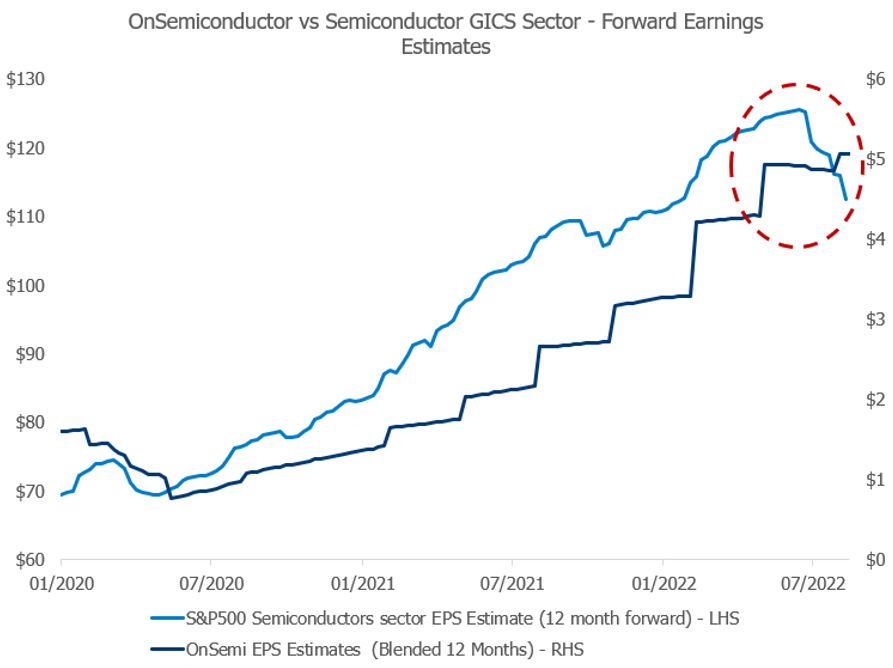

Five global ‘earnings upgraders’ outstripping the market

Global equity investors remain on edge. Investors have mainly been concerned about higher inflation and interest rates year to date, but fears are shifting to slowing economic growth. Specifically, whether slower growth will spill over into lower future corporate earnings growth.

It does appear that we are now entering an earnings downgrade cycle. During the recent second quarter earnings season, company outlook statements were dominated by discussions of weakening demand. There were signs of consumers trading down to lower end products and services, and a problematic level of inventory build. A record number of management teams also gave guidance on how they are expected to perform during a recession. They painted quite a bleak picture.

Evidence of this slowdown is building. The S&P500 earnings revision breadth (ratio of analysts upgrades/downgrades) or earnings sentiment are deteriorating. Across all sectors and industries. That generally indicates potential negative earnings revisions ahead.

US Earnings Revision Breadth suggesting more earnings downgrades ahead for the index

Source: Alphinity, Bloomberg

But despite the likelihood of entering a downgrade cycle, there are companies that can grow earnings ahead of expectations and enjoy earnings upgrades. Investors need to pivot towards ‘Upgraders’ because they can protect against downside risks and generate solid returns in a difficult market.

Below we look at 5 high quality, diverse global upgraders that bucked the trend during the recent second quarter reporting season.

