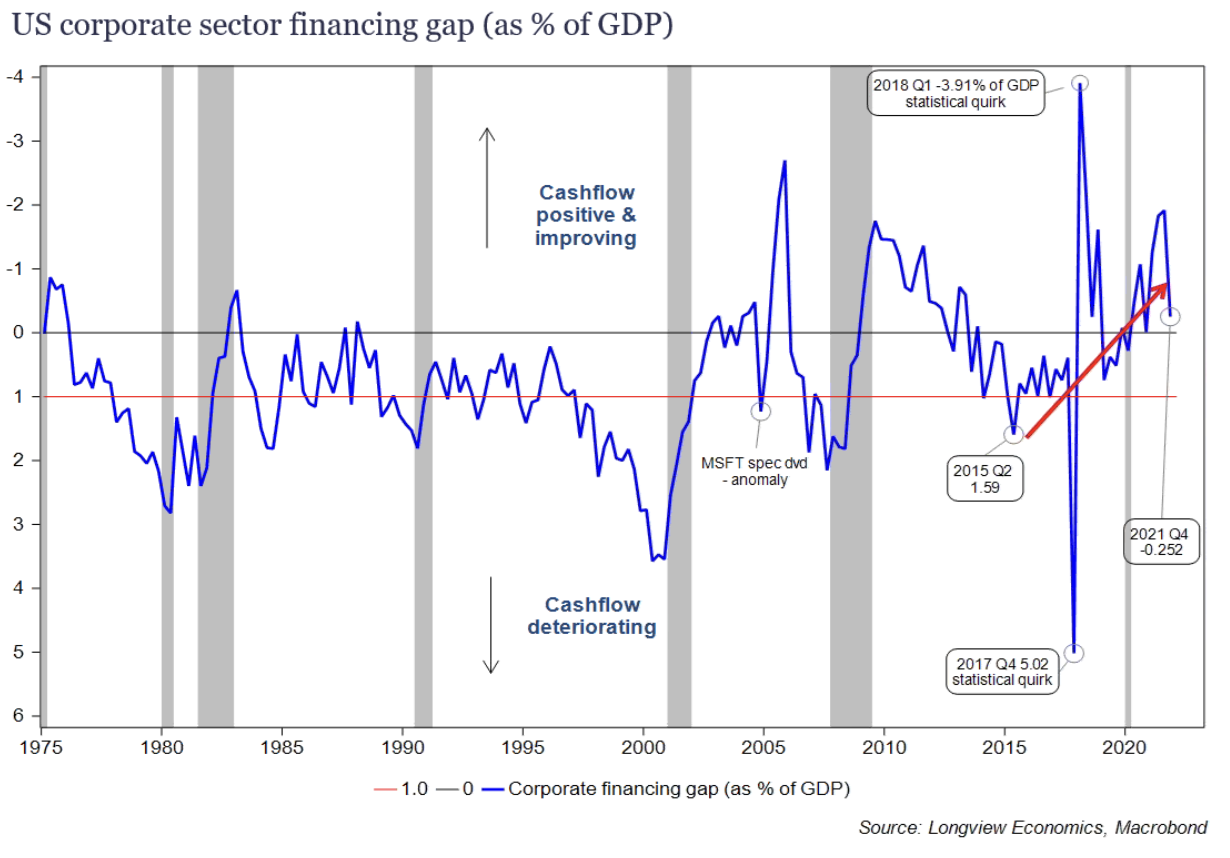

The good news? There are plenty of charts to describe that. The bad news? There are also one too many charts we could reference. However, Chris did eventually pick this one showcasing the health of the corporate sector.

"When the corporate sector is in good cash flow health, it tends to be a mid-cycle slowdown rather than a recession," Watling says. "If the sector has good cash flow, it's not going to panic."

The other buzzword(s): soft landing

Part of what macro strategists love to hang their hat on is the idea of a central bank "soft landing" - something that we've discussed at length here. Most economists are now firmly either in the "impossible" camp or, at best, believe the path is looking increasingly narrow.

Chris argues that the secret to the whole mystery will come down to the future behaviour of inflation - in particular, when (and if) prices will start to come down materially. Even the Federal Reserve's hike this morning didn't matter, in Chris' view given it's still on its path to normalisation.

