Finding long-term opportunity in short-term volatility

It might surprise some readers to learn that consumer discretionary stocks contributed the most to Auscap Long Short Australian Equities Fund returns during the financial year, given the negative ramifications of higher interest rates on discretionary expenditure.

This was a function of both the positive returns from the stocks and the Fund’s overweight position in them. It highlights that the market is forward looking. Tailwinds and/or headwinds for a sector are generally anticipated, and these are often priced into securities well ahead of events transpiring.

The market also has a tendency to overreact to changes in circumstances. Many market participants tend to view the economic outlook as being either extremely positive or extremely negative, despite the reality being that the economy is often simply trending between growing modestly and growing solidly. This can lead to overreactions in stock prices. For long term investors, this can mean that there may be enough value on offer to result in the stock price bottoming well before the company’s earnings actually trough.

Howard Marks has frequently described the swings in market sentiment as a pendulum, with extreme bullishness and bearishness at either end. But it is an unusual pendulum. It does not always swing consistently from one extreme to the other. Indeed it might swing only back to the middle, a rough approximation for fair value for a given company, and then return from where it came. In our experience negative deviations from fair value occur most commonly in companies that investors are inherently familiar with, because their understanding of the risks is intuitive but often exaggerated.

By contrast, in sectors that are new, exciting and less understood, where the risks are more difficult to comprehend, we see extremely optimistic assumptions often being made based on the powerful actual and/or perceived industry tailwinds at play.

We try to use these extreme swings in sentiment to our advantage. As we highlighted in our recent webinar, our core belief is that over time share prices will follow earnings. Meaningful deviations from the long-term earnings trajectory of a high quality business provide either an opportunity to increase or decrease the Fund’s exposure to that company.

For a number of retail companies, the share price declines they experienced in FY22 reflected, in many instances, the expectation of material declines in earnings in the coming years.

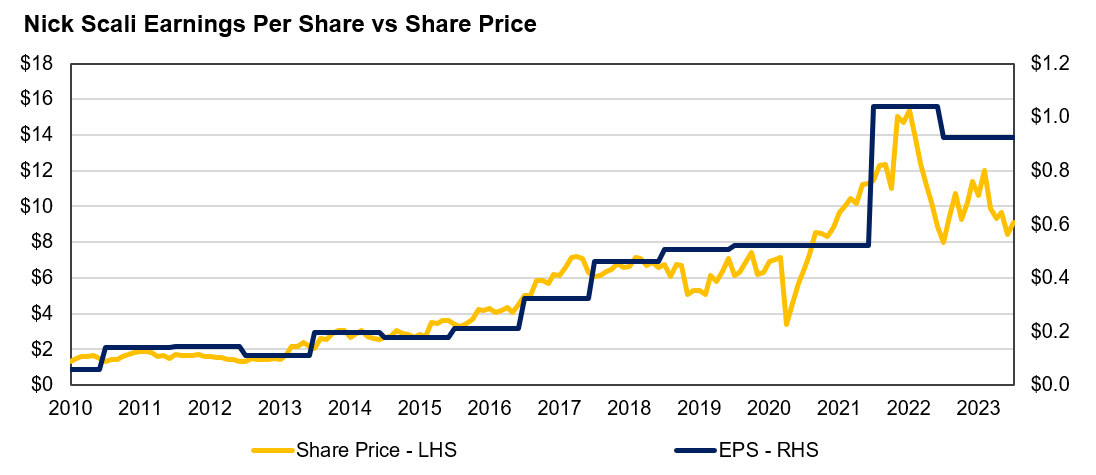

Nick Scali (ASX: NCK) has been a strong compound earnings growth company for many years, and a long-term holding for the Fund. It has seen its share price decline ahead of the anticipated fall in earnings in FY24, following what we anticipate will be a record FY23 result.

