Don't avoid the recession risk discussion

The conversation around positioning for recession is often more difficult for investment advisors, given the bias towards being on the long side here in Australia.

Avoiding the conversation is not the answer.

Advisors and investors should spend more time thinking about risks and asset allocation when the chances of recession (US/Global) are elevated. Arguably investors need more advice as opposed to less when recession potential looms. And whilst there have been few places to hide this year, with both equities and bonds falling, at least in the first half of the year, there are always options for portfolio positioning looking forward.

The discussion around "recession" is not new to markets, and the recession argument has ironically driven the current bear market rally. That is, as evidence of recession in the US becomes clearer, the FED may be forced to change its policy settings, focusing on growth and unemployment, as opposed to just inflation (2% target).

With the US inflation rate printing lower for the first time in over 2 yrs. in July (8.5% vs 9.1% for June), this fuelled hopes that the FED changing course would come early (the "pivot"). Plus, about as much negative news that could be priced into equities was before this recent rally.

The key questions we focus on:

- How likely is a recession?

- If a recession is coming, has this been priced into equities?

Recession signals

Always remember that one of the key drivers of both bull and bear markets in equities is financial liquidity. We went through two years of unprecedented liquidity in the system dealing with COVID-19 measures, this drove up inflation (demand-pull inflation) when combined with supply side issues (cost-push inflation). The Fed is dealing with the demand side by withdrawing liquidity, and slowly the supply side is fixing itself (The Fed can’t stop workers calling in sick, China lockdowns etc).

Recession

indicators continue to build in the US, with a number of housing, monetary,

credit, and financial market indicators flashing recession warning signals. You

can argue that the FED has already overtightened, and they still intend to

tighten further. The FED has a history of over-tightening until something

breaks, and this time may not be any different. Increasingly, the Fed

presidents are indicating a recession is a price they are prepared to pay in

fighting inflation.

“We’re committed to returning inflation to our 2% target and we’ll do what it takes to get there… …There’s a path to getting inflation under control but a recession could happen in the process” - Thomas Barkin, 19th August 2022

Recessions are the result of an overtightening of money (and/or a macro shock), which then forces the private sector to retrench (cut headcount, lower costs). Despite US unemployment running at record lows (3.5%), the prospect of retrenchment has already begun. Forbes published a PwC survey of seven hundred executives and board members from various industries last month, it showed that 51% have started layoffs or are planning to start layoffs.

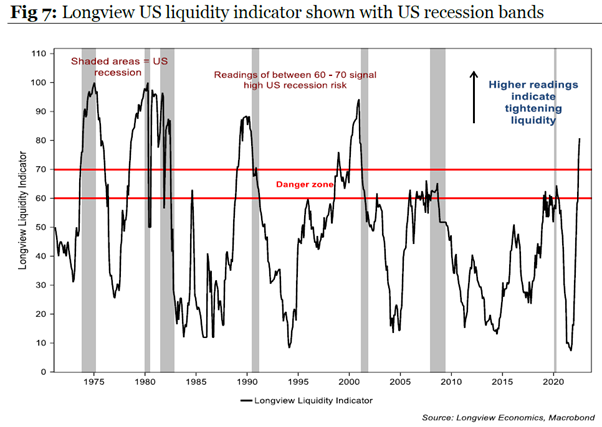

One chart that summarises how quickly liquidity is tightening is below. Longview Economics aggregates several key monetary, financial, and credit indicators into its liquidity model. Fig 7 shows how quickly liquidity has changed and how it is now overly tight. Noting their model goes back before the last major inflation crisis in the 70s and, in the past few weeks, it has punched through the danger zone.

There are a number of other key indicators warning of recession. Housing indicators, corporate sector financing gap, credit conditions in the banking system, yield curve inversion (can be early yes) and several other coincidental indicators (inventories in the US are now ~20% higher than pre-COVID).

Is a Recession priced into US equities? No.

Let's assume the recession assessment is correct. What does that mean for equities, is it in the price or does the bear market for equities have further to go?

Whilst the US is in a “technical recession” presently (the last two GDP prints were -1.6% and -0.9%), corporate earnings have been rising, and equity markets are concerned with an earnings recession, ie when company earnings fall. What sort of earnings growth is the market factoring in for 2023 and 2024? It may surprise that estimates are for earnings to rise 4.8% and 8.9% respectively. That appears too high.

