Citi’s 5 most attractive and 5 most unattractive ASX stocks

Every person invests in their own way. Some are pure fundamental investors, looking closely at balance sheets and management commentary to eye where a business’ earnings will go next. Some are pure technical investors, following trend lines and looking out for entry and exit signals.

Then, there are quant investors. Quant investors use a range of mathematics and algorithm techniques to gain an edge in their investing. Most major investment banks have a quant team of some form, including Citi, whose quant team has run a “radar” system for picking stocks since mid-1997.

In this article, we’ll go through the four quadrants of Citi's quant team's radar system and pick out the 10 most interesting stocks that have been highlighted for their attractive (and unattractive) qualities.

The four quadrants

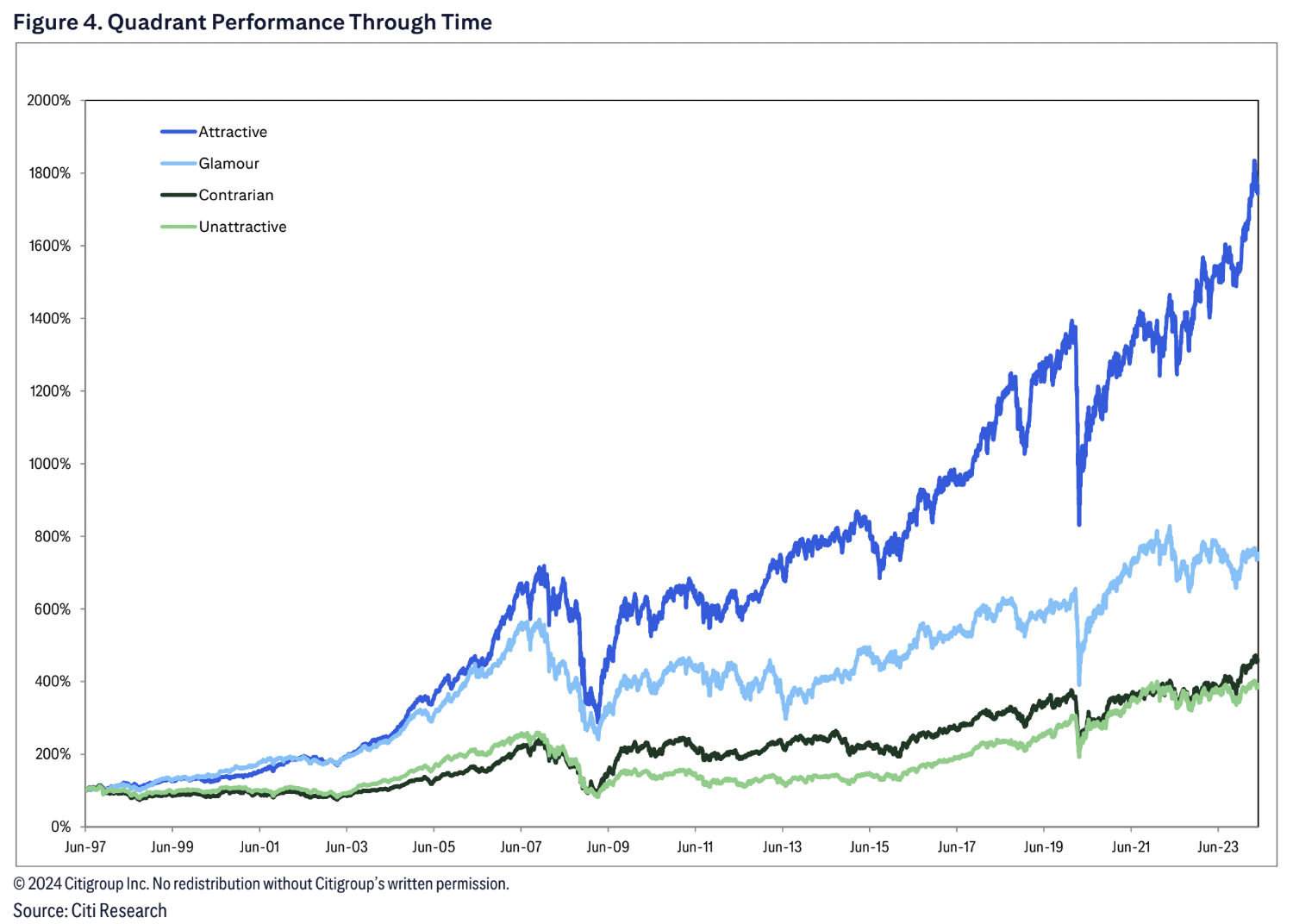

Citi likes to divide up its quant model portfolios into four “quadrants” - or more plainly speaking, four investing styles.

Attractive: Cheap stocks with strong sentiment

Glamour: Strong sentiment but expensive

Contrarian: Cheap but with weak sentiment

Unattractive: Expensive with weak sentiment

Over time, the model has shown what you might expect it to: Cheap stocks with strong sentiment (the “attractive” bunch) tend to outperform over the long run, while unattractive stocks tend to underperform. And the gap is not even close.

What might surprise you, is the relative outperformance of stocks with strong sentiment compared to those with strong contrarian tendencies. This, in Citi’s view, speaks to the idea that sentiment-centric strategies have performed more strongly over the long run in Australian equity markets than valuation-centric strategies.

Lastly, it should be noted that there are 27 “attractive” stocks and 26 “unattractive” stocks in the model list - suggesting it really is a stock picker’s market. For the purposes of this piece, we will go through the five highest conviction mentions in each list.

