Finding the next generation of winners

Like the Big Four in tennis, tech’s Big Four – Apple, Facebook, Alphabet, and Amazon – are generally closer to the end of their ‘career’ than the beginning. While they no doubt still have many wins ahead of them, injuries are becoming more common, and the biggest successes are now largely behind them, says Nick Griffin from the Munro Global Growth Fund.

“While we think many of the Big Four will continue, some of them will begin to wane. We are moving on from stocks like Facebook, we’re picking our winners out of those Big Four, and we’re using that money to really look at the next generation of internet winners.”

In this interview, Nick tells us about the next generation of internet winner, explains what the bears are missing about Tesla, and shares one key area of interest that he says is “the biggest opportunity since the internet.”

Edited transcript

Why has ‘internet disruption’ dropped down your list of areas of interest?

There are several factors at play here. The internet has been with us for 20 years now, it’s basically underwritten my investment career. As we followed disruption from the early search engines of Google through social media, through digital videos, through digital video games, through to digital software and on we go. And so from our point of view, there's 20 years of disruption there and we think it continues. We do still like this area a lot, but we think there's more of a changing of the guard going on.

The best way to think about this is it’s a bit like the tennis. So it's February, it's Australian Open time, and we've had the big four in tennis for a long time, the big four tennis being Djokovic, Nadal, Federer, and you could argue Murray. The big four, we would say in technology are Apple, Facebook, Google, and Amazon. While we think many of the big four will continue, some of them will definitely begin to wane. And what we're doing with our internet stocks at the moment is we are moving on from stocks like Facebook. We're basically picking winners out of those big four, and we're using that money to really look at the next generation of players coming through – the next generation of internet winners.

Who could they be? Who could actually do this trick again? We’re looking at companies like Spotify, Twilio and ServiceNow in software. Like HelloFresh in e-commerce. Those are the next big winners, we think.

Because we are your global growth manager and we need to continue to find those next big winners. And so that's what we're doing with internet disruption today. We still like the theme, but it's about finding that next generation today.

Are you still positive about Tesla, given the rally over the last 12 months?

Yeah, so when we came into 2020, before COVID happened, we were shooting a video like this one. And our biggest theme for 2020 was climate change. We thought climate change would become really important in the world. We thought that we'd reached a tipping point and that the acceleration of the decarbonisation of the planet would happen. Tesla was part of our investment thesis there, it was one of many holdings we held in that area. When COVID came along, we did worry. We worried that, as happened back in 2008 through the financial crisis, other concerns would mean climate went to the backseat or climate concerns got overlooked. And actually the reverse happened. What happened is we seem to have one globally planetary pandemic issue, and then everyone started worrying about the next one being global warming.

So, if anything, it's accelerated. People can now see that decarbonisation is going to happen across the world at a very quick rate, whether it's the US, whether it's China, whether it's Europe. All they've done with Tesla is pull forward all the demand into the valuation. So what we probably would have thought would happen to Tesla over a three to four year period, happened all in one year.

