Four founder-led companies worth watching

Four Founder-Led Companies Worth Watching

Last week was eventful for certain ASX founder-led companies, as revelations exposed significant governance failures, sparking critical questions about board oversight and leadership.

Investors, including us, have been reminded of the "key man" risk tied to charismatic founders.

So, the question arises: How risky are founder-led companies?

The revelations highlighted the importance of strong governance, and underscore that the best founder-led companies are those that evolve with well-established governance frameworks.

A visionary founder, paired with a strong board, can create a powerful combination. Conversely, a weak board may allow excessive risk-taking if the founder is left unchecked, which could expose minority shareholders.

Most importantly, founders should surround themselves with aligned, capable management teams that can carry forward their vision and build on their legacy.

Fortune Favors Founder-Led Companies

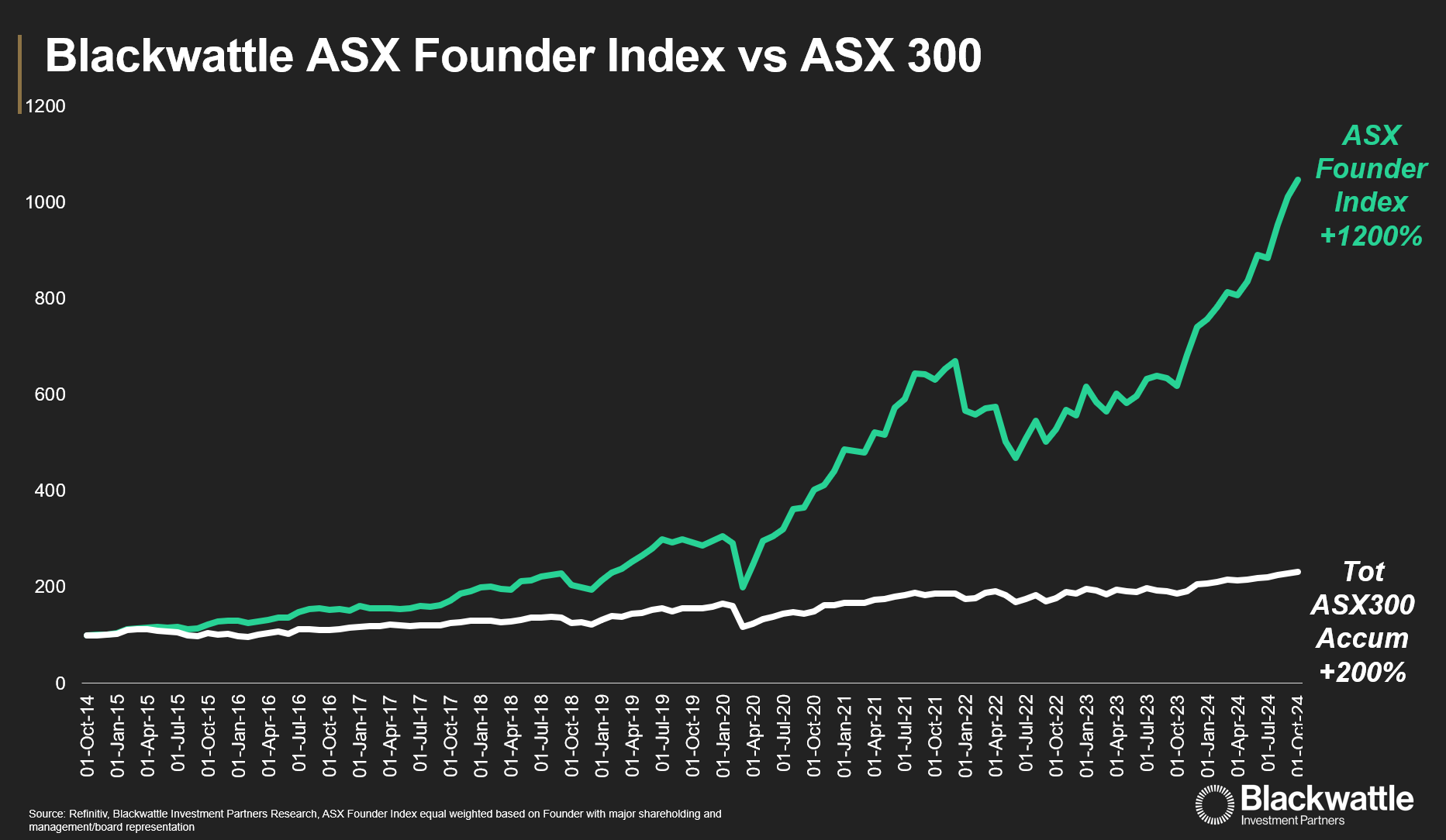

Despite failures among some companies, there is profuse evidence that founder-led companies have delivered above-average returns.

