Deglobalisation and decoupling are upon us with consequences for portfolio construction...

One of the things our team is very focussed on right now is relations between China and the West, and what this portends about the future. There is little doubt that we stand astride a historical inflexion point in geo-political relations that needs to be carefully parsed if one is to make thoughtful assessments about the distribution of future states of nature. In the same way that our quants built real-time COVID-19 infection/fatality tracking and forecasting systems, some time ago I asked them to construct tracking systems for trade linkages between China and the rest of the world to enable us to monitor decoupling in real-time. In this context, there are a few core hypotheses that we are exploring:

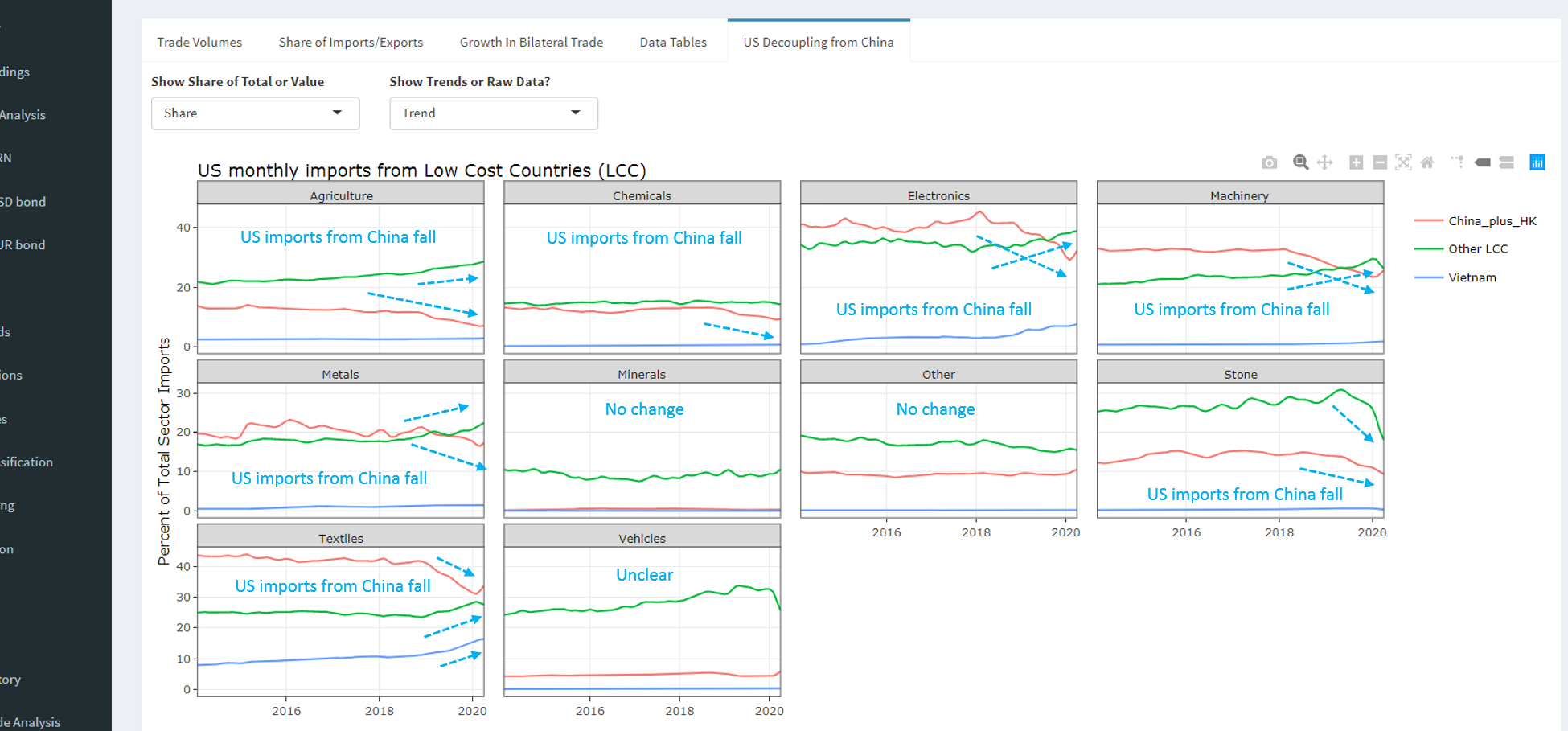

