Cryptocurrency regulation: The elephant in the room

.png)

Bitcoin reclaimed its all-time-highs last week, and it seems like time that we examine its largest threat – regulation.

As levels of adoption and awareness continue to grow, it has become more and more likely that cryptocurrencies will play a role in our future economy.

Cryptocurrencies, as the native currency of our blockchain-based internet, have a significant opportunity to innovate and create value within the ecosystems in which they operate, whether this be through rebuilding capital markets, democratising financial systems, or revolutionising the way we store and transmit data.

However, as with any major innovation – regulation will play a major role in how things will progress.

Given the capacity of cryptocurrencies to alter the flows of capital within our economies – regulation for governments will largely be a balancing act between maintaining control and encouraging innovation.

Too much regulation and you stifle all innovation - where any increase in economic output will either move to a different country or disappear altogether.

Too little regulation and you risk not having sufficient safeguards for investors and consumers, where governments may also lose their power in areas of monetary and fiscal policy.

So, as the topic of today’s note, we will focus on cryptocurrency regulation – the good, the bad, and the ugly.

We will focus primarily on the US – who lead the world in terms of cryptocurrency development, and ownership (by dollar value).

The Good – Reduced Consumer Privacy and Bitcoin ETF Approval

Over the past few years, a prevalent theme within developed economies has been a continual reduction in privacy – where governments have attempted and succeeded to increase their levels of surveillance in multiple aspects of our lives.

What is most relevant to the future popularity of cryptocurrencies is the increased level of financial surveillance, where governments have sought to restrict and monitor cash transactions and gain greater transparency over our bank accounts, and the transactions we make.

Whilst an increase in transparency for governments may at times be important when enforcing anti-money laundering (AML) and tax evasion requirements, there is a fine line which society will tolerate between enhanced oversight and perceived intrusion of civil rights.

In Australia, we almost saw the introduction of the Currency (Restrictions on the Use of Cash) Bill 2019 – where all cash transactions over $10,000 would become illegal, and punishable by a two-year jail sentence. This bill was passed in the House of Representatives but was turned down in the Senate in December of last year, not because of opposition, but due to the prioritisation of our economic response to COVID-19.

As a result of this, it is likely that this cash ban will be passed at some point in the future, and potential even at a lower level than $10,000 (discussions were made regarding a $2,000 limit), where it will represent another step towards the increased financial surveillance capabilities of our Federal government.

In America, the Biden administration attempted to pass a new proposal where banks would have to provide transaction data to the IRS on all accounts with over $600 in total annual transactions, which was met with staunch opposition, where the requirement in the proposal has been updated to $10,000.

Even with this new revision, a large proportion of Americans would fall under this categorisation, with both proposals having been pushed heavily by both President Biden and Treasury Secretary Janet Yellen as a solution to reduce tax evasion.

Most important throughout this process has been the strong opposition from Americans, where they were promised an administration who would “tax the rich” but have instead attempted to target tax evaders from lower socio-economic backgrounds.

This is all bullish for cryptocurrency, where Americans have voiced their concerns with the increased levels of government surveillance and the perceived infringement of their rights (something Americans value quite dearly) – where cryptocurrencies can offer a decentralised solution, unable to be controlled by those on Capitol Hill.

The speculation and eventual approval of the first US-based Bitcoin ETF has also put a rocket under the cryptocurrency market over the past month.

This overcame a significant hurdle for the market, where the SEC was yet to approve a Bitcoin ETF despite countless applications dating back to 2013.

One distinction must be made on the underlying securities of this ETF - the ProShares Bitcoin Strategy ETF (NYSEARCA: BITO) – where it is only able to invest into Bitcoin futures, making it inferior to an ETF able to invest into Bitcoin itself.

This inferiority is due to the fact that futures ETF’s deliver poor performance in the long run and substantial tracking error, through their negative carry, management fees, hedging and transaction costs, and cash balances.

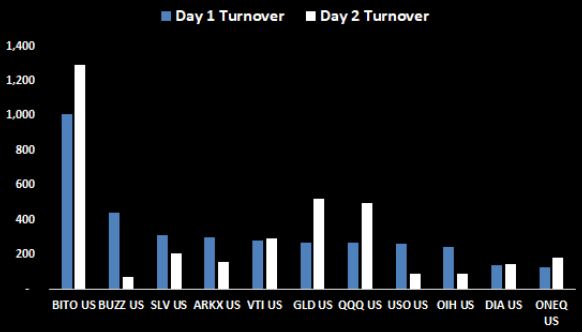

Despite this, it was the fastest ETF to reach a total market capitalisation of $1bn USD (when excluding pre-seed investments), reaching the figure in only 2 days, as well as having the highest turnover over the first 2 days of any US-based ETF.

Chart 1: Most Successful US ETF Launches of All Time (excluding large institutional flows)

Source: Bloomberg

The SEC elected to only approve a futures ETF (where Valkyrie also launched their version last Friday – NASDAQ: BTF – with other competitors to follow suit in the coming weeks), due to the presence of existing regulatory frameworks at the Chicago Mercantile Exchange (CME) – where all contracts will be sourced.

