Finding tomorrow’s star performers

Ahead of the Pinnacle 2020 Virtual Summit, we asked two Alternatives managers and two Emerging Strategies managers to share a chart from their presentation and explain its importance.

Firetrail’s Patrick Hodgens argues that alternatives can assist clients in the construction of robust portfolios, by potentially providing returns in both rising and falling markets, while Riparian Capital Partner’s Michael Blakeney makes the case for water assets as Australia’s most vital and irreplaceable resource. In term of Emerging Strategies, Sean Martin from Solaris explains why equity income managers will need to rethink their investment holdings and Spheria’s Gino Rossi highlights the dispersion in analyst coverage between microcaps, small caps and the S&P 500.

These emerging and alternative strategies have the potential to make a real difference for your clients over the next three to five years.

Alternative Strategies

The case for a compelling alternative to equity markets

Patrick Hodgens, Firetrail, MD & Portfolio Manager

Opportunities are elevated across equity markets. Increased volatility and corporate activity such as capital raisings, pre-IPO’s and IPO’s all create opportunities for active stock pickers.

But risks are also elevated. Today, the market is pricing in a V-shaped recovery whilst the economy is on life-support. In addition, extreme valuation risks are emerging in pockets of the equity market driven by investor sentiment as opposed to fundamentals. On the horizon, further lockdowns, US elections, trade wars and the after-effects of unprecedented fiscal and monetary stimulus are all known unknowns. Many of which are not reflected in company valuations today.

Click on the image to enlarge

The slide we have shared ahead of the Pinnacle Summit provides an alternative investment that is designed to be different. The Firetrail Absolute Return Fund is a market-neutral strategy that aims to capture stock-specific opportunities across the equity market (both long and short), whilst mitigating the impact of equity market movements and macroeconomic risk on portfolio returns.

Since re-launching the Fund in March 2018 under Firetrail (the ex-Macquarie Pure Alpha Fund team), the Fund has delivered equity like returns, with less volatility than the market. But most importantly, it has remained truly market-neutral and provided much needed positive risk adjusted returns during a period where the market return has been negative.

Join me for the Pinnacle Investment Summit, as I provide my insights on the risks and opportunities in today’s market and why now is the time for this sector to be a compelling alternative for investors’ portfolios.