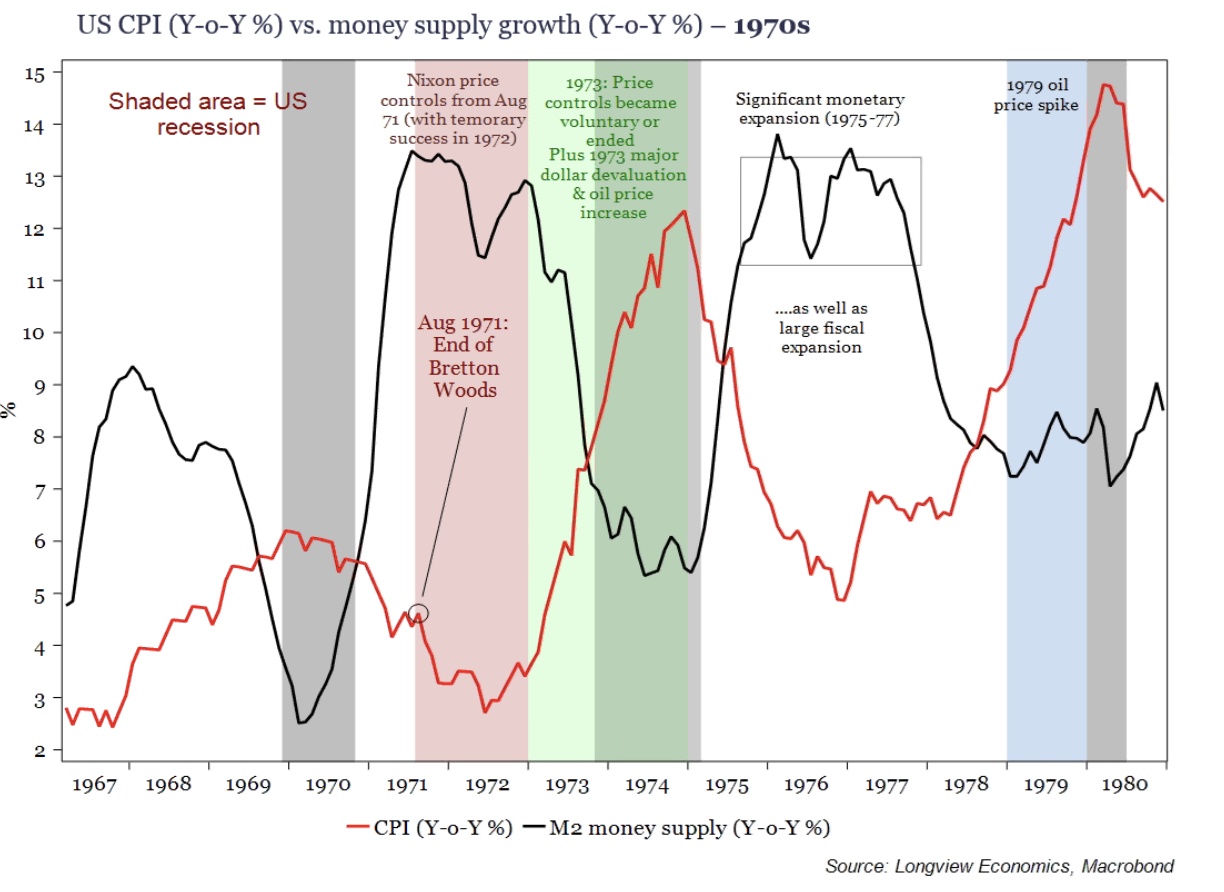

"This is just the best example in my working career of monetary inflation," Chris says. "This is not the 1970s - there are parallels but the Fed is very different to what it was then," he adds.

"The soft landing case is not lost, it's just diminishing."

Speaking of monetary inflation, he points to this chart which he says could tell a lot of the story. He argues there is much more correlation with the late 1800s/early 1900s.

Where to invest if Chris' base case eventuates

As always, this section depends on your investment time horizon. Having said this, Chris did admit that the market uproar caused the team to switch from a tactical overweight to underweight almost overnight. His longer-term strategy has also moved back to a neutral position.

Before that, he highlighted that Australian and European equities were not in a bear market. As a consequence, he sees both places as medium-term pockets of opportunity.

"Australia, the UK, and Europe are the places to go - not the States. I think the is in a state of secular underperformance that will last many years," Chris says. Friday and Monday's Wall Street moves have also only enhanced the latter half of this view.

Chinese assets are also of interest to Chris given the stimulatory environment that the tiger economy is staring down. In fact, if you compare the CSI 300 and the S&P 500, the selloff of recent days was so steep that the Chinese market is now materially outperforming the American market (though, of course, it comes with the caveat that everything can change.)

Finally, the China thesis also supports why Chris would back commodities - and even ASX miners. From iron ore to natural gas, the post-war changes will be "great" for Australia.

In summation

Adding it all up, the strength of the consumer and corporate balance sheets are the fundamental reasons why Chris does not believe a recession is coming. He's not even convinced that most equity markets are in a bearish downtrend - much less experiencing bear market rallies. For now, Chris continues to stick with the bullish commodities thesis while adding history won't repeat itself (ala the 1970s) because the lay of the world is so different.

Grab the popcorn and stand back, folks.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

4 topics

5 stocks mentioned

2 contributors mentioned