Dr Philipp Hofflin predicted China's slowdown in 2019, here's what he thinks will happen next

In 2019, Dr Philipp Hofflin from Lazard Asset Management made the prediction that after repeatedly stimulating the economy, the Chinese government would ultimately struggle to endlessly jumpstart activity and keep the world’s global growth engine running smoothly.

That is what is playing out right now, with serious ramifications for both global and Australian investors.

In backing over that prediction, Hofflin notes that his assessment at the time was that the Chinese economy was too dependent on property where there were clear signs of overinvestment.

He also contrasted the Chinese economy with the Asian tigers, noting that even when those economies were flying, they all had regular capex recessions, whereas China to that point, had not.

"Again and again, the Chinese government kicked the can down the road, as they did in 2008/9 and 2015, used the banks to lend a lot of money and avoided the issue, but at the cost of increasing leverage in the economy.

Eventually there is a risk that this comes to an end", said Hofflin

The impact on Australia of a slowing China will be immense, with Hofflin describing it as “an ill wind that blows nobody any good”. China accounts for about one-third of Australia’s export demand and about half the demand in many of the commodities Australia exports.

"It’s not just the case that they take a third of our exports, but they determine the price of almost 100% of our exports".

Can the good times for value keep delivering?

In the period between 2016 and 2021, the multiples on those stocks with the highest PE almost tripled. It was an extraordinary time for growth investing as valuations defied gravity.

The flip side of this liquidity-fueled rally was that low PE stocks, historically a happy hunting ground, were shunned.

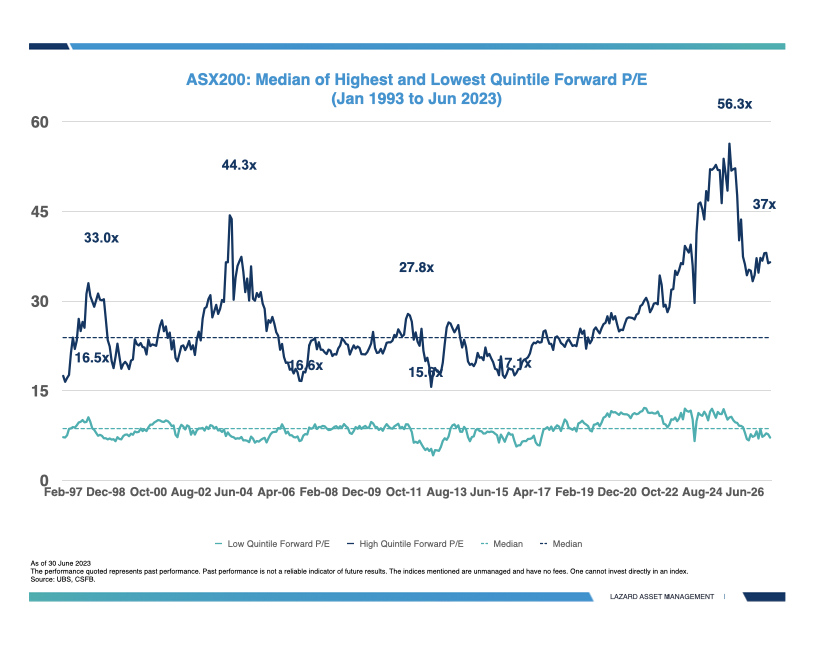

ASX200: Median of Highest and Lowest Quintile Forward P/E (Jan 1993 to Jun 2023)

As the chart shows, the low PE stocks failed to participate in the multiple expansions seen by growth stocks. This trend started to reverse in 2022, and with that reversion came a change in fortunes for value investors.

Whilst growth stocks have come off the boil, Hofflin notes that most expensive stocks are still trading on 37 times. A mark that he says is still simply too high.

"The top quintile is still at 37 times. That's still too high. For those top stocks, 23 or 24 times is fine, but not 37," said Hofflin.

Hofflin also makes the point that value funds tend to be low beta. What does that mean? They rise less in hot markets and fall less when the going gets tough.

This is relevant because calls for a soft landing are growing in the face of history's most aggressive interest rate hiking cycles.

So, will we avoid recession?

Hofflin, a great student of history, points to the fact that the US Federal Reserve, the RBA and the ECB all continued to hike rates into 2008 - even though the US was deemed retrospectively to have entered recession earlier that year.

Hofflin concludes that despite open collaboration and communication between global central bankers, they didn't know what impact the hikes were having. His view is that there is minimal cost in avoiding areas that are vulnerable to a downturn. He calls out discretionary retailers, highly geared stocks or companies that carry high levels of credit risk as three examples.

In this extended interview, Hofflin explains how a concentrated portfolio of attractively priced stocks can be defensive and deliver returns.

He also outlines the thesis for one of Lazard's largest portfolio holdings.

Topics discussed

- 0:00 - Introduction

- 0:36 - The China story and the impact on Australian investors

- 3:07 - The broader implications for a weakening China

- 4:14 - If China takes the pain, how will that impact your portfolio?

- 5:45 - The return of value investing and what has brought about the change

- 8:55 - How long will it take markets to return to ‘normal’?

- 15:00 - Concentration and conservatism – what they mean in a portfolio sense

- 17:16 - The stock idea that best represents the Lazard methodology right now

More about Lazard Asset Management

Visit the Lazard Asset Management website for more information. Click Here

Click on the fund profile to learn about Lazard's philosophy, process, performance and fees

4 topics

1 fund mentioned

1 contributor mentioned