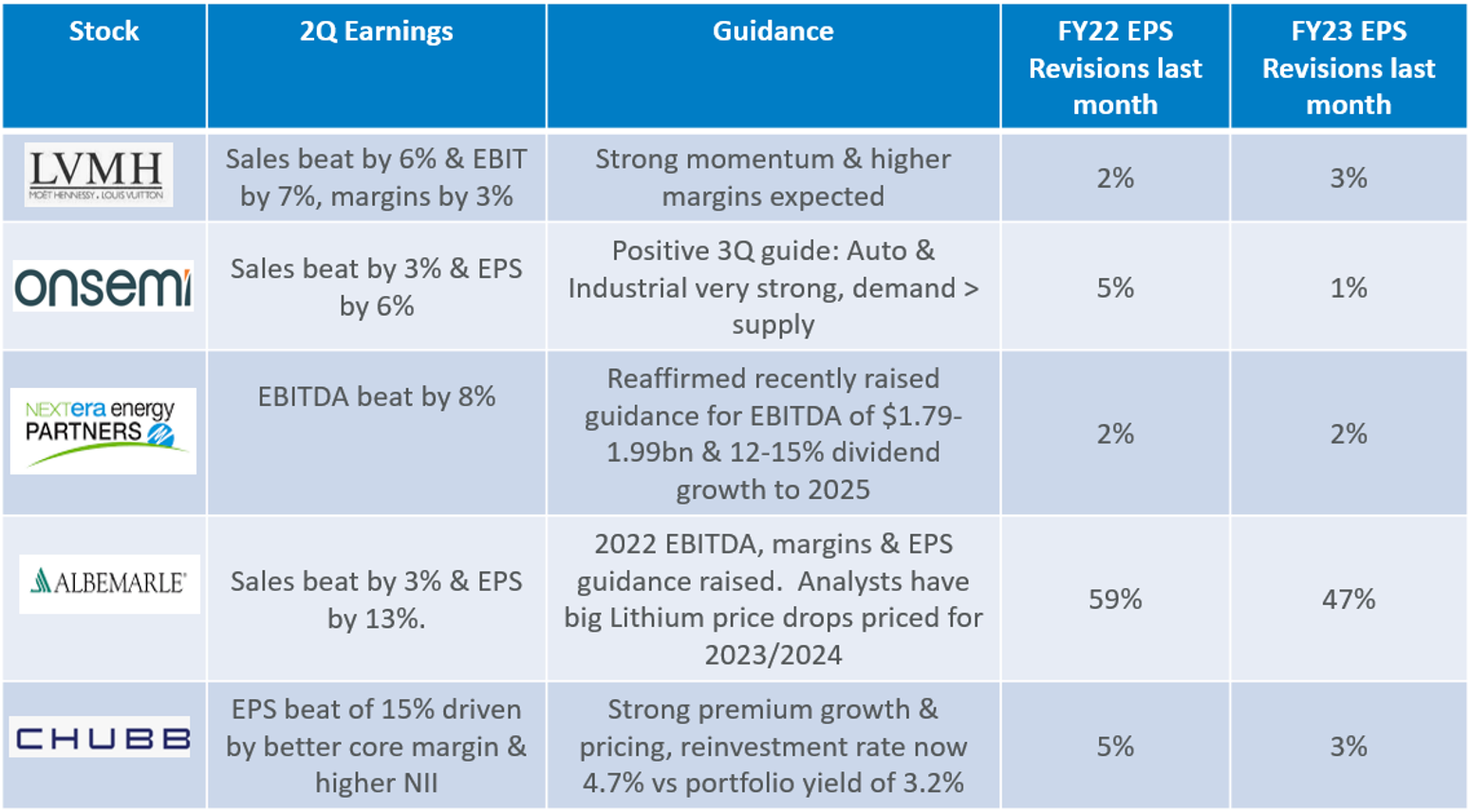

Source: Alphinity, Bloomberg, 15 August 2022

LVMH Moet Henne (MC FP) – Confidence in luxury

LVMH, the world's largest luxury goods group, reported another solid set of results for 2Q22. The company beat top and bottom-line expectations, despite experiencing a decline in sales in China due to Covid lockdowns. All Fashion & Leather Goods brands are profitable and performing well, especially Louis Vuitton. Wines & Spirits also benefitted from restaurant reopening and a strong tourism season in Europe.

Consumer demand remained strong across their other key markets and the management team is “confident” in a demand recovery in China once restrictions have lifted. The company guided to strong momentum persisting in 2H22 and maintained their EUR1.5b buyback level in the absence of any M&A opportunities.

LVMH has subsequently enjoyed earnings upgrades for both FY22 (+2%) and FY23 (+3%) on the back of top line growth and higher margin expectations. Despite the outperformance, the stock’s valuation remains attractive at 22x FY23 Price/Earnings in our view.

