Dividends hiding in plain sight

Headlines during reporting season have claimed that ‘dividends have slowed to a trickle.’ In reality though, it is cash returns that have slowed to a trickle. Cash interest is so low that it struggles to cover costs, let alone taxes and inflation. This situation is unlikely to change in the coming years, as the RBA has indicated that near-zero rates are here to stay.

Yields across almost all other asset classes have fallen too. Term deposits, bonds, even alternative credit. The yield on all of these has fallen along with the cash rate. The Australian equity market however, still has a gross yield of around 4.7%.

With reporting season now finished and dividends largely a known quantity, I sat down with Mark Cormack and Dr Peter Gardner to debrief. We discuss how results and dividends shaped up across a range of key sectors and companies, what our dividend trap model is telling us about stocks to avoid, and the sector that is becoming ‘the new banks’ for income investors.

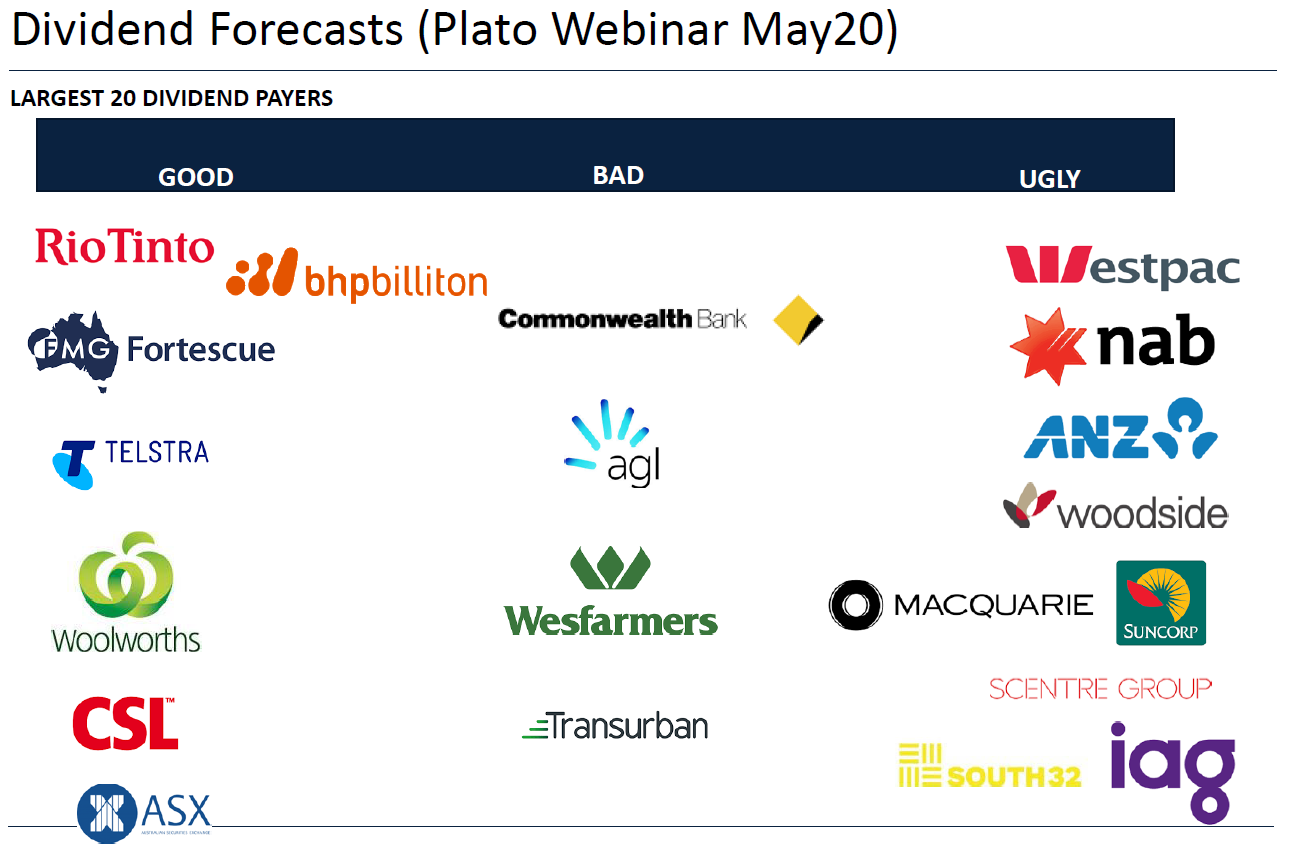

Mark Cormack: Plato made some dividend forecasts back in May this year on our outlook for income. Let's recap on those and what's transpired during the August reporting season.

