EV industry’s shift from regulation to consumer demand

Recent concerns over declining lithium prices and a perceived oversupply in the sector have overshadowed a critical development in the electric vehicle (EV) sector: a potential shift from a regulation-driven market to one increasingly shaped by consumer demand. While these market fluctuations are noteworthy, they reflect broader shifts in the sector rather than signalling a fundamental change in the long-term growth outlook. These trends indicate the industry’s progression towards a more sustainable and robust phase of growth, driven by consumer preferences rather than regulatory mandates.

The transition from regulation to consumer demand

The initial phase of EV adoption was largely driven by government policies, including emissions standards, subsidies, and tax credits that incentivised both manufacturers and consumers. These regulatory measures were crucial in establishing a foundation for EVs in the global market. As the industry evolves, global EV market penetration has reached around 15%, with higher adoption rates in regions like Europe and China. Now, as some governments begin phasing out incentives, the focus shifts towards consumer-driven growth. The challenge ahead is ensuring that EVs continue to appeal to a broader audience, making this transition smooth and sustainable.(1)

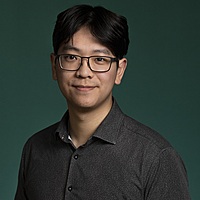

Technological advancements are essential to this shift. Innovations like silicon and lithium-metal anodes will improve energy density and efficiency, addressing concerns over range and charging times. Solid-state batteries, with compact designs and less need for thermal management, promise longer ranges, making EVs more practical for daily use.