Defensive luxury demand driving solid earnings upgrades

Source: Alphinity, Bloomberg, 15 August 2022

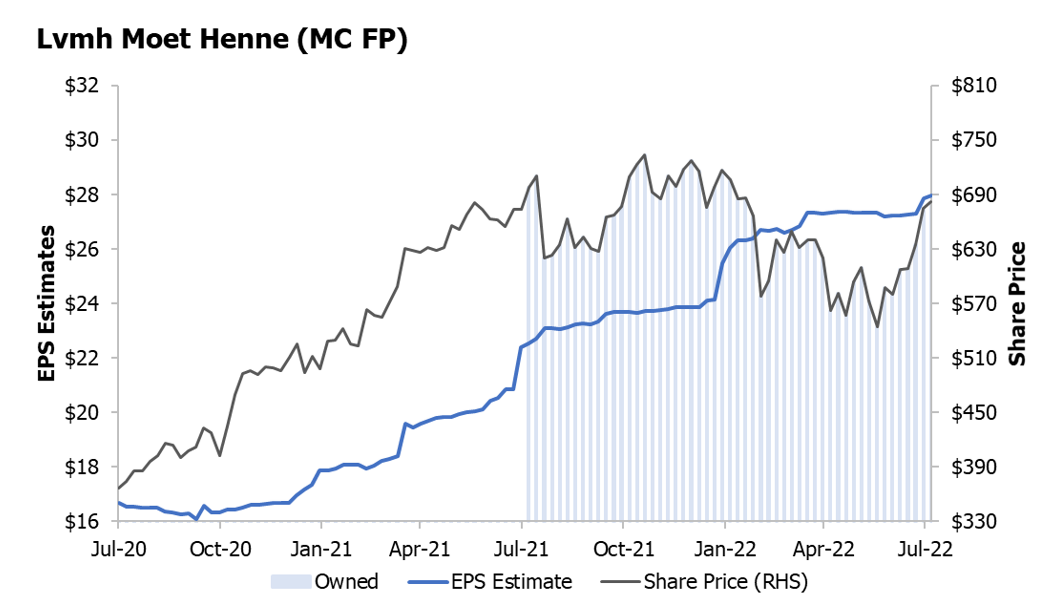

Albemarle (ALB US) – High growth exposure to Lithium

ALB is amongst the largest and lowest cost Lithium producers in the world. The company reported a knock-out 2Q22 result, beating earnings estimates by 13% and revenue by 3%. The key highlight was the big increase in forward guidance, with FY22 EPS increased by 52% and EBITDA margins to 45%-47% (vs. 38%-40%). Production is expected to double from 88kt in 2021 to around 200kt by 2025.

In response, ALB has seen EPS upgrades of 59% to FY22 earnings expectations and 47% to FY23 over the last month.

The global demand for Lithium is forecasted to increase 3 times by 2025 to 1.5mt, and more than 6 times by 2030 to over 3.2mt. We see lithium in the context of the broader battery materials supply chain as one of the key secular trends in basic materials and believe ALB’s current multiples reflect little of the pricing and volume upside that lies ahead.