Dr. Peter Gardner: Thanks Mark. Stocks whose outlook have changed a little bit is Wesfarmers, which actually delivered a better dividend then we had expected back in May and that was due to the strong performance of Bunnings and Officeworks being able to more than offset the poor performance from some of the other areas of their business. So Bunnings and Officeworks have had sales increases of over 20% and they're doing really well in the current market environment. Woolworths was a little bit weaker than we had expected back in May just given the amount of COVID related costs that they had to take on, made up for the increase in sales so the dividend was actually slightly weaker than last year.

Another one of the changes was Woodside Petroleum which actually paid out more than we expected. During the last six months, oil prices, as you all know, have dropped significantly so we were expecting them to cut their dividend by even more than they did, but they've actually maintained a fairly high payout ratio in the current market environment.

But apart from that, most of our other expectations were pretty much on the money. Westpac obviously didn't pay a dividend, but ANZ and CBA did in the current period. That was slightly better than I expected and Suncorp actually paid a dividend as opposed to IAG, which didn't pay one at all. In terms of the reporting season a whole though, it was actually a decent reporting season.

In aggregate during the August reporting season, if you look at an equally weighted average, the average stock downgraded dividends by about 29%. The median stock downgraded dividends by 25% but the market cap weighted average(adjusting for the size of the stock), that was down 18% and it was actually probably slightly better than we expected. The results were slightly better than the market expected in terms of both dividends and earnings.

About 57% of companies were able to beat the market expectations with their results and around the same percentage upgraded their guidance. So it was a decent reporting season.

It was very different, depending on which sector you are in. While you saw 34 companies in the ASX 200 admit dividends, you actually had strong dividend increases from stocks such as JB Hi Fi and Wesfarmers in retail, Evolution and Northern Star in gold, Fortescue and Mineral Resources in iron ore, Aurizon and NRW Holdings in industrials and Magellan and Steadfast in financials. It was a strong result from CBA as we suggested it would be. And they had to cut their dividends given the APRA guidance, but actually still cut it to what was their maximum payout ratio allowed. So overall it was a decent reporting season where companies were able to generally beat expectations albeit obviously down on last year in terms of dividends.

Mark Cormack: Looking at these results, it's a very mixed environment. As you say, there's plenty of income if you do know where to look, however being active and avoiding dividend traps has never been more critical. Can you take us through what your dividend trap model is predicting and what stocks income investors should avoid?

Dr. Peter Gardner: Back in May, we were forecasting dividends to be cut more than they were in the GFC. Given what's happened around the globe and in Australia, things haven't been as bad as what we expected back in March. You can say that dividend cut proclivity for the overall market has come down somewhat so that we're now forecasting around 30 to 35% of stocks to cut their dividends.

Some of the areas have been impacted more than others, such as the tourism and leisure sector. Crown Casino and Flight Centre didn't pay a dividend in the current period. Some retailers such as Lovisa, which makes a lot of fashion accessories, have been struggling with people not going out too much.

Some industrial companies have struggled as well, cutting their dividends to zero. The resources that are not exposed to iron or gold were somewhat challenged in the current period. Some of the infrastructure stocks such as Sydney Airport and Transurban cut their dividend significantly. And the retail REITs, as we've been highlighting for a while, also cut their dividends.

You need to be careful looking at historical yield when you're evaluating yield going forward. We're very active in our fund, trying to predict the upcoming dividends rather than looking at historical dividends. You can say the three examples we've got listed in that table of Crown, Bendigo and Boral all had pretty good historical annual yields when you looked at them at the end of March, but it turned out you didn't receive a dividend from any of them in the current reporting season. Investors have to be careful.

