Early super withdrawals will cost taxpayers more than $100bn

The almost $30 billion Australians have yanked from their super during the government’s early release program is anything but free money, BetaShares modelling shows.

The fund manager estimates the $29.4 billion withdrawn from super as of 29 July will amount to a a bill of between $100 billion and $130 billion for Australia’s retirement income system over the coming years.

Much of the emphasis so far has been on the long-term impact for individuals making use of the scheme, which has already surpassed Treasury’s initial total estimate of $27 billion. But little thought has been given to what this will eventually cost the government in additional pension payments.

“This was a well-intentioned but misguided policy from the start,” says BetaShares CEO Alex Vynokur.

“The true cost of allowing people to access their super early will ultimately be paid by future Australian governments and taxpayers."

Vynokur believes further analysis into the broader effects is crucial, particularly on the back of the government’s decision to extend the scheme until the end of 2020.

“An amount between $100 billion and $130 billion represents a very significant future shortfall, which will only increase as further super is released early,” he says,

“It will need to be funded by future Australian governments and therefore the Australian public will ultimately bear the cost, as those who have withdrawn super will be less able to fully fund their own retirement needs.”

Vynokur expects a number of Australians who have accessed their super early will fall into the Government’s “safety net” of either a full or part pension.

There’s a broader argument about the scheme’s potential to permanently alter the way Australians view superannuation. The former Prime Minister who first introduced compulsory superannuation, Paul Keating, recently spoke about the current government’s early release scheme.

“Of the income support in Australia to date in this Covid emergency, $32 billion has been found and paid for by the most vulnerable, lowest paid people in the country,” he says.

“So, instead of Jobseeker and Jobkeeper carrying the main burden, the main burden of income support is people ratting their own savings.”

Keating believes Australia’s huge pool of retirement saving – now the third-largest of its kind in the world – points to the true measure of our national resilience.

“The Liberal party as an organisation...had to be dragged screaming to the new Australian community standards of universal compulsory retirement incomes,” he says.

“A measure of Australia’s true resilience is whether we are a capital adequate country able to fund its obligations, but more than that a capital exporter.”

Younger Australians to be hardest hit

Analysing the impact of withdrawing $10,000 of retirement savings for people between five and 40 years from retirement, BetaShares warns that younger Australians have the most to lose.

Based on an annual growth rate of 5% plus CPI, $10,000 withdrawn today becomes a $70,400 nest egg over 40 years. When an average annual rate of 7% plus CPI is used, this increases to $149,745.

By contrast, a person who withdraws $10,000 and is 20 years from retirement will lose out on $26,533 based on a 5% plus CPI return and $38,697 based on a 7% plus CPI return.

Even conservative estimates suggest the modelling shows younger Australians will be the hardest hit by missing out on decades of compound returns.

“Not only that, younger Australians will already have to foot most of the bill of one of the largest government debts this country has ever seen,” Vynokur says.

Ironically, Treasury figures revealed that half of all claims under the early super scheme are being made by people under the age of 35 – which in some cases comprise withdrawing most, if not all, of their super balance.

This is a point also made by Keating.

“In a country with low levels of public debt to GDP, with very low interest rates, should young people under the age of 35 be the principle carriers of the burden? Because that’s what’s happened,” he says.

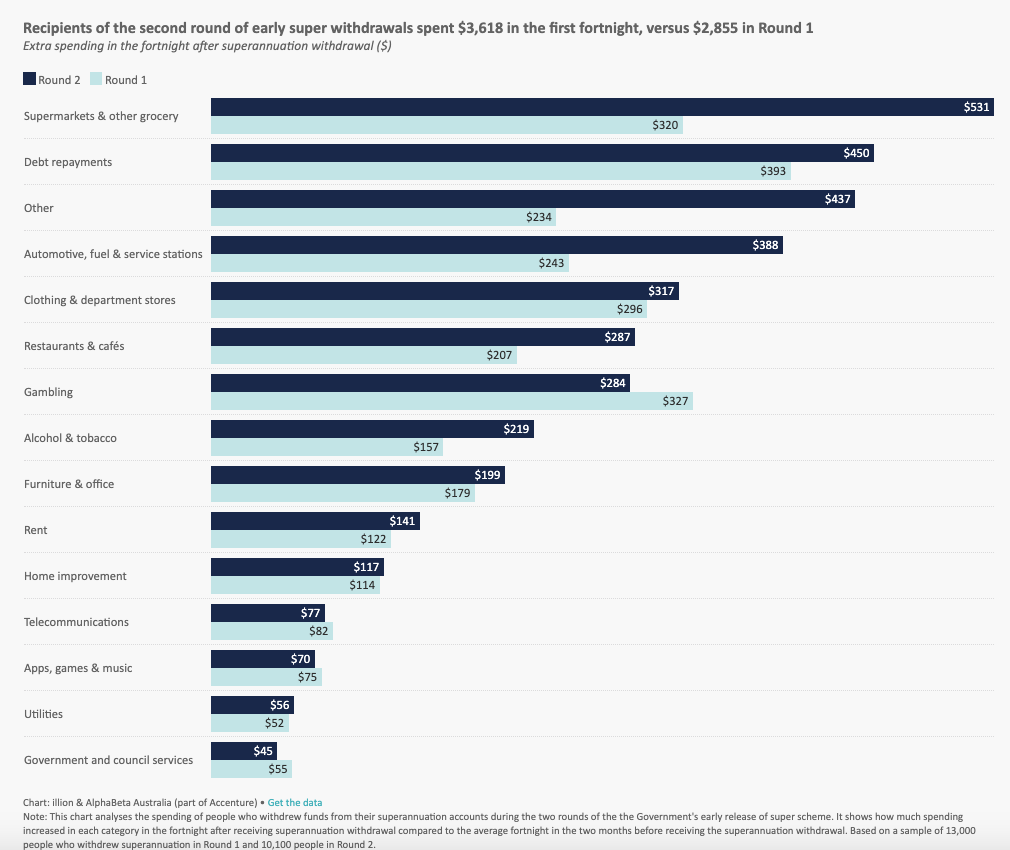

Recent data also revealed that 64 per cent of people who accessed their super spent the money on discretionary items such as clothing, food, gambling, and alcohol.

Source: Illion and AlphaBeta Australia

Vynokur suggests there is enough evidence to show the scheme is being abused as the use of proceeds is in many occasions inconsistent with the intention of the policy.

“Unfortunately, it is the least informed and the least financially literate that are in the most vulnerable position for opting in for early super withdrawal,” he says.

“As such, the scheme will further the gap between the haves and have nots. It has also damaged the educational effort in which the Australian Government has invested over decades to highlight to Australians the importance of superannuation and long-term wealth accumulation.”

'A dangerous precedent'

The undermining of the importance of superannuation is a real problem, warns Vynokur.

“The reason why we punch above the rest of the world as a nation is because of that compulsory superannuation system," he says.

“I fear that going forward our superannuation system will become a tempting target to be used by governments, present and future, as an ATM to withdraw money to plug holes in the economy. Without proper governance, the Early Release policy has set a dangerous precedent."

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

1 contributor mentioned