Coles, Woolworths, McDonalds... equities, bonds or property?

Fawkner Property

There’s a saying that “to the man with a hammer, everything looks like a nail”.

- Equity investors must hammer equities.

- Fixed Income investors must hammer debt.

- We live in a complex world where a range of tools is required for success.

Investors must not be limited to the hammer when they really have access to the whole toolbox.

Income dilemma?

We are now living in an era where investment income is a precious commodity. Since the Global Financial Crisis in 2008, global Central Banks have steadily driven interest rates toward 0% and in some cases, even below zero.

Historically, investors have been able to rely on a balanced portfolio of fixed income and equities to generate adequate levels of investment income. But with interest rates now at record lows, the fixed income component is no longer able to meet the income objectives of many investors (unless it is actively managed by high-quality managers such as Christopher Joye's Coolabah Capital team).

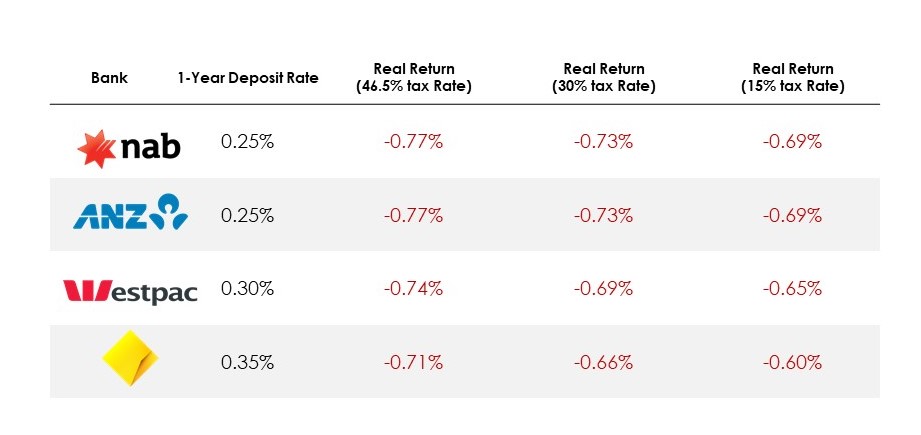

Even 12-month term deposits as offered by the major Australian banks do not exceed the current rate of inflation (i.e., they are generating negative real returns).

This poses a problem for current day investors – and particularly retirees. Retirees are supposed to rely on investment income to support their living and minimise the required drawdown on capital. The traditional view is expressed by Investopedia:

“…if you’re retired … fixed income instruments must move into the driver’s seat.” (1)

Investors, including retirees, are now faced with a tough decision – to accept the low levels of income offered by traditional fixed income products or move up the risk curve in search of higher yield. Many believe this means the choice between buying corporate bonds or buying equities.

Option 1: Debt

In August 2020, Coles (ASX: COL) re-entered Australian debt capital markets with a long-dated multi-tranche $450 million transaction, comprising $300 million of 10-year fixed-rate notes and $150 million of 5-year floating-rate notes.

It was a fantastic opportunity for yield-starved investors to again lend money to a blue-chip Australian company. The only problem, like all Investment Grade borrowers, Coles’ prices were Down Down!

If you were willing to lend money to Coles for 5 years, you were offered a return of ~1.00% p.a. However, if you were more patient and willing to lend Coles money for 10-years, this rate increased to 2.10% p.a. (2) The value of these bonds has since increased and the current Yield to Maturity is now 1.94% p.a. (3)