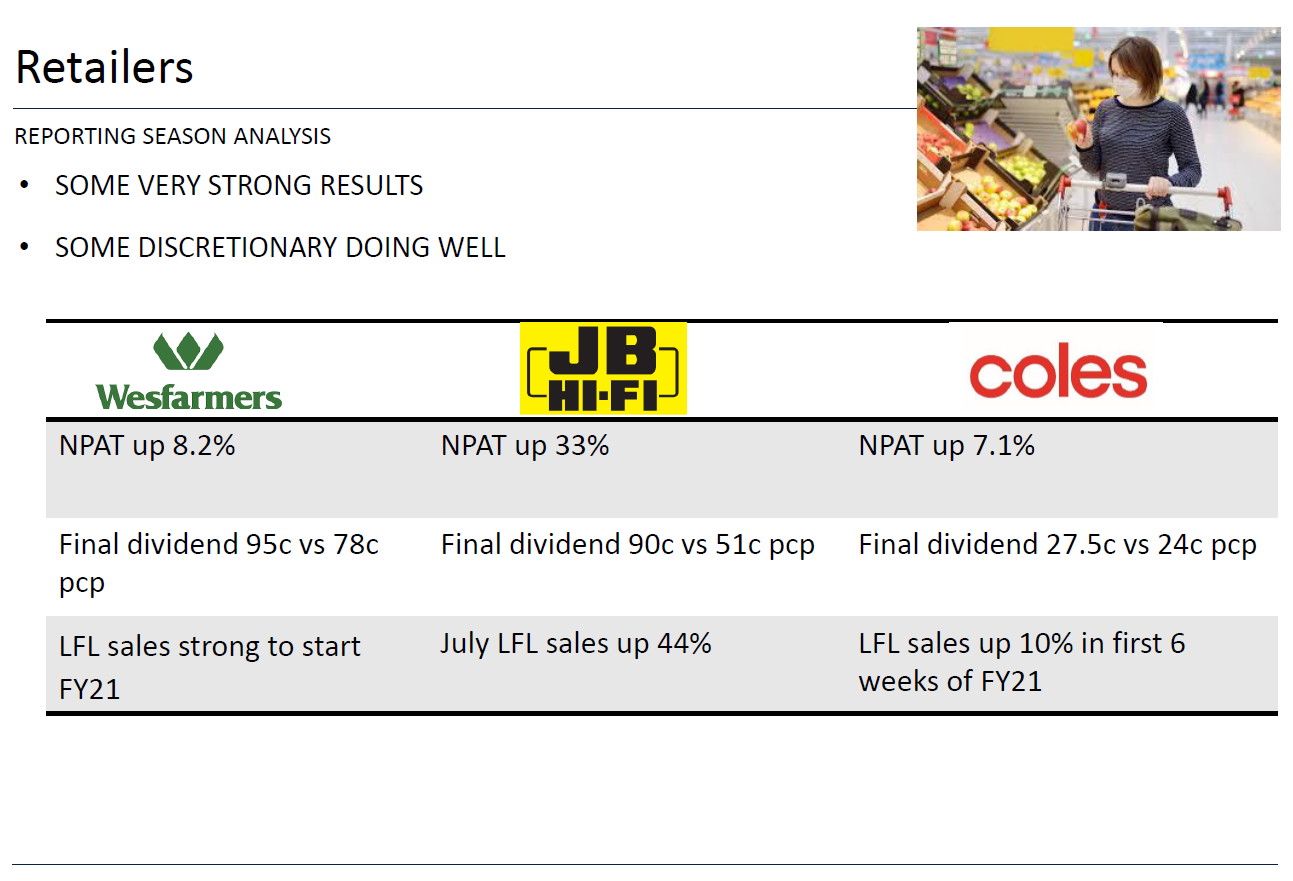

Mark Cormack: Let's drill into some sectors. With all this fiscal stimulus, Pete, how's that impacting sectors like retailers?

Dr. Peter Gardner: Retailers have been doing amazingly well in this period. There was an initial peak due to the panic buying. That was largely concentrated in Woolworths, Coles, etc. Then we did have a big drop off and retail trade in April as we went into lockdown, but then when the government stimulus came out, and with people being able to withdraw money from super, they actually saw a massive increase in retail trade to well above average. That largely underpinned a lot of the results of the retailers.

Wesfarmers, JB Hi Fi and Coles had strong profit increases, paid higher dividends than last year and they had exceptionally strong results to start July and August when the retailers continued to do well.

Mark Cormack: Banks have always been a big source of income for retirees. You mentioned APRA made some announcements regarding payouts, take us through this sector and their results.

Dr. Don Hamson: APRA muddied the waters for banks and insurers. In April they came out and told the banks not to pay dividends, to defer them or if you do pay them, be incredibly prudent. ANZ, Bank of Queensland and Westpac all heeded that advice and deferred their dividends. NAB went contrary and still paid a dividend but cut that dividend about 64%. So that was the initial announcement. Now, thankfully APRA updated their guidance at the end of July, just before this reporting season and said,

"look, things aren't as bad as we thought, there is less uncertainty. We still think you should be prudent, so pay no more than 50% of your earnings out as dividends."

CBA took that advice completely and paid out 49.9% of its earnings. So as much as it could in its final dividend, a 98 cent final dividend, remembering that it squeaked in a full interim dividend in March or in February and announced it before COVID really hit. The CBA result was generally good. Yes, it's profit is down 11%, but compared to expectations and some of the other banks, that's actually a pretty good result. The capital is still very strong at 11.6%, which is in that ‘unquestionably strong’ area for APRA.

