Four essential takeouts from Livewire's Top-Rated Funds Series

COVID-19 is the destructive force that’s shaken the tectonic plates of financial markets and sparked a rethink of how portfolios and risks need to be managed in the years ahead. That’s the main message from leading investment professionals who featured on Livewire’s 100 Top-Rated Funds Series.

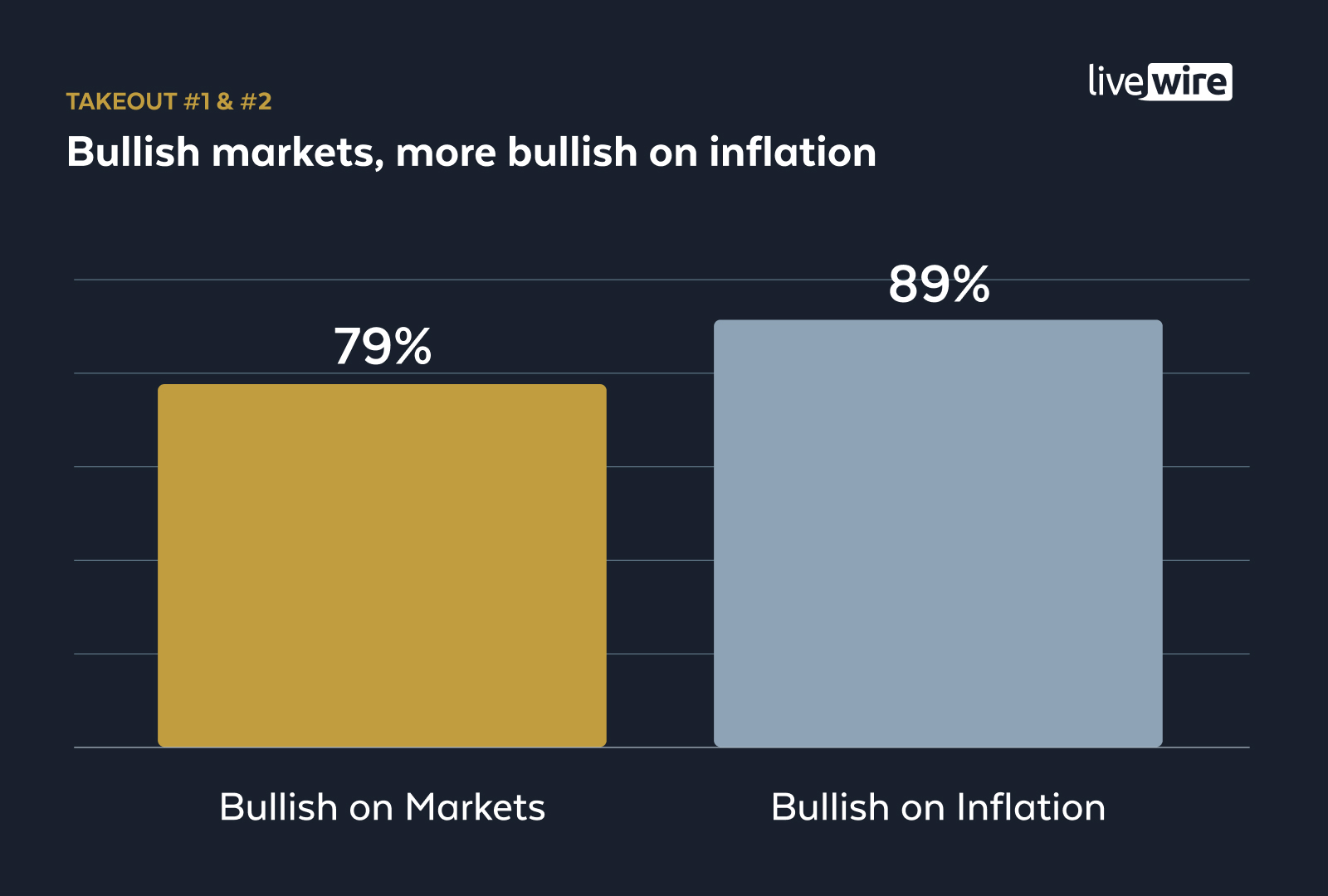

After conducting 19 in-depth interviews with the country’s top researchers, equity managers, and bond investors, we found that 79% are bullish on markets going forward and that 89% think higher inflation is coming and likely here to stay.

Yet that potent cocktail of optimism combined with rising consumer prices and themes emerging from the health crisis has led the experts to believe that now is the right time to rebalance and reset portfolios for a post-pandemic era.

