ESG investing is the purest form of capitalism

Investing has always been about identifying opportunities and managing risks, but what if the key to mastering both lies in one of the most misunderstood areas of finance—Environmental, Social, and Governance (ESG) integration? Often dismissed as a principled or "woke" agenda, ESG investing is, in reality, a profit-driven approach rooted in financial pragmatism. Critics argue that ESG considerations detract from financial returns or impose political agendas, as seen in policies like Florida's ban on incorporating ESG factors in state retirement system decisions. Yet, these misconceptions miss the point entirely, overshadowing the financial merits of ESG integration.

Far from being a matter of ethics or political ideology, ESG integration focuses on evaluating how environmental, social, and governance factors influence financial risks and opportunities. The goal is straightforward: to maximise returns by identifying and managing these critical influences. Many of the most profit-driven investors already incorporate ESG factors into their decision-making, sometimes without realising it.

This blog will explore the true essence of ESG investing, illustrating how it embodies the purest form of capitalism and why overlooking its potential could mean missing out on a powerful driver of financial performance.

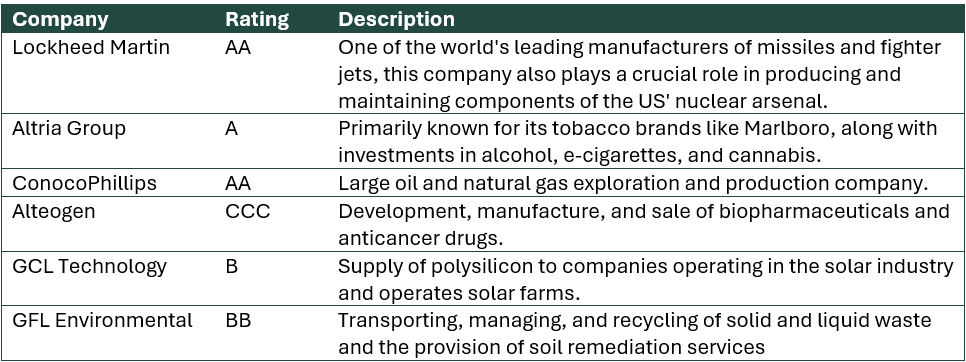

The examples below illustrate that companies operating in sectors like weapons, tobacco, and fossil fuels can have a strong ESG rating (as measured by MSCI) if they effectively manage their ESG risks and opportunities. Conversely, firms in industries typically viewed as sustainable—such as healthcare, solar, and recycling—might display weak ESG performance due to poor management of these risks and opportunities. This underscores the fact that ESG integration transcends ethical, moral, or political agendas and focuses squarely on managing ESG-related risks and opportunities.

Sources – MSCI, Facset

Understanding that ESG investing primarily aims to enhance economic outcomes raises a critical question: Does it effectively achieve this goal? To address this, we examine the relative performance of shares included in the MSCI ACWI index based on MSCI’s ESG ratings. This analysis looks at performance based on two factors: total return (in local currency) and the volatility of returns (measured using the monthly standard deviation of returns).

It's crucial to underscore that this analysis focuses on relative performance. This approach seeks to determine whether stocks with strong ESG ratings yield higher returns and exhibit lower volatility compared to stocks with weaker ESG ratings. Therefore, the analysis involves ranking the returns and volatility of the stocks rather than examining their absolute returns or volatility metrics.

Method

We calculate total returns and annualised volatility of returns over three year rolling periods over the past ten years. The analysis starts on 1 Jan-13 and the last period in the analysis is 1 Jan-22 to 11 Nov-24, which is not quite three years, but is the most contemporaneous data as at the time of writing.

We calculate results along two dimensions: MSCI ESG rating at the start of the period, and by sector. We apply the analysis at the sector level in recognition of the cycles impacting each sector. The result for each sector is based on the median return and median volatility. We then rank the returns and volatility by MSCI ESG rating and GICS sector.

Statistical analysis relies on a large sample size rather than focusing on individual results. This approach requires examining data over a full ten-year period and aggregating performance across all sectors, rather than isolating the performance of one sector during a single reference period. Since any combination of sector and rating can randomly emerge as the best performer in a single calculation period, the goal is to identify systematic results. This involves measuring performance comprehensively across all sectors and time periods, ensuring that results are aggregated rather than limited to an individual sector in a specific time frame.

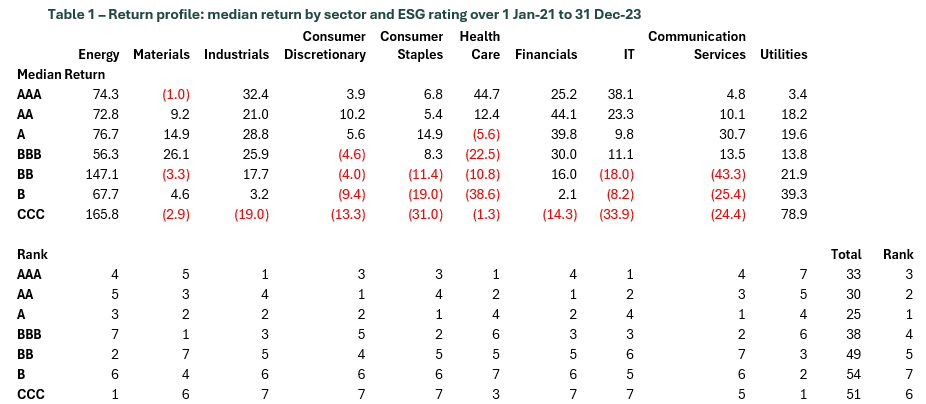

Below is an example of the analysis using the period from 1 Jan 2020 to 31 Dec 2023. Table 1 shows that during this period, companies rated AAA by MSCI in the Energy sector delivered a median return of 74.3%, while companies rated CCC by MSCI in the Communication Services sector delivered a median return of -24.4%. The table also ranks the performance of each rating category by sector. For instance, AAA-rated companies delivered the fourth-highest return in the Energy sector, whereas CCC-rated companies achieved the highest return within the Energy sector. The final column highlights the ratings that delivered the highest returns across all sectors. According to this analysis, A-rated companies were the best performers, AA-rated companies were the second-best performers, and B-rated companies delivered the worst performance.

