Finding winners in this growing megatrend

Note: This interview was taped on Friday 15 November 2024.

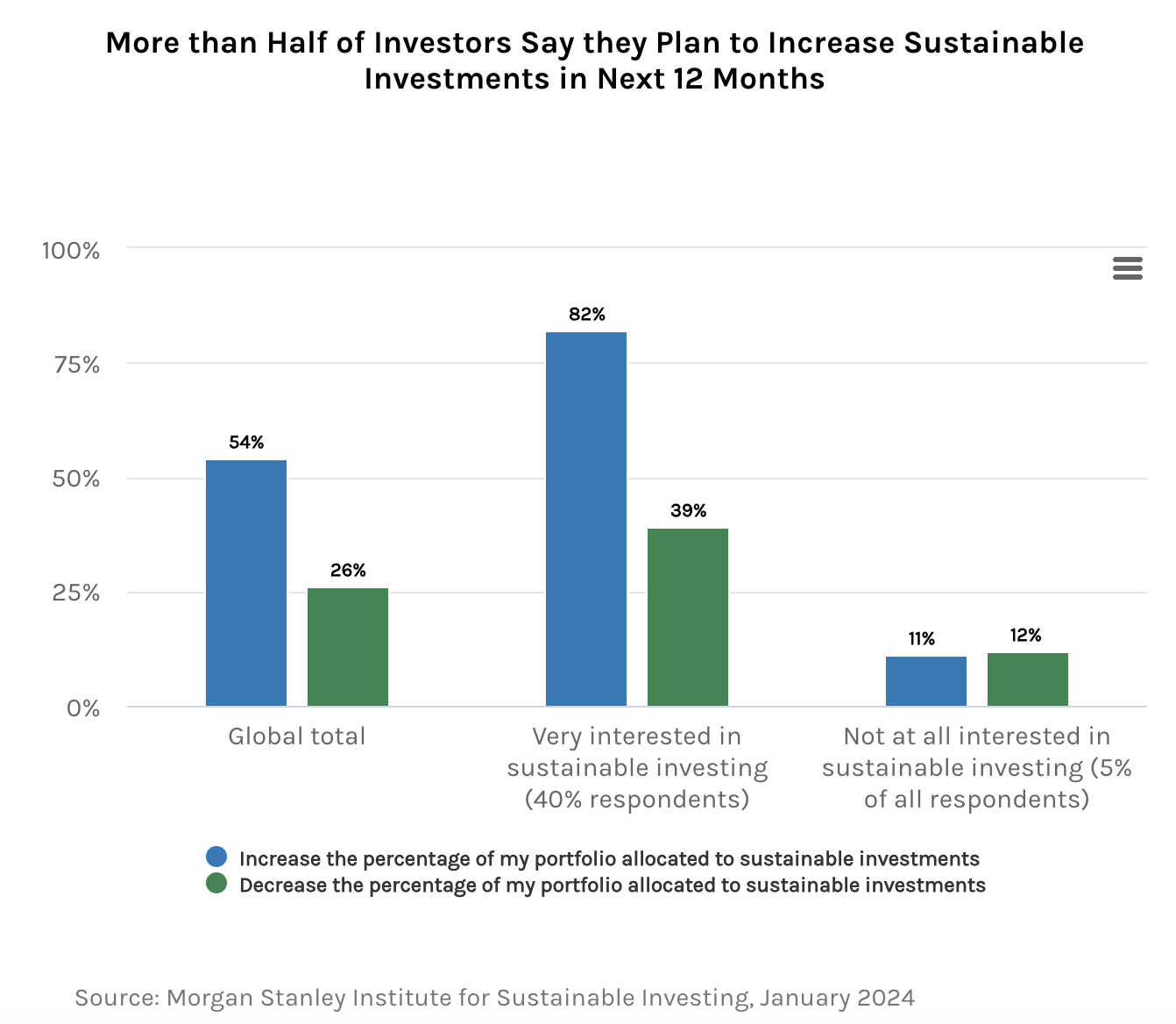

Sustainability - or ESG - investing has seen a massive surge in interest in recent years. Until very recently, that surge was mostly carried by institutional investors like superannuation funds and high-net-worth investors. But, research from Morgan Stanley Wealth Management suggests retail investors are also warming to sustainable investing that reads remarkable even compared to its pre-COVID surge. It found that more than half of individual investors plan to increase their allocations to sustainable investments in the next year.

In addition, for those who are "very" interested in sustainable investing, more than 80% of them are increasing their portfolio allocations to this space.

Sustainable investing's themes have also undergone some radical shifts in the last few years. It's no longer the case that sustainable investing is just about investing in companies that are proficient at green-signalling nor is it all about investing in renewables. Sustainable investing is now a truly cross-sector endeavour. Businesses ranging from healthcare companies to education firms and industrial companies are actively seeking more revenues from sources that are linked to the UN's Sustainability Development Goals.

So, to find out how sustainable investing has changed in the last few years (and even longer than that), Livewire's Eddie Orchard sat down recently with Impax Asset Management Senior Portfolio Manager David Winborne.

In this video, Winborne will discuss why he believes this economic transition is worth investing in, where he is finding opportunities in this transition, and will give some examples of the businesses he is backing to make it happen.

EDITED TRANSCRIPT

Why is the energy transition a thematic worth backing?