Bendigo did not pay a final dividend. There was a 27% hit the cash earnings and their capital's only 9.25%, not nearly as strong. So, no wonder they didn't pay a dividend and Westpac was a bit of a laggard amongst the big fours because ANZ did announce a dividend in the end, but Westpac decided to not even pay an interim dividend at all, remembering that it also has that AUSTRAC fine outstanding. Its earnings were actually probably the biggest disappointment, but I would say that Westpac seems to have conservatively provided large provisions against future debts. So I think it's a bit of a sandbagging by the new CEO there, but all in all, CBA highlighted that it's the strongest of all the banks and of course, late breaking news today NAB is selling MLC and that will probably put it in a stronger position than Commbank in terms of capital. If that sale goes through their tier one ratio will be at 11.9%. So that might bode well for future dividends for NAB.

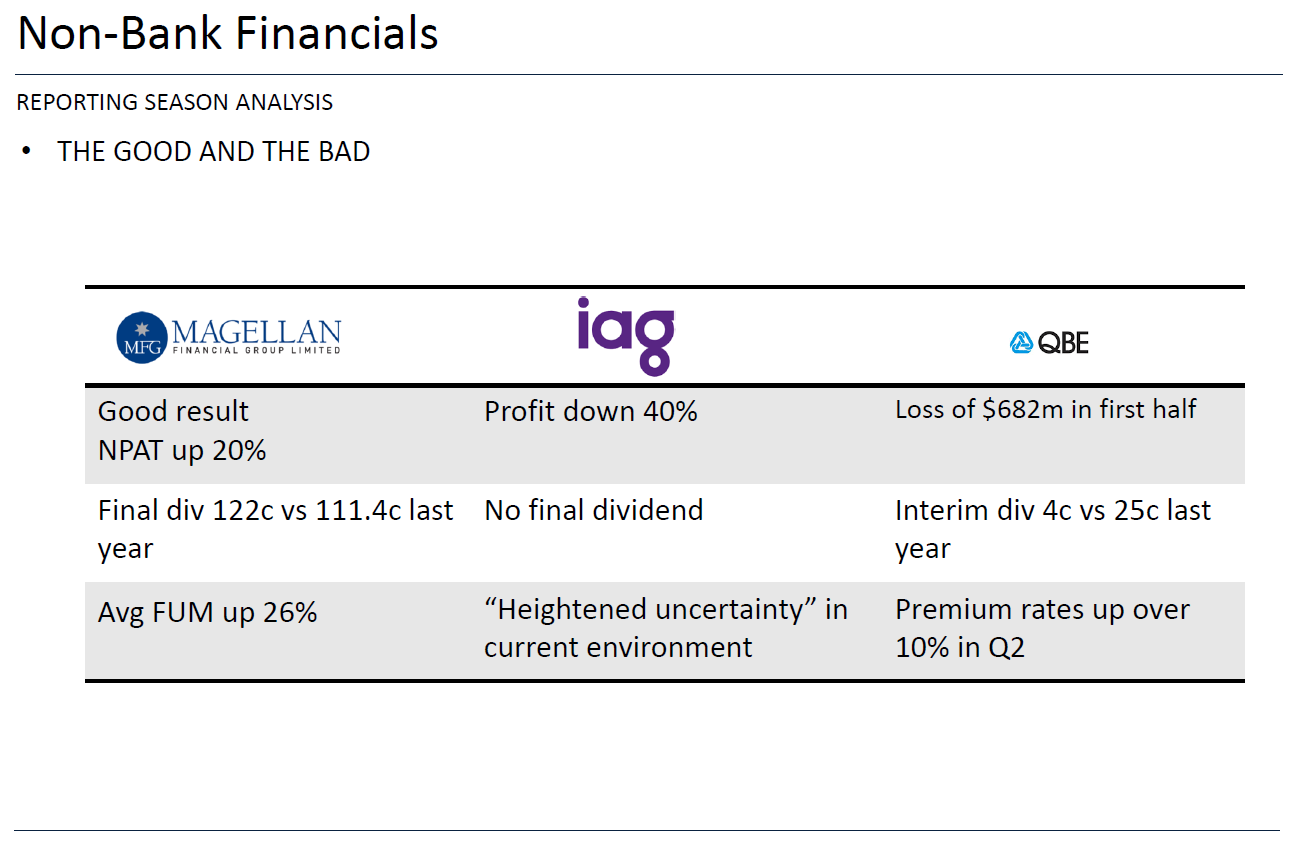

Mark Cormack: While we're on financials, Plato been very positive on stocks like Magellan, not only from an income perspective, but from a total return perspective. So we don't have to rely on just the banks, in the income, in the financial sector for income, but take us through how the non-bank financials reported.