A notable study by Rudiger Fahlenbrach, "Founder-CEOs, Investment Decisions, and Stock Market Performance," showed a portfolio of founder-CEO companies achieved excess returns of 8.3% per annum from 1993 to 2002.

At Blackwattle Investment Partners, our analysis of a portfolio of over 50 ASX founder-led companies yielded similar, if not superior, results.

To qualify as a founder-led company, we looked for companies where a founder or key manager is an influential shareholder and concurrently holds an executive or board position.

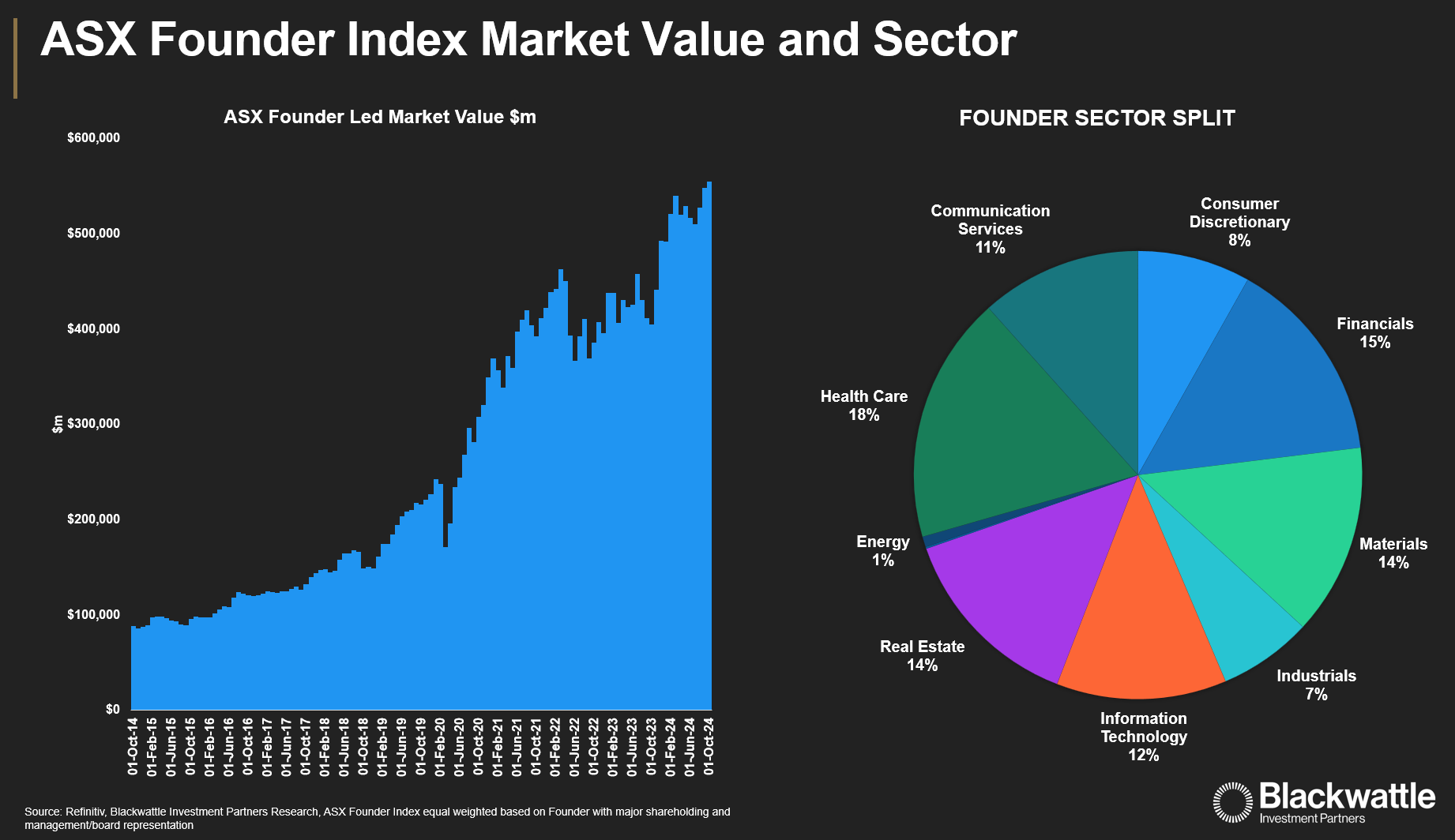

Based on our ASX Founder Index, founder-led companies delivered excess returns of 18% per annum compared with the ASX 300, including dividends. Since 2014, the total market value of ASX founder-led companies has compounded at 19% per annum, reaching $550 billion.

