Climate moneyball: the star player stocks aren't the usual suspects

Have you seen the movie Moneyball? Based on the Michael Lewis book, Moneyball: The art of winning an unfair game, it tracks the Oakland Athletics baseball team and the efforts of their manager Billy Beane (played by Brad Pitt) to assemble a competitive team.

The motif was adopted by Nanuk Asset Management in their latest presentation to financial advisers. Tom King OAM, CIO explained his thinking:

"The outlook for sustainable technology hasn't really changed significantly over the last twelve months... But the investment outlook has changed quite significantly. And the topic Moneyball provides some themes or messages that are very relevant today."

The first is that the obvious or popular approach may not be the only or the best way to achieve your objectives.

And the third analogy or message is a question, is it time to have a swing?"

I was in the audience for the presentation and use this wire to present some key insights for your portfolio.

Note: The presentation on Wednesday 18 October 2023 includes mention of several stocks. Nanuk Asset Management holds these stocks in their Nanuk New World Fund. You can read my recent interview with Tom King here.

The obvious approach is not the best way

Sentiment towards stocks bearing a "sustainable" badge has shifted over the past two years, according to King. In short, sustainable technology stocks today aren't so egregiously cheap that they are a ‘home run’ and guaranteed to outperform, but he argues that over the medium term (say 5 to 7 years) the odds have become increasingly good that they will.

Best bets might not be the star players

In recent years the world has recognised the almost certain longer-term adoption of key sustainable technologies such as EVs and renewables, and to a lesser extent hydrogen: However, while they are important, they only address around one-quarter of the world's global emissions problems, King noted. People now realise that the world needs to use all the solutions available at a much larger scale. He also highlighted that investment returns in these areas have disappointed since early 2021.

"A pattern we see repeated over and over in which niche industries and companies in those industries will see extraordinary runs up in share prices as people factor in very high growth rates and high levels of profitability our into enormous total addressable markets.

But inevitably, what we see happening is those cycles end up providing to be overly optimistic and people eventually realise those profit growths aren't going to appear. Share prices come back down normally to where they started," he said.

Is it time to have a swing?

The short answer, according to King, is no – sustainable technology stocks are not so cheap that investors can be assured of outperformance. But although they could still underperform, their investment potential today should not be ignored. The real question, King posed, is “if not now, when?”.

"Over the medium-term, we believe you are more likely to come out ahead than behind investing in sustainability themed equities today," he argued.

He cites four reasons for this view:

-

Recent market performance of sustainability themed equities improves the odds of future outperformance.

In 2021, higher growth technology stocks underperformed, but more traditional areas of environmental investment like waste management and sustainable packaging performed well. 2022 saw a different dynamic with the war in Ukraine, rising interest rates, oil and gas stocks performed well and many stables like tobacco also performed well. These sectors are usually excluded from ESG or sustainability funds and consequent led many to significantly underperform. The big trend in the markets in 2023 has been the performance of the large cap US tech stocks, the FANGs. As a cohort. these stocks account for between 17-20% of global indices, more than half of global equity returns this year are due to these stocks. The trends of the last two years are unlikely to continue indefinitely and the underperformance of sustainable themed equities is increasingly likely to reverse of the medium term. -

The hype is nearly gone.

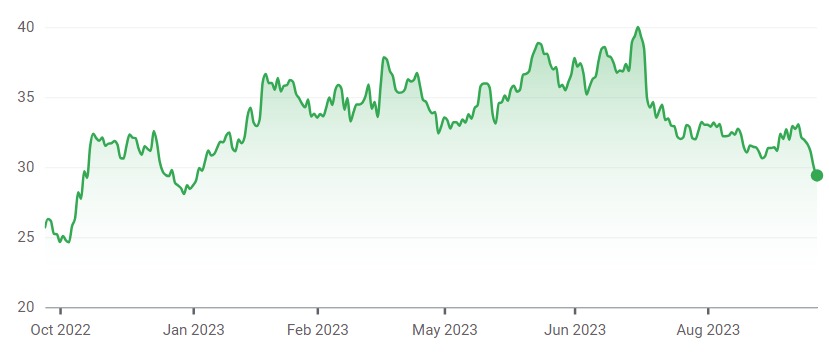

The hype and elevated valuations associated with higher growth clean tech stocks have largely evaporated, with the share prices of many having completely retracted significant gains during 2020. -

Policy expectations are pretty low.

