Dogs of the ASX for the 2023 Financial Year

The past twelve months have been very volatile for equity investors, with significant falls in September, December and March offset by gradual recoveries in the other months. Atlas sees that extreme market volatility over the past year is very unusual and a result of a normalising of interest rates and, for many investors, their first experience with inflation. Additionally, investors have had financial experts calling for an imminent global recession, leading to three market falls of around -6% over the year. Despite what feels like a bruising twelve months for investors, the ASX 200 has enjoyed a pretty good year, up 9.7% or (or +14.8%, including dividends).

The solid gain in the ASX 200 over the past year masks a large dispersion in returns, with a range of mining, energy, bank and tech companies posting solid gains that offset significant falls in the share prices of companies exposed to the consumer or real estate. At year-end many institutional investors cast an eye over the market's trash to find some treasure to drive portfolio returns over the coming year. Invariably, several bottom-performing stocks will confound market expectations and stage remarkable comebacks! This was the case over the past year, with the Dogs of FY22 handsomely outperforming the market and most fund managers!

In this piece, we will look at the "Dogs of the ASX" in FY 2023, sifting through the market's trash looking for treasure, see how the 2022 Dogs performed and review how accurate Atlas's predictions were in July 2022 for the coming year.

The theory behind the Dogs of the Dow

Michael O'Higgins popularised a systematic investment strategy of investing in underperforming companies named "Dogs of the Dow" in his 1991 book Beating the Dow. This approach seeks to invest in the same manner as deep value and contrarian investors. O'Higgins advocated buying the ten worst-performing stocks over the past 12 months from the Dow Jones Industrial Average (DJIA) at the beginning of the year but restricting the stocks selected to those still paying a dividend.

Restricting the investment universe to a large capitalisation index like the DJIA or ASX Top 100 improves the unloved company's chance of recovery in the following year.

Larger companies are more likely to have the financial strength or understanding capital providers (such as existing shareholders and banks) that can provide additional capital to allow the company to recover from corporate missteps or unfriendly economic conditions. Conversely, smaller companies in the Dogs of the ASX 200 from 2022, such as Zip Money, have been removed from the ASX 200 and appear to be fighting for their corporate lives.

Retail investors have an advantage.

One of the reasons this strategy persists is that institutional fund managers often report their portfolios' contents to asset consultants as part of their annual reviews. This process incentivises fund managers to sell the "dogs" in their portfolio towards the end of the year as part of "window dressing" their portfolio before being evaluated. Institutional fund managers selling of underperformers is especially prevalent in December and June of every year. For example, in early July 2022, fund managers would have seen some pretty stern questioning from asset consultants about why they owned Evolution Mining or Xero in their portfolios, two of the worst performers over the previous 12 months that subsequently staged dramatic turnarounds.

Retail investors can afford to take longer-term views on the investment merits of any company that may have hit a speed bump, as retail investors are not swayed by asset consultants questioning short-term underperformance. Additionally, many underperformers see tax-loss selling around the financial year's end, further depressing share prices in June. Often the share prices of these underperformers rebound in the new financial year when this tax loss selling finishes and investors repurchase their shares.

Dogs of the ASX in 2022

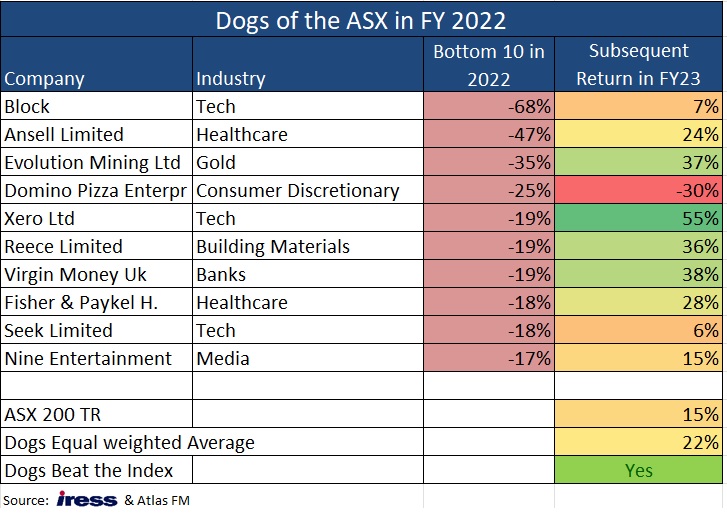

Over the past year, the Dogs from 2021 fell -2%, significantly outperforming the ASX 200 index's return of -6.5%. This makes this the eighth time since 2011 that the Dogs of the ASX 100 strategy has outperformed the index and the strategy's second-best year after 2016.

From the table above, six out of the ten "dogs" of 2022 rebounded strongly and outperformed the ASX 200, with Xero, Evolution, Virgin Money and Reece leading the charge. Xero's decline in 2022 was due to a general sell-off in high PE tech stocks globally and concerns about growth, particularly in the UK. In May, the cloud-accounting software provider's share price rallied strongly after revealing strong UK subscriber growth and better-than-expected profit growth. Evolution benefited from a higher gold price, but more importantly, improved production (versus low market expectations) and extension of the mine lives for two of the company's assets. Virgin Money UK (the sixth pillar of the Australian banking system) outperformed pessimistic market expectations, with the company's beaten-down share price recovering on better-than-expected profits, low loan losses and a surprise £50 million buy-back.

Conversely, the pain continued in FY23 for Dominos Pizza. The global pizza maker has seen a significant decline in its share price since February after revealing falling profits due to lower sales and the inability to pass on increased food costs to consumers.

Our picks from July 2022??