Water assets: returns uncorrelated to traditional markets

Michael Blakeney, Riparian Capital Partners, Managing Partner

Click on the image to enlarge

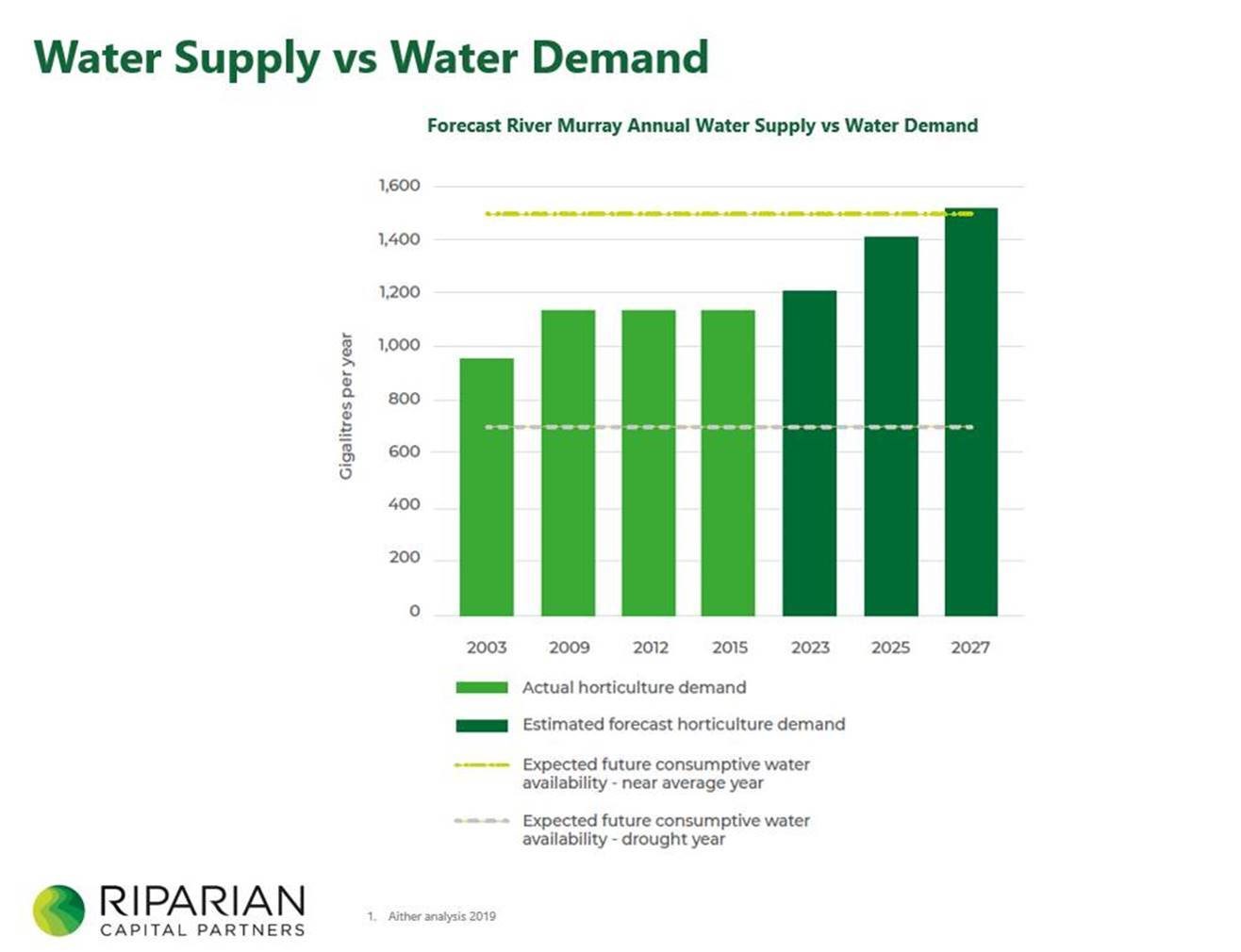

Water is Australia’s most vital and irreplaceable resource and the above chart highlights the growing demand that exists for water. The parallel lines you can see in the chart, show expected future consumptive water availability – average rainfall years (yellow) and drought years (grey). Naturally, water availability can only be illustrated using flat line forecasts. On the other hand, forecasts for horticulture demand shows a significant rise over the next decade. This supply/demand equation is illustrative of and forms an important aspect of our outlook for water markets.

Australia’s water market framework caps the amount of water rights on issue, creating a fortress asset class that remains competitive in the current market. Over the last five years, southern Australia has seen unprecedented levels of new plantings in a range of higher value crops including almonds, citrus and table grapes, all of which will require more and more water as they mature. The supply/demand balance has reached an interesting point where the amount of water able to be delivered may not support all of these plantings at maturity, meaning that competition for water rights should increase over time. While recent rainfall may have created temporary relief, it also creates an opportunity to acquire these assets at a competitive valuation.

At Riparian, our view is that owning these critical and capped assets provides a reliable method of generating annual income and providing a return uncorrelated to traditional markets. The combination of aiming to generate reliable annual income, along with the uncorrelated nature of water entitlement returns make the asset class particularly compelling both in the current market, and longer term. In times of volatility and uncertainty, essential real assets such as water can provide supportive diversification to any investor’s portfolio.

Emerging Strategies

Why Australian equity income managers must shed past baggage

Sean Martin, Solaris Australian Equity Income Fund

Click on the image to enlarge

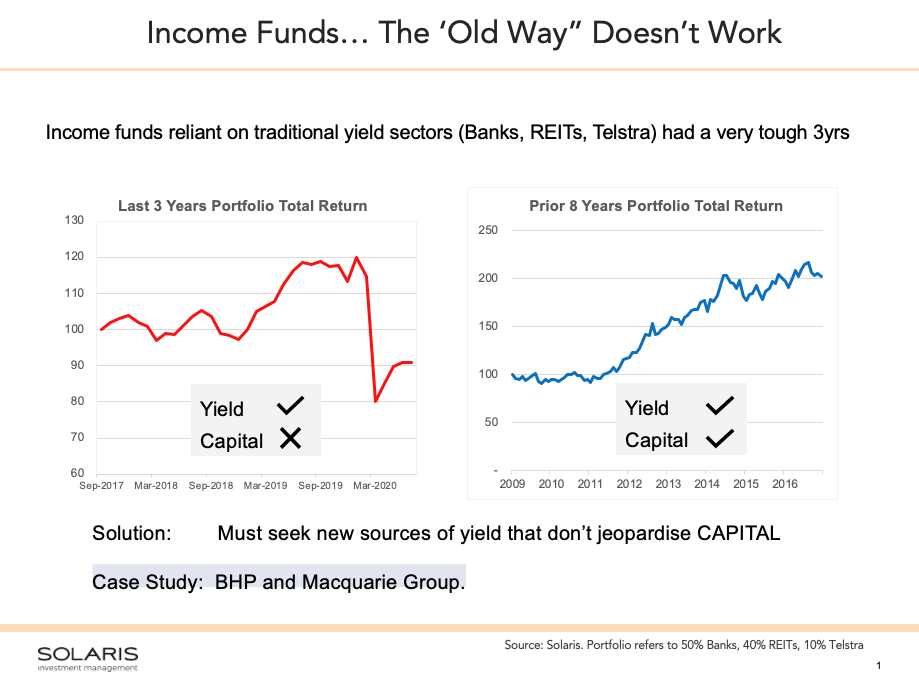

The chart above shows two traditional yield portfolios and their total return performance.

