Danger flags are waving

There are moments in life where unnecessary risk is taken despite the warning signs. For example, swimming outside the flags at the beach when the surf looks exciting. The flags are there for a reason, it protects you from turbulent currents that could suck you out to sea. For the stock market, the warning flags are overvaluation and slowing growth and investors should take heed when they are waving.

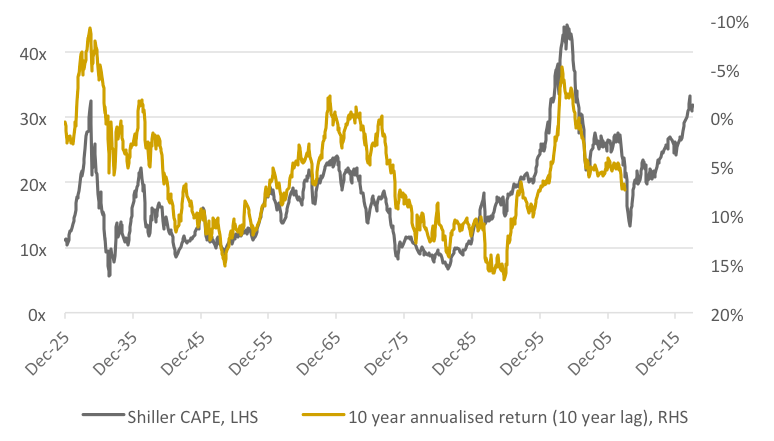

The overvaluation flag has been flapping for some time. For example, the Shiller Cyclically Adjusted Price Earnings index (S&P500 price dividend by its trailing 10-year average EPS) has been flashing extreme valuation levels for the US stock market.

Chart 1. Shiller Cyclically Adjusted Price Earnings index is pointing to low long-term returns.

Source: Yale Shiller data, Vertium

Despite the high likelihood of low long-term returns, valuations are overlooked because the only game in town right now is growth and momentum. However, over the long-term valuations cannot be ignored because growth is cyclical. When growth slows, share prices fall when there is no valuation support.

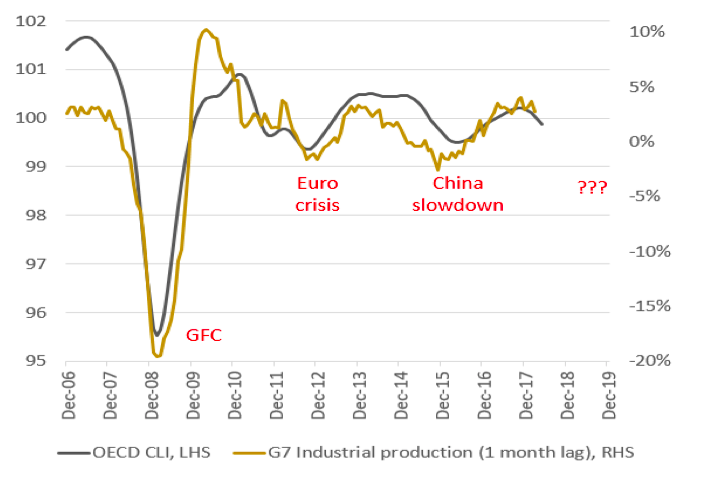

And recently the other warning flag is fluttering. Global growth has peaked and is expected to decelerate further. Signs of a slowdown have been evident since the beginning of 2018. For example, the OECD composite leading indicator (CLI), which precedes global growth peaked in December 2017 and has been contracting since then. Over the last decade every global slowdown has been marked by a crisis.

2008 was the Global Financial Crisis.

2012 was the Euro crisis.

2015 was the China/emerging markets slowdown.

If the OECD CLI continues its slide then another crisis is looming on the horizon.

Chart 2. OECD composite leading indicator is guiding to slower global growth

Source: OECD Vertium

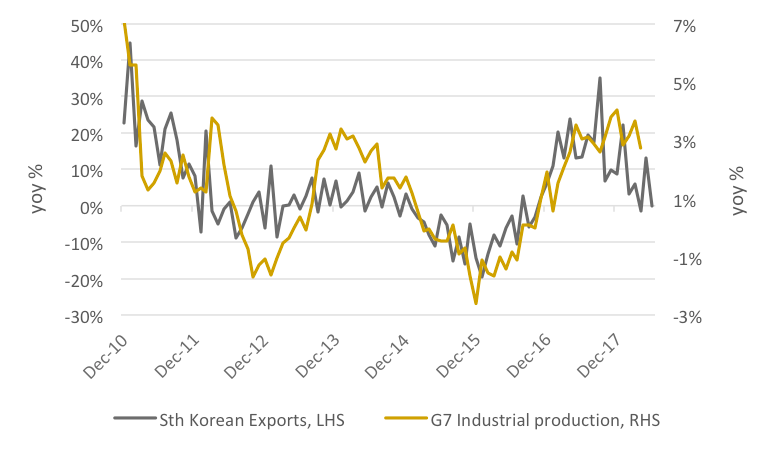

Even before tariffs dominated news headlines, global trade as proxied by South Korean exports hit negative year-on-year growth from the beginning of 2018.