"The pervasive attitude seems to be today that we can't afford to invest in decarbonisation anymore because of inflationary pressure. It's politically not acceptable. " But climate issues continue to worsen, and it is highly likely that policy and regulatory support for sustainable technology will be increased, not decreased, as we move through this decade. -

Good reasons why profits in sustainable technology companies are likely to improve in the next year or two.

With an exposure focused on industrial technology being used by industrial customers, sustainable technology companies typically have limited exposure to consumer end markets, and many stand to benefit in 2024 and beyond from strong policy support in major economies and the expansion of margins as cost inflation eases.

Nanuk’s portfolio managers outlined several stocks owned by the Nanuk New World Fund that illustrate how the manager is seeking to capitalise on the current situation through good quality businesses offering both attractive valuations and exposure to growth trends.

"The analogy or message from Moneyball that the odds are potentially better in the players that are worth less or cost less. The buying shares of high prices isn't the only way to win. Arguably, you are better paying for less well-known companies that can deliver solid outcomes," King said.

Stocks for this theme

The team of five portfolio managers gave examples of stocks that they believe illustrate this theme.

Advantest Corporation (XTKS: 6857) is a Japanese company providing semiconductor testing equipment.

"Every single chip on your smartphone, in your car, PC or in a data centre undergoes rigorous testing to ensure quality, safety and reliability," says Marie Miyashiro.

Advantest tends to trade in line with semiconductor stocks, with the stock price based on a function of its market share and the size of the semiconductor market. As the complexity of chips increases, the demand for testing increases; Miyashiro’s view is that test revenue wasn't just simply a function of market share and market size but of the increasing complexity of advanced semiconductors and the increasingly sophisticated testing required. She noted that Advantest operates in a duopoly with its nearest competitor Teradyne (NASDAQ: TER) but that Advantest is becoming an effective monopoly in higher-end testing applications.

Peter Wilmshurst discussed Infineon Technologies AG (ETR: IFX), a German manufacturer of power semiconductors and microcontrol units. Power semiconductors are pervasive in electrical applications and the company has a strong track record of growth driven by electrification within the automotive industry as well as growth in sustainable technologies like wind turbines, solar PV panels and heat pumps. The other core area of its business is microcontrollers.

"When we talked about cars, it was all about the engine. But going forward, cars are going to be defined very differently. They're all about the level of autonomy you're getting, the things that computers can do in your car. And electrification," he said.

John Lobb's example stock is Prysmian Group (BIT: PRY), an Italian manufacturer of cables and systems for energy and telecommunications: electricity, data and fibre optic cables. It's an industry with high barriers to entry, notes Lobb. Prysmian is also a global leader in its field.

Tristan Patience highlighted Denso Corporation (TYO: 6902), a Japanese car parts manufacturer, which offers electrification systems, mobility electronics and advanced devices.

"Denso provides key components of the electrification system. With electric vehicles, power management is really important. They also make thermal systems: as batteries expand, electric vehicles need systems that keep energy efficiency to maximum. They also make driving assist for vehicle collision and accident prevention. That really helps the efficiency of the vehicle fleet," said Patience.

Binya Even's discussed Zebra Technologies (NASDAQ: ZBRA), a US-headquartered provider of hardware (handheld computers) and software in the enterprise asset intelligence space to such industries as retail, healthcare, warehouse and distribution, manufacturing, transportation and logistics, energy and utilities, hospitality and e-commerce fulfilment.

"I live in the UK and I use Zebra products pretty much every time I go shopping. If I go to the supermarket - I can't remember the last time I checked out at a till - when I go through the door, I pick up the Zebra Zapper and I'm just zapping between my buys as I walk. And then when I get to the point of sale, it already knows what I owe. I just pay it and go," Even said.

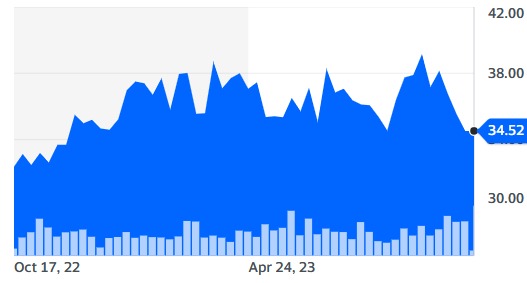

Even highlighted the significant downcycle in supply chain investment by customers like Amazon had provided an attractive entry point into the stock.

Over to you

Are you taking a swing on climate players? Let us know in the comments which sustainable stocks you are investing in