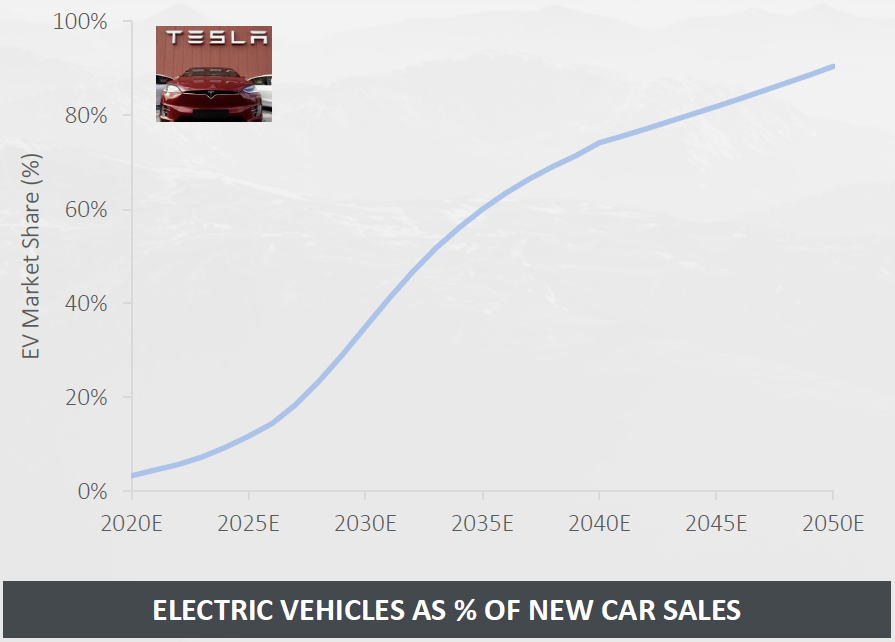

Where do we sit today? Look, you can get the maths to add up for Tesla here. If you just think about the fact that it's 2% electric car penetration today, and it's going to go to 80%, it is. 20 years from now, every car that's sold is going to be electric. If Tesla holds its market share at the moment, which is 25%, then their stock is easily too cheap. We don't think it will hold its market share; we think it'll lose its market share. So that's the argument you have to have with Tesla. While it may have pulled a lot of that demand forward in one year, I think we'll still be talking about this stock three, five, 10 years from now.

What are the Tesla bears missing in their analysis?

I'll give you a simple analogy that we're using when we think about Tesla. Back in 2009, we were looking at the smartphone market. The smartphone came along and it was going to disrupt the way we look at phones. Apple was going to make it, and they were selling a phone for a thousand dollars. Everyone thought, "You can't buy a phone for a thousand dollars. They're 200 bucks." But Apple came along and smartphones disrupted regular phones.

Apple still only has 20% of the market, yet they make more than 80% of the profits in smartphones. At that time, Apple had a $50 billion market cap and the smartphone total addressable market was $500 billion. So, you thought they could penetrate smartphones and they would do quite well, and potentially go to $250 billion company.

Now, what actually happened is they became a $2 trillion company. They became four times the size of their total addressable market because they added app stores, they added recurring revenue streams all the way through the company. That allowed it to be revalued and allowed them to get higher margins.

Tesla today sets up exactly the same way, or at least a year ago it did. $50 billion market cap, five times the total addressable market, two and a half trillion, disrupting the regular car base. Now obviously none of us know what's going to happen, but it does set up very much the same way. So, if they do manage to take that share as electric cars shift, and hold onto that 20% share, then just think about all the things they can sell on top of that. I think that's what the bulls are looking at, and it's definitely something that we've got in our numbers.

Climate change has been known about for decades. Why is now the time to invest in the theme?

Climate is now the biggest area of interest at Munro Partners today. It was very important to us last year, and at the start of this year, it's now the biggest area of the fund. It's nearly 20% of fund exposure. Why is that?

Because we think the race to decarbonise the planet is basically the biggest opportunity we've seen since the internet. The reason we say that is because you are literally right at the start of probably one of the biggest S-curves that we're going to have in our lifetime.

If you simply take it on face value that Europe wants to go to zero carbon by 2050, China wants to go to zero carbon by 2060, the US I'm sure is about to announce a zero carbon target. Most states, countries, councils have a zero carbon target. Every single corporate we speak to has a zero carbon target. So, if you think about that, you basically got the entire planet all saying, they want to go to zero carbon by 2050. And that's not emitting no additional carbon, that's emitting zero carbon.

