Earnings Growth or Earnings Revisions

Note: This video was taped on Wednesday 2 October 2024.

Not many investors can claim to have stuck to one area of the global financial markets for over 20 years. But one such person who can is Man Group's Head of Asia ex-Japan Equities, Andrew Swan. Although he is originally from Australia, Swan has invested in the world's largest continent for a long time - first at J.P. Morgan Asset Management and then at BlackRock for nine years as its head of fundamental Asian and EM equity strategy.

Swan has invested through two major economic regime changes in his career:

First, China's entry into the World Trade Organisation in December 2001, which he calls "a transformational moment". Then, following the Global Financial Crisis, the fundamental change to China's economic model saw the Middle Kingdom counter-act the global downturn with trillions in fiscal stimulus. The plan worked for a long time - until it didn't.

And although Swan says we might now be on the brink of a third major economic regime change, his investing philosophy remains the same.

"For us, it's trying to work out where surprise may lie versus what the market is anticipating on a company's fundamentals or profits," Swan notes.

To find out where Swan has had success with this approach in the past and where he thinks you will find outperformance over the next few years, join us for this episode of The Pitch.

EDITED TRANSCRIPT

LW: Tell us about your background in markets and Asian equities in particular.

Swan: Without giving away my age, I have been investing for more than 20 years now consistently in the region. I spent most of that time up in Asia but came back to Australia a few years ago. Before joining Man Group, I was at BlackRock as the head of Asia and emerging markets in fundamental equities, and prior to that, I was with JP Morgan.

LW: What is the biggest change you have seen in your time and how has that affected your investment view?

Swan: I think the way we invest, in terms of what I believe in, hasn't really changed at its core. But I think the themes that have been driving the market, I guess you could categorise them into both short and long cycles.

We've had probably two big long cycles. One really came when I started my career. China entering the World Trade Organisation was a transformational moment. I think the second moment was probably after the Global Financial Crisis and how the economic model in China changed at that point. And I guess we're pretty much on the cusp of now a third change. It's almost like these things come in decades. These are the long cycles.

Short cycles are more around monetary and fiscal policy both locally and globally. And I think the combination of both short and long cycles means there's a lot of volatility in the region. It is an emerging part of the world still. It seems to always be emerging, but with emerging parts of the world, you get a lot more volatility.

LW: What is your approach to generating alpha in this asset class?