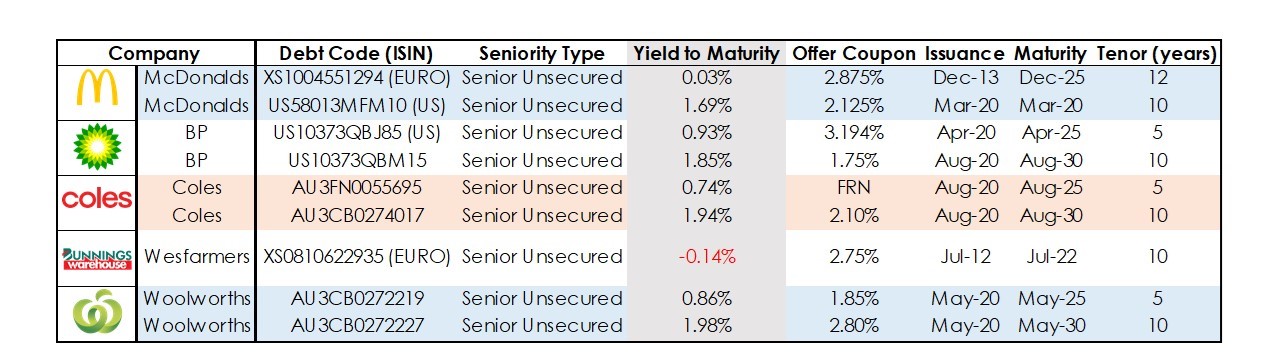

How do the bond yields of Coles compare to Woolworths (ASX: WOW), Wesfarmers (ASX: WES) or even international household names like McDonalds or BP?

The answer can often be difficult to find due to the institutional nature of the bond market. Also, the minimum parcel size of $500,000 for corporate bonds in the over-the-counter market makes significant diversification for many investors impossible.

The table below highlights the current Yield To Maturity (YTM) of these companies for instruments expiring in five and 10 years. The YTM is the total annual return anticipated on a bond if the bond is held until it matures. (The grey column shows the YTM).

Put simply, if you were to purchase McDonald's debt maturing on 25 December, you would receive only 0.03% p.a. interest on your investment.

Option 2: Equities

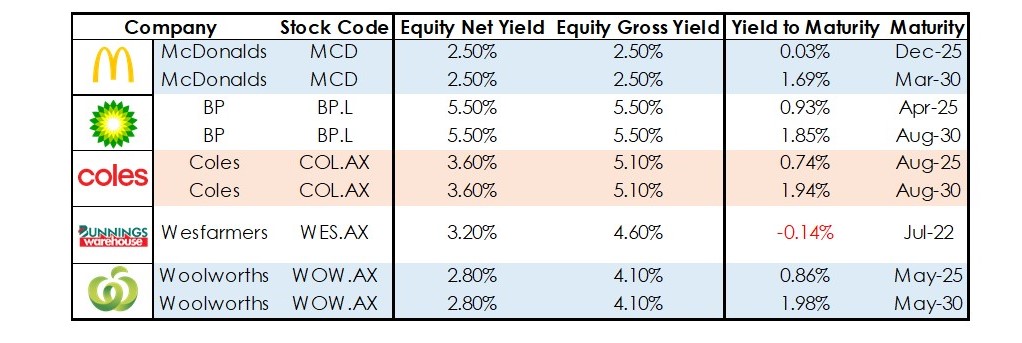

Another option to increase your return over the long term (rather than to lend money to the company) is to become an equity holder. Volatility is typically higher and the capital security is lower, however, the dividend yield and prospects for capital gains is also higher.

Where the Coles share price currently sits, the stock offers Net Yield of circa 3.6%, when accounting for the franking credits attached to these shares the Gross Yield on Coles shares is currently around 5.2% (give or take, depending on the day). The table below shows Coles Equity Yield alongside the YTM on their debt, as well as the same basket of peers. (4)

A recent ASX survey indicates this is the most likely scenario that an Australian investor would take. 50% of retirees said they intend to invest in “Australian Shares, held directly” over the next 12 months (56% for Wealth Accumulators and 83% for Next Generation investors).