When making our picks twelve months ago as to which of the Dogs from FY 2022 would rebound over the coming year, Atlas' strike rate was poor.

Our pick that Dominos Pizza would rebound as rising mortgage payments curtailed discretionary spending and budget-conscious consumers substituted a night out at a local restaurant for pizza meal deals proved incorrect. While rising living costs curtailed discretionary spending, Domino's declining sales combined with the commentary from Coles and Woolworths suggests that parsimonious pizza lovers traded down to frozen pizzas bought in supermarkets. Further, Dominos announced the closure of all of its stores in Denmark and plans to reduce the number of corporate stores across its global network by 15%-20% through closures and re-franchising, which is not a good look for a high price-to-earnings "growth" company. Thankfully we did not heed our own advice in July 2022, and Dominos was not added to the Atlas Portfolios.

We correctly predicted that Evolution would rebound in response to higher gold prices and improved production, with the company's share price bouncing off 5-year lows. Less successful was Atlas' prediction that Reece's sales of high-end bathroom fittings would falter in 2023, with the company reporting strong sales growth in February as Australian consumers continued to spend and momentum gathered in the company's US operations. Accounting software company Xero benefited from both tech stocks being re-rated and reporting stronger-than-expected results in May that showed solid subscriber growth and minimal churn from subscribers failing to renew.

What does the class of 2023 look like?

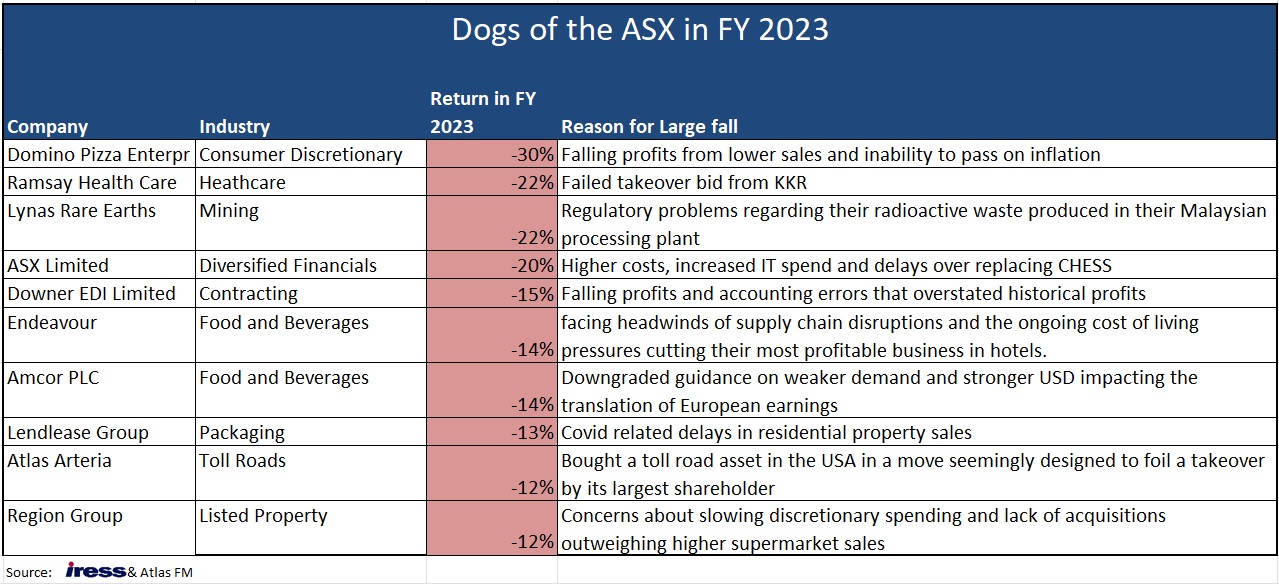

Looking through the list of the underperformers of 2023, there are many new faces, with Downer and Dominos the only companies to have previously been on this list of ASX 100 Dogs over the past ten years.

The key themes in the list of the Dogs of FY 2023 are a) failed takeover bids (Ramsay and Atlas Arteria), b) concerns about consumer demand (Dominos, Amcor, Endeavour and Region), and c) self-inflicted wounds (Downer and ASX).

Our Picks for FY 2024

Every year, three or four companies in the Dogs of the ASX look like poor additions to an investor's portfolio on July 1st but will significantly outperform the market over the following year. In selecting a share price recovery candidate for the next year, we generally look at companies whose current woes are company-specific rather than caused by factors outside the control of their management team, such as commodity prices.

We see that toll road operator Atlas Arteria is well placed to recover in FY24, with the -13% fall over the past 12 months due to frustration around the acquisition of the Chicago Skyway, which resulted in a large capital raising in October and possibly derailing a takeover offer. However, Atlas Arteria's underlying business is performing well, with first-quarter revenue up +7.6%, and we note that in May, IFM increased their ownership stake in the company from 19% to 22%.

After years of solid performance, Amcor debuted on the Dogs list after downgrading earnings growth for FY 2023 due to a small volume fall and a stronger USD reducing the translation of euro-denominated earnings. We see that the fall in Amcor's share price is not warranted, given that the bulk of the fall in revenue was due to the company exiting Russia and a stronger USD. While the stronger USD is negative for American investors, it is positive for Amcor's Australian investors as the AUD has fallen against the USD.

Atlas sees that the ASX will continue to struggle over the coming year, impacted by higher operational expenses, capital expenditure to replace the exchanges CHESS settlement system and minimal revenue growth from a stagnant IPO market. Given these issues, the ASX still looks expensive, currently trading on a forward price-earnings ratio of 26 times and is unlikely to be re-rated upwards unless its settlement software issues are magically fixed.

2 topics

5 stocks mentioned