Top contributors to this have been Goodman Group (GMG), Fortescue Limited (FMG), Wisetech (WTC), Block Inc (SQ) (following the Afterpay merger), and Resmed (RMD), which together account for 55% of the market value of ASX founder-led companies.

Beyond the top five, we observed $262 billion in market value distributed across 49 companies spanning diverse sectors.

What Drives Founder-Led Company Outperformance?

Founder-led companies have historically outperformed due to unique characteristics and motivations embedded in the founder-CEO psyche.

These qualities, difficult to quantify on a spreadsheet, pose a challenge for analysts attempting to gauge future shareholder value creation through traditional valuation methods.

Notable characteristics of founder-led companies include:

- Long-Term Vision and Intrinsic Motivation: Founder-CEOs often view their firms as personal legacies, fostering a commitment to long-term value creation. This intrinsic motivation, or "obsession" with maximizing shareholder value, can drive sustained growth and performance.

- Higher Investment in Innovation: According to Fahlenbrach’s study, founder-CEO companies allocated up to 22% more to R&D and 38% more to CAPEX than non-founder-led companies. This investment reflects a culture focused on growth and innovation.

- Risk Tolerance and Strategic Decision-Making: Founder-CEOs tend to have a higher tolerance for risk, often pursuing value-creating mergers and acquisitions aligned with their deep business knowledge. They are less likely to engage in empire-building through diversification.

- Alignment: Significant ownership stakes foster greater alignment with shareholders, promoting longer-term decision-making and reducing agency conflicts, such as the temptation to game remuneration incentives.

With this understanding, we detail four ASX founder-led companies within our index that have achieved remarkable success worth keeping a close watch on:

