Circular economy stock comes full circle

Fiftyone Capital

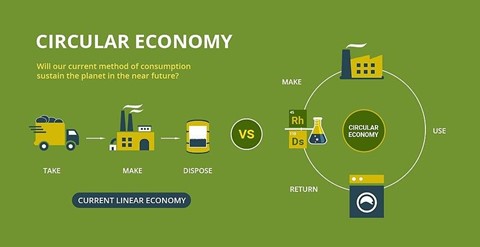

The circular economy refers to a shift away from the typical linear model of production - > consumption -> discard, to an economy where the end-of-life use can be restored or regenerated. The concept creates a more sustainable way of living by eliminating waste and pollution, re-uses the same products/materials and preserves our environment. While the concept is compelling, it does not necessarily translate to an economic business.

Purecycle is a plastics recycling company that came to life via a SPAC during the SPAC craze of 2020. Its 'pure planet' goal is to commercialise a technology developed by Procter & Gamble to restore waste polypropylene ('PP', think plastic containers, reusable water bottles, toys) into virgin-like resin, enabling it to be re-made into another product. This was a +$1bn deal and at its peak PCT reached a market capitalisation of $4bn, not bad for a pre-revenue company that has not even built a production plant yet.

The business had hallmarks of being a highly disruptive winner. The TAM was big, with 167 billion pounds of PP consumed each year worth $75 billion. Its unique patented process is not only revolutionary in its ability to convert waste PP back into a virgin quality state but is also more cost-efficient with purported 50% EBITDA margins. The demand is real with ESG front of mind of Fortune 500 companies and the company stating it had offtake agreements secured with the likes of P&G and L'Oreal. The problem we always had with the business was, can it deliver on its lofty promises?

The reality of plastics recycling is that it is incredibly difficult to build an economic business case for it. This is reflected in the current state of plastics recycling. Polyethylene terephthalate ('PET', think soft drink and water bottles) is the most recycled plastic type driven by being the highest value plastic. Even so, PET recycle rates are low at <20% globally with PP recycle rates far lower at <1%. Unfortunately, anything that is not recycled ends up in landfills or pollution.

For Purecycle's technology to work, it needs to collect PP feedstock first, and this is where the model is already doomed. Collecting waste PP is not only a costly exercise, but it also requires a shift in consumer mentality. Consumers will first need to know what PP is and that it can be recycled, and secondly, they must choose to recycle PP. Unless there is a cultural (eg. everyone else does it, so I should do it too) or economic reason (eg. you get paid 10c for each recycled item) to recycle PP, most consumers would have no impetus to do so. Not to mention, once you get the waste PP, sorting and cleaning it to a state to which it can be processed is another major challenge to overcome.

Purecycle is building its first plant in Ohio with capacity of 107 million pounds and commencing production in late 2022, with ambitious goals to roll out additional production lines and plants to reach 1.3 billion pounds capacity by 2025. If reached, this would be larger than the entire PP recycling market today. Purecycle states that it has reached an agreement to sell its product for between 90c - $2.00/lb despite PP selling for just a fraction of that at c.50c/lb. It is somewhat plausible that companies would be willing to pay a premium for "green" plastic, but 100-300% mark-up sounds too good to be true.

Let’s not also forget its alleged 50% EBITDA margin, which would place it above the likes of Apple and Google, despite Purecycle being more akin to a capex intensive industrials business.

For argument's sake, let’s assume $1/lb price and 50% EBITDA margin, its first plant would deliver $50m EBITDA. This compares to an estimated development capex of $250m, equating to a pre-tax return on capital of 20%, which is respectable, albeit based on questionable assumptions. At its peak market cap, the business was trading at a sky high +70x EBITDA, and even at today's prices it implies +10x EBITDA.

The stock has had a wild ride from $10 to a high of $35 in early 2021 before briefly collapsing 50% in May 2021 to $12 on the back of a short report published by Hindenburg Research, only to double again a month later. Ever since then, it has generally been drifting lower.

We stayed away from shorting the speculative end of the market in most of 2021 for fear of retail reddit armies and ample hot money around to trigger short squeezes. It appears that phase has well and truly dissipated which is when we started looking at adding shorts on concept stocks. We were far from picking the top when we started shorting Purecycle, but for a business that looks destined to add to the failed SPAC tally, there is no need to.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Portfolio Manager for the Progressive Global Fund at Fiftyone Capital

Expertise

Portfolio Manager for the Progressive Global Fund at Fiftyone Capital