Finding value in the banking sector

Bank Sector Valuation Approach

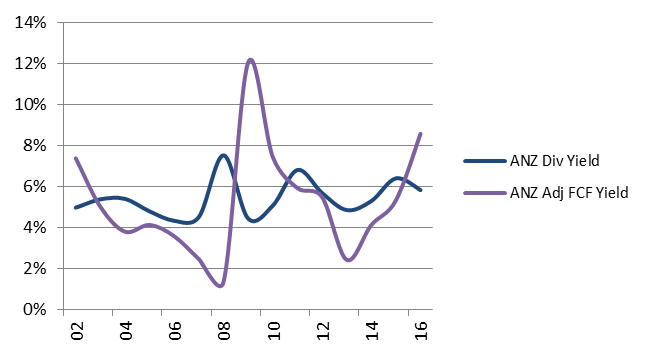

Chart 1: Focus on sustainable cashflow through the cycle

Source: Merlon Capital

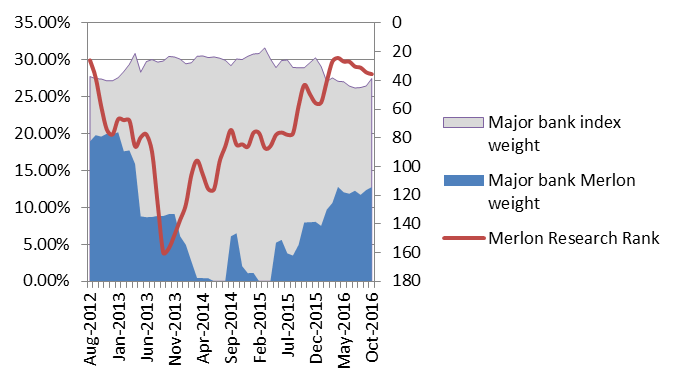

Chart 2: Merlon process and Portfolio Construction

Source: Merlon Capital

Banks are undervalued on our long-term view

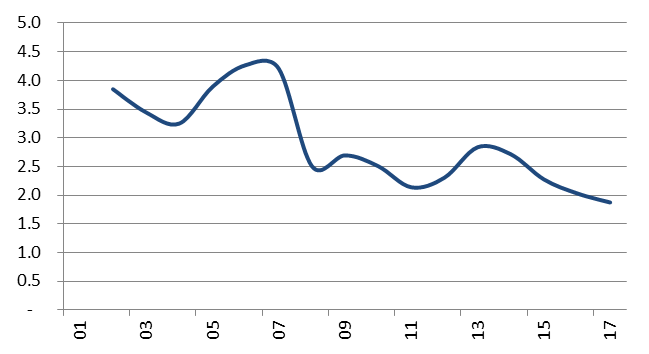

The free cash flow for a bank is a function of its return on capital which, for the sector, is at a record low of around 15% compared with 20%-30% before the GFC. This explains why banks look cheap as lower returns translate into lower free cash flow and dividends. The mixed news is we are not projecting returns to recover, nor are we projecting further declines. The price to book or net tangible assets chart clearly shows banks are cheap on a 15-year view. They also remain cheap relative to Industrial stocks on a P/E basis.

Chart 3: Bank Sector Price / NTA: Cheap v history

Source: Merlon Capital

Bull Case

- Cheap vs. history

- Cheap vs. ASX Industrials

- Cheap vs. bonds (& TDs)

- Not factoring in returns improving

Bear Case

- Lower returns = lower free cash flow

- Bad debts low vs. history

- Downside risk to credit growth

- Expensive vs. global banks

To work through the bull v bear cases, there are three core issues to address.

Key issue 1: Pricing Power Absent

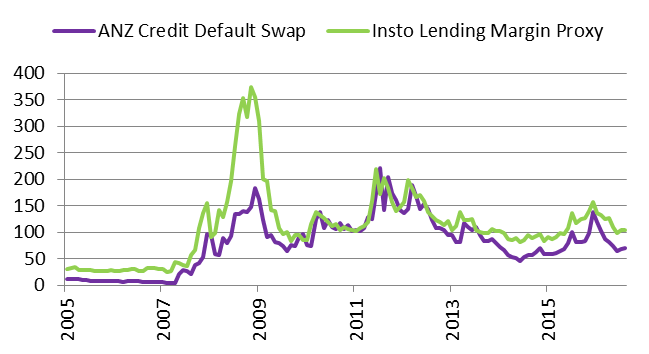

Conclusion: Industry margins unlikely to return to prior history but won’t erode further

Banking sector margins are lower than historical norms.