There are two adjustments to think about for markets. That is, how far could earnings fall? And how might the price multiple (PE) derate in a declining earnings period?

The magnitude of the earnings downgrades?

Longview Economics published recently that

“Usually in recessions, earnings fall by between 16% to 40%”.

This is a long way from the growth forecast above, and the obvious reason for caution.

For some perspective, and also from Longview, during the GFC, forward earnings estimates fell by 35%. During the 2020 Covid pandemic and the early noughties dot-com crash, earnings estimates fell by ~20%.

It is important to note that whilst the key driver of recession is common (liquidity), the policy settings and financial conditions going into recession are nearly always different. And the options to change course for policy makers differs. There are many variables. For these reasons, we (nor Longview Economics) are suggesting, that this will be a GFC-type debt crisis and earnings will drop 35%. The path into recession is still somewhat unclear.

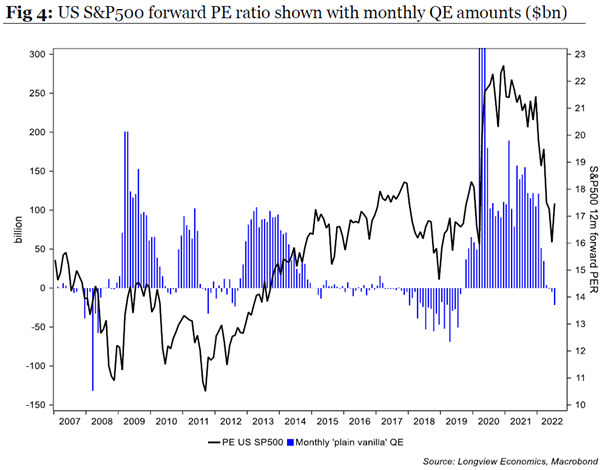

The P/E contraction during recessions

Earnings

multiples (P/E) contracts generally as liquidity is sucked out of the system.

The chart below shows that clearly (Fig 4). Going back to 2007 (GFC), you can

see the S&P500 P/E multiple during periods of quantitative easing and

tightening. Whilst the P/E has clearly come back from an excessive post-COVID

peak, you need to remember it is not factoring in a drop in earnings as yet.

Further, if markets look to price in recession, then it usually derates further

during the earnings downgrade cycle.

Longview Economics published a detailed research note on the potential fair value for the S&P500 under various recession scenarios. To quote-

- a sensible, ‘midrange’ scenario points to a bear market low in the S&P500 index of about 2,700 (i.e. about 34% below current levels)

How any recession scenario plays out will be influenced by the US macro, inflation, and Fed policy. Longview Economics doesn’t view the 2,700 level on the S&P500 as a forecast, but as a “valuation stress test”. All the ingredients for recession look to be there, how it is put together is uncertain.

For some perspective, the longer-term mean P/E for the S&P500 is 14.63. The recent bear market rally has pushed the P/E to 17.3, up from 15.6 in mid-June. Obviously, there is less value and more risk at the current market level, if we assume coming downgrades to earnings.

Other models tell a similar story of caution. As real bond yields rise, equities have to compensate by offering greater returns. Longview Economics published their Equity Risk Premium ERP model, in a similar stress test scenario, and that derived –

“imply a devaluation of the S&P500 to around 3,083 (a fall of 17%).”

(noting the detail in the ERP model is complex, but in simple terms, as real bond rates rise, this places pressure on equities to devalue).

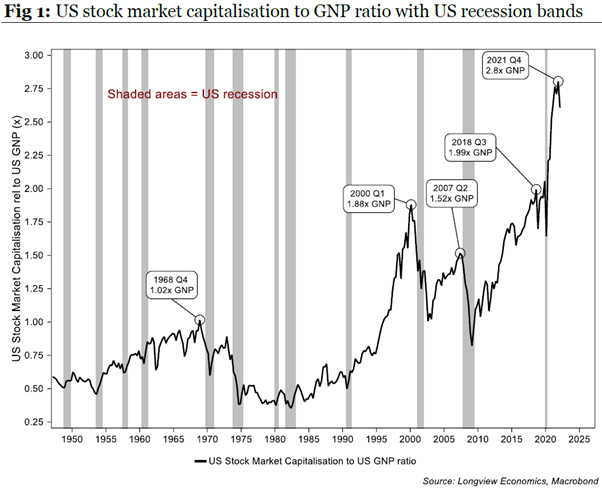

The

model Warren Buffet often points to as his favourite valuation indicator

is the ratio of the stock market capitalisation relative to GNP (Gross National

Product). That indicator is also uncomfortably high.