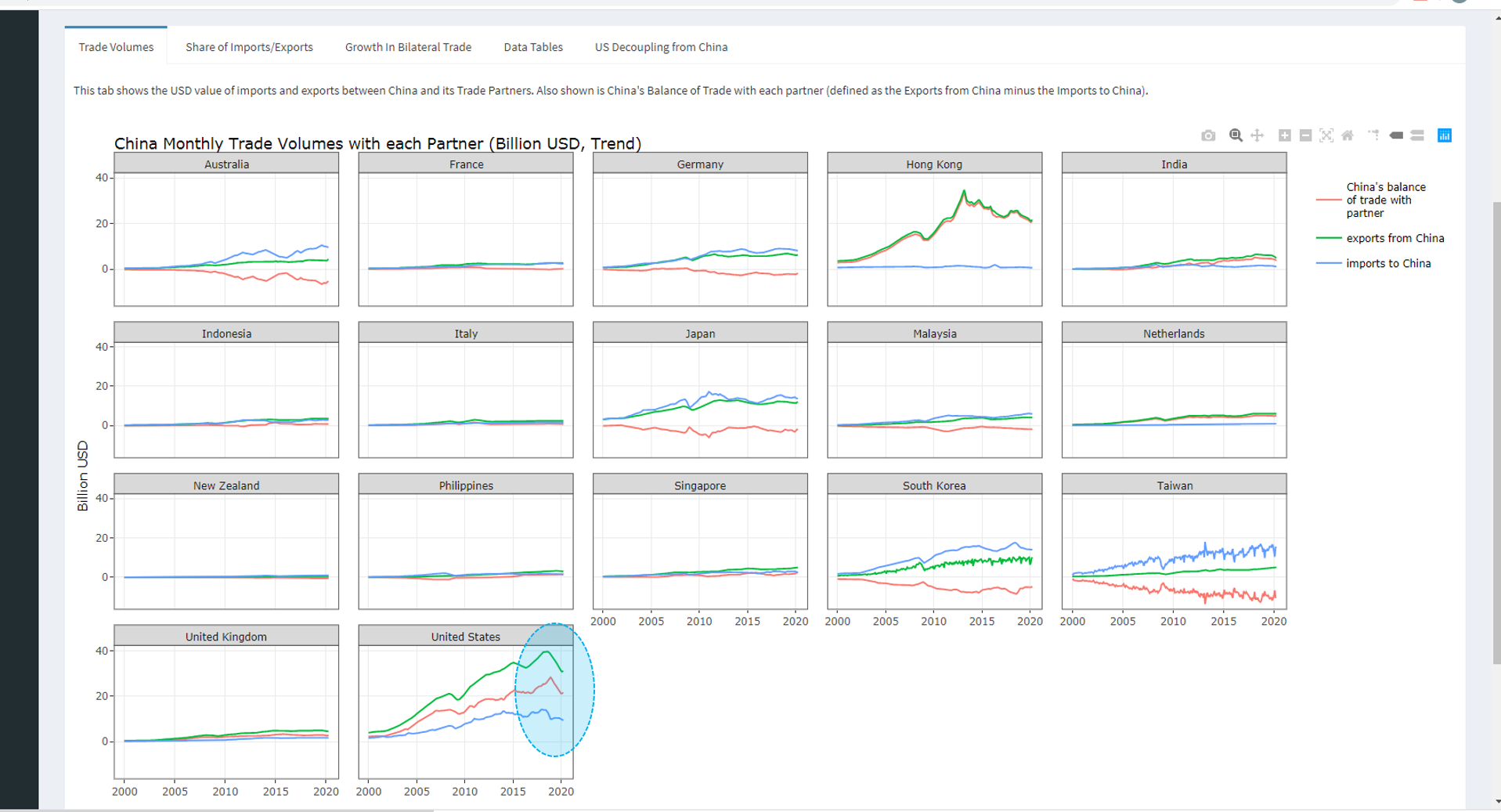

- First, we expect to see outright decoupling between the US and China precipitated by the US desire to disconnect given the growing conviction regarding the indivisibility between security, prosperity and liberty. This should motivate a shift in US trade towards other low cost markets (eg, Vietnam, Cambodia, India etc), more proximate regions (eg, Canada and Mexico), and, perhaps most interestingly, internally as the US fosters investment in domestic supply chains, which is a really big deal.

- Second, we think that this domestication of supply-chains in the US will be further fuelled by automation, artificial intelligence and robotics, which will reduce the importance of labour input costs and hence the legacy competitive supply-chain advantage of developing countries with relatively low per capita incomes.