From carving out a place for ESG strategies and infrastructure to rethinking bond investing and holding the line on growth stocks while making a tilt into value, we summarise the key takeouts from the interviews conducted during the series in this wire and include a useful snapshot of their highest conviction themes, fund, and stock calls in a handy infographic.

Takeout #1 – Most fundies are bullish on markets

When asked to take out their crystal ball on markets, 15 of 19 fundies in the series were bullish due to factors including an upbeat outlook from management teams, positive forward indicators, and analysis of bond markets as well as previous cycles.

“Every CEO, corporate, we talk to at the moment, they're saying, "Things are looking very optimistic for the Australian economy" and those are companies operating within that economy pretty much across the board. That's quite a broad trend.” - Catherine Allfrey WaveStone Capital.

However, investors shouldn’t expect markets to keep rising in a straight line, with Kate Howitt of Fidelity International warning that shares may “collapse a little bit under their own weight” in the second half of the year.

“But if you step back a bit from that in the broader market cycle, there's so much liquidity that's been put into the global economy to get us out of the impacts of the pandemic. And so much of that is flowing through into asset prices and asset valuations. And that's not going to be unwound anytime soon. So a little bit of a pause, but then on a bigger picture basis, we think there's still room for optimism to continue to build. - Howitt

While the majority are optimistic, we at Livewire admire and respect our contrarians and dissenters. In this regard, Andrew Parsons of Resolution Capital is feeling nervous about what could happen to markets when policymakers withdraw emergency levels of stimulus from the global financial system.

“The market is drunk with liquidity at the moment. It's had an enormous amount of government intervention and central bank intervention. All I can say is that it's just an unusual set of circumstances and trying to come to grips with, as I say, the enduring impacts of all those different inputs, QE, low interest rates, and, as I say, direct government intervention. That's a tricky one.” – Parsons

Meanwhile, Hugh Giddy of IML doesn’t mince his words when it comes to the notion that the 2020s will be reminiscent of the last century’s Roaring Twenties, when global economic prosperity and asset prices soared after the Spanish Flu fizzled.

"We start from such a different position. We start with the stock market at a crazy valuation. Back then the stock market was on probably a fifth of the valuation it is now. You start with debt levels that are crazy, compared to debt then, and there's a whole lot of things that are different that suggest that that's a complete pipe dream.” – Giddy

Takeout #2 – Most fundies also expect higher inflation

17 of 19 fundies also happened to be bullish on inflation, though it isn’t necessarily the case that the same market optimists are also expecting inflation to rise.

PIMCO’s Adam Bowe was the stand-out contrarian, holding the view that higher prices will be a passing fad; an optical illusion created by adverse undershoots and overshoots of CPI readings due to economic closures and re-openings during the pandemic.

“We're characterising it internally as a head fake. Some of it is just optical. If you look at year-over-year inflation numbers and you drop off the really negative ones, then the year-over-year numbers go up quite significantly.” – Bowe

Bowe is backed in his belief by Hyperion Asset Management’s Mark Arnold and Jason Orthman, though their thesis also includes the following systemic factors:

- structural headwinds such as high debt levels,

- ageing populations,

- natural resource disruptions, and

- the hollowing out of the middle class, which will impede real demand growth and inflation.

“In addition, technology disruption and innovation will exert downward price pressures on most sectors including energy, transportation, healthcare and human capital markets.” – Arnold

But Paul Skamvougeras of Perpetual disagrees and insists that investors shouldn’t try and second-guess Uncle Sam (and Uncle Scott) when they tell the public they’re going to spend money to reboot the economy. He says policymakers worldwide have already disbursed US$20 trillion or 15% of global GDP to offset the impact of COVID, and there’s political will to create inflation via higher wages and recovery-driving stimulus packages.

“You have monetary policymakers and fiscal policymakers, especially in the US and Australia, very much intent on creating inflation. And that's what we're seeing. Monetary policy cannot do much more from here. But now the governments are taking over and they're really, really spending.” – Skamvougeras

For David Wright of Zenith Investment Partners, the risk isn’t necessarily that inflation rises and then slots perfectly into mandated ranges for central banks, but rather that it overshoots and then spirals out of control.

“And I know that the Reserve Bank and also the Federal Reserve have spoken about expecting a blip of inflation and then being able to control it. We're not so sure, expecting that if it does overshoot, you have potentially larger moves in bond yields. That's not good for equities and would create a pretty challenging investment environment if inflation surprises on the upside.” – Wright

Marcus Burns of Spheria Capital says higher prices are inevitable and will cause the proliferation of zombie businesses who survived COVID-19 to finally fail.

