Don’t ask 'Will it rain?' Take an umbrella in case it does

People often leave their house or car, look to the sky and ask themselves: "Is it going to rain?" But for us at Talaria it’s fundamentally the wrong question. The right one is: "Do I have an umbrella if it does?"

One of the great virtues of this question is that it is answerable in advance, and without forecasting.

When it comes to investing what can be known, or at least inferred, is the way a market is positioned ahead of an event.

For example, with the S&P 500 having outperformed MSCI World ex USA by more than 155% since the March 2009 post GFC low, and with the NASDAQ Composite having outperformed the S&P 500 by more than 70% over the same period, one can reasonably conclude that investors are heavily exposed to the broad US index - and that they are probably even more heavily exposed to Technology stocks.

Furthermore, with the S&P 500 and NASDAQ Composite trading on price earnings ratios of 22x and 34x today versus 13x and 22x a decade ago, the valuations at which investors maintain such exposures are high relative to history and in absolute terms.

So with that set up, what’s the impact of potential inflation? Is it transitory, cyclical or more long term? Everyone seems to have an opinion (forecasting again), and the bulk of the market is set up for it to be transitory - but that just shows that it too is the wrong question.

The right one is: Are you prepared if it’s not transitory?

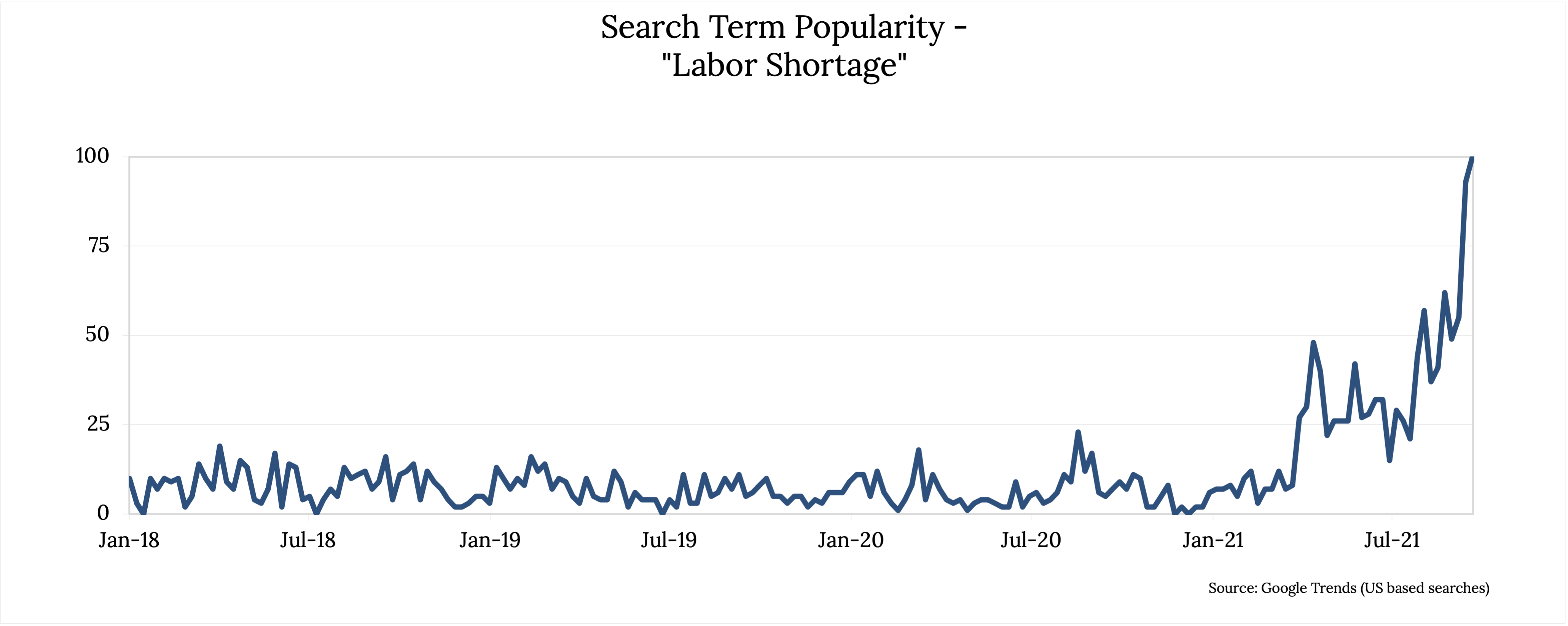

Now if you don’t think it's worth worrying about, then consider some of the data out there to show that inflation may turn out to be more permanent. Perhaps the most striking is the below chart showing the intensity of coverage of corporate US labour shortages. If inflation is transitory, this should be falling.

Now let’s look at a stock to really bring the inflation position point to light. Facebook (FB) currently has an earnings yield of 4.4%, yet the headline inflation rate is 5.4%. So if inflation increases or remains flat, you’re looking at a negative real return, which is theoretically at least a good way to lose money.

Obviously, Facebook’s earnings yield could turn out to be higher if earnings turn out to be better than forecast, but with the valuation at current levels, investors are placing a greater reliance on continued growth or multiple expansion, which comes with greater risk.

To expand that further the NASDAQ earnings yield is even less at 2.9%. Having persistent inflation above that level raises the risk of losing money for many investors.

So what to do? While future-proofing is impossible in investment, diversification provides a critical line of defence. Investors should consider prioritising:

- Income versus capital growth

- Active over passive management

- Other parts of the world, away from the US and Australia

- Non-tech versus tech sectors

- Value-based strategies, over other investment styles.

To be forewarned is to be forearmed and so while we are not in the business of forecasting, we are in the business of being as prepared as possible.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics