ETFs vs LICs: Which one is better?

If you’ve been investing in the ASX for a while, you’re probably familiar with exchange-traded funds (ETFs). They’re cheap, easy to use, and a great way to track the market. But have you ever considered listed investment companies (LICs)? If not, you might be missing out on some unique advantages.

Instead of looking at ETFs and LICs as competing products, why not see them as complementary tools? Knowing how they work together can help you build a more robust portfolio - whether your focus is growth, income, or a mix of both.

So, let’s break it all down. By the end of this wire, you’ll have a clear understanding of ETFs and LICs, how they perform in different market conditions, and how you can use them to your advantage.

Watch the video or read the written version of the explainer below.

ETFs and LICs: Tools that hold investments together

At a high level, ETFs and LICs are what the finance world calls “investment wrappers.” Think of them like the tortilla in a burrito holding the ingredients together. What ultimately matters is the fillings you choose, rather than the shell.

These wrappers can hold Aussie stocks, global shares, bonds, or even commodities like gold. The combination of what you put inside, and how much of each ingredient you use, determines your long-term returns.

.jpg)

But while the filling drives performance, the wrapper you choose also plays an important secondary role. So, what’s the difference? Let’s start with ETFs and their key features.

ETFs: The essentials

1. Open-ended structure

ETFs don’t have a fixed size. They can create or redeem units based on investor demand. That means you can buy in or sell out without worrying about limited availability of units or fund size.

2. Mostly invest passively

Most ETFs are designed to track an index, such as the ASX 200 or S&P 500. This means they move in line with the broader market rather than trying to outperform it.

However, there are also actively managed ETFs and “smart beta” strategies that sit somewhere between passive and active investing. While these alternatives exist, the majority of ETFs follow a purely passive approach.

3. Low fees

Since most ETFs aren't actively managed, their fees are generally lower than those of LICs.

4. Trade close to NAV

ETFs are designed to trade close to their net asset value (NAV), ensuring you buy and sell at a fair price.

The NAV represents the true price of an ETF - calculated as its assets minus liabilities, divided by the number of units available.

If an ETF’s NAV is $10, it should trade at $10 in your brokerage account, not $9.50 or $10.50. This matters because investors want to buy and sell ETFs at a fair price, avoiding premiums or discounts.

When an ETF’s market price drifts too far from its NAV, a special feature the market employs called "authorised participants" (APs) step in to create or redeem ETF units, adjusting supply and demand. This mechanism helps keep the price in check, ensuring you’re not overpaying or underpaying when you enter or exit a fund.

LICs: What makes them different?

1. LICs are structured as companies

Unlike ETFs, LICs are companies with their own management teams, boards of directors and balance sheets. They pay tax on profits, which allows them to generate franking credits for investors.

2. Fixed number of shares (closed-ended)

LICs issue a set number of shares at launch. If you want to buy in, you need to purchase shares from another investor - new shares aren’t created when demand increases.

3. Actively managed

LICs have professional fund managers who research and select different securities with the goal of outperforming the market.

4. Higher fees

Since LICs rely on active management, they tend to have higher fees than passive ETFs.

5. Profit reserves for consistent dividends

One of LICs’ standout features is their ability to retain earnings and pay out consistent dividends over time. This allows them to smooth out distributions even when market conditions are rough.

6. Trade at discounts or premiums

Unlike ETFs, which typically trade close to their NAV, LICs can trade at a discount or premium to their net tangible assets (NTA). These deviations can be significant - often around 20%.

For example, an LIC with an NTA of $10 might trade at a discounted $8 or a premium of $12. This creates opportunities to buy an LIC for less than the value of its underlying holdings. However, discounts can persist for long periods, so investors should be mindful that a bargain price doesn’t always guarantee a quick reversion to fair value.

How ETFs and LICs handled the COVID crash

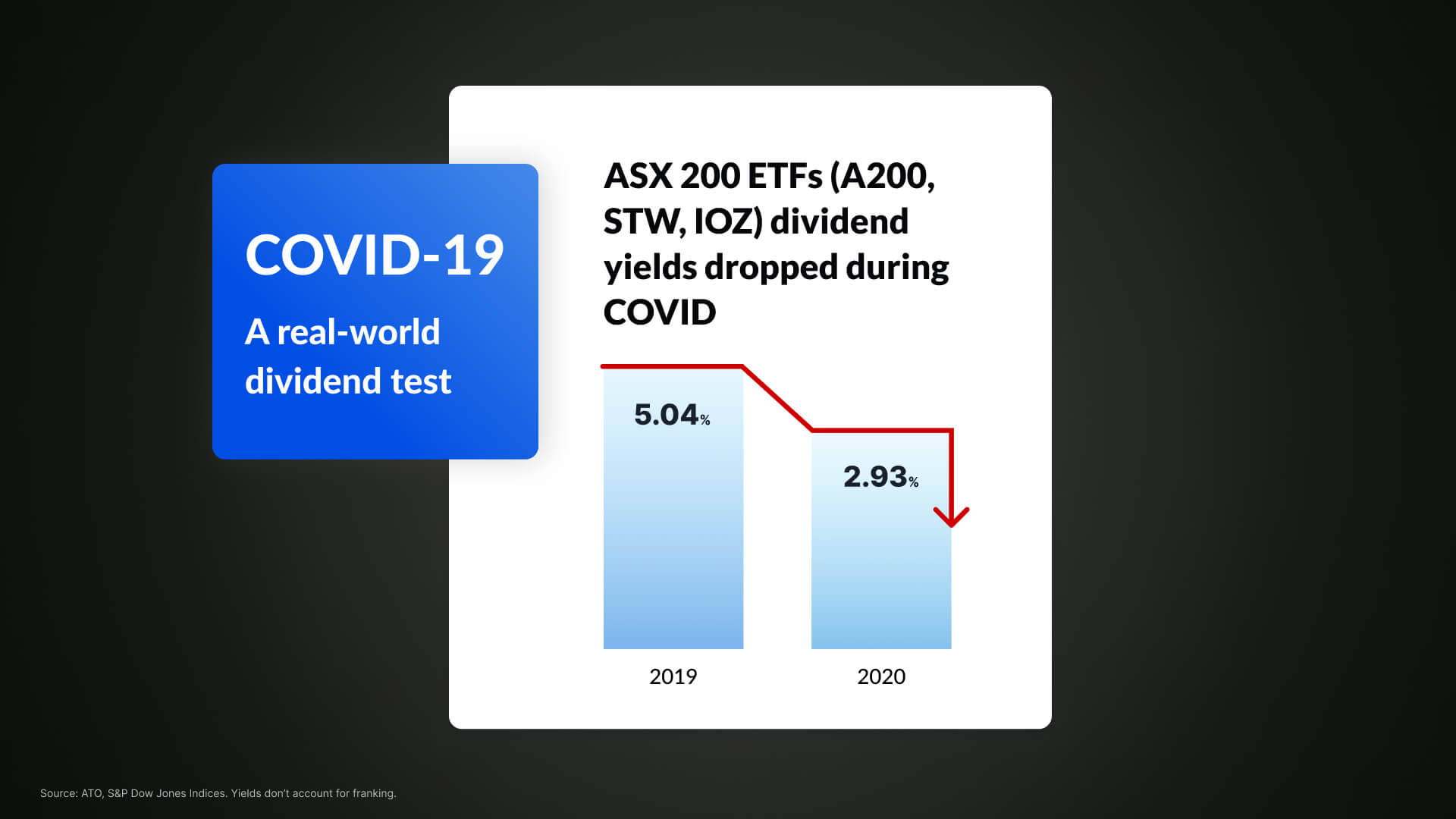

Let’s rewind to 2020, when markets were in turmoil due to the COVID-19 pandemic.

During this time, ETFs that tracked the ASX 200 - like Betashares Australia 200 ETF (ASX: A200), SPDR S&P/ASX 200 ETF (ASX: STW) and iShares S&P/ASX 200 ETF (ASX: IOZ) - saw their dividends shrink as major dividend-paying stocks (especially banks) cut their payouts. The ASX’s overall yield dropped from approximately 5% to below 3%, and these ETFs mirrored the decline.

.jpg)