Dr. Peter Gardner: Magellan had a really good result. Their profit was up 20%. That final dividend was 10% higher than last year. What bodes well for future earnings for Magellan is that their average fund was up by 26% over the year. They're actually doing really well in the current market environment. The growth stocks in the US, which they're exposed to are doing really well.

With regards to some of the insurers such as IAG and QBE, this year's result was very disappointing for all the insurers with investment earnings coming down significantly. IAG’s profit was down 40%, QBE declared a loss. IAG didn't pay a dividend, QBE paid a very small dividend, but one of the reasons we prefer QBE in our portfolio over some of the other insurers is that they're having strong premium rate increases. So in the second quarter of this year, their premiums were up which bodes well for their earnings next year.

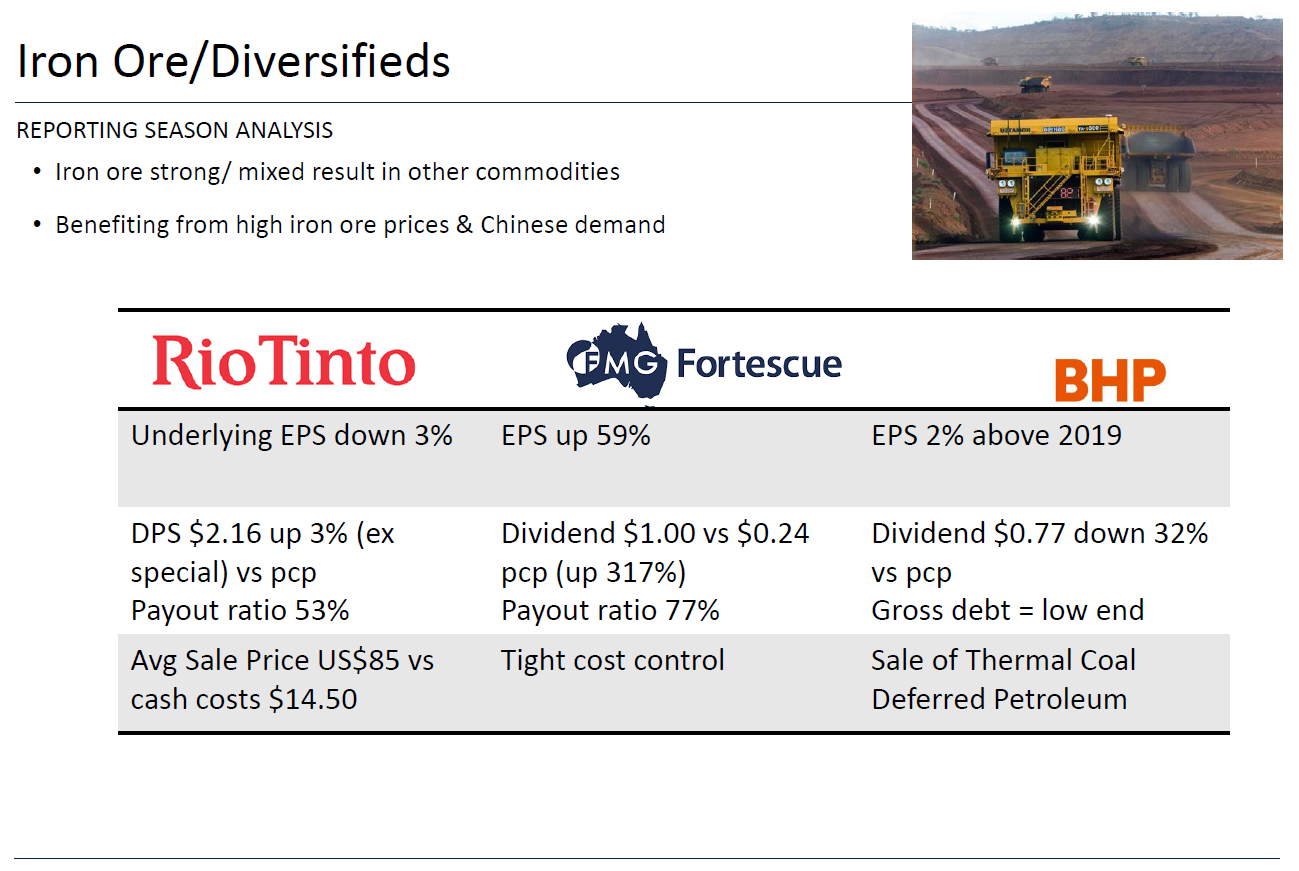

Mark Cormack: Don, resources and miners... A couple of years ago, they were cutting their dividends by over 80% and Plato was underweight and now they're paying some big income and Plato is overweight. Take us through how they report.