1. Premier Investments Limited (ASX: PMV)

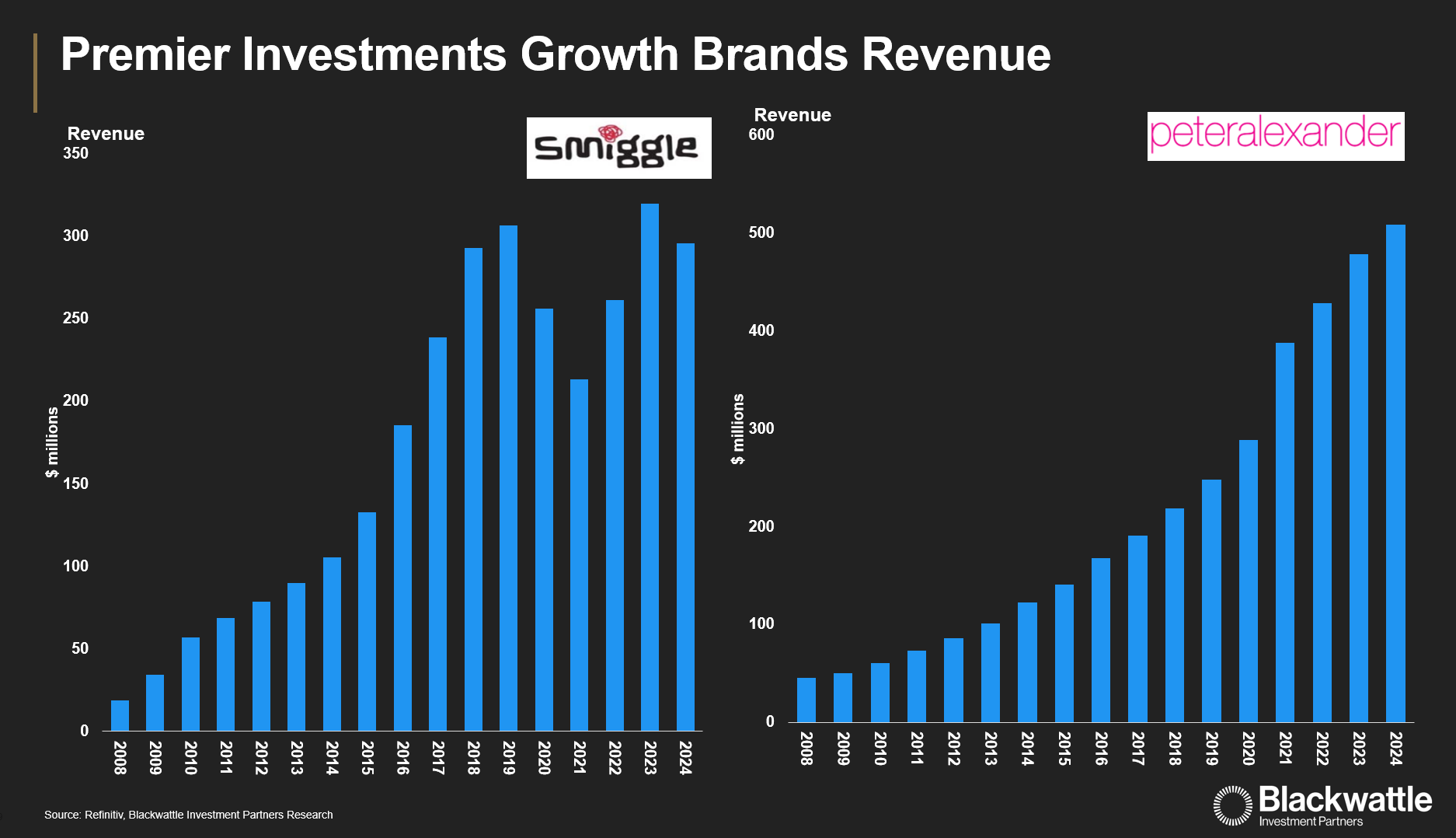

Premier Investments may not be a household name, but it owns some of the most iconic and fast-growing retail brands, including Peter Alexander, a premium sleepwear retailer, and Smiggle, a trendy stationery brand.

Premier is also the largest shareholder of Breville Group (BRG), known for innovative appliances like coffee machines and food processors.