Both portfolios comprise the same mix, being Banks 50%; REIT’s 40%; Telstra 10%, while the blue line equals that portfolio’s performance in the eight years to 31 August 2017 and the red line shows the performance of the same portfolio for the three years to August this year. As you can see, they have entirely different results. The recent portfolio in red produced an inadequate total return of -7% while the same portfolio for the previous eight-year period in blue produced an impressive total return of >100%.

Interestingly the yields of each portfolio were quite similar with the delta all being in the capital, ie. the portfolio in red actually achieved its yield objective and just failed in its capital result.

While an investor from an income fund does seek yield as the primary objective in the short term, obtaining this at the expense of capital produces a grossly inadequate outcome.

Equity income managers must delve further and wider and without the baggage of the past in the search for appropriate yield candidates for their funds. I’ll detail two just such candidates on the following slides during my presentation: BHP Ltd (ASX:BHP) and Macquarie Group Ltd (ASX:MQG). BHP and Macquarie Bank have been large contributors to the yield and capital outcome of our income fund over the last three years, despite being most unlikely income fund candidates (a miner and an investment bank) in the eyes of any traditional equity income participant.

Microcap darlings: Why analysts often miss the stars of tomorrow

Gino Rossi, Spheria Portfolio Manager

Many great companies start from humble beginnings. Netflix began in 1997 in a rented Best Western conference room with funding of $1.9m. The company floated in 2002 with a market capitalisation of $309 million. By year-end, its value had slipped to $244 million and only three analysts were covering the stock. However, by 2010 it had a value of $9.2 billion and 30 analysts covering the company.

Click on the image to enlarge

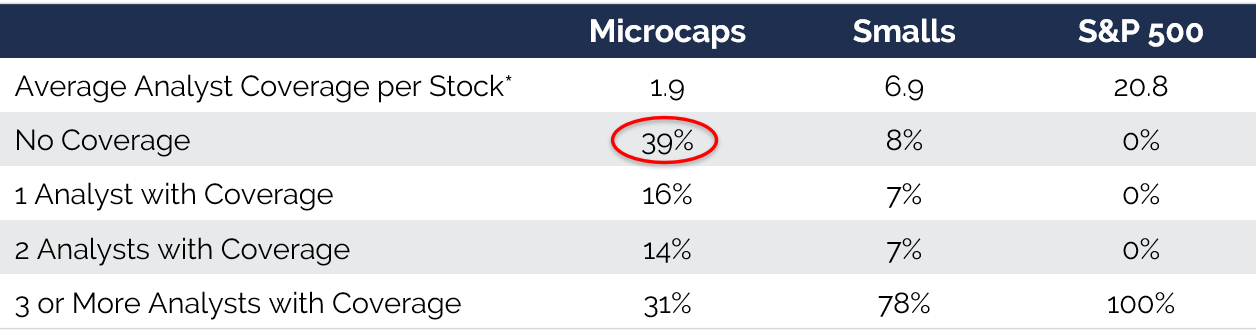

At Spheria, we believe that looking where others don’t can be a powerful advantage. The table above highlights the dispersion in analyst coverage between microcaps, small caps and the S&P 500. While Amazon has 54 analysts submitting a recommendation on Bloomberg, 39% of companies in the MSCI Kokusai Index (World Ex-Japan) have no analyst recommendation at all. This is one of the reasons we believe resounding opportunities lie in global microcaps.

The Spheria Global Microcap Fund is focused on finding undiscovered companies with a market capitalisation under US$1 billion among a universe of over 10,000 stocks from around the world. Investors, guided by market cap weighted benchmarks, often overlook these stars of tomorrow.

With less attention on microcap stocks, this segment of the market is trading at an attractive discount to larger peers.

Long-term data shows that microcaps are the best performing segment of the equity market, with much of this outperformance delivered during times of economic recovery.

As the world gradually mends from COVID-19, you may start hearing more about these currently overlooked companies.

Register for the Pinnacle 2020 Virtual Summit

Hear from some of Australia’s most experienced investors in Alternative and Emerging strategies as they discuss the key trends shaping the sector and how investors can gain exposure. Zenith CEO, David Wright will host a Q&A session with the panel of presenters following the presentations.

You can register for the session here, or view the entire event calendar here

Important Information: Please be advised that the Pinnacle 2020 Virtual Summit is designed for sophisticated investors only

3 topics

2 contributors mentioned