Dr. Don Hamson: You can argue that the iron ore miners are the new banks of Australia in terms of dividend payers. The standout for us was Fortescue. It's a pure play. So it gets the full benefit of the uplifts iron ore prices which have remained extremely strong because of issues with supply in Brazil and strong Chinese demand. We've been very positive on these. Fortescue, despite actually rallying around 60% from its pre COVID price, is still on a 14% gross yield. That's amazing, isn't it? It paid $1.76 dividend for the full year fully franked. That’s a gross yield of 14%, 77% payout ratio, not reinvesting too much, which is good.

Iron ore miners are the new banks of Australia in terms of dividend payers.

Pretty good result from Rio as well. It's trading on an 8% plus yield, it increased its ordinary dividend by 3%, only paid out 53% of earnings, which bodes well for future dividends. It's doing pretty well.

BHP is a little bit of a laggard. Obviously, it's held down by some of the petroleum assets and thermal coal. It’s looking to sell its thermal coal assets, if it can. A bit late to the party there, given what those prices are doing. It's dividend and was actually down 32%, but the board could have paid a higher dividend. They announced that they were very cautious with their dividends. I think there's plenty of scope for them to increase their dividend in the future, if iron ore prices stay strong.

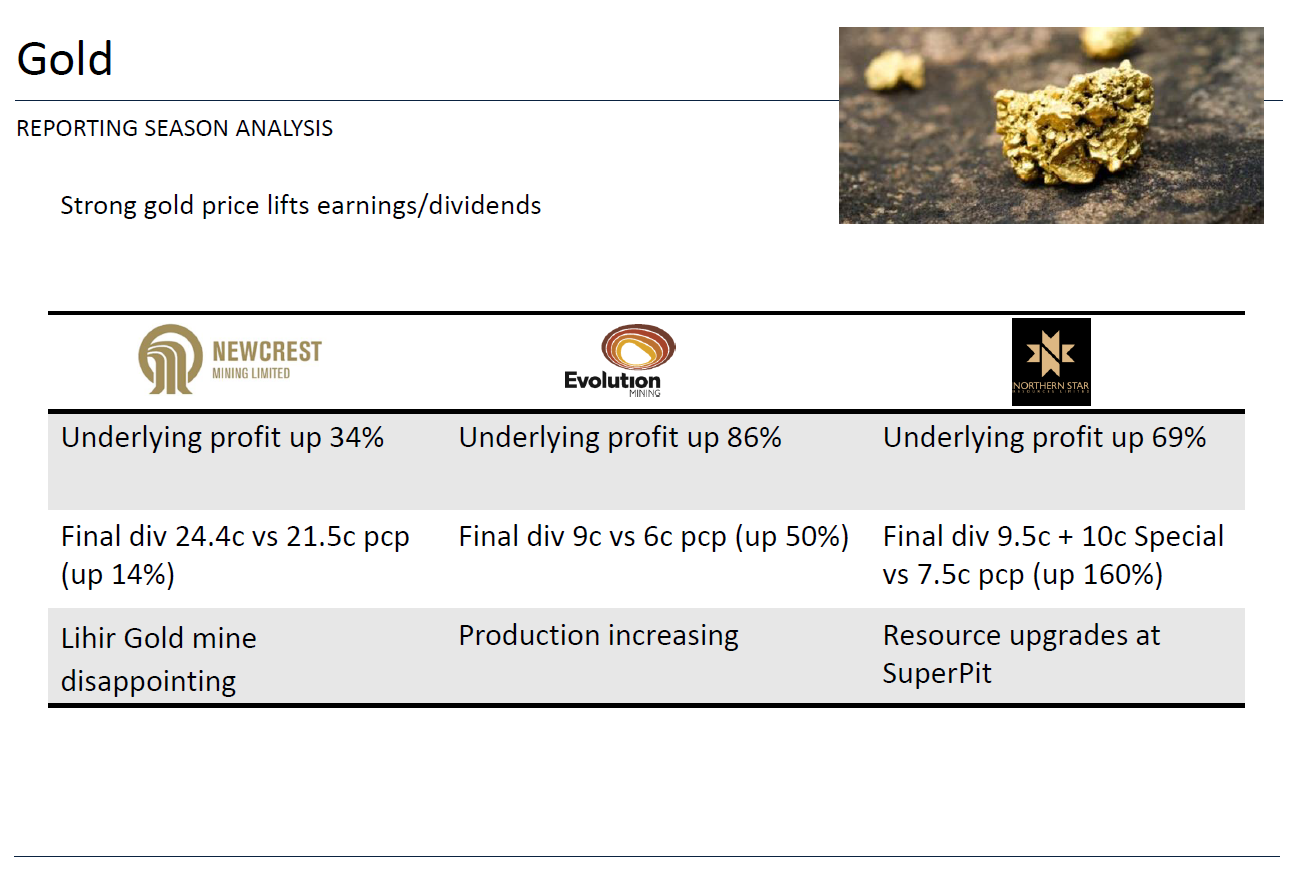

Mark Cormack: The gold price is run hard. It’s not a traditional high yielding sector, but a number of stocks you guys have liked from their total return perspective and they do pay some income.