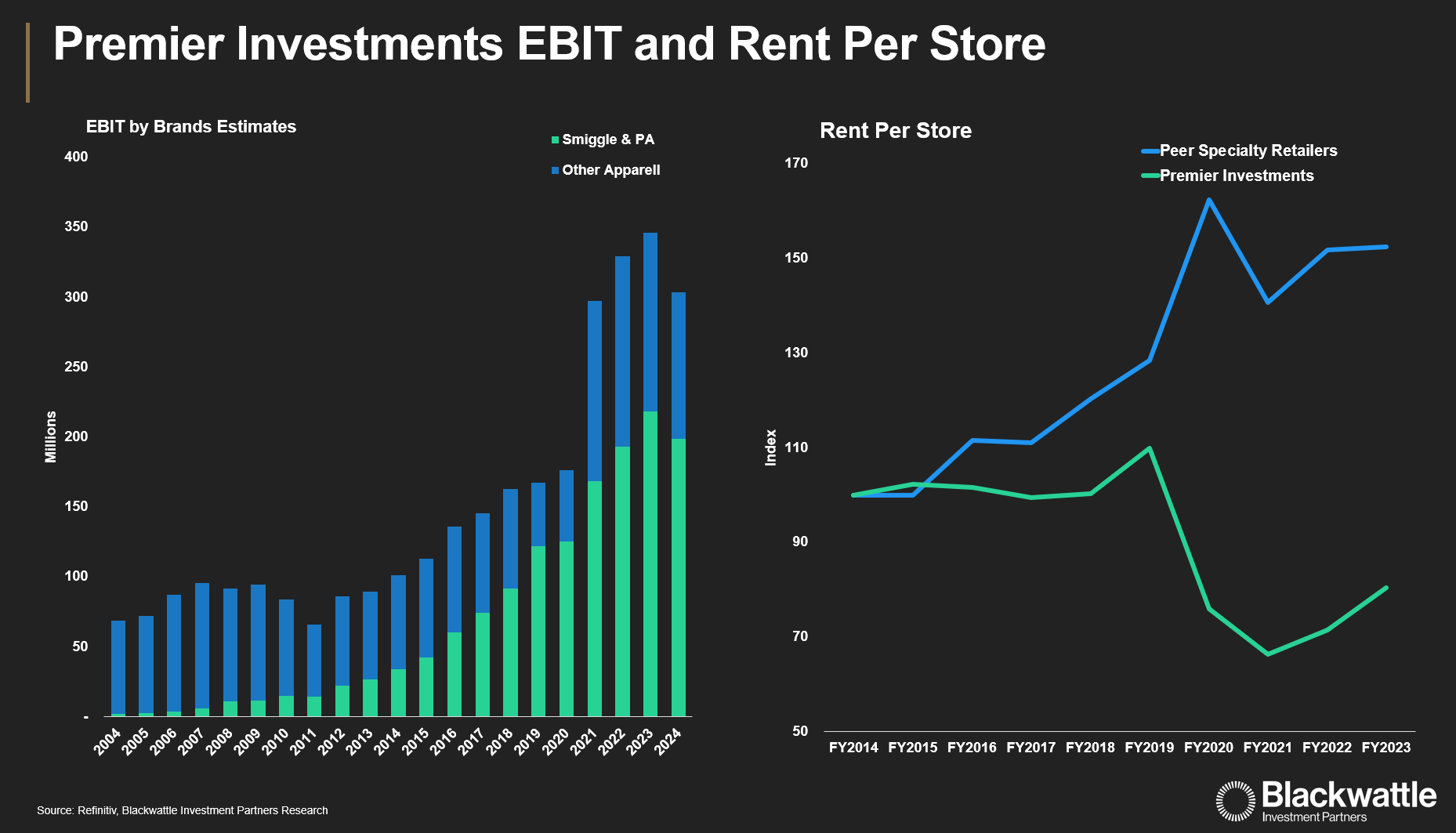

Premier is chaired by retail mogul Solomon Lew, who holds a 32% stake in the company. Lew has a strong track record in capital allocation, having acquired Just Group in 2008 and growing retail EBIT from $83M in 2010 to $325M in 2024.

Lew also maintains a Fort Knox like balance sheet, that is anchored by $0.5 billion in cash and property, alongside the $1.1 billion in investments in Breville and Myer.

Lew’s leadership is renowned for driving his business managers to outperform in even the most challenging conditions through laser focused inventory management, gross profit maximization, cost control and strong cash generation.

As Lew puts it:

“The group’s strategy is always anchored on delivering value for customers in our products and shopping experience, while also maintaining a relentless focus on inventory productivity and operational efficiencies”.

The growth opportunity for Premier Investment shareholders lies in expanding Peter Alexander and Smiggle into overseas markets while extracting more value from mature apparel brands like Just Jeans and Jay Jays through the Myer merger.

Separating the faster-growing brands into a separately listed vehicle will increase shareholder focus on the performance of the high growth and higher margin Peter Alexander and Smiggle brands, which have been obscured by the drag of the mature brands.

What sets Peter Alexander and Smiggle apart from the rest of the portfolio is the unique market position of each brand, underpinned by in-house design teams that are focused on innovation and curating on-trend products that have created a cult like following amongst consumers.

Peter Alexander has the potential to become a global powerhouse in sleep wear, as it caters to a wide audience pool for women, men and children in a highly fragmented market.

In 2024, Peter Alexander topped record sales of $508m, representing a CAGR of 15% since 2014 and confirmed a launch into the UK, with 10 sites selected.

Smiggle, though facing recent headwinds from management turnover and cost-of-living pressures, is still achieving near all-time high sales per store benchmarks, with a strong presence in over 20 countries.

Growth opportunities for Smiggle include both proprietary store growth and wholesale/franchise partnerships.

Although Premier has recently faced tough retail conditions and leadership challenges, Lew’s track record of overcoming similar obstacles suggests that these difficulties may be transitory.

Should Lew be successful in executing on his international growth ambitions, and complete the restructure of the mature apparel business, Premier’s enterprise value to EBIT of 10x (adjusted for cash and investments) may look conservative when contrasted with other retailers with a growing international segment.

2. Pinnacle Investment Management Group (ASX: PNI)

Pinnacle Investment Management is a leading Australian investment firm, specialising in affiliate boutique managers. Led by founder and managing director Ian Macoun (second largest shareholder with a 9% interest), Macoun was one of the pioneers of the multi-boutique investment model.

The Pinnacle co-ownership structure empowers investment managers to build an enduring franchise, think like business owners and foster an entrepreneurial culture based on partnership. For Pinnacle shareholders, the multi affiliate model reduces dependency on a single asset class or strategy, smoothing revenues through different market cycles.