“Whether it’s through inflation and rates rising, or whether people start demanding to be paid something on their cash, that will cause the cost of actually giving companies capital to rise and will cause bad businesses to fail and we haven’t really seen that. We’ve just put the defibrillator on, gushed more adrenaline into the veins and kept it all alive.” – Burns

Takeout #3 – ESG, growth stocks, infrastructure, and carefully selected bonds rank as top themes

The COVID-19 crisis has not only brought on the greatest recession since World War II, but investors are also calling it the 21st century’s first “sustainability” crisis and one that has renewed the focus on environmental, social, and governance issues including climate change, supply chains, inequality, and workers’ rights.

A good chunk of the experts we interviewed during the series agreed, with 42% nominating ESG or environmental issues as their top theme over the next decade.

“There is much more focus from investors, advisers and fund managers on ESG assessments and practices. I do think that will play out pretty strongly over the next five years and will have big implications for how money's both managed and invested.” – David Wright, Zenith

It’s an area that Kate Howitt of Fidelity and Peter Gardner of Plato Investment Management have been thinking deeply about in recent times, with both calling out decarbonisation as a major theme to watch within ESG.

“That decarbonisation process for the world is going to take somewhere between US$100-$150 trillion. That's a lot … the U.S. economy GDP is only about US$21 trillion.” – Howitt.

Plato, a long-time signatory of the UN Principles of Responsible Investing and Montreal Carbon Pledge, says that process is likely to play out over the next 20 years and could adversely impact the performance of companies and funds that don’t incorporate ESG in their investing strategy.

“If you look at Europe, when you control for stocks in the same industry over the last 10 years since the European market has been pricing carbon effectively, you've seen stocks with high carbon intensity underperform stocks with low carbon intensity by about 40%. In the US there has been no such under-performance of high carbon intensity stocks, but carbon hasn't been priced in the US market over that time. So, in the future if we see US and Australian governments price carbon effectively, we are likely to see a similar result in those markets.” – Gardner

Growth stocks

Despite the overall level of hype in the industry and media about the long-awaited rotation into value, finding sustainable growth stocks was nominated by 21% of managers as the next most powerful theme after ESG.

While high P/E stocks have witnessed a correction over the past month, Peter Green of Lonsec doesn’t believe it’s the end of the growth story.

“Automation and digitalization tend to be the domain of the growth manager and especially the high growth managers. They've had a big correction of late, but that's something short term and they’ve just been through a period of pretty high valuations. So it was natural that, as we get some different narratives in the market, they’d start to come off. – Peter Green, Lonsec

Green also adds that Australian mid-caps should be considered by investors as part of their risk bucket, given they offer higher EPS growth than large caps, but superior balance sheets and liquidity than small companies.

Sam Ruiz of T. Rowe Price observes that markets are currently behaving in a “bipolar” manner, with value or growth outperforming on any given day based on volatile inflation indicators. His suggestion to investors is to not try and time the cycle, but rather to stick with businesses that would survive and thrive if markets closed for three years.

“Because picking this cycle is very tough - you might time it well on the way up, but no one knows when it will hit that apex. We're actually finding now that while we had a really good opportunity during COVID to pick up cheap oversold cyclical businesses, we’re getting a similar opportunity now in select growth stocks because the market just doesn't want to own anything that was a 2020 winner.” – Ruiz

Hyperion backs this approach and goes on to suggest the so-called “value rotation” is transitory given Arnold and Orthman’s view that inflation and rates are likely to remain low, and that high-quality structural growth companies which are capturing large addressable markets – such electric vehicles (EVs) and digital payments – will prove too good to pass up.

“A lot of cyclical, commoditised companies that are enjoying expanding earnings currently will face a much tougher outlook post-COVID-19. In contrast, certain structural growth companies that are being caught in the value-to-growth rotation are well-positioned to grow their earnings sustainably over the next 10 years.” - Orthman

EVs also happen to be the biggest theme for Aussie small-cap boutique Eiger Capital’s Stephen Wood and Victor Gomes, who are accessing this opportunity through suppliers of the raw materials enabling electrification.

“How are we going to achieve this transition? We’re going to get there through electric motors, batteries, grid storage and the like. In Australia, you can buy lithium, rare earths, copper, and nickel miners, and our view is this is a structural play. What we’re also finding is that the valuations in a lot of these materials, the picks and shovels of the EV and battery storage revolution, are actually looking reasonable.” – Gomes

Infrastructure

Behind structural growth stories is infrastructure, the asset class that tends to quietly achieve. It was nominated as a top theme by 15% of managers in the series, and for good reasons.

