Fortescue up 10% year-to-date for good reason

Fortescue Metals Group shares have doubled since April 2019 when you include dividends. Earnings have significantly exceeded market expectations over that period almost entirely driving its share price appreciation; its multiple of earnings is still around the same.

We expect earnings to surprise again in the coming year as we believe the price it gets for its iron ore will benefit from a tight demand/supply balance and an improving product mix, whilst its costs will benefit from the weak Australian dollar and the lower oil price. If the iron ore price holds at current level, earnings would lift by more than 40% in the coming financial year.

A company like this, with a rock-solid balance sheet combined with reasonable valuation and further earnings upside, seems to us to be a good place to have exposure in a market environment where earnings downgrades abound.

Earnings expectations driving the share price

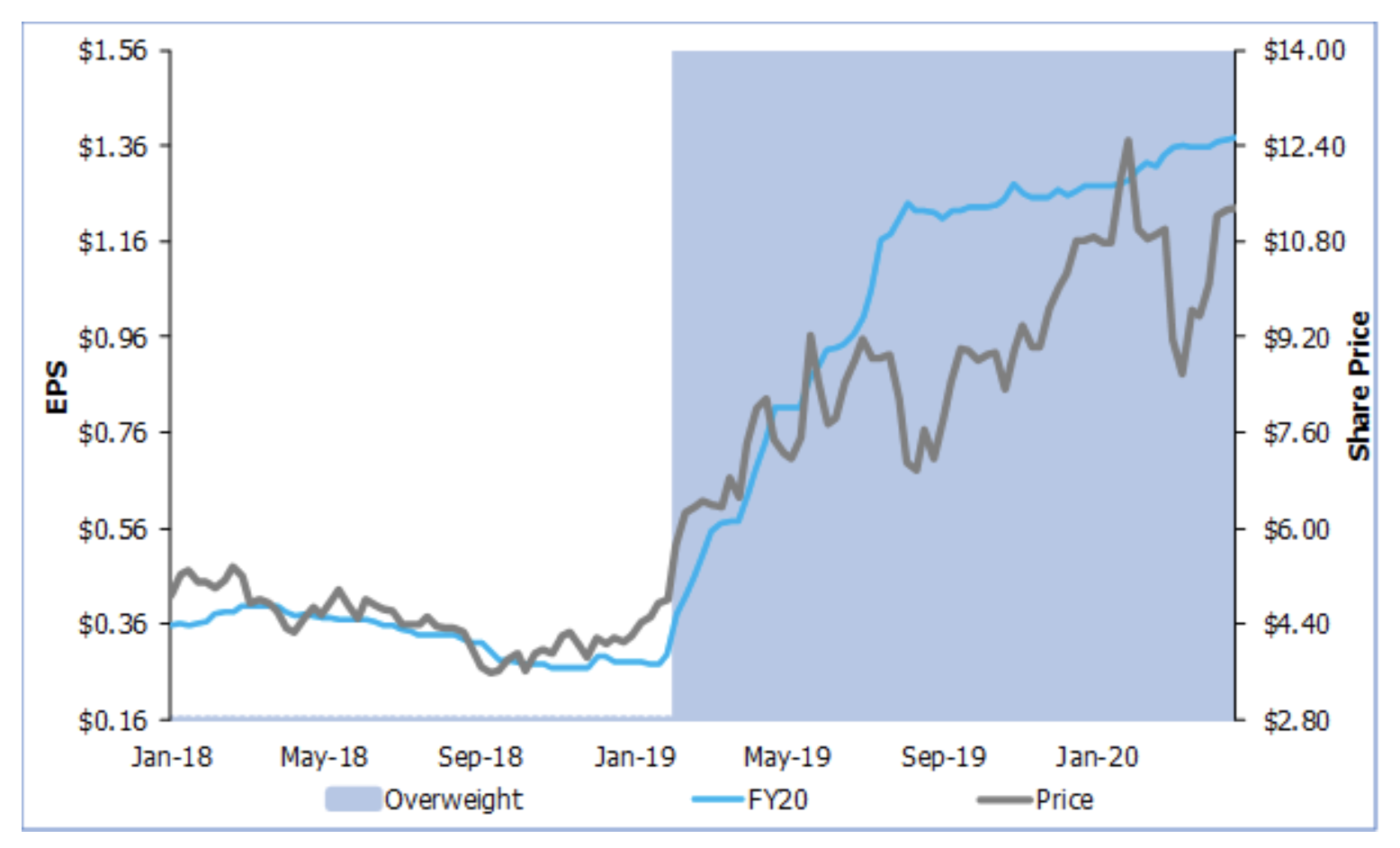

Source: Bloomberg, Alphinity

This chart shows Fortescue’s share price (blue line), market earnings revisions for FY20 (grey line) and the period Alphinity has owned the stock (shaded area).

