Do You Wanna Be Right, or Do You Wanna Make Money?

Ellerston Capital

One way to transpose ethical views to investing is via shorting. This can involve attempting to profit from the fall or the share price of companies one deems to be misaligned with your ethical views. The question is, would you rather be right by shorting an unethical stock and prove a point or not get involved and preserve your capital?

We have a question that we ask interviewees: “what do you prefer: the challenge of being proven right? Or the search for the truth even if it means you are proven wrong?” There’s no right answer by the way, just different types of personalities.

The point of the question, from our perspective, was to try and understand what drives the person being interviewed; what gets them out of bed in the morning. Both motivating forces can be quite powerful. A search for the truth coupled with an inquisitive mind is very powerful. Likewise, the desire to prove to others that you are right can be very motivating.

One of the issues, however, about wanting to be proven right is that it can blind you to issues around the timing of the thesis working out or even worse – your thesis is actually wrong. Within investing this means losing investments are held too long waiting, hoping, that you can prove to others you are right (“I KNOW I’m right”!).

So how is this relevant to ethical investing?

Many, if not all, ethical investors believe passionately in the causes they support. This is fantastic as it’s this belief that leads to people volunteering their time to causes; helping out; lobbying members of parliament for change; or even running for parliament!

Issues emerge though when you apply this passion to investing and more specifically within investing, shorting. The Morphic Ethical Equities Fund (ASX: MEC) is Australia’s first ethically screened Long/Short fund.

What this means is that investors not only avoid investments in sectors and stocks that don’t fit with their ethical views, but that they can profit from the fall in prices of any stocks, including those they deem “unethical”.

One of the most topical types of stocks on the MEC negatively screen list is coal. This blog won’t be delving into the current issues in Australia relating to AGL and energy policy - well not today anyway! – but coal is clearly a divisive issue. We think longer term coal as an energy source will suffer as electricity production is shifted away to other sources globally. The issue, if you haven’t already guessed, is timing…

Did you short a Coal stock?

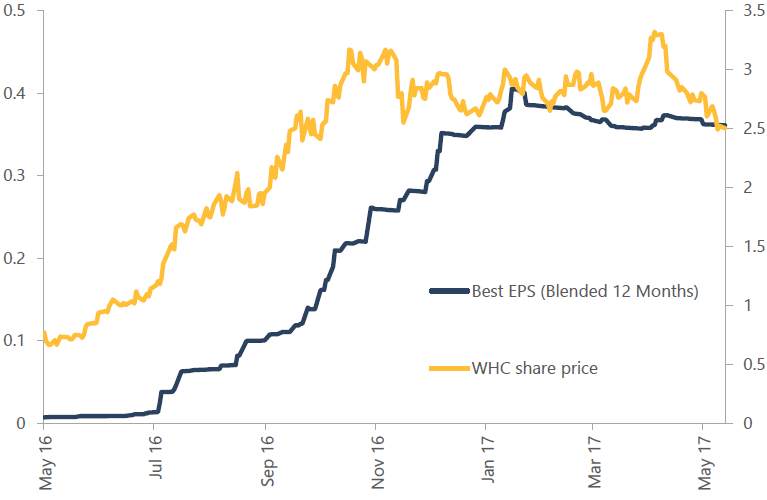

Back in May, we had started to think that the coal sector may be a potential short candidate. The stock we focused on was Whitehaven Coal (WHC) here in Australia. 2016 has seen a stellar run in coal stocks and commodities in general globally, as Chinese demand accelerated at the same time as they shut down some local supply. This led to a squeeze in production and a demand mismatch, with a resultant surge in pricing.

But by May earnings expectations had started to fall (blue line), as all the good news for coal producers had been incorporated into the price. The spike in coal prices from the Queensland floods in late March, had been unwound and the stock was back at its lows (yellow line).

Figure 1 – Whitehaven Coal’s earnings expectations and share price as at May 2017

Source: Bloomberg, Team analysis

So, we incepted a short position at around $2.75, with a price target of $2.30 as our first point of taking profit.

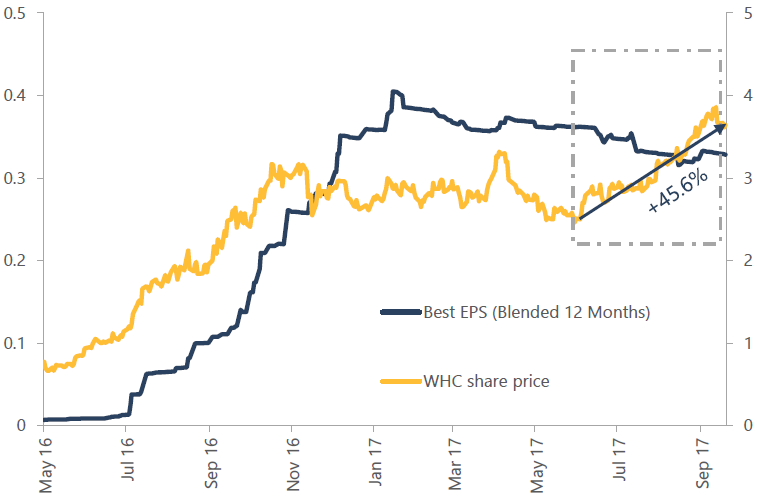

And we were completely wrong. Figure 2 below shows what came next:

Figure 2 – Whitehaven Coal’s earnings expectations and share price as at September 2017

Source: Bloomberg, Team analysis

After some initial success on the short side, the stock has surged over 50% to be $3.65 now. Spot thermal coal prices rose over the Chinese summer, as demand improved and Chinese coal-producing capacity didn’t come back. This is why Australia is now talking about a shortage of local coal in the spot market. Markets looked through the lower forecast earnings and instead focused on improving medium-term fundamentals.

So why is this a good story?

It’s a good story because we’d “rather make money than be right”. This meant that as the price went from $2.50 through $2.70, we covered our short position to walk away break-even.

Nothing that we can see has changed the medium-term dynamics: moves away from coal-fired power stations, coupled with Indian expansion of coal production suggest pricing returns to a downward trend at some point. News that the Chinese government is looking to ban fossil fuel powered cars is evidence they care about air pollution – something coal produces a lot of.

The old saying that you can only lose 100% on a long, but you can lose infinite on a short is true. So we’d rather not lose our investors their money, so we can short these stocks again.

For further insights from Morphic Asset Management, please visit our website

1 topic

1 stock mentioned

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.

Expertise

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.