Five global stocks that could outperform in the global rotation to value

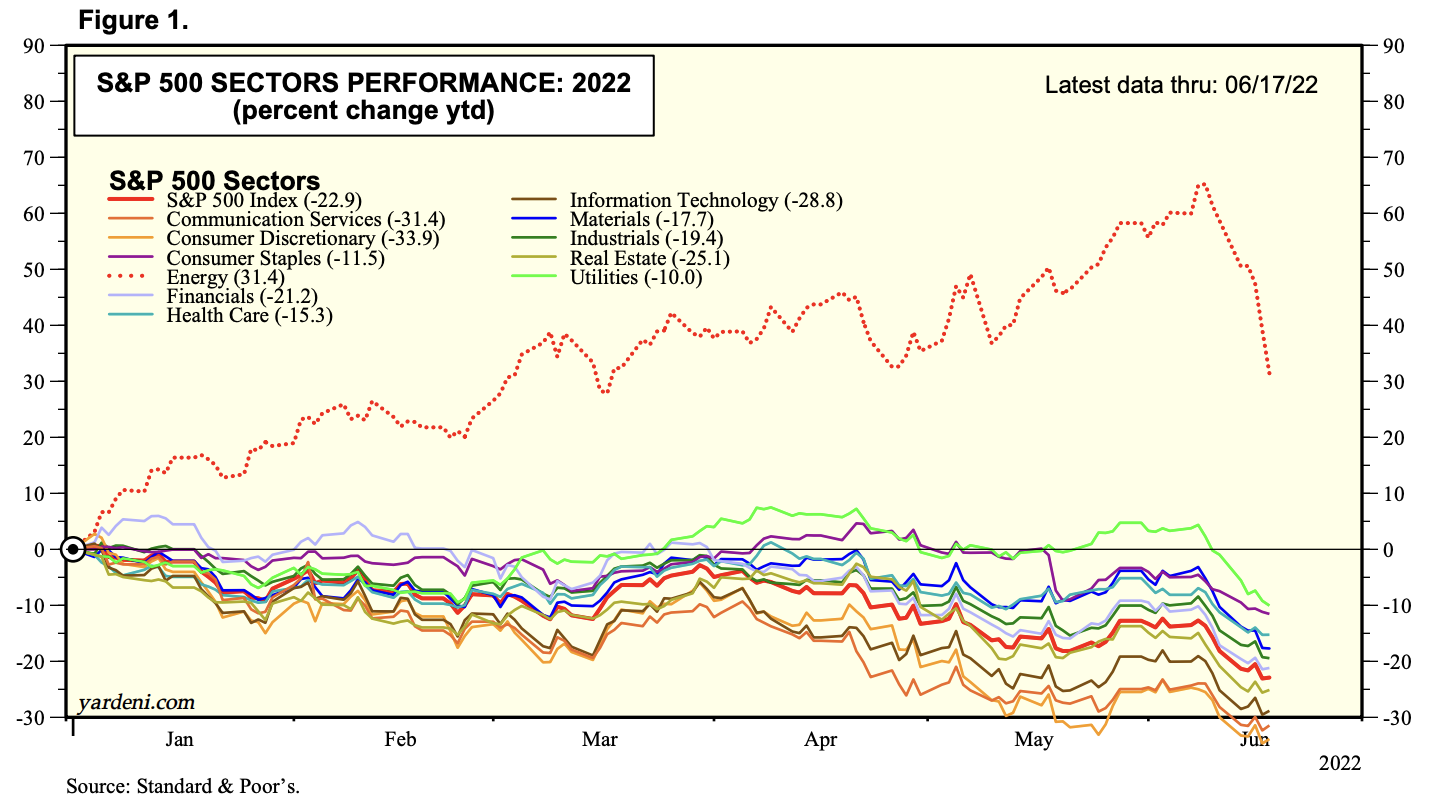

When investors write the history books, chances are the 2022 chapter will read something along the lines of "making money was rough and tough." The S&P 500 has had its worst first half since 1970 and 10 of the 11 sectors in the S&P 500 are down double digits, as this chart shows.

Despite the falls, Matthew Landy and the team at Lazard Asset Management have pulled off a healthy year-on-year return of 7.5% in an otherwise torrid market. So what is the secret to their success? The combination of quality and value, for one.

In this edition of Expert Insights, we will take a deep dive into one of the consequences of this change in sentiment - the unwind of growth stocks. We'll also examine two sectors that Landy thinks could outperform in this broader rotation away from growth into global value stocks. As a bonus, he shares his thesis for why picking broad sectors is a cautionary tale.

Edited Transcript

LW: Have we finally reached the end of the growth cycle?

Matthew Landy: We think we probably have, yes, and there's a couple of reasons for that. The first one is that we think the economic environment has changed. So we've all been living in, for the past 10 years, in an environment where interest rates have been structurally low - around 1 or 2% stuck at that rate, despite the fact that we've had economic growth of 4 or 5%.

There's nothing normal about that.

