Credit Suisse: The catalyst to go underweight equities (and the triggers to reverse it)

It’s no secret that the past year has been a tough environment for markets. As Andrew McAuley, chief investment officer and wealth manager for Credit Suisse points out, it’s been the worst start to a calendar year for equity markets since 1966.

Yet, it was only on 29 August that Credit Suisse decided to underweight its equities allocation. So, what pushed the change?

According to McAuley, earnings downgrades and challenges to valuations were significant factors, combined with the commentary from Jackson Hole and the US Federal Reserve Symposium. It's a tactical decision and one McAuley expects to be adjusted with the phases of the market cycle.

“This time next year, the narrative will be very different. Equities will probably be cheaper assuming prices come off and we’ll be talking about rate cuts," he said.

In this edition of Expert Insights, Andrew McAuley discusses how markets have reached this stage, the phases of the market cycle, the decision to underweight and why central bank commentary will be a key trigger to change their weightings.

Note: This interview was shot on Tuesday 30 August 2022. You can watch the video or read an edited transcript below.

Edited Transcript

What factors have led bonds and equities to dramatically fall this year?

What we’ve seen up to the end of June was a dramatic fall in bonds and equities. It’s not unusual for bonds and equities to fall at the same time. In fact, it’s normal when you begin a rate rise cycle. When central banks start raising official rates to slow inflation down, bond yields rise to factor in expectations for future rate rises. So it’s no surprise that bonds fell in price, particularly as yields have been falling for many years and we’re at extremely low levels.

I think what caught a lot of people by surprise was the drawdown in equity markets. The S&P500, as an example, fell the most it has since 1966 for the start of a calendar year. It’s not unusual for both bonds and equities to fall at the same time but what was unusual was the size of the falls in equities. This was a response to the front-end loading of rate rises by central banks. We weren’t getting 25 basis point increases in official rates – we were getting 50 and 75. There was talk of 1% in developed markets. That hasn’t eventuated, but you get a sense of how aggressive the central banks have become now.

Bond yields are used as the discount rate to apply to the cash flows that companies are generating. As bond yields go up, the risk-free rate goes up and the theoretical value of those cashflows goes down.

The share markets become much more uncertain about the future when rates are going up. As a result, they are much less likely to apply a ritzy valuation to earnings way out into the future. So consider long-duration earnings. If some companies are on a very high valuation based on earnings in 10-20 years' time because they have strong growth, the market goes, “you know what? We’re not going to value it as we did previously. It’s going to be worth less than what we thought previously.” As a result of that, equities fell quite sharply.

What part of the market cycle are we in at the moment?

You can break the cycle up into three phases. Phase one is what we’ve just gone through. Rates start to rise in response to inflation. Bonds and equities both fall. What was unusual about this phase was the degree to which bonds and equities fell.

Now that central banks have been raising rates and inflation data has been developing, markets are getting more comfortable about where inflation is heading and when and where official rates will peak. That means we’re moving out of phase one into phase two. We’re moving from a point where bonds and equities are both falling to one where the market’s going, “you know what? We’ve got a pretty good grip on inflation. Its year-on-year numbers are still high. Looks like they’re peaking. Looks like they’re coming down. Bond yields are higher. The risk-return metric is much better.”

So the market is then attracted to bonds as a safe investment.

Phase two is where the market is almost or completely comfortable with inflation. We’re not quite there. There’s plenty of volatility and bonds are acting as a proper hedge. There’s still plenty of uncertainty around earnings in equities.

