Did APRA just make banks riskier to reduce its own reputational risks?

Years ago I argued that APRA would be better off getting rid of bank hybrids and replacing them with pure equity (ie, ordinary shares). Why? Primarily because ordinary shares are the highest quality form of first loss, or so-called "Tier 1", capital (also known as "going concern" capital). Why have an inferior form of equity capital via the use of Additional Tier 1 (AT1) bank hybrids, which only act as equity in certain extreme circumstances, when there is already an enormous sharemarket out there? Why not simplify the capital stack with just pure equity and debt? The counter-arguments were plentiful and include:

- All global banking regimes allow banks to draw-on a combination of pure equity and hybrid capital to meet their Tier 1 capital requirements;

- Hybrids are cheaper for banks to issue than ordinary equity - they are, therefore, return on equity accretive and shareholder friendly;

- The Basel 3 hybrids established in 2013 are forced to automatically convert into true equity in all extreme scenarios, most notably when a bank's equity capital ratio falls to very low levels (they do, consequently, act as equity when you need them);

- The Aussie and global hybrid markets are massive with $41 billion of ASX listed hybrids alone, and in Australia have proven to be an exceptionally reliable, cheap and flexible source of Tier 1 capital funding during shocks (eg, in 2008, 2020, and post the 2023 Credit Suisse collapse); and

- We saw that in the case of Credit Suisse, hybrids served their intended purpose of recapitalising a failing bank very quickly - in fact, over a weekend.

Given the arguments above, it made sense to allow Aussie banks the freedom and flexibility to source their Tier 1 capital through a combination of ordinary shares and via listed and unlisted hybrids in Aussie dollars and foreign currencies, which they have done on APRA's instruction for the best part of 25 years. It also puts Aussie banks on the same playing field as all other global banks.

APRA's latest proposal to simply eliminate hybrids altogether from the Aussie banks' capital structure seemed superficially simple and sensible, which was my original reaction (see here).

But the more we drilled into the detail, the more serious questions emerged about why APRA was really doing this and the risks it would be imposing on the bank depositholders that APRA is legislated to protect. In particular:

- APRA never canvassed the complete elimination of the hybrid market in its original discussion paper. Outside of the banks, industry participants, including depositors, stockbrokers, advisers, bondholders, and investors appear not to have been consulted about this radical shift.

- APRA is very directly increasing bank risks, as represented by a substantial increase in leverage, and hence depositor risks, by removing a key component of the banks' Tier 1 capital buffers.

- It is directly undermining the banks' credit ratings on both their Tier 2 bonds and senior bonds, and hence their deposits, as highlighted by a deterioration in their S&P RAC ratios, although we are not expecting any formal rating changes at this juncture.