Chart 3. South Korean exports is the canary in the coal mine and is gasping for air

Source: CEIC, Factset, Vertium

Given the precarious state of global trade, a tariff war could create a Wiley Coyote moment where global growth could fall off a cliff.

Moreover, global growth is not expected to improve in the near term because global liquidity is evaporating. Cash, as represented by real M1 money supply, is being withdrawn from the global banking system.

Chart 4. Shrinking money supply precedes global growth slowdown

Source: Absolute Strategy, Allianz Global Investors

And more liquidity is expected to be drained from the markets as the US Federal Reserve is accelerating its balance sheet reduction (quantitative tightening). Last quarter, the Fed reduced their balance sheet by $30 million a month, this quarter it’s $40 million a month, and in Q4 it will increase to $50 million a month.

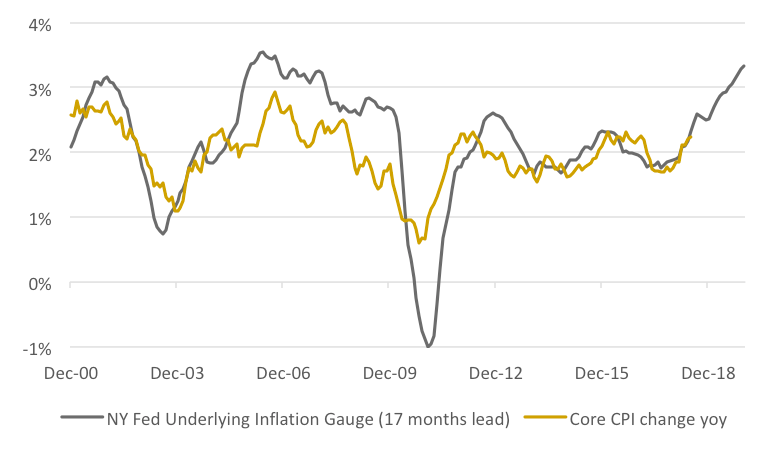

While there are strong signs of slowing global growth, there is little doubt inflationary pressures are building in the United States.

Chart 5. US inflation is expected to rise over the coming quarters.

Source: FRED, Vertium

Naturally, rising inflation expectations may make investors think about rising interest rates. However, the prospect of slowing economic activity is disinflationary, which offsets inflation concerns. As a result, US bond yields have fallen in recent months.

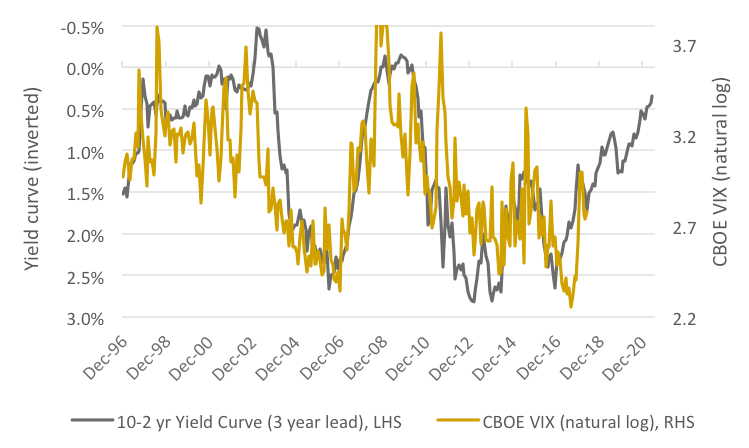

With a benign US 10-year bond yield, the yield curve is fast approaching zero highlighting that the end of the economic cycle is nearer. When market valuations are high and growth disappoints the natural consequence is increased volatility: share prices fall when high expectations are revised down.

Chart 6. Flattening yield curve points to greater volatility ahead

Source: FRED

So, what does slower global growth mean for Australian stocks?

Most Australian companies are linked to the global industrial cycle in varying degrees. Resource stocks are highly leveraged to the global cycle while defensive stocks such as real estate investment trusts and utilities have the least correlation.

