Everything you need to know about using franking credits

There’s a well-known and well-loved aspect of Australian investing that politicians over the years have learnt is an election-killer. I am, of course, referring to franking credits – though you would be forgiven for thinking I’m talking about other election-killers like negative gearing.

While the concept of franking credits is not unique to Australia, the additional ability to use them for a tax refund is an important distinction that Australian investors love to take advantage of.

More than half of the companies listed on the S&P/ASX 200 either pay fully or partially franked dividends and it’s an essential component to an income investor's toolkit – and particularly for retirees.

While a hot investment topic, franking credits are often poorly understood so I spoke to Michael Maughan, portfolio manager for the Tyndall Australian Share Income Fund to explore the ins and outs of franking credits and how to use them as part of your income approach.

What are franking credits?

A franked dividend is when a company pays out their after-tax income to investors with a tax credit. When it comes to tax time, the investor only needs to pay tax on that dividend to the extent that their own marginal tax rate exceeds the rate of tax the company has already paid on that dividend income. If their marginal tax rate is less, the investor may be able to claim a refund of the tax.

“Put simply, franking credits exist to prevent double taxation. If a company has paid 30% tax, that is passed onto shareholders as a credit with any dividends,” says Maughan.

He notes that the franking credit regime has contributed to the strong dividend culture in Australia.

“Consistent dividends are a great sign of a company with solid cashflows, and a franked dividend adds the comfort of knowing they are real earnings being declared to the ATO and not just paper profits,” he says.

How franking credits work and the difference these can make to income

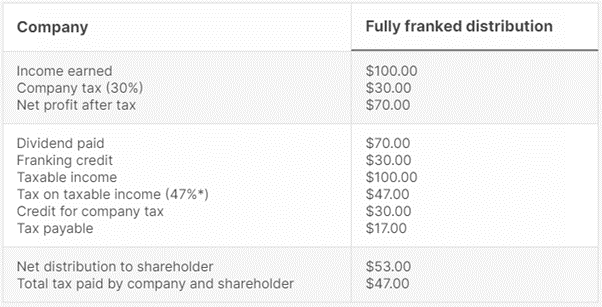

You can see how franking all looks in theory with this example from the ATO, which considers an investor in the top tax bracket.

The application of franking credits effectively means you have the opportunity to earn a higher yield on an investment because you aren’t double-taxed on it.

Take Telstra (ASX: TLS) as an example, which will pay an 18 cent per share dividend this year (which equates to a 5.1% yield). You might see this as comparable to a term deposit, but Maughan says when you consider franking credits, it changes the story entirely.

“When we include the franking credits to make these yields truly comparable, the grossed-up TLS dividend yield is 7.3%. Of course, that is before the potential for the TLS share price to go up over time,” Maughan says.

It also changes the yield of the ASX200 in general when you factor in franking credits.

“More generally, the ASX 200 has had a dividend yield over the last 15 years of approximately 4.2% per annum but it is 1.6% higher at 5.8% per annum when you include the benefit of franking credits,” says Maughan.

Zero-tax and the retiree love of franking credits

As mentioned earlier, where Australia is unique, is in offering a refund on franking credits. Investors with tax-free income, such as many retirees in the active pension phase, can use franking credits to receive a tax refund on top of the dividend paid.

If you revisit the previous ATO example, an investor with tax-free income who had received a $70 dividend with a franking credit of $30 would then receive a tax refund of $30. This brings the total income the investor receives to $100.

As a result, any significant changes to the imputation regime could mean a drop in income for many retired investors.

What changes to off-market share buybacks and capital raising mean for franking

The government some changes last year, meaning that dividends are the only way investors can receive franking credits – previously off-market share buybacks and capital raising were an opportunity for franking and earnings accretion.

Maughan says there are two clear repercussions of the changes.

“Firstly, there is the risk of franking credits remaining trapped inside companies. Secondly, it means that some franking credits will be wasted on international shareholders who cannot use them.

This has resulted in companies like Westpac (ASX: WBC) and Ampol (ASX: ALD) instead paying franked special dividends to distribute excess capital and franking credits (e.g. due to an asset sale or strong earnings) rather than undertaking an off-market buyback.”

The search for franked dividends

Not all Australian companies pay franked dividends, but you can filter for franking on lists such as this list of highest dividend yield paying ASX 200 companies on the Market Index website.

Be wary of simply looking for the highest yield or being fully franked.

“The key to investing in these types of companies is ensuring the dividend is sustainable, otherwise the yield is high for good reason!” says Maughan.

In looking to incorporate franking as part of a strategy, investors should still follow the usual rules in analysing company fundamentals. Whether or not a company offers a fully franked yield shouldn’t necessarily put off investors either. High calibre companies like CSL (ASX: CSL) or Macquarie Group (ASX: MQG) for example have revenue streams outside of Australia so would pay foreign tax on those earnings where Australian franking is not applicable.

Maughan also cautions investors planning on using franking to understand the rules.

“There are specific rules such as the 45-day holding period and delta hedging rules (around the use of options) that investors need to understand before trying to “harvest” franking credits,” he says.

Maughan’s top franked dividend pick

When you think of franked dividends, there’s probably a range you might already hold, such as BHP (ASX: BHP), any of the big four banks and Telstra.

But Maughan’s top pick is Metcash (ASX: MTS), which he sees good value and yield in.

“It has reinvented itself into a strong food, liquor and hardware group with many of the qualities of Woolworths, Dan Murphy’s and Bunnings for a fraction of the share price.

Importantly, MTS used its COVID windfall to buy Total Tools and Superior Foods which we believe will sustain its growth rates. At a 7.5% grossed-up dividend yield, we see MTS as offering a very attractive defensive exposure,” he says.

What are your top franked dividend picks? Let us know in the comments.

3 topics

7 stocks mentioned

1 fund mentioned

1 contributor mentioned