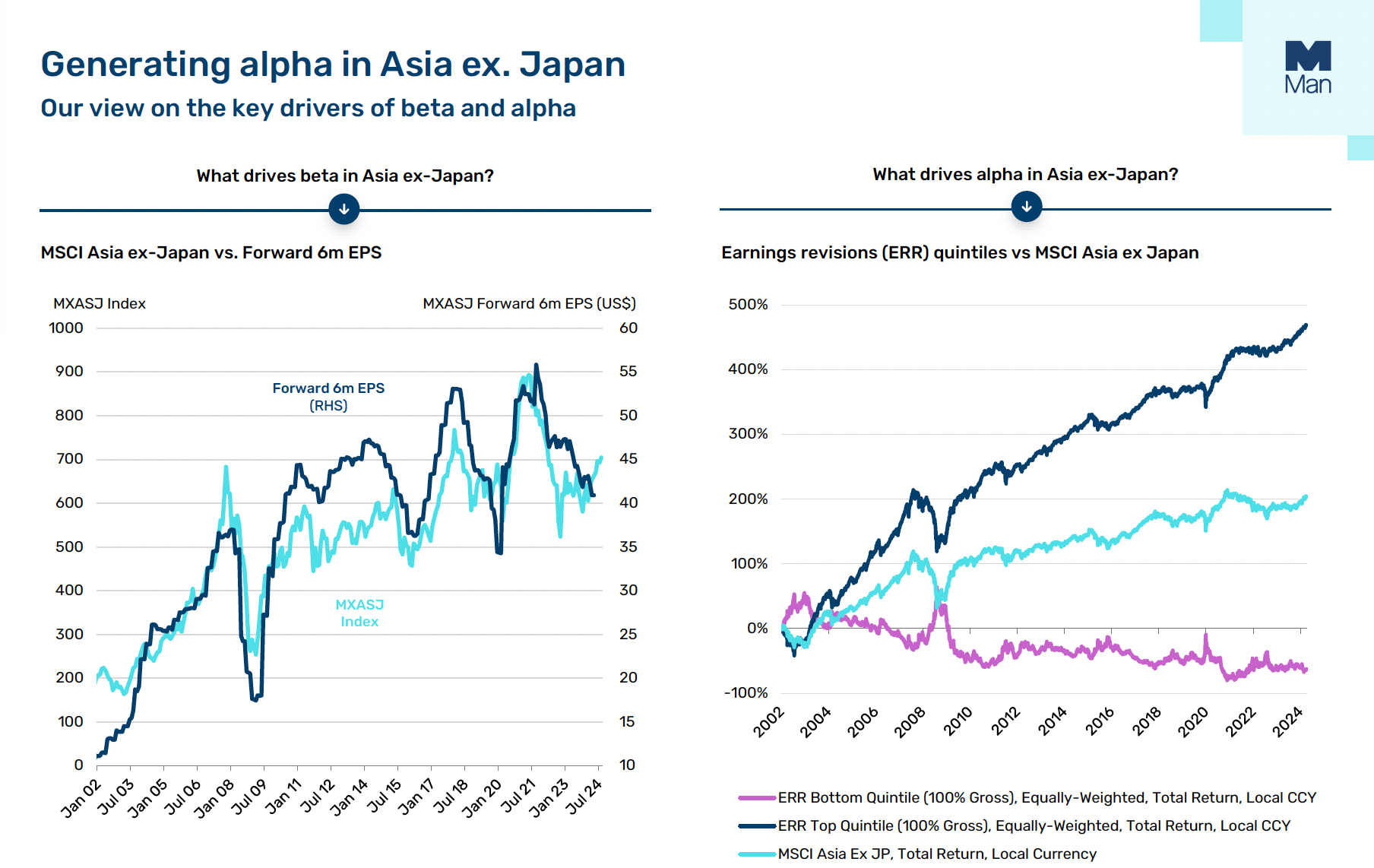

Swan: There's a lot of research around what drives returns in the region. For us, and again, what I've done to the core for more than 20 years, is trying to work out where surprise may lie versus what the market's anticipating on a company's fundamentals or profits. And the phrase we use is earnings surprise or earnings revisions.

Source: Bloomberg and Man Group as of 31 August 2024 (LHS) and 30 June 2024 (RHS). Opinions expressed are those of the author and are based on current analysis and are provided for information purposes only. These statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements.

And what we like to do is own stocks where we think profits will be higher than what the market expects and avoid stocks where profits are most likely to be lower than what the market expects. And I think that's what I've been doing pretty consistently now for 20 years, and it does deliver consistent returns if you execute well.

LW: Where have you had previous success with this approach?

Swan: I think the key to this approach is that the sources of those returns, whether it's sectors or countries and even investment styles do change through time. So rather than have a bias per se, I think you need to have a flexible approach because you've been just looking over the last 20-odd years we've had China leadership, we've had India leadership, we've had consumer stocks leading the market, we've had technology stocks leading the market really in the first part of the last 20 years. It was value stocks that did very well when the global and regional economy was doing well. And in the last 10 years, it's been more growth stocks, which tend to do well in lower growth environments.

The reason I've been able to do this for a long time with consistent returns is because I look at these sorts of things agnostically, not having bias around them because, ultimately, what leads the market is very much hostage to the macroeconomic environment.

And sometimes, if you do have a bias, you can have great performance for a period of time, but then the macro changes and leadership changes and then that style goes out of favour for a long period of time.

The other point is that we really try to minimise the macro in many ways. We like to take a view on how macro can influence asset prices, but relative to the benchmark, what we try and do is minimise that macro risk and maximise what we call idiosyncratic risk or stock-specific. Our returns get a little bit of help from the macro getting the macro right, but mostly it's stock-specific. It's a diversified set of stock-specific opportunities in the region that deliver most of the returns through time.

LW: Tell us about where you think you will see outperformance moving forward.

Swan: I think the setup today is very interesting because we have been in a trending market that is, literally, as we speak, starting to reverse coming out of COVID.

India has led the way in the region, it's had both the best absolute growth, it's also had the best revisions in the region. And what we tend to find is the change in the valuation multiple correlates very well with earnings revision. So if earnings are being revised up, then multiples tend to expand as well. And the flip side of that is that when earnings are being revised down, multiples tend to contract. You get this double whammy on share prices because multiples correlate with revisions.

Now, the setup today is that India has had the best revisions, the best growth, and as a result is the most expensive market in the region, both relative to other markets, but also relative to its history.

That's occurring at a time when liquidity in the economy is a little bit tight, particularly post the election we saw in the middle of the year and expectations are high. We've entered 2024 by moving money out of India and into China because on the other side of things is China, and China has had some pretty significant challenges from a macro point of view for several years now and for different reasons.

But the result of these trends has been that earnings expectations have been revised down a lot or earnings revisions have been negative and valuation multiples have contracted exactly at a time when we think liquidity is going to move from being tight to loose. So the big opportunity for us is really to be looking at China more than India at this point.

3 topics

1 fund mentioned

1 contributor mentioned