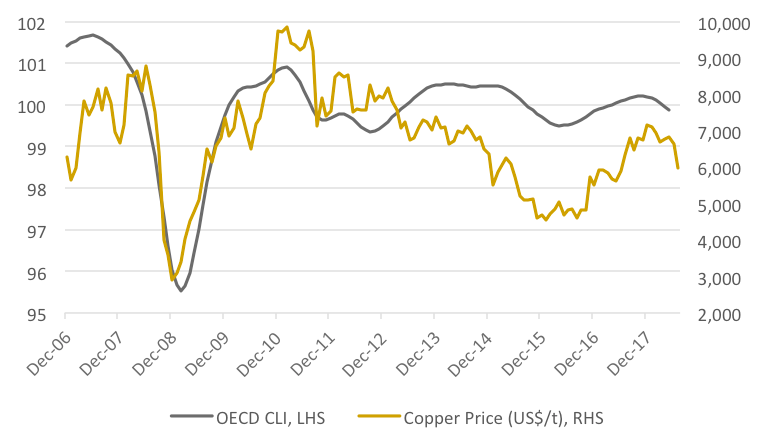

While resource stocks are not trading on excessive valuation multiples, their earnings are at risk when the global industrial cycle turns down. Copper, the global economic bellwether, has already confirmed the weakness in global growth.

Chart 7. Dr Copper looks sick

Source: OECD, Iress

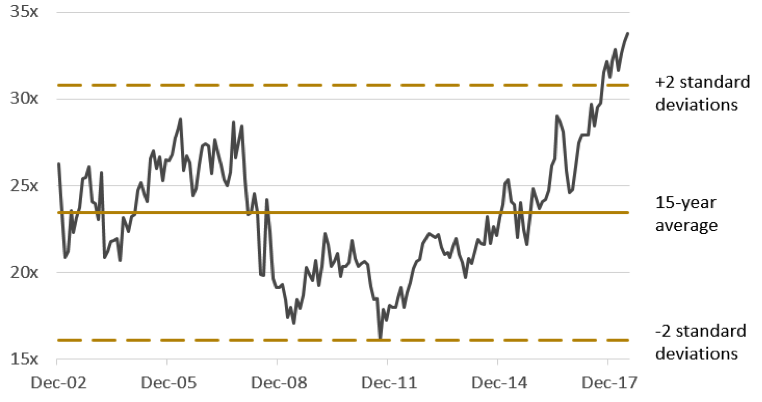

You may think it is safer to invest in high growth industrial companies that can grow through economic uncertainty. Think again – many high growth stocks are priced for perfection.

For example, the healthcare sector, led by growth kings such as Cochlear, Resmed, and CSL has historically delivered robust earnings growth and will no doubt continue to deliver consistent earnings going forward. However, their valuations are at decade-highs, yet forecast growth rates are lower than they were a decade ago.

Chart 8. The average PE multiple of Cochlear, ResMed and CSL are in nosebleed territory

Source: Factset

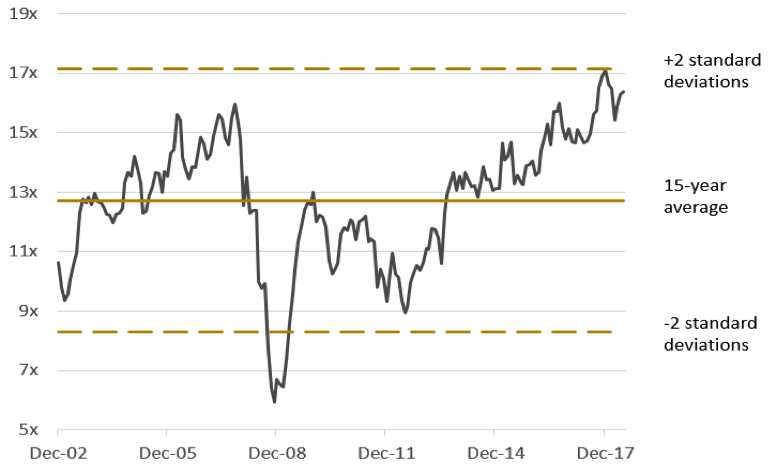

Another area of the market where investors seek out growth is from small companies. Like the healthcare stocks, the sector is trading at extreme valuations.

Chart 9. Small Ords PE multiple is at extreme levels

Source: Morgan Stanley

High valuation multiples mean one thing – expectations are very high. Any disappointment from lofty heights would result in stock prices falling. Investors in recent fallen angels such as Ramsay Healthcare or A2 Milk (profit expectations have been revised down twice in the last 2 months!) are surely reassessing whether they are paying too much for their underlying growth.

In summary, the warning flags of overvaluation and slowing growth are clearly waving. Ignoring them will be like swimming against the tide in choppy waters. In the current environment, where the potential for disappointments are high capital preservation should be paramount in investors’ minds.

3 stocks mentioned