Dr. Peter Gardner: Yeah, that's right. Our portfolio is not all about income. We also want to have a higher total return in the market and gold stocks fit that category. With the US Federal Reserve printing over $3 trillion dollars since COVID has begun, that's caused the gold price to rally significantly, which has led to great profits from all these miners. Newcrest, Evolution and Northern Star all had strong profit increases in the period. Newcrest's result was a little disappointing with that Lihir gold mine continuing to disappoint, but some of the names that we prefer like Evolution and Northern Star had strong increases, increasing their production right at the right time gold prices are high. They're doing really well.

Mark Cormack: REITS have traditionally been a defensive, high yielding sector. Very mixed results, but Plato again has called it right with your allocations, according to the results that have been delivered in an August.

Dr. Peter Gardner: The Scentre and Vicinty results were two that we've been highlighting as dividend traps for a while. The cash flow of Scentre is down 45%, cancelling its interim dividend. Its NTA was valued 11% lower. The retail REITs are struggling a lot in the current market environment.

On the other hand, Goodman and Charter Hall actually had strong profit increases during the current period and were flagging decent profits in the upcoming period. So they're not struggling too much in the COVID period. Particularly Goodman - they're exposed to a lot of distribution centres that is used for online sales so they've had a positive impact from this COVID period. Both of them are doing really well.

Mark Cormack: Most income funds wouldn't have held CSL in their portfolios, but Plato's not just after income, but capital growth and total return as well. CSL has been a top 10 holding. Take us through their results and some of the interesting things in the sector.

Dr. Peter Gardner: There were some challenges in the healthcare sector. Stocks like Ramsey Healthcare or Cochlear are exposed to elective surgery and so they struggled a bit. Both Ramsey and Cochlear didn't declare a final dividend.

Sonic Healthcare is exposed to COVID testing, particularly in the US. They were able to maintain the dividend and had an increase in underlying net profit during the period.

CSL had an increase in profit of 10%. They're struggling a bit from the decrease in the US dollar recently, with a lot of their earnings from overseas. They've also been challenged by their plasma collection in the US. They need people to come in and donate blood, which is happening less in the current period. But they still going well in the current environment.