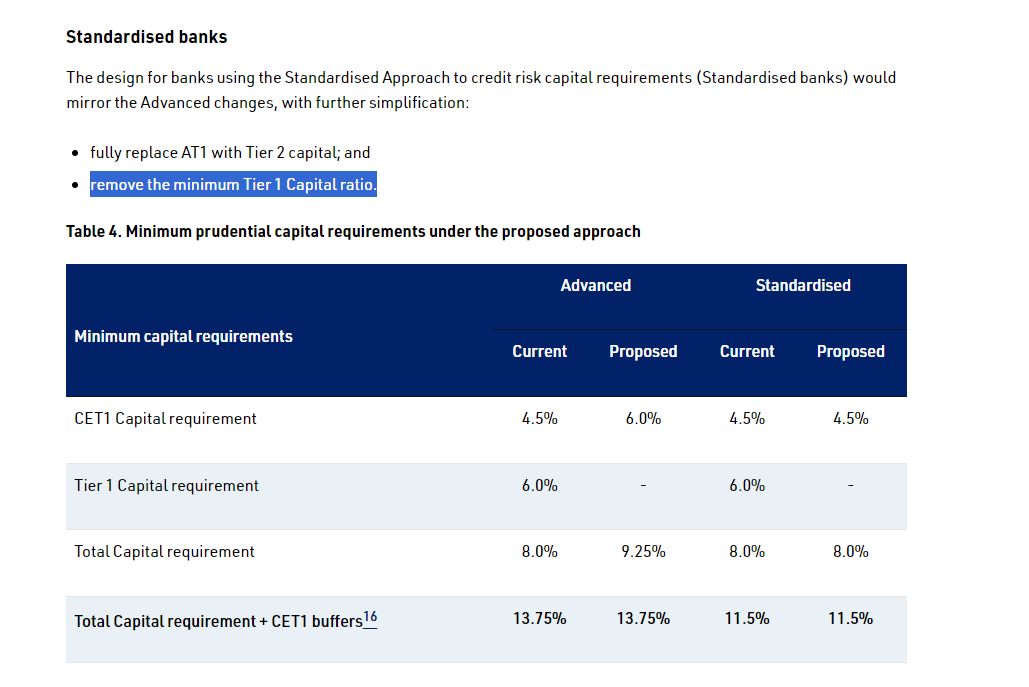

- It is breaching the Basel 3 minimum Tier 1 capital targets for all the smaller standardised banks, which it previously complied with. These minimums will fall very substantially to 4.5% compared to the Basel 3 minimum of 6% that APRA historically adhered to. Given this breach, APRA has proposed junking the Tier 1 minimums for all standardised banks, which seems reckless.

- It is significantly reducing the equity funding flexibility that banks have relied upon as demonstrated during the GFC, the pandemic, and after the Credit Suisse collapse.

- And it appears to be doing all of this simply because it is worried about the reputational and management risks that APRA faces when it is supposed to be doing its job of protecting deposit-takers by allowing hybrids to automatically convert into equity during a serious banking crisis (or using real equity in its place).

- The primary motivation for these changes appears to be the fear of a backlash from individual investors, even though banks and the industry have spent 25 years educating them on what are inherently low probability risks.

One especially spurious argument APRA makes is that retail investors understand bank equities, but don't understand hybrids, which they imply are riskier securities. This is wrong on all fronts. Since before the GFC, Aussie bank hybrids have displayed about 25% of the volatility of bank stocks, and have had 25-50% lower losses. All hybrid equity-conversion risks in a stress scenario in turn dilute-down shareholders, which mean that bank equities actually face the same risks as hybrids - and then a vast array of additional hazards. Mathematically, hybrids are easier to value than equities because they have a predetermined running yield.

While we run an ETF that can invest in hybrids, called HBRD, it is a full capital structure solution that allocates across cash, senior bonds, subordinated bonds, and hybrids, including AUD and foreign currency securities. Given hybrids are trading on the tightest credit spreads since 2007, it has only a modest, circa 30% allocation to the sector.

Whether hybrids continue to exist or not does not change that product's capacity to roam up and down the capital structure, locally and globally. While my initial reaction to the APRA proposal was that the simplification of the capital structure might be sensible, questions have since emerged about the risks of this process...

What triggered the APRA review in the first place?

The review was precipitated by the collapse of Credit Suisse March 2023 and the write-off of the Credit Suisse hybrids and recapitalisation of the bank at that time, which, ironically, was exactly what the hybrids were designed to achieve. The Credit Suisse hybrids were written-off with extraordinary speed, over a weekend, hammering the Aussie credit funds that held them.

APRA claimed in its original discussion paper that the Credit Suisse experience suggested hybrids could be illiquid, that hybrid funding markets could close, and that they did not work as quickly as they should. All these arguments were grossly incorrect, as I explained at the time:

"No less than $890 million of Aussie listed hybrids traded in March 2023 at the time Credit Suisse collapsed. Aussie hybrid credit spreads widened, but only modestly. One month later in April 2023, more than $500 million of Aussie hybrids traded in orderly conditions.

By May 2023, CBA had launched a huge $1.55 billion hybrid issue at a cheap 3 per cent spread above bank bills. To say that Credit Suisse’s write-down of its hybrids shut down the market is totally wrong.

The worst blow-out in hybrid spreads in history was in March 2020, when the pandemic forced them to 8.5 per cent above bank bills – even higher than the levels reached during the global financial crisis.