Winborne: I think it's a very powerful trend over time. As you may know, Impax is only focused on this sustainable transition over this time. The way that we've always framed this opportunity is the reason why we do what we do - and it is to generate better financial returns.

It's not responsible investment and it's not ethical investment. We think that pure focus on generating those better returns has really resonated with investors over time. Now, why is it an attractive opportunity? The reason why is that essentially we think four drivers are driving us towards a more sustainable global economy.

The first is technological improvement. In other words, technology is improving and it's enabling the adoption of more sustainable technologies across all sorts of different sectors. You see that with the rise of electric cars as one example.

Consumer preferences are another one where consumers are much more aware of the impact of their purchase decisions. People might consider buying an electric car now, or even in the food industry. You see concern about the rise of ultra-processed food. What does that mean? Consumers might want to consume healthier, less processed food.

The third driver is the fact that companies are changing their behaviours in response to consumers wanting different things. You see in that food industry, the fact that large food producers now producing more natural food products is one example.

The final driver is policy and regulation. And generally, even though we've got a little uncertainty in the US at the moment, the trajectory of policy and regulation globally is for more support behind a lot of these markets. And so we think, taken together, those four drivers really pushed the global economy towards a more sustainable footing and will provide some really attractive investment opportunities.

How are you positioned to benefit from this transition?

Winborne: If I were to summarise how we try to capture these elements of moving to a lower carbon economy, it's really through those companies that enable greater energy efficiency and existing processes. We have lots of companies in the industrial and IT sectors that focus on those areas. So, just thinking of a couple of companies we have in the portfolio.

One is a company called Schneider Electric (EPA: SU). Schneider Electric is a French company. It provides primarily medium and low-voltage equipment, which does a couple of really interesting things. Firstly, it is some of the building blocks behind buildings. Buildings are huge emitters of carbon. And if we can find ways to reduce those carbon profiles, that's great, as well as reducing the cost for those companies, which is a fantastic thing. The second would be looking at companies that renew a very ageing electrical grid infrastructure.

The most amazing thing is that the typical age of the transmission and distribution cabling in the US is 25 years. Now, if you think of that in the context of GDP, which has probably doubled over that time and population, which has probably doubled, obviously we need a huge amount of investment toward that. That's not even getting onto the huge amount of extra transmission and distribution cabling you will need with the data centre boom we're seeing at the moment. We think areas like that will play a greater role in the whole "getting more from less" trend. Often, industrial companies will help us. Then, just looking at it as well, we've got exposure to some companies in the portfolio that make the factory environment more energy efficient and this is essentially through automation.

So for example, in the portfolio, we have a company called Keyence (TYO: 6861), which is a Japanese company that makes optical sensors for production lines. Why that has a big energy efficiency saving is the fundamental reason why you automate a factory. It is not necessarily to save costs but it's actually for product standardisation. When you standardise products, then you have less waste as a result of that. So those kinds of companies which are making the factory more efficient, buildings and its grid more efficient, all play an important role. And that's where we try to focus our investment energy.

What is your approach to picking the winners and avoiding the losers?

Winborne: I think picking the winners and losers is actually really hard. I think one way that we typically try and approach it is that we try to invest in the enablers of a transition. So let's take the transition that you are very aware of at the moment, the transition tools, electric cars. Now, I don't have any idea whether Tesla, BYD or a resurgent Volkswagen is going to dominate the electric vehicle paradigm. What we do know is that demand for things like electric vehicle architecture and autonomous driving solutions will increase almost regardless of which car company dominates that paradigm.

What we're trying to do is essentially invest in some of the enablers of that change without betting on one company dominating a particular area. That's a very common pattern across our end markets.

One other interesting example - I touched on the transition towards more healthy natural food. We wouldn't be so interested in a big food producer like Nestle or Unilever and Danone. Instead, we're interested in the food ingredient companies that basically provide reformulation solutions to those large food groups so they can make their products less heavy in salt, sugar, and artificial flavours.

Tell us about a company that you have backed which represents this opportunity.

Winborne: A very big holding within the portfolio is an industrial gas company called Linde (NYSE: LIN). And for those that are not so familiar with industrial gas companies, essentially what these companies do is they separate atmospheric gas. They separate gas into its constituent parts of carbon dioxide and oxygen trace elements.

These gases are used as the building blocks of efficiency across so many different industries. In the production of diesel, they use the de-sulphurise diesel fuel to make it less environmentally harmful. It's used to purify water and water utility companies. It's used by the food industry. When you buy your packaged food products and you see kind of the transparent layer, you'll see some gas in there. That's an inert gas provided by when the industrial gas companies. They have an almost systemically important role to play.

But what I think is really interesting is if you think about this transition to a lower carbon world, one of the big bottlenecks there will be decarbonising very difficult to decarbonise industries. Industries like cement production, steel production and things like that.

Linde and a handful of other industrial gas companies have carbon capture and storage technology. Essentially, that will capture some of the emissions from those industries and help them get to a lower carbon profile. So when I look around and I think about the companies that really will play a crucial role in this transition, Linde is right up there and has been incredibly important to the move to a lower carbon economy.

Learn more

Impax invests in companies and assets that are well positioned to benefit from the shift to a more sustainable global economy. They seek higher quality companies with strong business models and governance that demonstrate sound management of risk. Visit their website or fund profiles below to learn more.

1 stock mentioned

2 funds mentioned

2 contributors mentioned