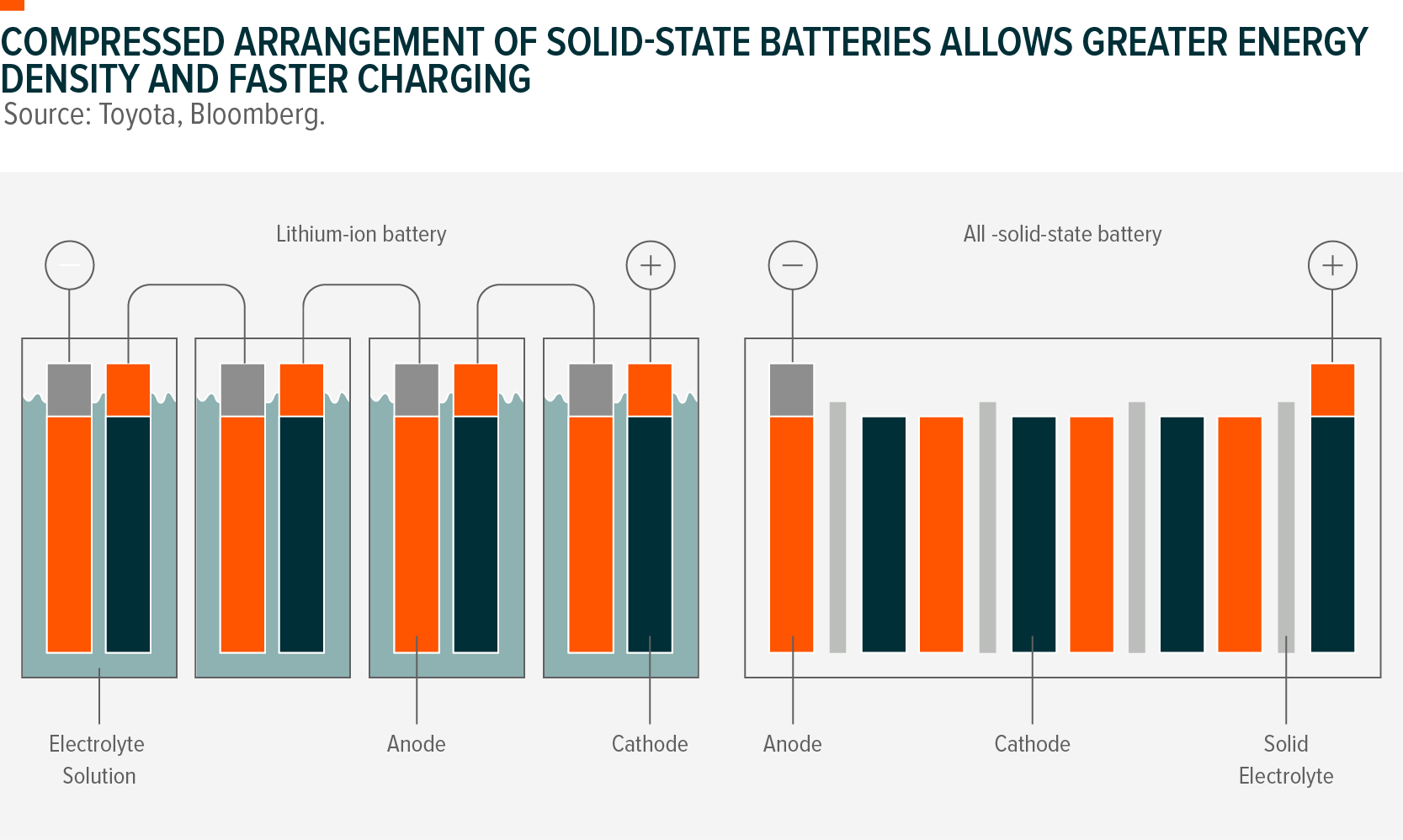

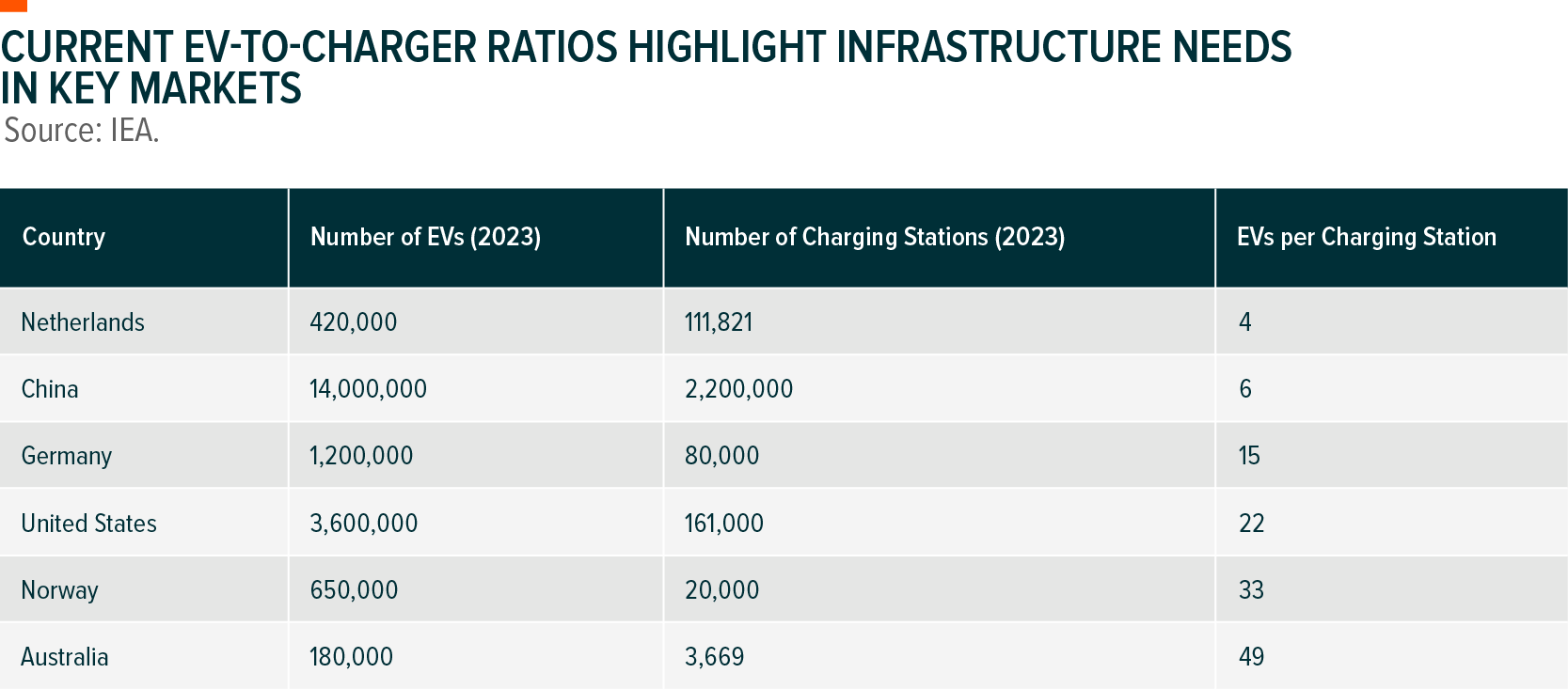

Yet, technology alone won’t drive this shift. The development of a robust infrastructure is crucial to supporting widespread adoption. Expanding charging networks, particularly in regions like China and the Netherlands, is vital to alleviating range anxiety and ensuring consumers feel confident in choosing EVs over traditional internal combustion engine (ICE) vehicles. For instance, China saw a 51% increase in public charging stations in 2023, adding over 930,000 new stations.(2) Similarly, the United States expanded its network by 40%,(3) while the Netherlands experienced over 30% growth in charging infrastructure.(4) Despite this progress, significant work remains to meet the growing global demand for EVs.