In an astonishing affirmation of the liquidity of the listed hybrid market, an extraordinary $1.22 billion of hybrids traded on the ASX in March 2020 alone. That was more than the entire OTC corporate bond market, which was closed.

Much of this trading was done by institutional investors, who have increasingly come to dominate Aussie hybrid flows during times of stress."

The real driver of the APRA review of the $41 billion ASX hybrid market seems to have been the bureaucrats' unease with the idea of Aussie bank hybrids being converted into equities, and possibly imposing losses on retail investors, during a time of stress. APRA appears to be extremely keen to reduce its reputational risks, so much so that it is now apparently prepared to shut-down the entire market - throwing the baby out with the bathwater. What is most perverse is that APRA is making banks riskier in the process...

Did APRA consult on this change?

At no point in its consultation paper published in September 2023 did APRA canvass the possibility of getting rid of hybrid capital. I further don't know anyone outside of the banks who had thought this was possible. In its paper, APRA simply referred to "reducing reliance on AT1 by changes to the level or mix of regulatory capital requirements" and "reducing the level of AT1 capital, offset by a commensurate increase in other capital requirements". If eliminating hybrids was really an option, APRA would have said so explicitly.

In discussions with industry (outside of the banks), APRA was primarily focussed on improving the ability of hybrids to convert into equity (option 1) and reducing retail investors' holdings of hybrids (option 3). This was the thrust of all the initial consultations with APRA.

The banks were clearly consulted by APRA on this idea of eliminating hybrids later in the process, but this seems to have been because APRA concluded it would have been hard to completely ban individual investors from holding hybrids. APRA's original vision was to shift hybrid issuance into the unlisted wholesale market and/or ban retail investors from accessing them on the ASX. When this appeared to difficult to achieve, APRA seems to have resorted to simply eliminating hybrids altogether.

Is APRA making banks riskier to reduce its own reputational risks?

The Aussie major banks hold hybrids worth 2.15% of their risk-weighted assets. This counts as equity or Tier 1 capital. Bizarrely, ARPA is getting rid of this 2.15% of Tier 1 capital and only replacing it with 0.25% of common equity Tier 1 capital, known as CET1. This means all Aussie bank Tier 1 capital ratios will drop very substantially. S&P reports an equity ratio that captures CET1 plus AT1 hybrids. This is called a risk-adjusted capital ratio or RAC ratio. S&P's RAC ratios for ANZ, CBA, NAB and Westpac will all drop by about 15-20% because of this move.

APRA is explicitly increasing bank leverage by reducing bank Tier 1 capital. This means APRA is increasing the risks that bank depositors and bondholders face. It would be perfectly logical if APRA was saying, "We are going to eliminate the 2.15% of hybrid Tier 1 capital and replace it with 2.15% of new CET1". This would leave Aussie bank Tier 1 ratios unchanged. In fact, it would make banks less risky, because the quality of Tier 1 capital would have improved due to the fact that you are replacing AT1 hybrids with better quality CET1 (ie, ordinary shareholder capital).

It doesn't matter whether you look at S&P's RAC ratios for Aussie banks or Moody's loss given default models, the equity capital protecting depositors and bondholders declines. The credit ratings on Tier 2 bonds and senior bonds might not change on our analysis, but those ratings definitely have less equity support than they did previously.

APRA is increasing the amount of Tier 2 subordinated bonds by 1.25% of risk-weighted assets. But as APRA explains carefully, this is not Tier 1 or equity capital. Tier 2 capital is "gone concern" capital that can only be used when a bank is declared by APRA to be "non-viable". That is basically an insolvency event. It is not first-loss equity, or going concern, capital that is used to act as a buffer when a bank is still alive.

APRA has further loaded up the major banks with the biggest Tier 2 capital ratios in the world - they will end up being about 8% of their risk-weighted assets. This makes declaring a bank non-viable even tougher because you would be converting such a massive sleave of globally held bank bonds into equity at that time, which would be practically impossible.

Is APRA violating the global best-practice banking rules (Basel 3) to reduce its own risks?