ALB seeing ongoing strong earnings upgrades underpinned by Lithium price rally

Source: Bloomberg, 15 August 2022

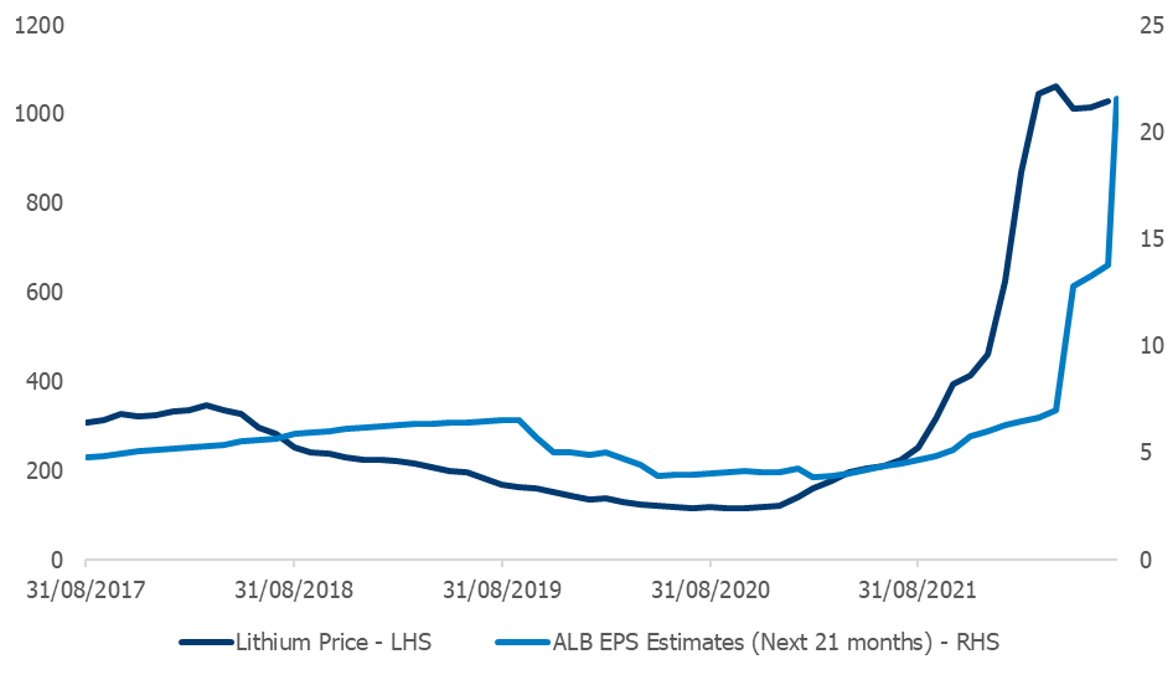

On Semiconductor (ON US) – Another beat & raise in a tough semi market

ON is a leading semiconductor company with strong positions in automotive and industrial end markets. ON reported robust 2Q 22 results with revenue, earnings and margins all beating market expectations.

End market demand in the automotive segment continues to be underpinned by the transition to electric vehicles which drives content per vehicle from circa $50 for an internal combustion engine towards $500 for an EV. In the industrial segment, automation trends continue to underpin strength in sensor demand. These secular trends stand in contrast to other semiconductor segments such as smartphone and PCs which are currently experiencing significant weakness.

Both revenue and earnings expectations for 3Q22 were upgraded for ON, and the significant gross margin gains made under new management (from 33% in FY20 to 48-50% in FY22) were guided to represent a new company benchmark for the future.

While ON has seen upgrades to FY22 and FY23 expectations, the broader Semiconductor subsector has become the pain trade within tech, with downgrades of almost 10% to next 12-month earnings estimates since the start of the earnings season.

On Semiconductor

Source: Bloomberg, 15 August 2022

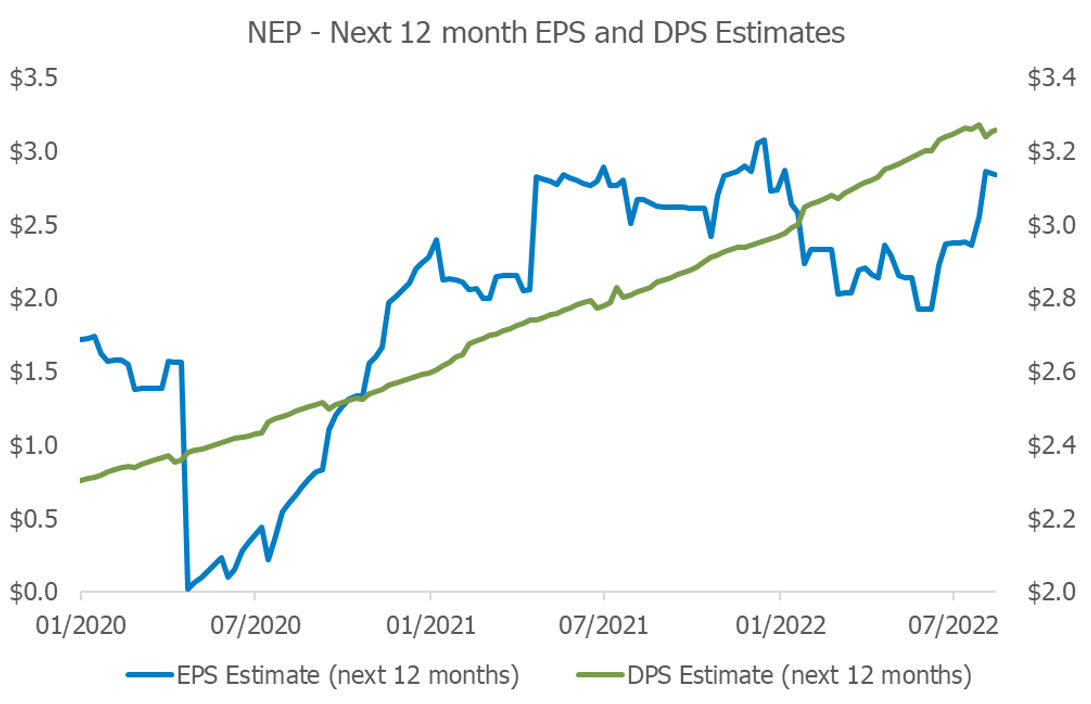

NextEra Energy Partners (NEP US) – Defensive US utility with multiple growth levers

NextEra Energy Partners is a utility Yield Company which acquires, manages, and owns contracted wind clean energy projects with stable, long-term cash flows. It is a growth-oriented limited partnership formed by NextEra Energy (NEE US), the largest and highest quality US utility company, which also owns 55% of the company.