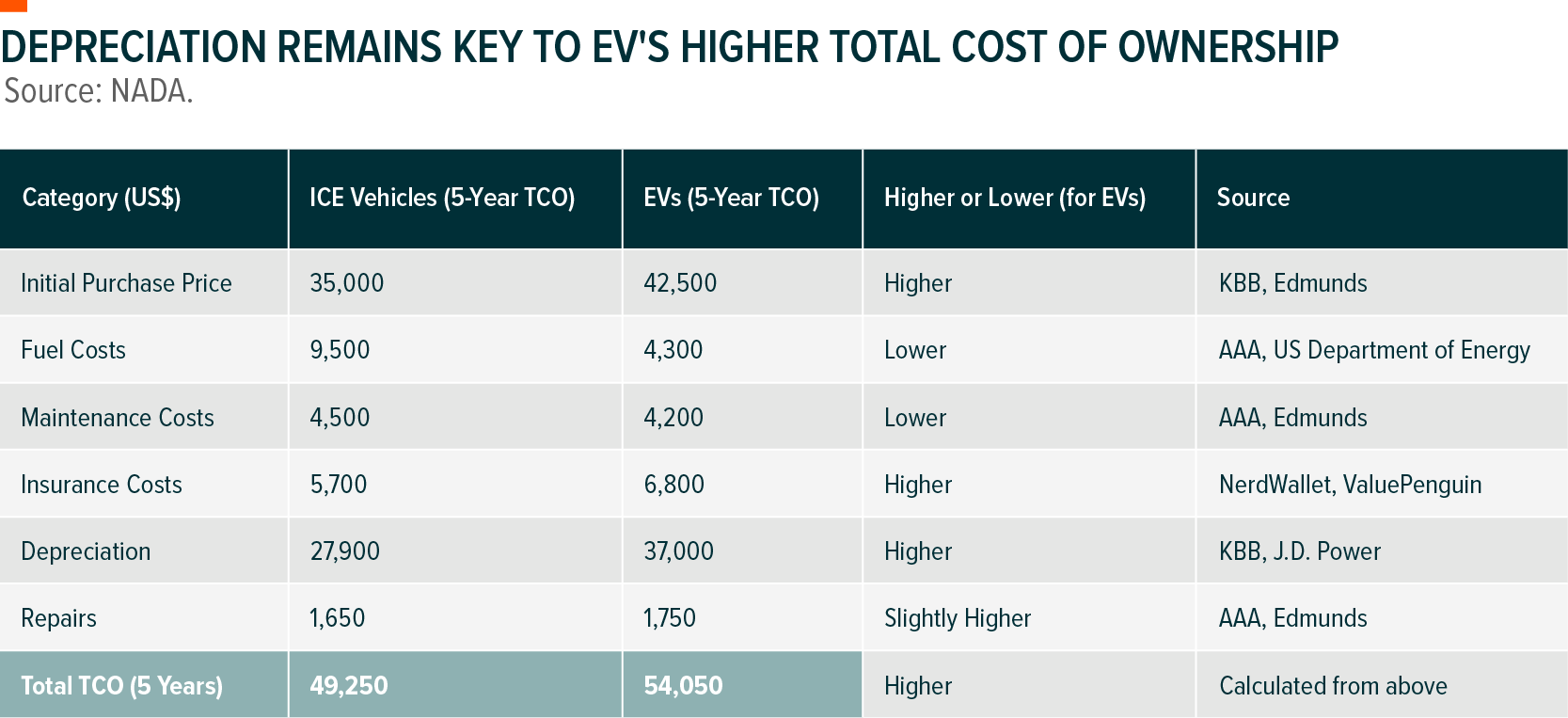

Price is another critical factor. While the total cost of ownership (TCO) for EVs remains higher in some regions, primarily due to higher initial purchase prices and insurance costs, ongoing advancements in battery technology are steadily driving costs down. As economies of scale take effect and battery efficiencies improve, the gap between EVs and ICE vehicles is expected to narrow, making EVs more competitive and accelerating consumer-driven growth.(5)

Navigating the regulatory landscape

While tech and consumer demand drive the EV market, regulation still plays a role. The European Union (EU)’s tariffs on Chinese EVs, aimed at Beijing’s subsidies, could affect Chinese competitiveness. However, a 9% tariff on Tesla, lower than other Chinese automakers, indicates a nuanced approach.(6) Chinese manufacturers may need to adjust prices or localise faster. Despite challenges, the EU remains a profitable priority for Chinese companies.