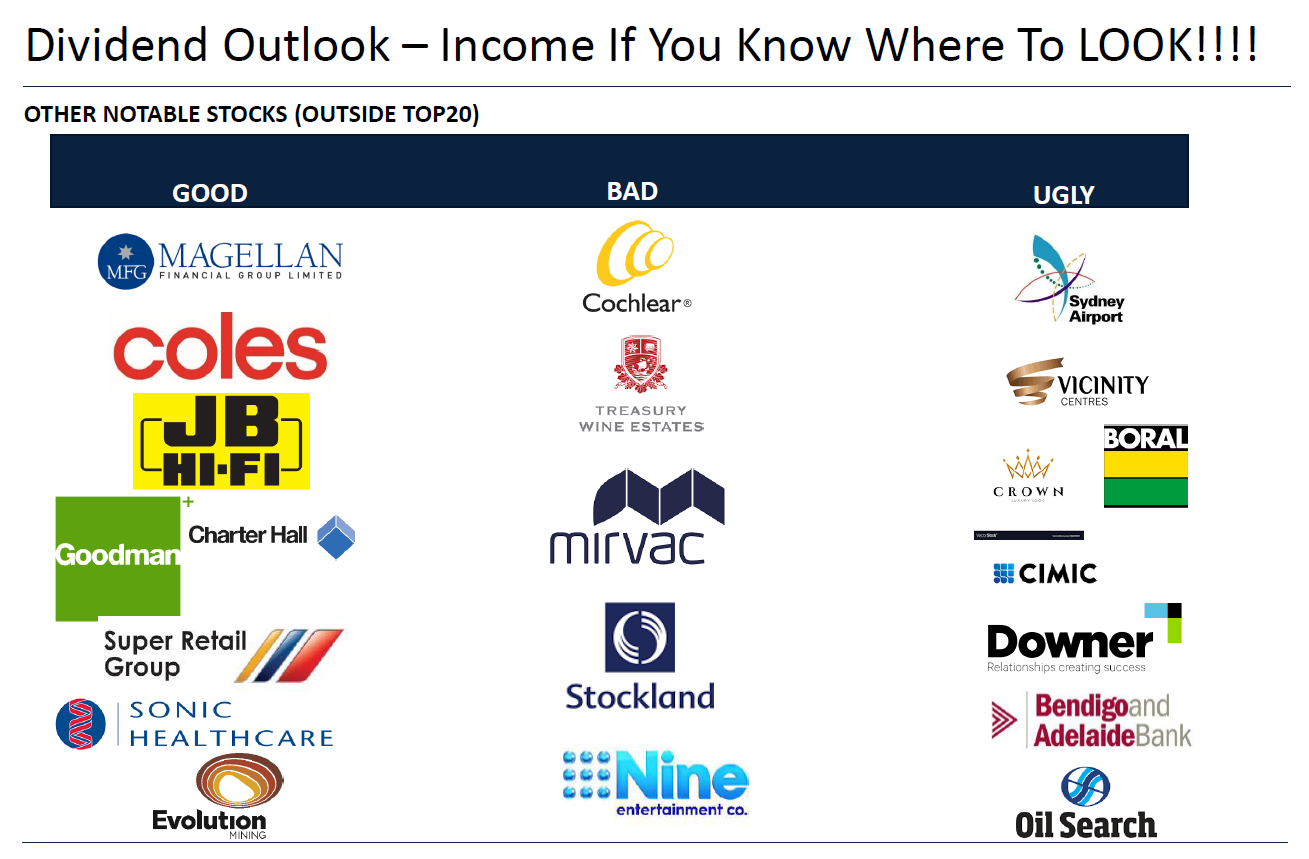

Mark Cormack: There's plenty of income if you know where to look in Australian equities. Even if you look outside the top 20 dividend players, there's still plenty of income if you do your homework like Plato does and know where to look. Equally important, you need to avoid those dividend traps. Pete, can you take us through some of those other notable stocks outside the top 20?

Dr. Peter Gardner: In the “good” category, Super Retail is exposed more to the camping end of the market, and a lot of people might be doing more camping over summer if they can't travel across borders.

In the “ugly” category, we've highlighted a few of the retailers, Sydney Airport, and building stocks like Boral, CIMIC and Downer. Also, the banks and Oil Search.

Some in the “bad” category. Cochlear I mentioned before. Treasury Wines is also struggling with less people drinking wine at restaurants. Now they’re struggling from the latest issue, which is the Chinese government turning their attentions to Australian wine. So Treasury Wines just recently took a hit from that.

Mirvac and Stockland, they've got a fairly diversified property portfolio, which is good. They do have some industrial exposure, but they're also exposed to retail as well. That's why they're in a bad category and not the ugly category.

Nine Entertainment is struggling from media earnings dropping in the current environment, but the STAN end of their business is doing okay.

Mark Cormack: Don, could you recap your approach and take us through your outlook?

Dr. Don Hamson: We're very active in the way that we seek out dividends. We actively rotate into stocks where we see good dividends. We've mentioned a lot of the good ones like Fortescue, Coles, and JB Hi Fi. We rotate in to those sorts of stocks to capture their dividends.

The other thing, I think very important, is to avoid those dividend traps. There are a lot of stocks out there that cut dividends completely. If you're sitting in those stocks hoping to get income and you're getting none, then that's not going to pay the bills. How do we avoid those guys? We always look at valuations, we look at quality and we look at a business momentum. That's helped us get out of a lot of those underperforming stocks as well.

We're looking at close to zero cash rates for probably two to three years, and that will roll out across term deposits and mortgage rates and bonds, et cetera. While it is true that all asset class incomes have been lower, we still see that in a relative sense, equity income looks very attractive indeed. Just comparing equity income to the current term deposit rate shows it's actually been going up, not down in a relative sense.

There is still plenty of income if you know where to look.

We've highlighted a lot of the stocks and stocks like Fortescue Metals... massive increase in dividends, and JB Hi Fi in consumer discretionary. Yes, a lot of stocks are cutting their dividends but if you're very active, you could still get a decent yield out there. It just won't be from the banks. We think in this environment with such a chalk and cheese impact from COVID, that the case for active management has never been stronger. Avoiding dividend traps is more important than ever.

Want to learn more about Australian Equity income?

Plato Investment Management is an Australian owned boutique equities fund manager specialising in maximising retirement income for pension phase investors and SMSFs. To find out more click "contact" below.

4 topics

29 stocks mentioned