Feeling Faint?

And the Bull Market is back on. After the wobble on Monday the Dow Jones has jumped over 1000 points in three days. Why did we ever question it?

- Maybe because the S&P 500 has now officially doubled since the bottom of the pandemic (up 100.45%).

- Maybe because the S&P 500 has returned a compound 69.35% pa since the bottom of the pandemic.

- Maybe because, even ignoring the pandemic, the S&P 500 has returned a compound 20.0% pa since the high BEFORE the pandemic. It is up 29.5% in 1.4 years not including the pandemic.

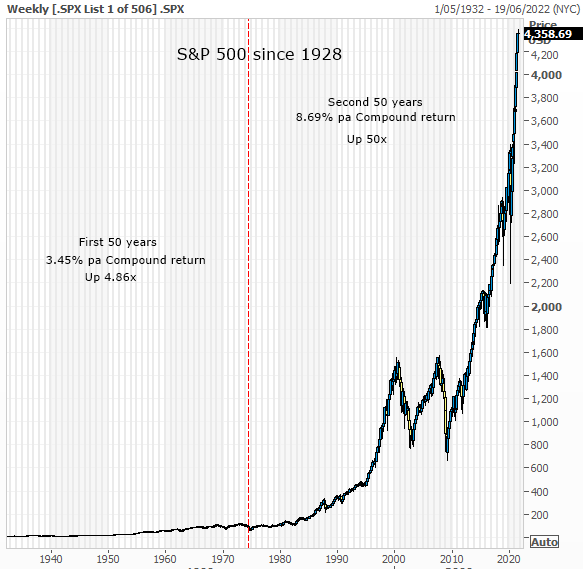

- Maybe because the S&P 500 has returned a compound 16.45% pa before dividends since the GFC, which is double the compound 8.69% pa over the last 50 years and 10% more than the 6.06% compound return over the last 100 years (before dividends).

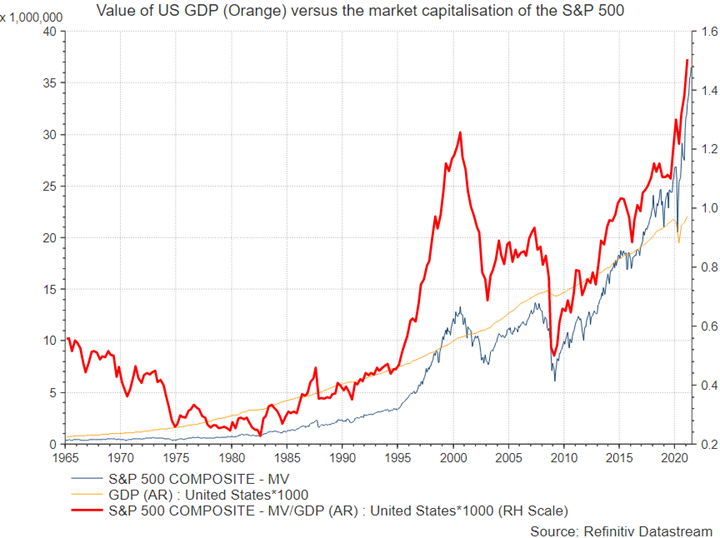

(I know we should look at log charts but this one is more fun)

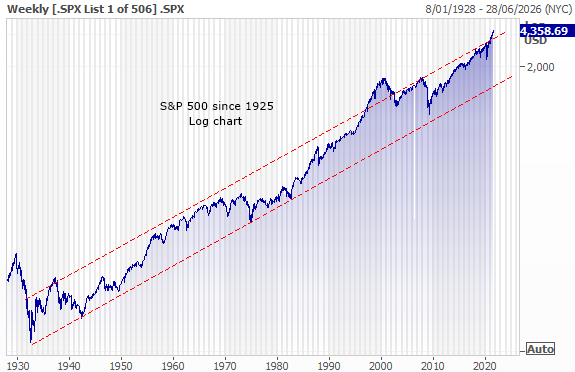

Even on the log chart, it's at the top of the range:

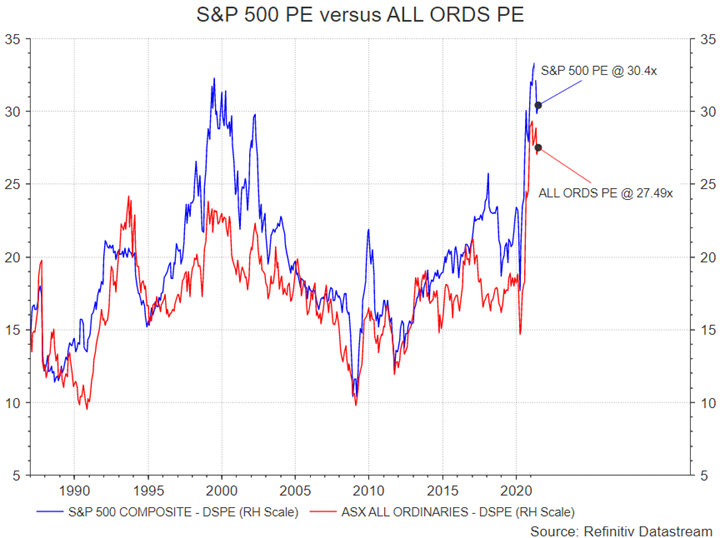

- Maybe because the S&P 500 is on its highest PE (30.4x) since the tech boom and the ALL ORDS is on the highest forward PE since I was born (38 years ago?).

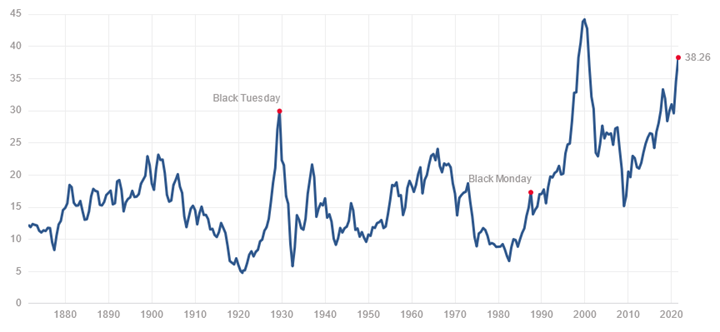

- Maybe because the current Shiller PE (Cape Ratio) is the highest since the tech boom (although if you believed it you'd have sold the market years ago - some high brow stuff is useless).

- Maybe because the market capitalisation of the S&P 500 versus the GDP of the US (they are supposed to be correlated according to Buffett) is the highest it has been in history. The market cap of the S&P 500 ($36.59 trillion) is the thin grey line. The US GDP value is the orange line. The ratio of the market cap of the S&P 500 to the value of US GDP is the red line. It’s never been higher (maybe the GDP number doesn’t capture all the US tax-dodging tech turnover domiciled in Ireland and the other tax havens).

OK – that was a bit of fun, but do not sell. Do not go all Chicken Little over a few statistics. Chickens are for slaughter and I abhor the chickens that sit on the sidelines and wag a finger at other people taking risk and making money.

We had a wise old adviser at Bell Potter wag his finger at us in the Tech Boom. And he was right. It was a house of cards. But all he did was deny all his clients one of the best money-making opportunities in stock market history. So let's not get on a high horse. These observations are nothing more than Bear biased bull, based on a predictably weak-brained mean reversion assumption. It's gone up so it must come down. Not true. You do not sell because things are going up.

But what these observations do do is establish that the conditions are here for a correction, for the herd to change mood rapidly. The US equity market (which will lead any sell-off) is expensive, it's overbought but it's not a sell until the herd thinks it has had enough. But with the US markets floated on Central Bank money and, who knows, Central Bank support (of the bond market - something happened on Tuesday), this could go on for years.

So let’s not be smarter than the herd. Let’s just be on alert for the day it changes its mind because, from up here, it could...easily and quickly. The air is thin and it's a lot easier to pass out at altitude.

But, as always, let's not predict it, lets just wait for it.

To stay up to date with our latest stock ideas and strategy updates sign-up for a 14-day free trial to Marcus Today - CLICK HERE to get started

4 topics