Does the uranium bull market have more legs to run?

Uranium prices crossed US$70/lb this month, marking 12 consecutive weeks of gains and reaching levels not seen since the 2008 Fukushima nuclear disaster. But after a near-vertical move, one must wonder – Is this just a short-term surge or the beginning of a long-awaited supercycle?

In this wire, I explore some of the key data points from Longview Economics and why the research house expects prices to remain higher for longer. I also look at why Citi initiated coverage of Paladin Energy with a Sell rating and some learnings from the lithium bull market.

Longview Economics: Tightness is to be expected

“We expect that the uranium market should remain tight in the long term, albeit with potential weakness in the near term if our view on a US/global recession next year is correct,” said Bradley Waddington, senior commodity analyst at Longview Economics.

The bullish thesis is backed by three core arguments: Mined supply growth remains slow, deglobalisation is disrupting supply chains and demand is re-accelerating.

Here are the key takeaways and data points to the above.

Supply headwinds: Cameco, the world’s second-largest uranium miner (behind Kazakhstan’s Kazatomprom), cut its 2023 guidance by 9.3% from 18.0 million pounds to 16.3 million pounds due to equipment issues, labour disputes and startup delays. In 2022, Cameco accounted for approximately 15% of global uranium production. An ongoing coup in Niger, which accounts for 4% of global uranium production (mostly exported to France) also poses a risk to supply.

Shifting supply chains: Waddington views uranium as an attractive hedge against the shifting geopolitical landscape (Russia and China vs. the West). “The uranium rally arguably started in May when the US began seeking to re-shore nuclear enrichment capacity (away from Russia),” he says, adding that this was “preceded by the Prohibiting Russian Uranium Imports Acts passed on 24th May.”

Demand and acceptance: There’s a long list of pro-nuclear advancements that have taken place in the past 12-24 months. Some of the key changes include:

- “In August, Chinese officials announced expansion projects for three nuclear power plants which will add (once built) to China’s Uranium needs … China currently has over 68 reactors planned or under construction.”

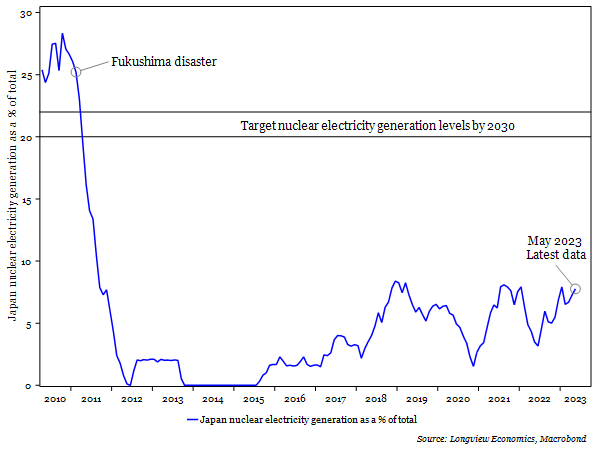

- “Japan continues to restart reactors (previously closed after the Fukushima disaster) in response to energy concerns … 12 reactors are now operational, out of a total of 33.”

- “Japanese officials plan for nuclear power to account for 20% - 22% of total electricity generation by 2030 (from 8% currently, equivalent to almost trebling nuclear power generation over the next 6 – 7 years”

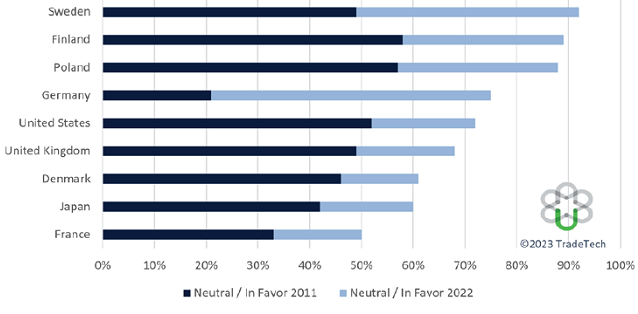

- “The World Nuclear Association (September 2023) doubled its 2040 uranium demand forecasts. That reflects improved sentiment over nuclear power (e.g. see fig 5), as well as expected growth in ‘Small Modular Reactors’.”

The state of play

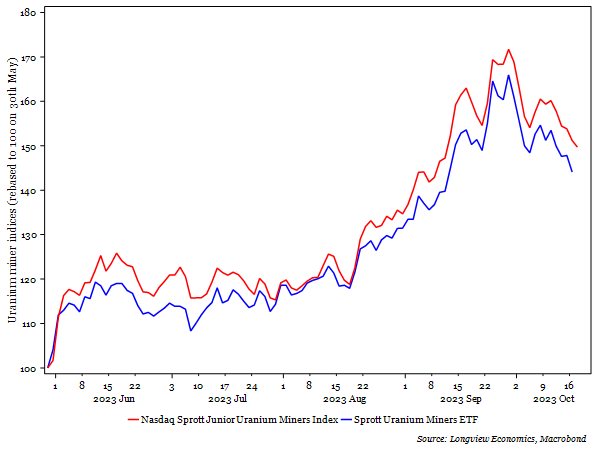

Longview brings up an interesting observation about how junior uranium miners have outperformed large-caps.

“That phenomenon is typical at the beginning of a commodity supercycle, as promising junior miners often have small mines with high-growth potential (thereby providing a new source of much-needed uranium),” the report said.

The emergence of the lithium sector from its bear market in late 2020 bears a striking resemblance to the current situation. This resurgence gave rise to numerous ten-baggers, including Arizona Lithium, Lake Resources, Ioneer, and Argosy Minerals (none of which are doing too hot at the moment but you get the point).

Valuation is a problem

In a note titled “Paladin Growing Brighter Than Its Worth”, Citi initiated coverage on Paladin Energy (ASX: PDN) with a Sell rating and a $0.90 target price.

“The spot market has surged from utilities and financial institutions, driving prices above US$70/lb. However, we anticipate U3O8 price stabilisation in 4Q-CY23 with an average price of US$65/lb,” the analysts said on Monday.

“While we remain optimistic about long-term supply and demand dynamics, we are Sell rated based on valuation concerns with the shares currently trading on 1.14x P/NPV.”

The $0.90 target price assumed a long-term uranium price of US$80/lb, which is still 14% above current levels of US$70/lb.

“We believe the market is pricing the shares beyond perfection and highlight valuation uncertainty surrounding undeveloped resources in Canada,” the analyst warned

%20Share%20Price%20-%20Market%20Index.png)

Food for thought

The lithium bull market has demonstrated that spot price momentum is arguably the most crucial factor influencing valuations and share price momentum. As long as spot prices continue to rise, valuations may remain seemingly irrational to what analysts might view as fair value.

Pilbara Minerals (ASX: PLS ) began reporting the outcomes of its Battery Metals Exchange auctions for lithium spodumene in July 2021, where the winning bid for the inaugural auction was US$1,250 a tonne. Prices climbed as high as US$7,805 a tonne by November 2022. But that’s as high as it got.

As price momentum began to dwindle, so did Pilbara Minerals shares. It’s been trading sideways ever since.

%20Share%20Price%20-%20Market%20Index.png)

Uranium prices have eased to the US$70/lb level after touching US$73 last week. Is this a breather before another run or is the best behind us? Let's see how this pullback plays out.

2 topics

2 stocks mentioned