The five most attractive stocks

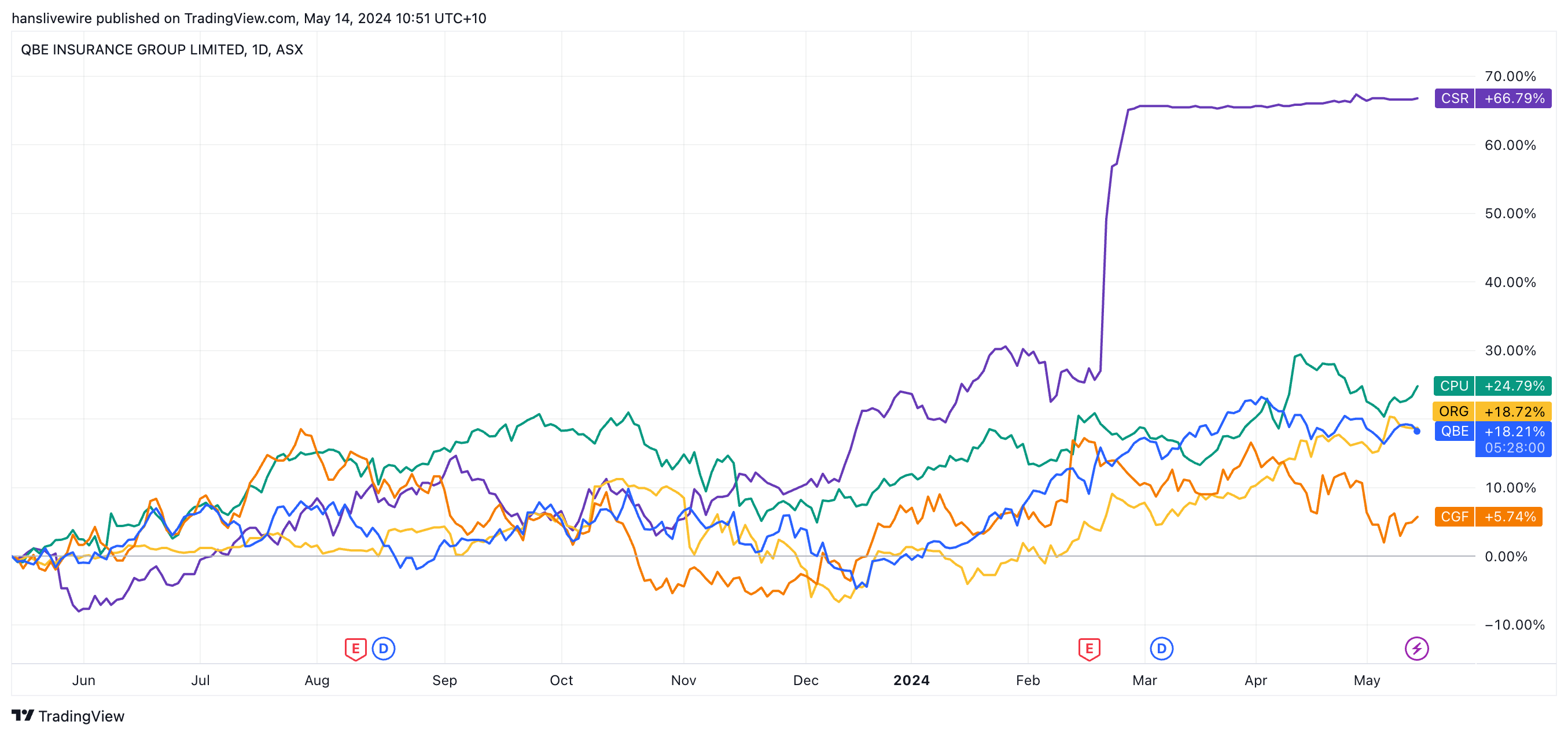

Of the five most attractive stocks, only QBE Insurance (ASX: QBE) and CSR (ASX: CSR) were highlighted in last month’s quant update. Any commentary, price targets, or ratings below are derived from Citi’s fundamental sell-side analyst team. Some additional information was provided by FNArena.

QBE Insurance (QBE) - “QBE looks on track for the growth and margin expansion we forecast and with the stronger investment returns, we lift our FY24E EPS: +3%,” analysts wrote earlier this week following the company’s recent Q1 update.

Challenger (ASX: CGF) - “While this earnings momentum could support the stock if conditions remain relatively benign, we still see risk that tighter credit conditions will eventually impact. We retain our SELL rating with a new A$6.65 price target,” said analysts back in February.

CSR (CSR) - No new research has been published by Citi on this company since November 2023. The current rating is NEUTRAL with a price target of $5.75 per share.

Origin Energy (ASX: ORG) - Citi does not currently have a rating or price target for Origin Energy.

Computershare (ASX: CPU) - “While CPU needed to slightly alter [its earnings] mix, large transactions and cost control should enable it to weather inflationary pressures and the overall relatively subdued transaction environment to deliver on guidance overall … We believe the story’s attractions remain and, reflecting this, we retain our BUY with a small lift in our TP to A$30,” analysts wrote back in February.

…and the five most unattractive stocks

