Default rates trending higher while prepayment rates drop sharply…

We have just published our August RMBS default index report, which you can download here. Key take-aways are as follows:

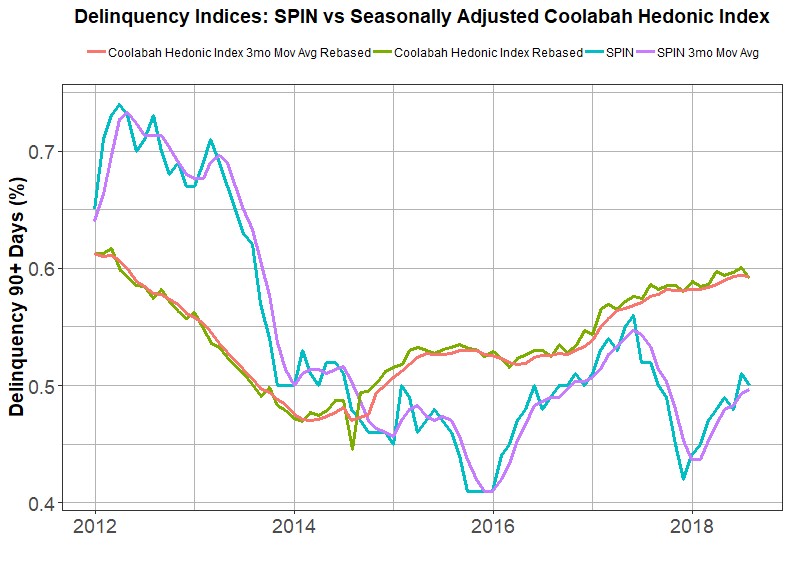

- Contrary to S&P data, Coolabah’s globally unique hedonic index of compositionally-adjusted Australian RMBS default rates shows defaults trending higher after controlling for the date of the RMBS issue, the average life of the loans, the average LVRs and geographic biases

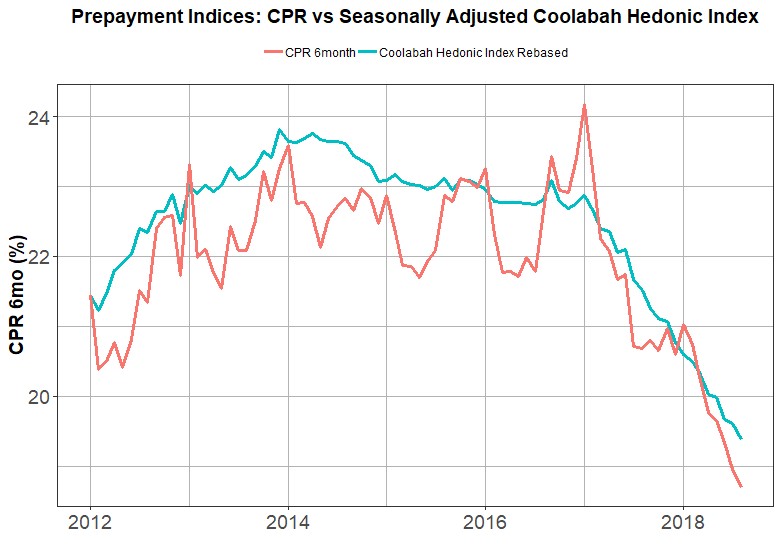

- Coolabah has also developed another global first, which is a hedonically-adjusted mortgage prepayment index, which shows Australian prepayments (or CPRs) are slumping sharply lower to the detriment of RMBS investors given this blows out the weighted average life of RMBS bonds

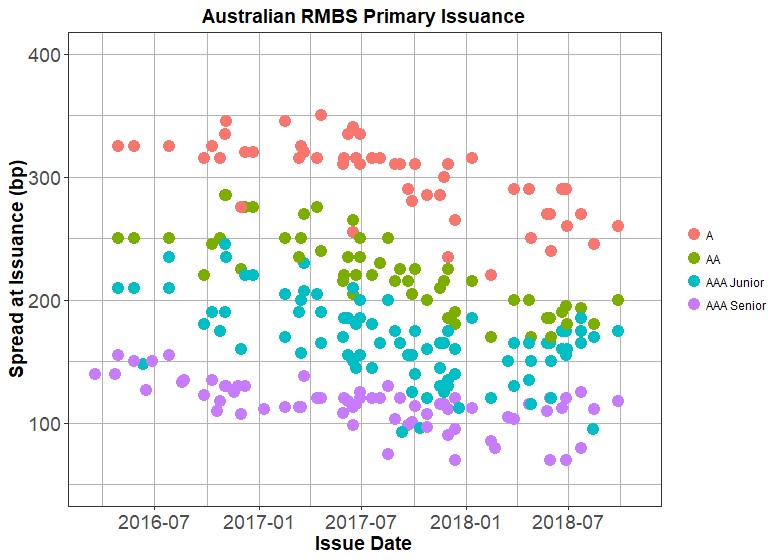

- Since April 2017 Coolabah has argued that Australian house prices would fall by 10%, a forecast recently embraced by ANZ, UBS and PIMCO amongst others. House price falls of 10% or more combined with higher default rates will very seriously threaten the credit ratings on junior RMBS tranches, from the AAA rated ABs and lower. Coolabah believes RMBS spreads are heading wider as this process unfolds over the next 1-2 years

- On the other hand, S&P has recently put Australia’s economic risks core on positive trend for an upgrade because house prices are falling and credit imbalances are unwinding. Coolabah believes this will result in the major banks’ RAC ratios rising above 10%, earning them SACP upgrades from “a-“ to “a”, which would in turn upgrade their T2 and AT1 bond ratings to BBB+ and BBB- respectively while reducing by one notch the assumed government support underpinning their senior bonds’ AA- ratings (ie, this is also positive for major bank senior)

You can download the full report here.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Chris co-founded Coolabah in 2011, which today runs over $8 billion with a team of 40 executives focussed on generating credit alpha from mispricings across fixed-income markets. In 2019, Chris was selected as one of FE fundinfo’s Top 10 “Alpha Managers” based on his risk-adjusted performance throughout his career across. He previously worked for Goldman Sachs in London and Sydney, the Reserve Bank of Australia, and founded the award‐winning research/investment group, Rismark. He has regularly advised governments, developing unique policy proposals. Chris graduated with the University Medal (Economics & Finance) from Sydney University. He studied in the PhD program at Cambridge University in 2002/03, leaving to set up his funds business.

3 topics

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

Investing for the biggest market shift since the GFC

Livewire Markets

Equities

Why ex-20 is the prime hunting ground for ASX returns

Livewire Markets