Option 3: High-quality, long lease Property

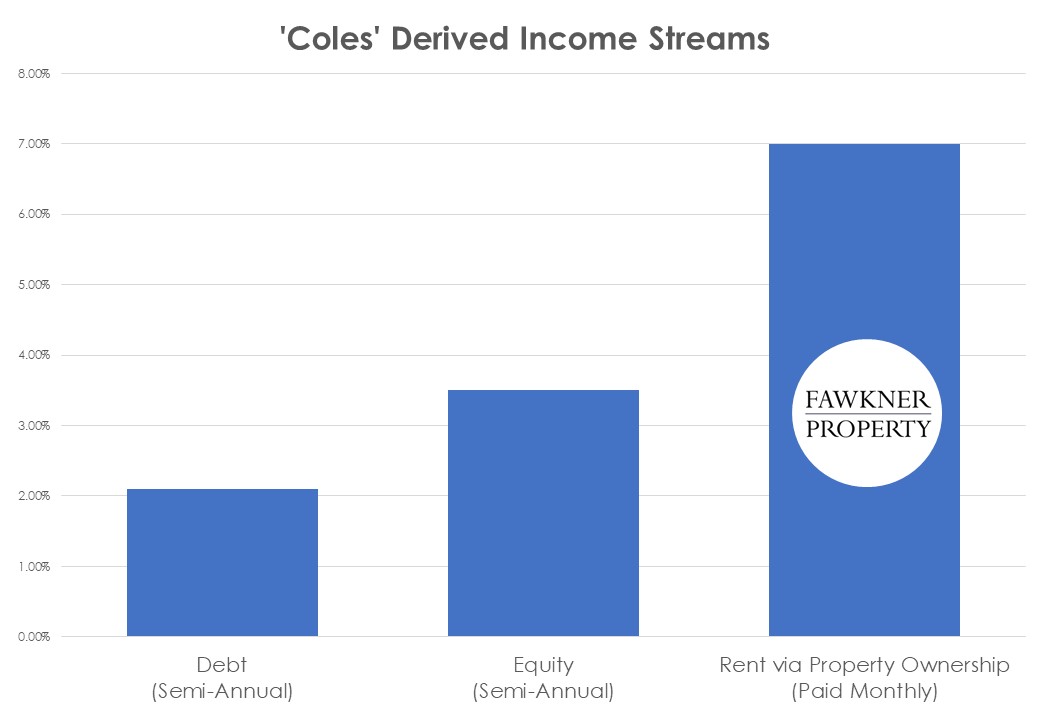

If 1% is not a satisfactory income return, nor a (pre-franked) dividend of 3.6%, where does an investor go for an income stream derived by one of Australia’s best retailers?

Unlisted property trusts were first introduced in the 1990s, allowing small and medium investors to gain access to direct commercial property. UPTs like the ones offered by Fawkner Property allow investors to take direct ownership in properties such as shopping centres that are anchored by Coles supermarkets.

Collect Rent – If you do it right you can get 7% p.a. (Paid Monthly)

As direct property owners and landlords, rent from companies like Coles or McDonalds is legally owed to you.

This places you higher in the capital stack than preferred equity holders but below secured lenders. The rent is often agreed on long-dated terms with fixed rental increases, providing you with security for your expected level of income. Not only can acting as a landlord offer significantly higher levels of income, but investor capital is also backed by physical Real Estate.

Comparison: Find the best way to get your exposure

Investors seeking a predictable income stream from Coles, Woolworths or McDonalds have 3 opportunities:

- Fixed income managers wanting to own Coles 10-year bonds had to accept 2.10% (paid bi-annually), now they must accept 1.94%.

- Equity managers wanting to own Coles, must accept the current dividend yield of 3.5% (paid bi-annually).

- Commercial Property investors wanting to secure a 5-15 year lease to Coles and McDonalds, have opportunities to generate income of 7% (paid-monthly) via Fawkner Property's Essential Service Trust No.15.

Diversify your portfolio with property supported by strong national brands

In times of uncertainty, long-term leases to non-discretionary tenants can provide much-needed income returns without the impact of equity market volatility. To find out more about Essential Service Property investing, contact us or read more here.

(1) Barnes R 2020. How to Create a Modern Fixed-Income Portfolio. Investopedia 31 Aug 2020

(2) (VIEW LINK)

(3) Refinitiv Data

(4) Refinitiv Estimates

(5) (VIEW LINK)