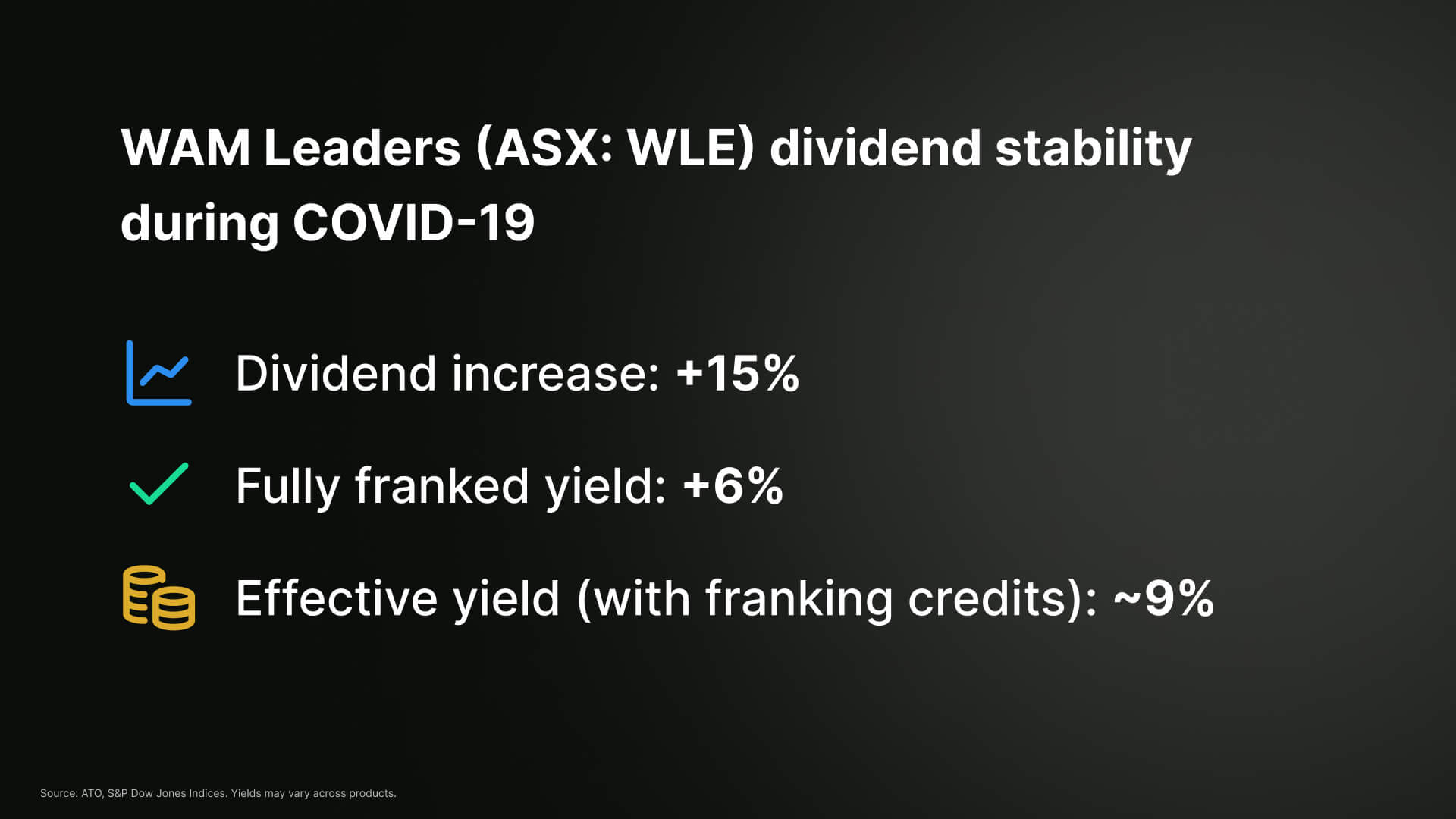

Meanwhile, WAM Leaders (ASX: WLE), a LIC focused on outperforming the ASX 200, took a different approach. It tapped into its profit reserves to increase its dividend by 15%, offering a fully franked yield of 6%; closer to 9% when franking credits were factored in. On top of that, WLE’s portfolio grew by 37% in the 2021 financial year, outperforming the ASX 200’s 27.8% gain.

.jpg)

In theory, if you had both an ASX 200 ETF and WLE in your portfolio during that time, you would have benefited from broad market exposure while also receiving more stable income and outperformance from the LIC.

Please note, this is a selective example of how certain investments have performed in the past and are not recommendations by any means.

ETFs or LICs: Which one should you choose?

Here’s the good news: you don’t have to pick just one. You can use both ETFs and LICs to create a balanced portfolio.

- ETFs offer broad, low-cost market exposure – they’re great as a core investment.

- ETFs trade close to NAV – you won’t have to worry about discounts or premiums.

- LICs provide active management – but you need to choose fund managers wisely.

- LICs can trade at a discount – this can create value opportunities, but discounts can persist.

- LICs can provide more stable dividends – thanks to profit reserves, their payouts can be smoother than ETFs.

Ultimately, the right mix depends on your goals. If you just want simple, low-cost market exposure, ETFs are a solid choice. If you’re after active management and more stable dividends, LICs could be a valuable addition.

3 topics

1 stock mentioned