One can clearly see that the share price lift has been driven by the increase in underlying earnings expectations. These have grown tremendously through 2019 after the tragic dam collapse in Brazil, which led to supply withdrawal, at the exact time that demand for steel in China surprised the market with much stronger growth than expected (8% if one believes the numbers). During 2019, the iron ore price (Fe62% CFR) went from $US72/t to $US93/t, with a spike to $US126/t mid-year. Its current price is around $US85/t.

Covid-19 having significant impacts demand-supply fundamentals

Iron ore mining has been declared “an essential service” due to its contribution to the economy, and this has permitted Fortescue to continue operating its mines and progressing its development projects. It recently re-affirmed its production guidance for the year, although management has wisely decided to suspend exploration activities.

To preserve the health and safety of its employees and avoid broad contamination risk, Fortescue has implemented measures to ensure physical distancing and stringent hygiene through a range of measures including regular health tests, longer rosters which reduce travel time by 40%, more charter flights, and relocation of non-essential activities away from site and offices to home spaces where possible.

From a macro perspective, Covid-19 has had and is continuing to have a significant impact on the global demand-supply fundamentals for iron ore:

- Steel demand outside of China is likely to fall by 10% this year due to production shutdowns caused by the virus.

- Perversely, production in China – the early epicentre of the virus – will probably be flat to up this year.

- On the supply side, in many countries there are production constrains which will further reduce iron ore production.

Our valuation is >25% ahead of market consensus

Valuation and its ability to deliver positive earnings surprise remain the key focus of our investment process. During the crisis, we’ve also paid extra attention on balance sheet, liquidity and cash flow metrics to ensure the company’s survival is not at risk. In the case of Fortescue, all these metrics look robust, certainly more robust than the rest of the market.

A raising is not likely as Fortescue’s balance sheet is so strong. It has net debt of only US$700m and available liquidity of US$4.3bn as at 31 Dec 2019. It will have record free cash flows in FY21 despite a large growth program. We have stress-tested these metrics under various realised iron prices and the company appears to be robust.

Our valuation of $14 per share is well above market target range of $10-11. It is based on a blend of discounted cash flows, P/E and EV/EBITDA ratios. The dividend yield is around 12%.

Fortescue has tended to polarise the investment community. There is huge scepticism around its ability to keep costs down and its ability to realise healthy prices. In previous times some investors had concerns about its gearing. Being also exposed to a single commodity was seen as a negative, attracting a discount compared to the more diversified producers.

Three things the market is under-appreciating

There are a number of things that the market has not fully appreciated. These include:

1) Fortescue’s earnings are likely to beat current expectations once again. This is based on our view that the iron ore market is tight and steel mill profitability low, allowing FMG to realise higher prices than expected for its ore. Its cash costs will also benefit from a lower currency and oil price. If spot prices are maintained, FY21 earnings would be 40%+ higher than the market currently expects. It may not turn out to be that high, but that’s a good enough buffer for us.

2) The medium-term benefits of the growth projects they are investing in. These will provide higher ore grades and a volume lift in the case of the Iron Bridge magnetite project. The Eliwana project also provides strategic optionality to allow blend mix adjustment based on market condition. Little value appears to be assigned to this.

3) The benefit of being the pure iron ore exposure in this market. Iron ore is the only commodity that is benefitting from tight demand/supply fundamentals. This is because its main exposure is to the growth in Chinese steel production which is already showing signs of recovery, with possible further upside should the government decide to stimulate the economy once it is confident a second wave of virus containment is not required. While iron ore demand is negatively affected by falling Western world steel production, Europe, Japan and South Korea absorb less than 20% of the seaborne market. This lower demand is roughly balanced by lower production from places such as South Africa, Brazil and India.

How might the company fare for the rest of 2020?

Fortescue’s performance will be very much driven by where realised iron ore prices are going. As mentioned, we believe the market is tight, and there is more risk of prices staying supported or even increasing on the back of more infrastructure stimulation in China, than going down as expected by the market.

A prolonged steel production shutdown in the rest of the world and/or a resurgence of the virus in China could quickly alter our view. The situation is very fluid, so we are monitoring it very closely. We’re also watching closely for any Fortescue-specific operational upset.

In summary

We see Fortescue Metals as a company with a strong balance sheet that is undergoing a positive earnings upgrade cycle which provides it with a meaningful valuation upside.

We rate management highly and consider it to be a rare source of earnings upgrades in what is clearly an environment of pronounced earnings downgrades across most of the market.

Want the latest insights on Australian resources?

At Alphinity, I focus on the Energy, Materials and Utilities sectors. To be the first to receive my latest Livewire insights, hit the 'FOLLOW' button below.

2 topics

1 stock mentioned