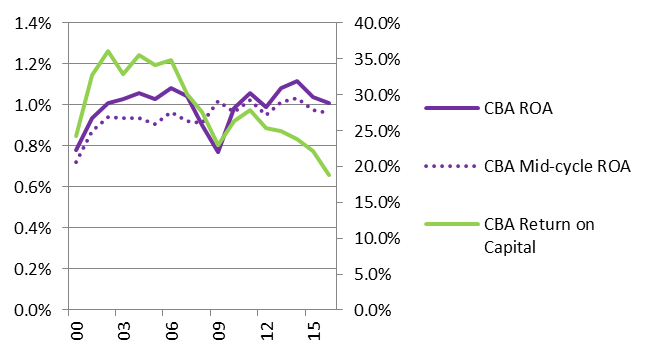

Chart 4: Returns before and after leverage

Source: Merlon Capital

Our valuations assume current returns stabilise here – industry structure, normalisation of interest rates and cost-out provide a buffer against further declines, but equally, a restoration of returns back to historic averages should be viewed as a bull case only.

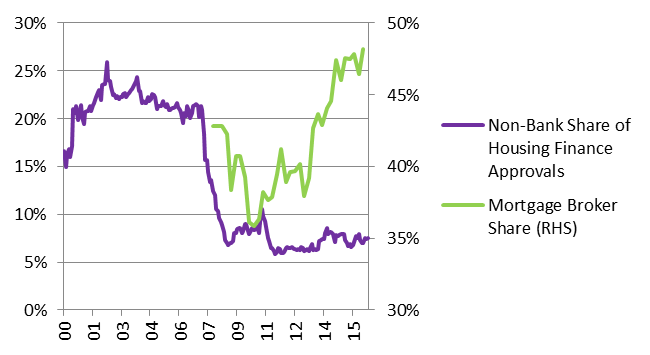

Chart 5: Non-bank share of Housing Finance (and brokers)

Source: Merlon Capital

Growth in broker share of mortgages written as well as heavy fixed costs in branch networks and distribution means banks will be looking closely at cutting cost out of their branch network, sales force and head office to restore returns.

Key issue 2: Bad Debts Rising

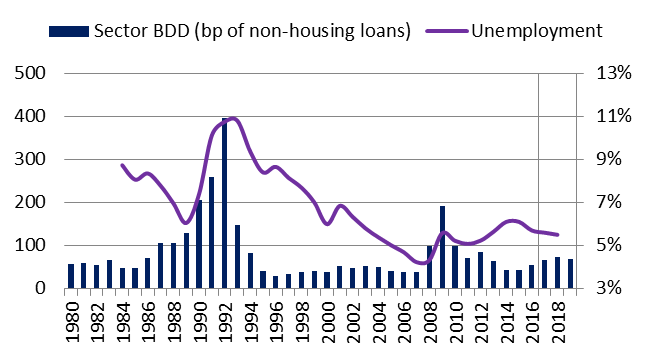

Conclusion: Long-term view enables one to look through cycle and conclude that bad debts are largely priced in

It is a fact that bad debts are rising but we are a little less concerned than the market. For starters, they are rising from low levels, consensus is forecasting they will rise and we assume a long-term average in our valuations.

Chart 6: Bad Debts in Content

Source: Merlon Capital

The oligopolistic industry structure means any rise in bad debts should lead to higher loan pricing, especially in institutional banking that has seen margins decline in tandem with lower bad debts.