Under the global banking rules that APRA seeks to abide by, known as Basel 3, banks have to hold minimum Tier 1 capital, which is CET1 plus AT1 hybrids, worth 6% of their risk-weighted assets. Because APRA is proposing to eliminate its current minimum target for AT1 hybrids of 1.5%, the smaller Aussie banks, known as "standardised" banks, will not have a minimum Tier 1 requirement of 6% under APRA's rules. This minimum would fall to just 4.5%, which is way below the official Basel 3 requirements. APRA acknowledges this, and is proposing to simply remove the minimum Tier 1 capital requirement for normal banks because it is reducing their equity capital and boosting their leverage or debt. The screenshot below highlights this.

This raises the concern that APRA is removing an important layer of going concern first loss equity capital (ie, hybrids) and only replacing it with debt capital (ie, Tier 2). In the case of standardised banks, this increases bank leverage and the risks faced by depositors.

As noted above, the advanced banks are also allowed to switch their hybrid equity capital for debt, materially increasing leverage. They do have to boost their CET1 capital by a tiny 0.25% margin under the proposal, which means that the total reduction in Tier 1 capital is about 1.9 percentage points (or the 2.15% hybrid capital less the new 0.25% of CET1).

At no point does APRA address the heightened leverage risks for depositors or the reduced credit quality of bank borrowings, which is extremely surprising given these are meant to be its primary prudential focus. It looks like these changes are solely motivated to make APRA's life easier...

Is APRA reducing bank funding flexibility during crises?

The $41 billion ASX hybrid market has been a consistent source of flexible and shareholder-friendly funding for banks during shocks, as demonstrated during the GFC, in 2020 after the pandemic shock, and following the collapse of Credit Suisse in March 2023.

In May 2008, in the midst of the GFC, Macquarie averted a crisis by raising $600m via a hybrid issue, boosting its Tier 1 capital buffers in a way that could not be done via pure equity. In June 2020, Macquarie again raised $641m on the ASX via hybrids in the middle of the pandemic. And in May 2023, just after Credit Suisse's collapse, CBA raised $1.55 billion via a hybrid issue. Aussie banks have also raised billions via hybrid issues in the unlisted USD and AUD markets, which they will no longer be able to do.

It is surprising that APRA would want to destroy all this cheap and liquid funding flexibility in the AUD and USD markets, especially in the case of the highly dependable ASX domain that has built-up a very reliable individual investor base that greatly value the franking credits that bank hybrids carry.

Is APRA taking an inconsistent approach to banks and insurers?

Another puzzle is why APRA has suddenly decided to eliminate the entire bank hybrid market but at the same time keep it in place for insurers. This seems, once again, completely inconsistent. Both banks and insurers have very similar equity, hybrid, and Tier 2 bond needs. APRA really ties itself up in knots in trying to explain why it is going to treat banks and insurers very differently when it comes to capital instruments:

For insurers, APRA is not proposing any changes to capital instruments at this time. APRA’s concerns for AT1 are less acute for insurers, and simplifying the capital framework involves different trade-offs, given the different nature of how stress may impact the insurance industry. APRA will monitor developments in the AT1 market for insurers and may review the approach to insurance capital instruments in due course.

Are there politics at play here?

With a federal election looming in the next 6-12 months, APRA is proposing to destroy a $40 billion franked investor market dominated by retirees and SMSF investors who prize the tax effective franking credits that hybrids offer. Franking credits were a key battleground between Scott Morrison and Bill Shorten at the 2019 election. APRA is increasing bank credit risks, and the hazards that deposit-takers face, apparently in the name of reducing the reputational risks it has to run when overseeing the conversion of hybrids into ordinary equity. All extremely odd stuff.

If APRA had said, we are removing the circa 2% hybrid capital buffer from the banks' equity ratios and replacing it with 2% of normal equity, we would all be cheering. But it is not doing that, presumably because the banks would start moaning about the impact on shareholder returns from replacing cheaper hybrids with higher cost ordinary equity...

So it is instead simply leveraging up the banking system, and transferring wealth from deposit-holders to shareholders, while myopically trying to protect its own hide in the process.

4 topics