Battery shifts and reduced lithium mining: A double impact

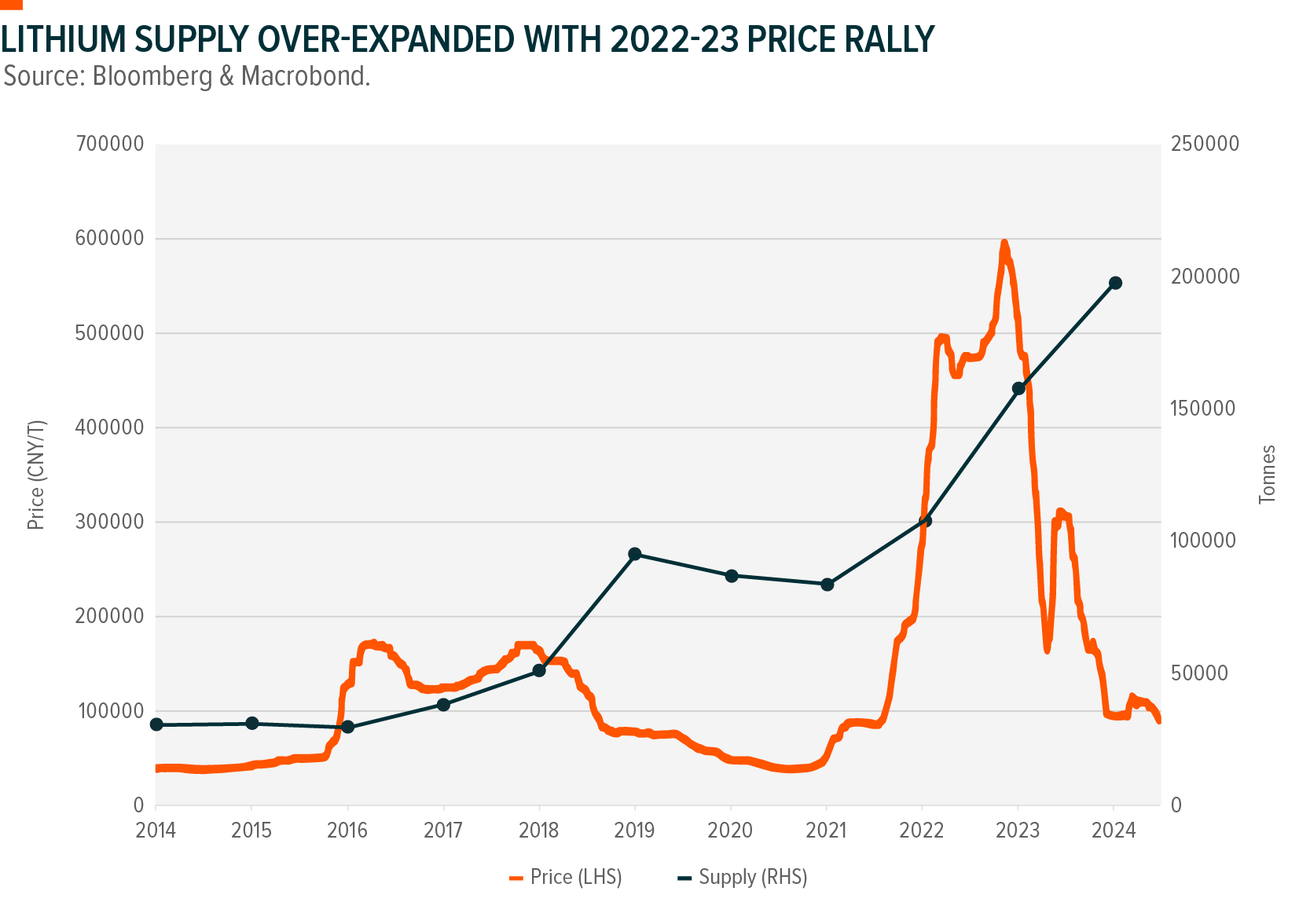

Lithium prices have fallen significantly after running into a slew of headwinds over the past year. Admittedly, the market currently suffers from pessimistic sentiment in the EV market, an over-expanded mine supply (as a result of the 2022 rally), as well as high inventory levels both up and down the battery chain. For lithium miners, this challenging macro environment will likely continue over the medium term, but there are positive catalysts on the horizon.

Innovation in highly competitive markets such as China has forced battery manufacturers to develop new cost efficient and powerful chemistries. Lithium Iron Phosphate (LFP) is emerging as a compelling alternative to current industry-standard Nickel Manganese Cobalt (NMC) battery chemistry. LFP promises improved charging speeds, increased stability, and longer life-cycles than NMC variants. LFP is also significantly cheaper than NMC. Its chemical mixture uses more lithium than NMC variants, but eliminates the need for dirtier, and often-more-expensive base metals. An industry-wide transition from NMC to LFP would drive lithium consumption and meaningfully increase demand. Furthermore, LFP would better capitalise on the low lithium pricing today, contributing to the EV industry’s goal of reaching price parity with traditional ICE vehicles.

Lithium miners have increasingly dialled back on new investments after the collapse of spot prices over the past year. Examples include Pilbara Minerals, which started the year with projections to double its lithium output in 2024 but has instead reduced capex guidance for FY24-25 and put both its growth projects – the build out of Salinas Lithium Mine in Brazil and expansion of Pilgangoora in Western Australia – on hold.(7) Albermarle, the world’s most valuable lithium miner, has also urged fellow miners to halt investment in supply – noting that current lithium prices cannot justify further investments.(8) This shift in sentiment among miners should limit or even decrease lithium supplies in the medium term, in turn allowing decreases in battery chain inventories, or a significant increase in EV demand to push prices higher.

Conclusion: Sector in transition

The EV sector is at a pivotal moment, shifting from a regulatory-driven environment to one increasingly shaped by consumer demand. This transition underscores the industry’s resilience and potential for sustainable, long-term growth. Technological advancements and current low lithium prices are contributing to lower costs and improved performance, especially with the rise of new battery chemistries like Lithium Iron Phosphate (LFP). These factors, along with further infrastructure expansion, position the EV industry for a significant shift towards widespread consumer adoption. If these catalysts align, the industry is set to enter a new era of robust, consumer-centric growth.

Learn more

The Global X Battery Tech & Lithium ETF (ASX: ACDC) provides exposure to the companies at the forefront of this transformative shift. By investing in companies involved in battery technology and lithium production, this ETF offers investors the opportunity to capitalise on the accelerating adoption of EVs and the broader electrification of the global economy.

1 stock mentioned

1 fund mentioned