Chart 7: Bad Debts increase Margins

Key issue 3: Never Enough Capital

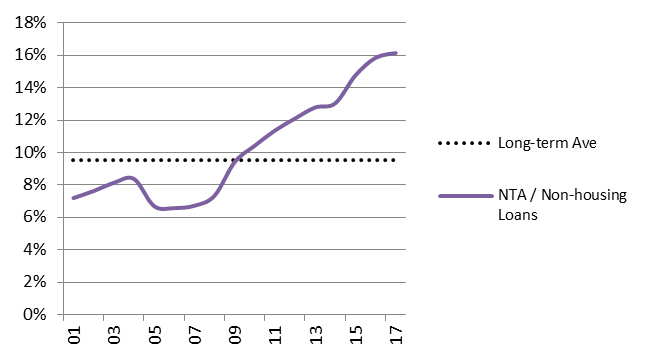

Conclusion: Sector is well capitalised but dividends are vulnerable

Banks have never been better capitalised and we don’t think the regulator will impose more.

Chart 8: Tangible Capital to Non-Housing Loans

Souce: Merlon Capital

Covering off on dividend sustainability, payout ratios should be driven by the rate of credit growth and return on capital using long-run bad debts. Slower credit growth is supportive but banks need to either raise loan prices, cut deposit rates or cut costs for the current 70-80% payout ratios to be sustainable, particularly as bad debt charges are below mid-cycle levels. The alternative is to keep issuing shares through dividend reinvestment each year but this is simply capital raising by stealth.

Managing Tail Risk

Banks are highly leveraged organisations so there are risks. Tail risks in the global financial system include China’s high debt and bad loans, and developed market bank unwillingness to lend, and low profitability in a zero rate environment.

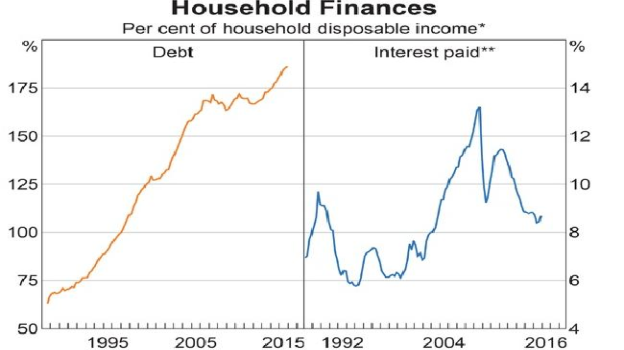

Chart 9: Household Debt

Source: RBA

In Australia, the record level of household debt / GDP relies on unemployment and interest rates staying low, especially as investors and interest-only loans make up almost 40% of new mortgages. There are 40,000 new inner city apartments coming on stream while banks are tightening lending standards. Typically banks lose money on developers rather than mortgages, and they have been reducing exposures to this segment, but one cannot completely rule out the probability of a major house price correction and associated flow on effects.

Merlon protects against these tail risks by not owning them when they are expensive, much lower maximum weights than their index weights and we have additional downside protection via the 30% hedge overlay.

Visit the Merlon Capital Partners website for more information: (VIEW LINK)

The information contained in this publication is current as at 31 October 2016 unless otherwise specified and is provided by Fidante Partners Limited, ABN 94 002 835 592, AFSL 234668 (Fidante Partners) the responsible entity and issuer of interests in the Merlon Wholesale Australian Share Income Fund ARSN 090 578 171 (the ‘Fund’). The information in this document is up to date as at the time of preparation and is intended for adviser use only. Merlon Capital Partners Pty Ltd ABN 94 140 833 683 AFSL 343753 (Merlon) is the investment manager of the Fund. This information is intended as general information only and not as financial product advice and has been prepared without taking into account any person’s objectives, financial situation or needs. Because of this each person should, before acting on any such information, consider its appropriateness, having regard to their objectives, financial situation and needs. Each person should also obtain a copy of the product disclosure statement (PDS) and any additional information brochure (AIB) and consider the information in those documents (including the information about risks) before making any investment decisions. If you acquire or hold an investment in the Fund we will receive the fees and other benefits disclosed in the PDS and any AIB for the Fund. We and our employees do not receive any specific remuneration for any advice provided to you. However, financial advisers may receive fees or commissions if they provide advice to you or arrange for you to invest in the Fund. Some or all of the Fidante Partners related companies and their directors may benefit taxation consequence of investing. Past performance is not a reliable indicator of future performance. A copy of the PDS and any AIB can be obtained from the Fidante website: (VIEW LINK). or by calling the Adviser Services Team on 1800 195 853.

4 topics

4 stocks mentioned