Source: Auscap, Factset

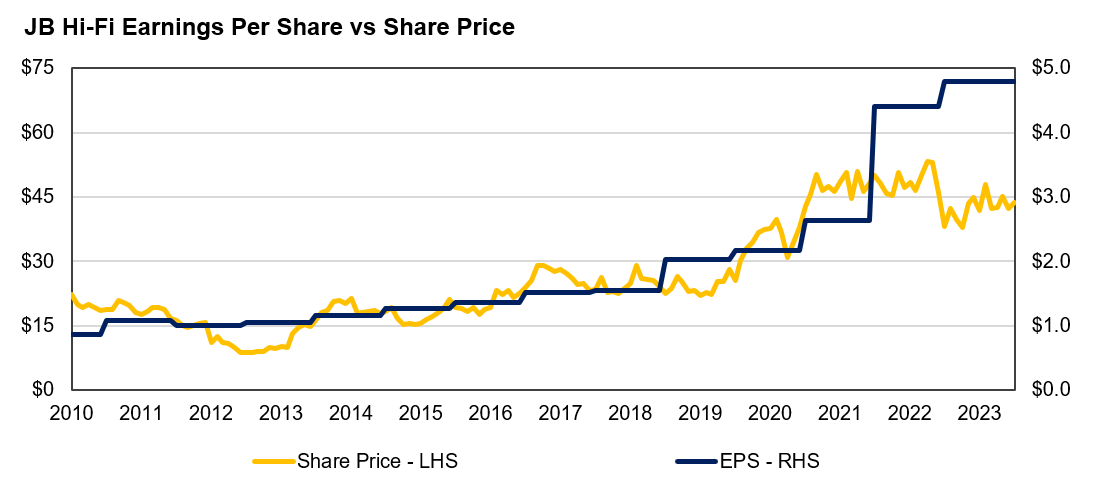

The same can be said for JB Hi-Fi (ASX: JBH), whose share price has also not kept pace with the recent growth in earnings per share (EPS).

Source: Auscap, Factset

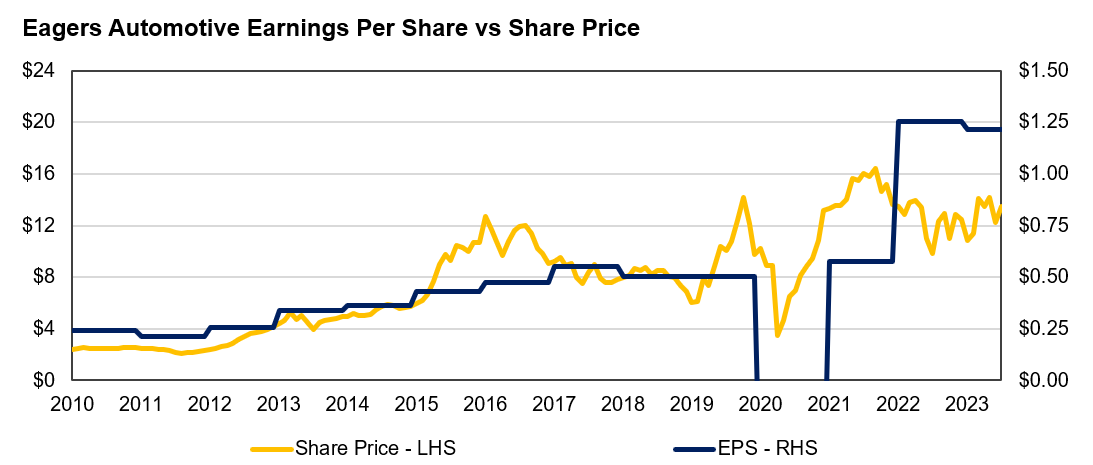

And likewise for Eagers Automotive (ASX: APE), despite its very considerable order bank, which should continue to support earnings for a number of years.

We view our role at Auscap as seeking to identify companies that will grow their earnings at attractive rates over the long term, and to then buy into those companies when they represent fair value or better.

Negative deviations between a stock price and the company’s earnings trajectory are an opportunity to initiate or increase the Fund’s exposure. Material deviations above the earnings trajectory represent a bullish swing in sentiment that we will, if significant enough, sell into in order to reduce the Fund’s holding.

One stock that we recently increased the Fund’s exposure to, given the value presented following a widespread decline in the stock prices for real estate investment trusts, was HomeCo Daily Needs REIT (ASX: HDN). We will discuss this investment in more detail in our next wire.

To be notified as soon as the wire is published, click the FOLLOW button below.

1 topic

4 stocks mentioned

1 fund mentioned