Emerging markets - the winning equation

E = MC

Emerging markets = Muted growth x Concentration risk

When investing in Emerging Markets (EM), expectations typically revolve around two key objectives:

- High GDP growth, which is expected to translate into high returns

- Portfolio diversification benefits

However, upon closer examination, both of these expectations have fallen short.

Muted growth

Following a period of explosive growth from 2002 to 2007, EM performance has largely stagnated. Over the past five and ten years, EM funds have delivered annualised returns of less than 2%.

Source: MSCI, performance in USD, as of 30/09/2024

The basket of economies classified as "Emerging" have lead to a poor translation of GDP growth to equity returns. Stock picking in this area hasn't been great either, with alpha achievements (as an average) being relatively mild.

Source: Refinitiv – 13 large EM Funds

Correlation of GDP, earnings and returns

The expectation that high GDP growth would lead to high returns has not materialised. This is not because EM economies have failed to grow, but rather because this growth has not translated into higher corporate earnings or equity returns.

Source: MSCI, Refinitiv, IMF

Historical data reveals a negative correlation (-0.29) between EM GDP growth and corporate earnings over the past 114 years. This means economic growth in EM countries has not reliably driven corporate earnings or equity returns. On average, EM returns have been less than half of their GDP growth, with countries like Turkey, China, Brazil, and South Africa dragging down overall performance.

Cyclicality of returns

With the exception of a few structural growth stories like India and Taiwan, most EM countries experience isolated booms and busts, displaying cyclical growth that cancels each other out at an aggregate level. The result is volatile underlying country weightings and survivorship issues, as countries like Russia and Portugal have come and gone from the EM index over time.

Source: Refinitiv, performance in USD

Concentration risk

Since the birth of the EM index, there has been a rising correlation between EM and Developed Markets (DM). diminishing the diversification benefits that investors seek in EM. This means investors are increasing the concentration risk for their equity portfolio.

Source: MSCI, 30-year data as of 31/12/2023

This has been driven by several factors:

- Globalisation of resource pools and the broader economy since the 1990s

- Increasingly global revenue streams for multinational firms, with over 30% of S&P 500 revenues coming from emerging economies

- ACWI mandates are common, with benchmarked passive and active allocations therefore providing liquidity to both segments

- Many EM mega-cap companies, such as Taiwan Semiconductors, Samsung, and Infosys, operate as global businesses.

What should we do?

Despite the challenges with EM as a broad investment class, we shouldn’t throw the baby out with the bathwater and disregard the market entirely. The problem lies with the structure of EM and how all of these countries are meshed together to create a single incoherent product. Investors can still look for structural stories by following a new equation:

S = HD

Single country = High structural growth x Diversification (low correlation)

High structural growth

By dissecting EM at the country level, the contrast between high and low-performing countries becomes clear. Selecting the right countries can lead to superior long-term returns.

Source: MSCI, performance data in AUD, as of 30/09/2024

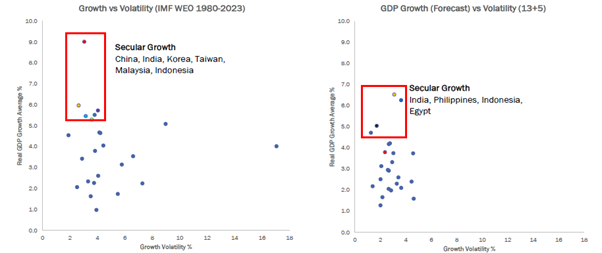

The key to robust performance is identifying countries with secular growth stories, supported by long-term fundamental drivers. To differentiate structural growth from cyclical or one-off booms, investors should assess not only historical and forecasted growth but also the volatility of growth over time. Countries with consistent and stable growth are more likely to deliver sustained returns.

Based on the results, we can observe that although at an aggregate level, EM has a high growth, high volatility profile, the underlying countries vary vastly. We can pick out the countries with a profile of high GDP growth and low GDP volatility as they are likely part of the structural narrative that will persist over the long term.

Diversification benefits

In addition to offering stronger growth potential, selecting individual EM countries provides investors with enhanced diversification within their equity portfolios. A large portion of individual EM countries have a lower correlation to the global equities (MSCI World) as compared to the EM index.

Source: MSCI, 30-year data as of 31/12/2023

By shifting focus from the EM index—a "basket of misfits"—to specific EM countries with strong growth fundamentals, investors can finally achieve the returns and diversification benefits they initially sought. The traditional EM equation (E=MC) can be replaced with a more focused approach: S=HD, where structural growth and high diversification unlock the true potential of emerging markets. The next phase of markets is going to require a deeper dive into EM for better results!

5 topics