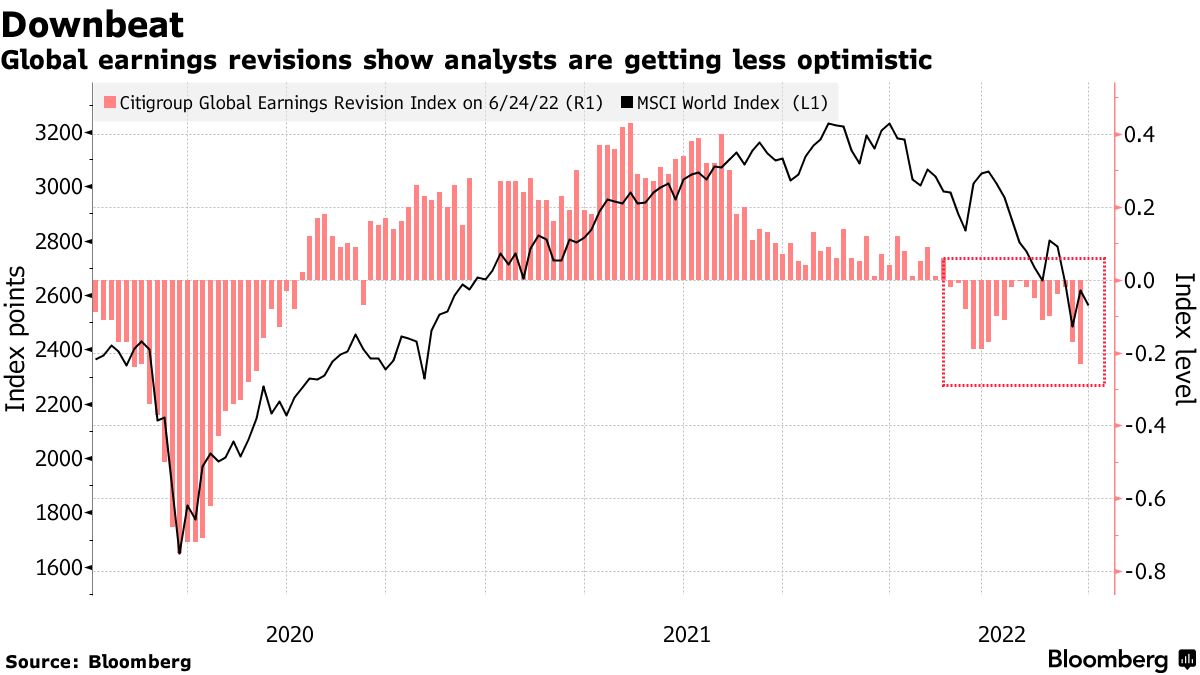

If you look at a graph of earnings revisions for the US and MSCI World, it’s trending down very obviously.

That’s where momentum is headed and we’re in this sort of limbo world for the next six months.

Has the market factored in enough for earnings downgrades? We think it probably needs to factor in a bit more. We see a bit more downside for the equities market over the next six months.

This all sounds pretty grim but the good news is this is just the cycle. It’s normal. The market is expecting a peak in the official interest rates in Australia by August next year and the US by April or May next year.

This time next year, the narrative will be very different. Equities will probably be cheaper assuming prices come off and we’ll be talking about rate cuts.

Market participants will be thinking “rate cuts, what does that stimulate?” and they’ll think, “hang on, earnings are about to turn up.”

It’s a completely different narrative, that’s the cycle and that creates opportunity. That will be phase three.

Why are Credit Suisse underweight equities at the moment?

There are a few reasons for that.

Number one – earnings are being gradually downgraded around the world, particularly in Europe. The European economy is under tremendous pressure as a result of rising commodity prices, and electricity and gas prices.

Number two - valuations aren’t nearly as supportive as they were after the market corrected. At one stage, the S&P500 was down 21%. That was the worst start to a calendar year since 1966. Other markets were in a similar vein. The market had factored in a hard landing. It recovered and valuations were reasonably supportive factoring in a soft landing. Since then, earnings have continued to be downgraded.

The true catalyst for going underweight on 29 August was the commentary from Jackson Hole and the Federal Reserve Symposium.

To paraphrase, Federal Chairman Powell basically said they will do whatever it takes to stop inflation. Markets reacted quite negatively to that.

We see that as a statement of intent that the Federal Reserve will raise rates a bit more than what the market is expecting. This means earnings will continue to be downgraded from where they are now. The valuation support that is there now won’t be sufficient over the next 3-6 months.

What triggers would you look for to change your weighting to equities?

We’ll be looking to commentary from central banks around the world for where they see the trajectory of official rates to move into a more constructive view on equities. You’ll start to hear speeches where they’ll say, “We think we’re nearly done. We’re not sure how many more rate rises we’ll need.” That will be a key indicator.

The central banks will be looking at inflation:

- Is inflation coming off?

- How fast is it coming off

- Is underlying inflation coming off?

For Australia, the RBA is targeting inflation between 2-3%. If inflation is heading towards that number, it’s a key indicator.

The other key indicator is that it’s darkest before dawn. Over the next six months, we’ll see companies come out and say things are tough. Earnings will be downgraded. You’ll start to hear companies say things aren’t getting any worse. That will be a key indicator for us to move back into equities.

Learn more

Credit Suisse Private Banking specialises in asset diversification, holistic wealth planning, next-generation training, succession planning, trust and estate advisory, and philanthropy.

2 topics

1 contributor mentioned