NEP reported solid 2Q22 results with EBITDA of $500m (vs consensus expectations of $460m) and reiterated the recently raised guidance for FY22 EBITDA of $1.79-1.99bn. The company is also on track for 12-15% dividend growth until 2025 with the currently yield at 3.9%. Over the last month, NEP has seen both consensus dividend and earnings upgrades for FY22 and FY23.

With clear growth visibility, NEP is a great way to participate in the significant US renewables growth. The recent passage of the federal clean energy legislation will also give an extra boost to clean energy producers such as NEE/NEP.

NEP – Earnings upgrades and continuous dividend upgrades

Source: Bloomberg, 15 August 2022

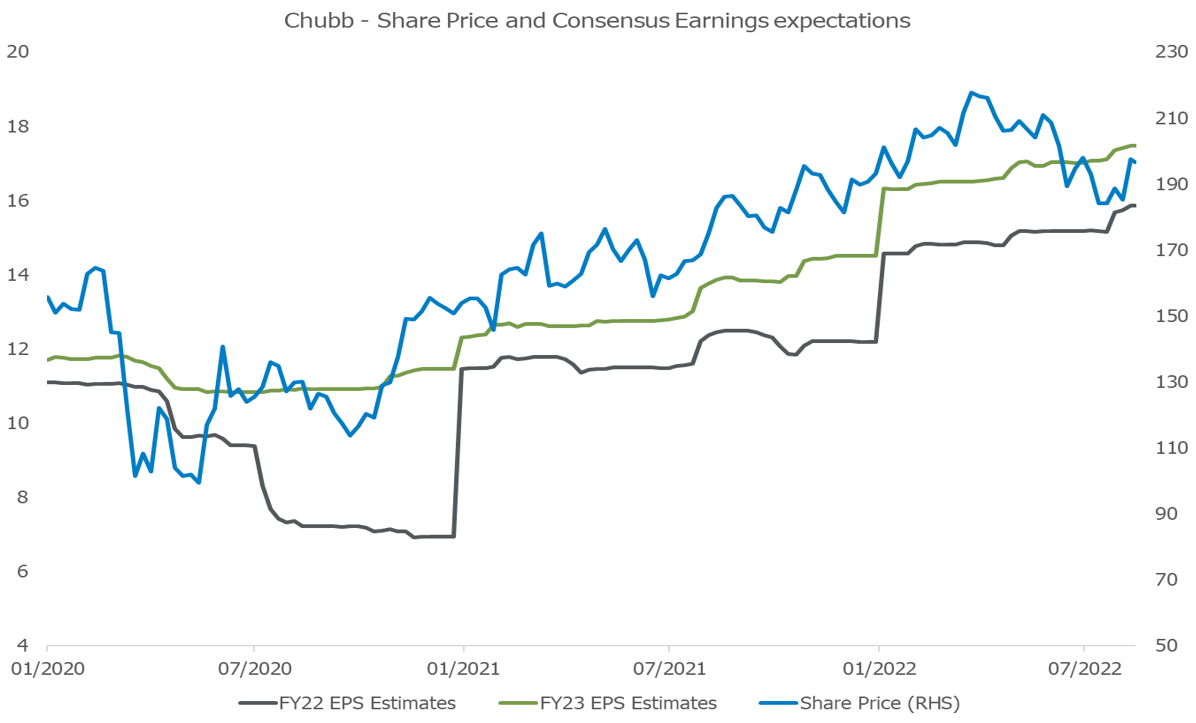

Chubb (CB US) - High quality P&C insurance company with earnings upside from margins & interest rates.

Chubb has one of the strongest and most diverse global insurance franchises, with more than 200 distinct commercial insurance and reinsurance products and services.

CB’s 2Q22 earnings surprised estimates by 15% driven by strong underwriting results across multiple segments as well as better than expected net investment income (NII). Looking ahead, management commented that that the Commercial P&C pricing remains strong and is still more than both current realised loss cost and future projected loss costs.

Chubb is one of the main beneficiaries of the hard commercial lines pricing environment and benefits from having a strong capital position, enabling it to capitalize on the improving market conditions. We expect the company to benefit from both strong premium growth and margin expansion in 2022 and should also see accretion from the acquisition of Cigna's international life and A&H business.

Chubb continues to enjoy strong earnings upgrades driven by higher margins and interest rates

Source: Bloomberg, 15 August 2022

Learn more

For more information on the Alphinity Global Equity fund, please click on the Fund Profile below, or visit our website for more information.

4 stocks mentioned

1 fund mentioned