Traditionally, when economic growth has been 4 or 5%, you've had bond yields, long bond yields roughly similar to that. What's happening in a sense is just a normalisation of that process. In other words, rates are rising and the trigger for that, of course, has been the pandemic, and a sudden and unexpected rise in inflation and the Fed is having to act.

But we have always felt that interest rates are abnormally low, and so in that environment, growth companies who have their cash flows far into the future are worth less than they were in a low-interest-rate environment, and value companies who tend to be more mature and whose cash flows are closer to the present, tend to be relatively more valuable.

We think the economic environment itself is likely to favour value over growth going forward. The second thing is just the sheer magnitude of outperformance of growth over value is very, very unusual in a historical context. If you look at that over longer periods of history, it's really just getting it started.

We think it's unlikely that the gross outperformance in this environment can continue.

LW: Is there an intersection between growth and value stocks in this environment?

Matthew Landy: Sure, and what I should say is we don't dislike growth stocks, intrinsically, we love businesses that can grow earnings, all investors do.

But what we look for in growth is a business that:

- it has a big moat or a competitive advantage that can enable it to keep competitors out of the market and capture most of the growth available in that industry and

- we look for a business where we can understand that growth path.

One such company is Visa (NYSE:V).

We focus on economic franchises - businesses that have very big, sustainable, competitive advantages. Visa clearly has that, it's the number one payment processor in the world. It benefits from network effects. The more consumers that use a Visa card, the more that merchants want to carry a Visa card and vice versa.

The barriers to entry are enormous, and as a result of that, it ends with super high returns on capital. Now, the other thing that's interesting about Visa is the growth story is very easy to understand. It's clear, so it's the switch from cash to cards around the world. Although in places like Australia, card penetration is already at about 80%, in many other parts of the world, it's not.

Even in developed economies like Japan and Italy, most transactions are still done by cash, and so the growth runway for a company like Visa is very clear and it's long. And it's something that we can get our arms around as value investors with a high degree of visibility.

Today, Visa is trading at one of its most attractive valuations in the past decade. It was sold off because of the pandemic, so cross-border transactions fell, which hurt its revenues a little bit in the short term, and people are concerned about new entrants into the payment processing world. But we don't think those threats are justified.

We think most of the buy now, pay later fintech companies, Apple Pay, Google Wallet, and things like that, are actually compliments rather than competitors to Visa in the long run.

LW: What growth or tech stocks have met Lazard's threshold?

Matthew Landy: Of the FANGs or the FANMAGs, we include Microsoft (NAS:MSFT) and Google (NAS:GOOGL) in our universe only because the other businesses don't qualify as economic franchises in our view. We love Microsoft and Google as businesses, and in fact, we own them for a long, long time when they were more attractive. We have nothing against those businesses at all. We have nothing against tech. In fact, we have many, we were overweight tech for many, many years. From 2014 through to 2018 when old school tech, as we used to call it, got cheap, so the Microsofts, the Ciscos, the Googles, and the Oracles of the world. The incumbent software and tech companies got cheap.

But come 2018/2019, we just couldn't justify owning them anymore, and it was just purely a valuation call.

The issue for us is the level of growth you have to assume for those companies to justify their share prices at that time was just too high for us. Now, prices are falling as we speak, so that may change quite quickly and things do.

What we've found is that you think a stock is just permanently expensive and then all of a sudden, in six to 12 months, the price falls and it becomes attractive again. We'd be very happy to own those stocks, but only at the right price.

LW: What sectors could outperform in this ongoing rotation?

Matthew Landy: I'd caution just picking sectors, and again, we focus on a universe of companies. We exclude all banks and energy, for example, so we don't necessarily have a view on those. I also think the idea that you can just pick a sector and that'll solve your problems in this market is not right. What we think is you actually have to do the basic blocking and tackling. Analysing the companies upfront that you want to own at all, working out their intrinsic value, buying them cheaply, and then diversifying sensibly.

There are no simple answers here.

That said, we are seeing some opportunities. In the consumer discretionary space right now. We see an opportunity in IGT (NYSE:IGT), which is the largest owner of lottery concessions in the world. We think it's very cheap.

We see an opportunity in Tapestry (NYSE:TPR), which is the number one luxury leather goods brand in the US. It's trading on six and a half times EBIT, a 12% free cash flow yield. It looks quite cheap. We see opportunities in healthcare and across quite a wide range of sub-sectors. So everything from Medtronic (NYSE:MDT), which is the largest medical devices manufacturer in the world, to CVS (NYSE:CVS), which is the largest retail pharmacy chain in the US and also has the biggest position in pharmaceutical benefits management and also a big health insurance business.

We see an opportunity in a business called Mednax (NYSE:MD), which is the largest provider of neonatal physicians to hospitals in the US. So very eclectic, diverse range of businesses, the common theme being their economic franchise is trading at attractive valuations.

Access companies with an 'economic franchise'

The Lazard Global Equity Franchise Fund seeks long-term, defensive returns by investing in listed companies which possess a combination of high degree of earnings forecastability and large competitive advantages. Find out more here.

3 topics

8 stocks mentioned

1 contributor mentioned