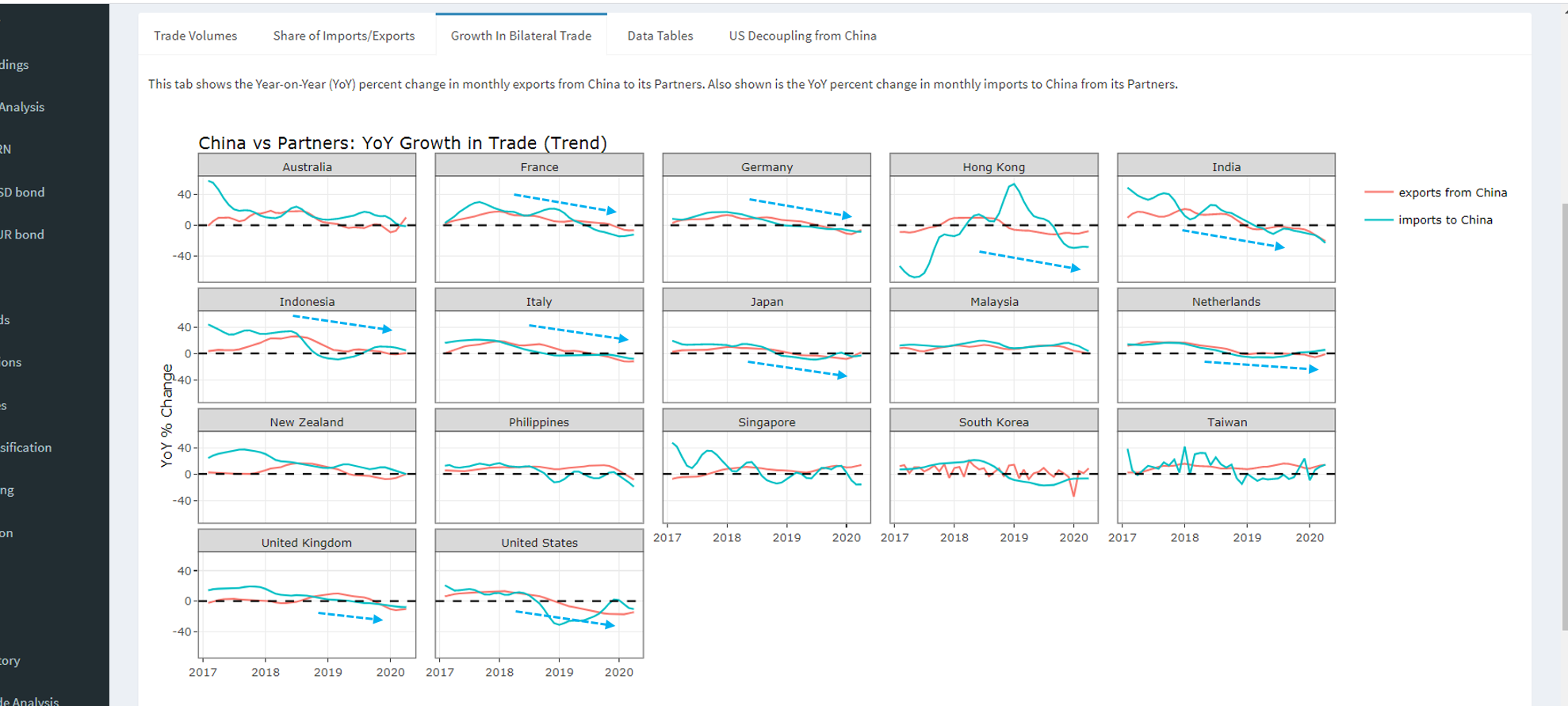

- Third, we believe that this decoupling will extend way beyond the US to most Western states, which is a process that has been catalysed by COVID-19. Striking recent examples of this shift include Japan paying its companies to bring supply chains home and the sudden decision of the UK and Canada to re-evaluate their relationship with certain Asian telecommunications companies vis-a-vis 5G infrastructure.

- Fourth, it is reasonable to assume that China will respond by trying to both actively resist the decoupling dynamic through various legitimate means while at the same time expanding her trade linkages with other developing markets involved in Xi's signature Belt & Road Initiative, including Eastern Europe, Asia, and Africa.

- Fifth, we fear that this could result in a fracturing of much of the global trading system as we understand it today into a bi-polar world cleaved by the Western and Sino ideological and business models, much as we observed during the last Cold War between the world's leading democratic and communist states; and

- Finally, we posit that deglobalisation and decoupling will not be limited to just national security sensitive industries as is currently assumed, but will gradually over a period of years extend to encompass any economically important sector.

While our research is still very embryonic, I am happy to share screen-shots from some of our systems below that show that this process of deglobalisation and decoupling is underway, especially if one focuses on trade between the world's two largest economies. In the medium-term, this will have profound consequences for portfolio construction that all investors should try to understand. That is certainly our mission right now...

Get investment ideas from industry insiders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

2 topics