“I think something like infrastructure has certainly, institutionally and on the unlisted side, been in play for a long time. All the major super funds have been doing it. For retail investors, areas like property and infrastructure have suffered quite significantly. Think of airports and the like. But I do think that it's got some good long-term legs to it beyond some of the dislocation caused by the pandemic.” – Aman Ramrakha, Morningstar

Ben Griffiths of Eley Griffiths agrees that infrastructure presents an “exciting longer-term opportunity” given the dislocations in the asset class mentioned by Ramrakha, and he’s made that one of his top recovery bets in his fund (the other is a growth thematic in online gaming and betting).

“The thought of owning an airport right now is something that would not impress people, but out of adversity, of course, comes opportunity.”

Meanwhile, Andrew Maple-Brown of Maple-Brown Abbott adds that beyond the current valuation opportunity, infrastructure companies offer a great way to participate in the broader ESG thematic while also providing inflation protection given their ability to pass on rising prices. In other words, the asset class hits three birds with one stone.

Maple-Brown and his team expect investment in renewables will accelerate very quickly for an extended period of time. And they’re particularly excited about the scale of the investment opportunity in transmission networks in particular.

“Renewables in most countries is a small proportion and a significant minority of current generation. But in terms of where the investment is going to be, it’s driven very heavily by renewables.” – Maple-Brown

Carefully selected bonds

In the context of fixed income, low yields against the backdrop of higher inflation and rates are making the world of bond investing challenging to traverse, but there are pockets of opportunities for those who dig deep enough.

Simon Doyle of Schroders, who runs one of the country’s top multi-asset portfolios, has undertaken extensive work in analysing where value is present in bond markets, nominating Asian corporate credit as an asset offering relatively high yields.

“Other areas which I think are of interest are private markets. I think the easy money has flowed into public markets, but there are some pockets of private markets where there's a risk premium, so investors can use their liquidity budget, if you like, to capture some of that additional risk premium.” - Doyle

Bowe agrees that private markets and credit are and will continue to remain key drivers of returns in fixed interest portfolios.

“For investors who need to take some risk to meet their real income targets or real return targets, having a look at the broader opportunity set, particularly within global credit markets, then have some liquidity premium attached to them are going to be very attractive.” - Bowe

While Jay Sivapalan of Janus Henderson has a substantial allocation to investment-grade credit, he says investors shouldn’t overlook the benefits of inflation-linked bonds, which could be a useful shock absorber and source of yield if inflation spikes.

"I really want to emphasise inflation, while it's not certain, could really surprise markets." - Sivapalan said.

Takeout #4 – The stock and fund ideas you’ve been waiting for

In this wire, we’ve encapsulated the views of 19 of the country’s top investment professionals on how to reset portfolios for a post-pandemic era. But we’d be (very fairly) accused of leaving you hanging if we didn’t provide some actionable ideas on how to access the range of themes discussed. Below, we present an infographic that sets out all the key ideas from the fundies, as well as the stocks and funds (where possible) to play those thematics.

Don’t forget that you can access critical information including fund fact sheets, PDS’s, and performance data on the strategies offered by the fund managers who featured in the Top-Rated Fund Series here. It’s an immensely powerful tool and we hope it helps you in your investing journey. Separately, you can access a deeper thesis for each stock idea in the individual interviews we conducted with the managers here.

Without further ado! (Click image to enlarge)

.jpg)

Conclusion

We hope you enjoyed this series. As the Livewire team reflects on the comments and views from the fund managers and researchers, it’s evident that the pandemic has ushered in a myriad of changes to society and markets, which in turn has put themes like ESG, inflation, and a more nuanced approach to bond investing in focus.

Importantly, a key observation from the experts is that while value has a place, growth is by no means dead, and investors may be doing themselves a disservice by opting purely for one or the other.

To build a robust portfolio, we’d like to share a page from the playbook of Patrick Hodgens at Firetrail: Whether value, growth, or quality is the flavour of the week, investors should be on the lookout for finding undervalued opportunities at any point in the cycle; always remembering that the price you pay is the biggest determinant of returns.

“I would compel any investor to focus on valuation when they're making an investment decision and don't overpay for anything. You could be looking at the nicest house, looking over the harbour, but if you pay a billion dollars for that asset, chances are very high that it's going to be a poor investment decision. For me, that is the number one rule of investing.” - Hodgens

Australia's 100 top-rated funds

Livewire's Top-Rated Fund Series gives subscribers exclusive access to data and insights that will help them make more informed decisions. Click here to view the dedicated website, which includes:

- The full list of Australia’s 100 top-rated funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with expert researchers from Lonsec, Morningstar and Zenith.

- Videos and articles featuring 16 top-rated fund managers.

2 topics

15 contributors mentioned