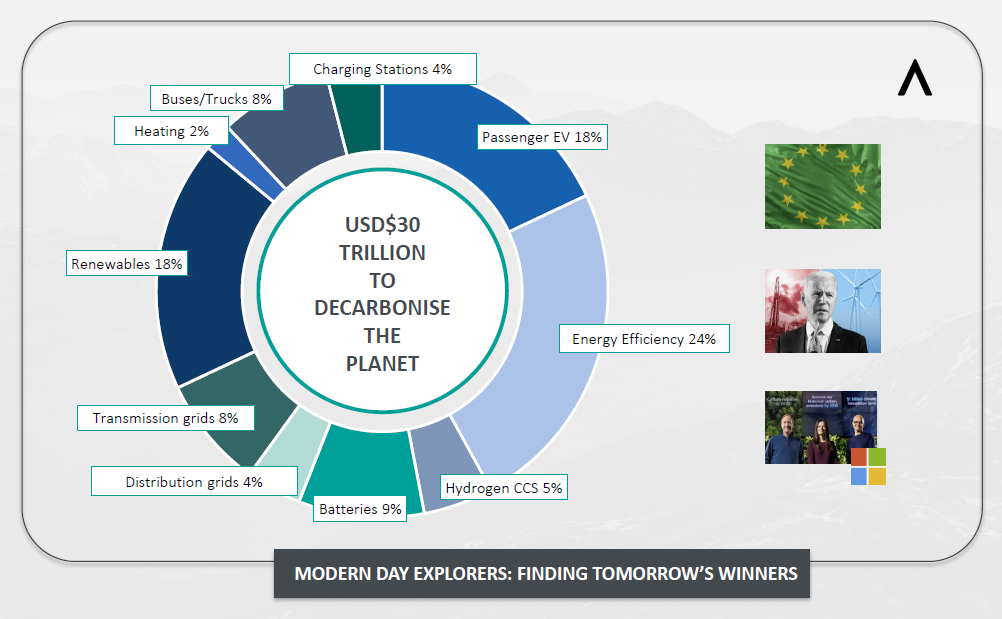

We think, conservatively, that it's going to cost $30 trillion over a 20-year time horizon and we have seen numbers that are even higher than that. So, from that point of view, all we are doing here is following the money to find where that $30 trillion will be spent and who will be the winners.

We would point out that it's not all going to be electric vehicles. There will be more than one Tesla. You need to look at things like energy efficiency. You need to look at things like renewable energy. You need to look at things like battery technology. You need to look at things like charging stations, et cetera.

We've spent the best part of two years now, collecting a group of stocks that we think could all potentially be ‘the next Tesla's’. We point to things like Orsted in Denmark, which is the world's largest offshore wind generator. We'd point to Vestas, which is the world's largest wind OEM or wind turbine manufacturer. We point to Samsung SDI in South Korea. We point to Alfen in Holland. We'd point to NextEra in the US.

There are all these different areas that are going to be hugely focused on to get to this 2050 target and the most important thing about this area, and the reason why we like it so much, is that we are right at the start. We are right at the start. We are at less than 2% penetration for electric cars. We're at less than 10% penetration for renewable energy globally. This will run for years and years, and hopefully we'll be talking about it for years and years. And our job, as your global growth investor is to get there first.

Could you share a stock example that’s exposed to these themes?

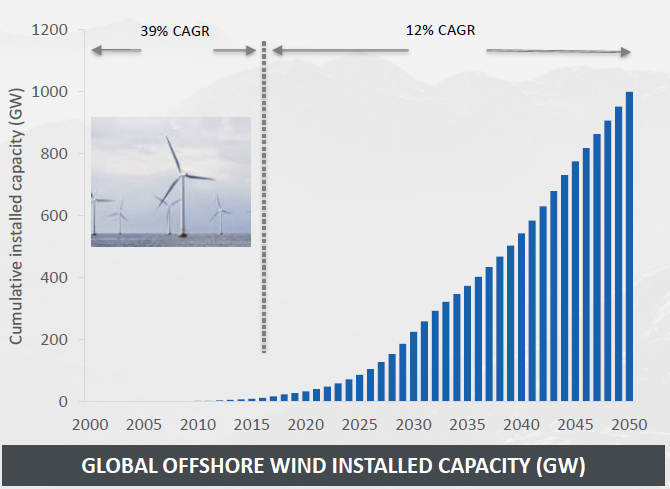

Yeah, let’s talk about offshore wind. Offshore wind is very simple concept. Currently, we generate all our energy from fossil fuels. That has to go away. If you believe the target, it has to go away. So either we're not going to meet the target, or it's going away. It’ll probably take longer, but it's going to happen.

In offshore wind, there are companies that have this huge lead. They have secured the offshore tenancies required, where you need to build the wind. They've secured the technology. They've got the know-how.

They are effectively like an oil and gas super major back in the 1970s. It's like discovering BP when they discovered Iran.

From that point of view, you're investing in Orsted, it's less than a hundred billion in market cap. But there's just no reason why it won't, over a long period of time, become the next super energy major. That's a simple example.

All the market's doing now, the more these targets get set in stone, the more the race to zero carbon gets more momentum behind it, the more markets prepared to pull forward that demand and discount it in the share price. We just argue that this process is closer to the start than the end. We've seen it happen with Tesla obviously, but we haven't seen it happen with all these other companies, and that's why we think it's so interesting.

Want to learn more?

Munro focuses on identifying and investing in companies that have the potential to grow at a faster rate and on a more sustainable basis than the peer group. To find out more, visit the Munro Global Growth Fund Profile.

1 fund mentioned

1 contributor mentioned