Again, any commentary, price targets, or ratings are derived from Citi’s fundamental sell-side analyst team, and some additional information was provided by FNArena.

Star Entertainment Group (ASX: SGR) - Citi does not currently have a rating or price target for Star Entertainment Group.

Lynas Rare Earths (ASX: LYC) - “A bleaker rare earths pricing outlook coupled with elevated unit cost expectations prompts our SELL call and reduced $5.30 price target,” wrote analysts back in late April.

Orora (ASX: ORA) - “Post trading update, we expect consensus double-digit downgrades, largely reflecting soft trends continuing with limited seasonal uptick… With low expectations and an improving outlook, we cautiously expect this could be the last downgrade. However, we await more detailed information on exact end market exposures of Saverglass to gain more conviction,” analysts wrote in early April.

Sims (ASX: SGM) - We maintain our BUY rating and $13.50 price target despite earnings downgrades as we’ve moved our P/E valuation to FY26 (from FY25). We believe now is the right entry point given we are at cyclical lows as earnings should lift beyond FY24,” analysts wrote last week.

Nanosonics (ASX: NAN) - “NAN guided to flat sales in FY24, a significant change from the +15-20% growth guided in August 2023. We view the US budget constraints and need to offer customers financing as negatives for the LT outlook,” analysts wrote in their sector-wide review of the ASX healthcare space in early March.

This piece was first published on Market Index.

3 topics

10 stocks mentioned