The volatility analysis follows the same approach as the returns analysis. However, while higher returns are preferable in the returns analysis, lower volatility is more desirable in the volatility analysis.

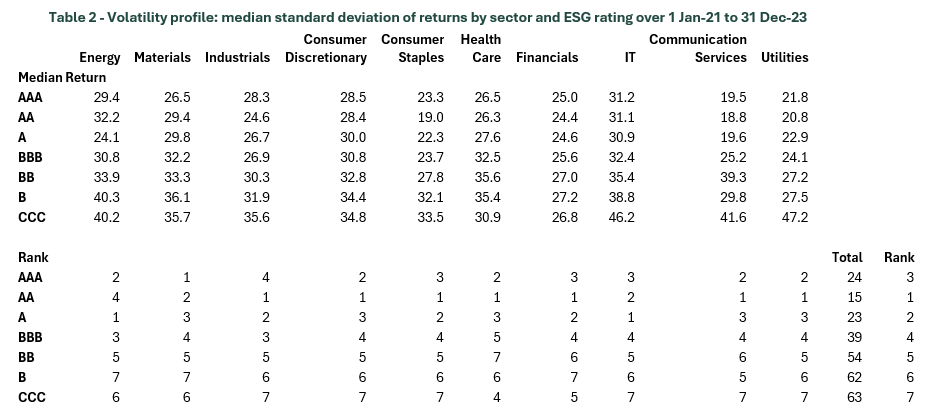

Below is an example of the analysis using the period from 1 Jan 2020 to 31 Dec 2023. Table 2 shows that during this period, companies rated AAA by MSCI in the Energy sector delivered a median volatility of 29.4%, while companies rated CCC by MSCI in the Communication Services sector delivered a median volatility of 41.6%. The table also ranks the performance of each rating category by sector. For instance, AAA-rated companies delivered the second-lowest volatility in the Energy sector, whereas CCC-rated companies achieved the sixth highest volatility within the Energy sector. The final column ranks the volatility scores by MSCI ESG-ratings across all sectors. According to this analysis, AA-rated companies were the best performers, A-rated companies were the second-best performers, and CCC-rated companies delivered the worst performance.

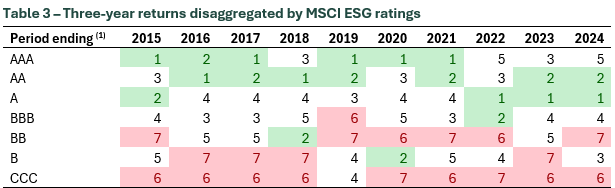

With an understanding of the methodology in place, we can now review the results. Table 3 summarizes the return outcomes, showing that throughout the analysis period, the companies with the best performance consistently had MSCI ESG ratings of A, AA, or AAA at the beginning of the analysis period. The years ending 2022, 2023, and 2024 were somewhat atypical, with companies rate AAA by MSCI ranking third or lower. However, this deviation was balanced by AA and A-rated companies, which ranked highly during those years. Additionally, throughout the reporting period, the worst performing companies consistently had the lowest MSCI ESG ratings.

This data strongly suggests that ESG ratings at the start of a period are a significant predictor of returns over the subsequent three years.

Source – Pella

(1) Three years ending that year

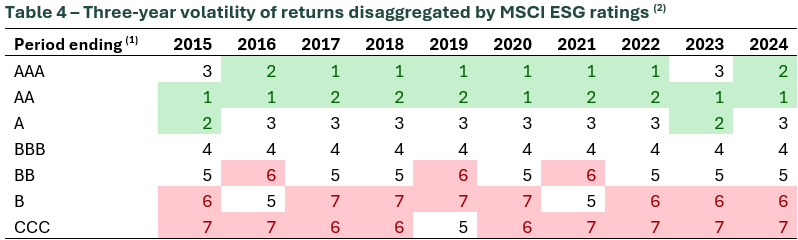

Table 4 summarizes the volatility outcomes, showing that throughout the analysis period, the companies with the lowest volatility companies consistently had MSCI ESG ratings of A, AA, or AAA at the beginning of the analysis period. Meanwhile, throughout the reporting period, lower-rated companies consistently had the highest volatility.

This data strongly suggests that ESG ratings at the start of a period are a significant predictor of the volatility of returns over the subsequent three years.

Source – Pella

(1) Three years ending that year

(2) Rating of 1 means those companies had the lowest volatility and a rating of 7 means those companies had the highest volatility

The analysis demonstrates that the MSCI’s ESG rating at the beginning of a three-year period has been a strong predictor of both returns and return volatility over that span. This suggests that, over the past decade, ESG integration has effectively enhanced economic outcomes, thereby fulfilling its primary objective.

ESG integration exemplifies the profit motive at its finest by systematically evaluating environmental, social, and governance risks and opportunities that will shape future investment returns and volatility. This is not just theoretical; as the analysis demonstrates, it is a proven strategy that delivers results in practice. Far from being a concession to ideology, ESG integration is a disciplined, data-driven approach to capitalism. Finally, you should have some pity for the unitholders in the Florida pension scheme.

3 topics