Geopolitical risk is more real than it has been for some time

Normally

it pays to look through geopolitical events (elections -Trump, BREXIT etc), as

markets rapidly move on. With a real war (not conflict) in Ukraine, and serious

implications for energy, in a time of high inflation, looking the other way is

not possible. The energy issues in the EU are serious, particularly as we move

towards the northern winter. The two US visits to Taiwan at this time add to

the concern. The lukewarm relationship between the Saudis and US may throw up

challenges. All of these potential factors add complexity and real economic

risks.

Cheap vs Expensive – it’s a relative thing

In this note, the focus is on the US and the S&P500. It looks to make the case for moving underweight US equities on a relative basis.

And when thinking of how to manage asset allocation it is often a relative call.

European (EU) equities valuation discount vs US equities is at its highest going back to 1987 when data started. No doubt driven in part by Ukraine/Russia and Energy issues. This applies also to EU equities vs bonds.

It’s a similar picture for UK equities.

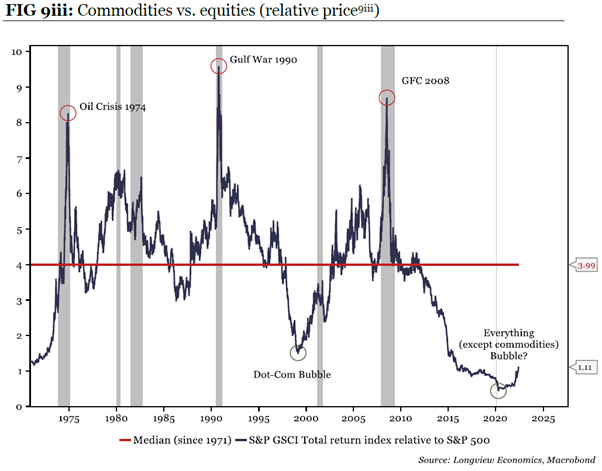

And

of particular interest from the Australian perspective is commodities,

are they cheap or expensive? Despite many commodities trading at

historically high levels, commodities relative to equities remain relatively

low. Longview Economics' view is that a new commodities supercycle could be emerging,

so commodity valuations could start to rise vs equities. This is one of the

reasons we have been decreasing our US equities relative to AUS exposures.

US treasuries could be close to peaking.

If the bond market starts to price in recession, then we may have seen the highs (or close to highs) for US 10yr treasuries. The next moves in inflation will be key to if the highs are behind us. If we have an environment of inflation trending lower and a recession risk rising, then rates may have peaked around 3.5%, with cause for rates to then move lower (bond prices move higher).

As portfolio managers, what are we doing?

How has our asset allocation shifted? After moving tactically overweight international equities in Mid-June, we are now taking those positions off and moving underweight. Our thinking is two-fold. First, the bear market rally in equities (S&P500 rallied ~10.4% since moving O/W) looks well advanced, and complacency looks to be back. Second, for the reasons discussed here, markets appear to be discounting the recession signals and the impact this may have on earnings. With the Fed’s Jackson Hole meeting this Thursday/Friday in the US, this could be a telling time for the Fed in terms of its commitment to its inflation target.

On the buy side, we have been adding to US Government bond exposure (hedged in A$). This positioning may be early, however, in a recession scenario peak rates may be close to 3.5%, given the speed by which financial conditions have been tightening in the US.

AUS Government bonds could also be starting to look attractive, however, AUS may be 6 or so months behind the US in terms of the inflation/rates cycle.

US 10yr Bond yields – 10-year chart

In summary, the pricing of the downside risk is always a valuable exercise, when you are considering your asset allocation. We put these ideas into practice in our Multi-Asset Class portfolios. Our positioning changes have been more frequent over this period of fast-moving macroeconomic changes and challenges, and will likely continue in the near future.

In managing our portfolios, we use the research of Longview Economics, based in London. We have quoted their recent reports in this note. Chris Watling is the CEO & Chief Market Strategist of Longview Economics, and a Livewire contributor and well worth following.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics

1 contributor mentioned