In order to approve a spot Bitcoin ETF, the SEC will have to get comfortable with a cryptocurrency exchange – which is good news for Coinbase shareholders (NASDAQ: COIN), given it is the most likely candidate.

The Bad – Unrealistic Reporting Requirements

Cryptocurrencies made their first major foray into US legislation, where a series of strict financial reporting requirements were included within the $1 trillion USD bipartisan Infrastructure bill, which is set to come into effect in 2023, pending final approval of the bill.

These reporting requirements were included to generate additional taxation revenue – estimated to amount to $28bn USD over 10 years.

What was concerning to the cryptocurrency industry were the parties to which these regulations applied to.

These “brokers” include cryptocurrency exchanges (as expected), but also miners, nodes and non-custodial software developers (primarily Decentralised Finance (“DeFi”) protocols).

This will involve more detailed KYC reporting requirements, as well as significantly higher punishments for non-compliance.

For cryptocurrency exchanges, it makes sense, however for all other parties involved, the regulations are unrealistic and pointless.

When it comes to the DeFi industry, this would be akin to the Australian government requiring Gumtree to provide in-depth KYC profiles and transaction details for every purchase/sale facilitated through their website.

The DeFi protocols are not involved in the transactions themselves, but just provide a platform in which investors can communicate to each other on a P2P basis (see this note for further details on DeFi).

These laws, as well as the conceptual misunderstandings made throughout the proposal, indicate a lack of cryptocurrency knowledge on Capitol Hill.

The affected “brokers” will simply move to other countries which are more accommodative, which will make this policy change a pointless endeavour, where they are able to raise little additional taxation revenue whilst still losing out on potential innovation.

The Ugly – Clarity is Key

When it comes to regulation, clarity is key.

Without having a clear understanding of the relevant laws, how can one appropriately run a business?

Within the US cryptocurrency industry, there is very little clarity, where perspectives contrast between regulatory bodies over almost everything – including their relevant jurisdictions.

The Commodity Futures Trading Commission (CFTC) views Bitcoin as a commodity, Treasury has referred to cryptocurrencies as “currency”, and the SEC is currently in the midst of a landmark case against Ripple, where it is attempting to define it as a security, using a 75-year old precedent called the Howey Test.

Should Ripple be defined as a security, then the regulation of many cryptocurrencies which raised capital at issuance would fall under the purview of the SEC, where many would have to pay large fines and halt US operations.

One important point of clarity which the SEC has provided to date is their confirmation that they won’t follow China’s footsteps by implementing a ban on cryptocurrency.

The key reason behind the lack of clarity to date has been the difficult task for regulators to both learn about the industry, and to fit digital assets into existing regulatory frameworks.

What the industry needs is the creation of a regulatory body dedicated solely to cryptocurrency – or the allocation of responsibility to 1 organisation.

The organisation would have to establish an entirely new regulatory framework which is suited to the unique characteristics of the industry, where current approaches are akin to fitting a square peg into a round hole.

As an industry currently worth US2.5trn, it has already become too big to ignore.

The longer there is a lack of regulatory clarity, the more cryptocurrency organisations will continue to leave in search of greener pastures.

This could involve some companies coming to Australia – where a Senate inquiry has recently advised for the creation of a new regulatory regime for cryptocurrency assets.

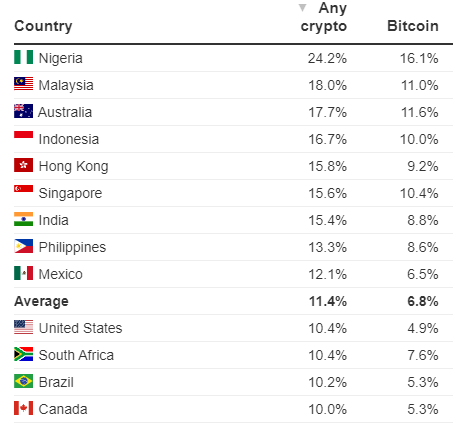

As a country with the 3rd highest adoption rate in the world, where ~18% of Australians own some form of cryptocurrency, the opportunity could be immense.

Table 1: Percentage of People Who Own Cryptocurrency, by Country

Source: Finder.com.au

A Regulators Worst Nightmare

The task ahead for regulators is immense, where they have been asked to generate a regulatory framework for a nascent but burgeoning industry, which has the capacity to play a key role in developing the economy of our future.

Given the industry’s ability to reshape our society – particularly through the flow of capital – the task ahead for regulators and governments will be a balancing act between maintaining control and supporting innovation.

As the internet proved to be a boon for the US economy, the same opportunity could exist right now, where the US could act as a centre for cryptocurrency and blockchain-based innovation – a race that their largest economic competitor, China, has effectively backed out of early.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

.png)

Mike is an Investment Analyst at Mason Stevens, where he is responsible for a broad range of investment management activities, primarily focused on the firm’s fixed income product offering and wealth services. Mike has a strong interest and...

Expertise

.png)

Mike is an Investment Analyst at Mason Stevens, where he is responsible for a broad range of investment management activities, primarily focused on the firm’s fixed income product offering and wealth services. Mike has a strong interest and...

.png)