For investment managers, Pinnacle’s shared infrastructure provides a scale advantage, allowing managers to focus on executing their investment strategies, while outsourcing business functions to Pinnacle.

Pinnacle’s strong distribution platform also provides managers an ability to reach and retain a broad set of clients without necessitating a large upfront investment.

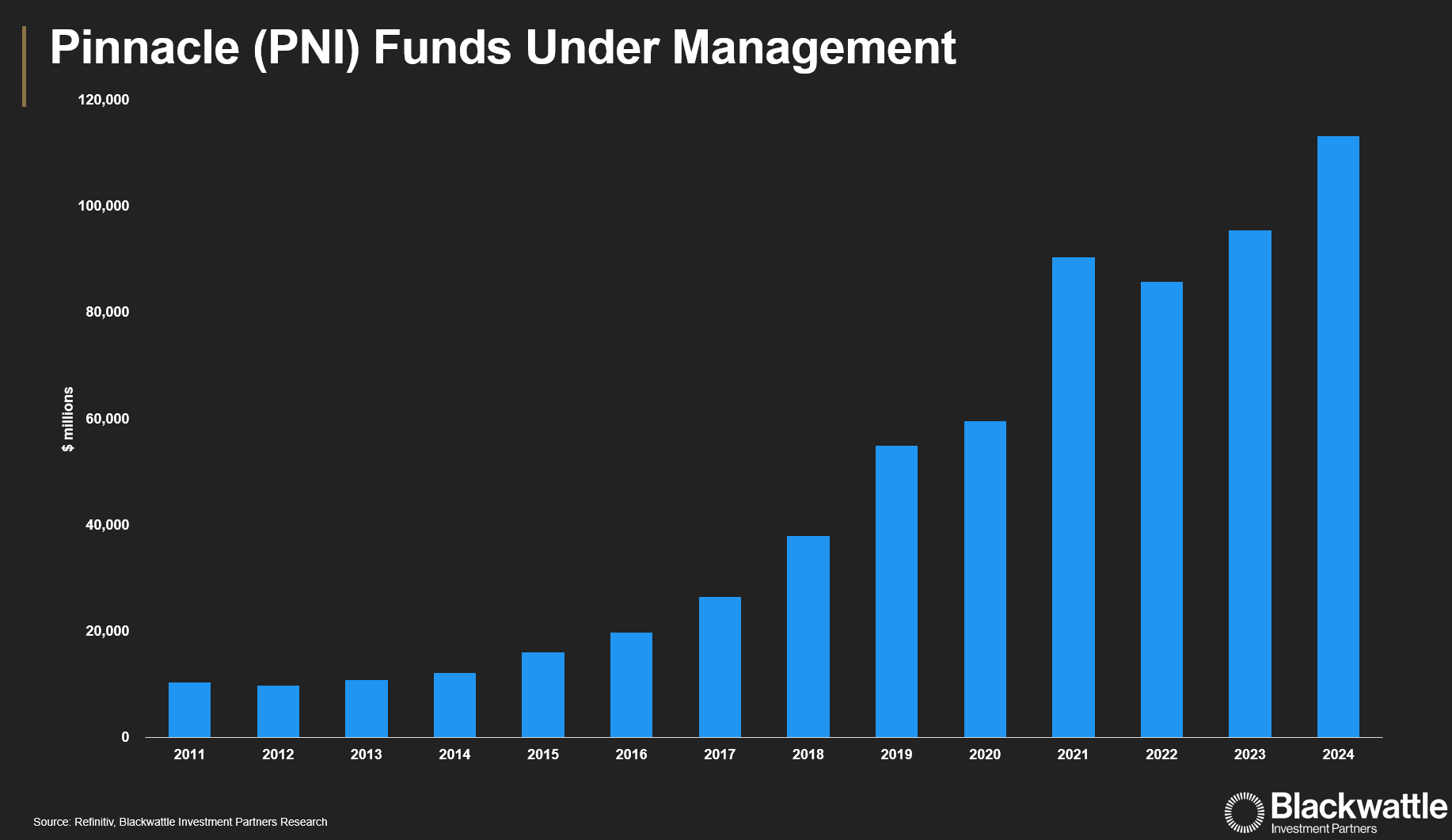

This is evident by remarkable growth in affiliate funds under management, which has increased $10bn in 2011 to over $110bn in 2024.

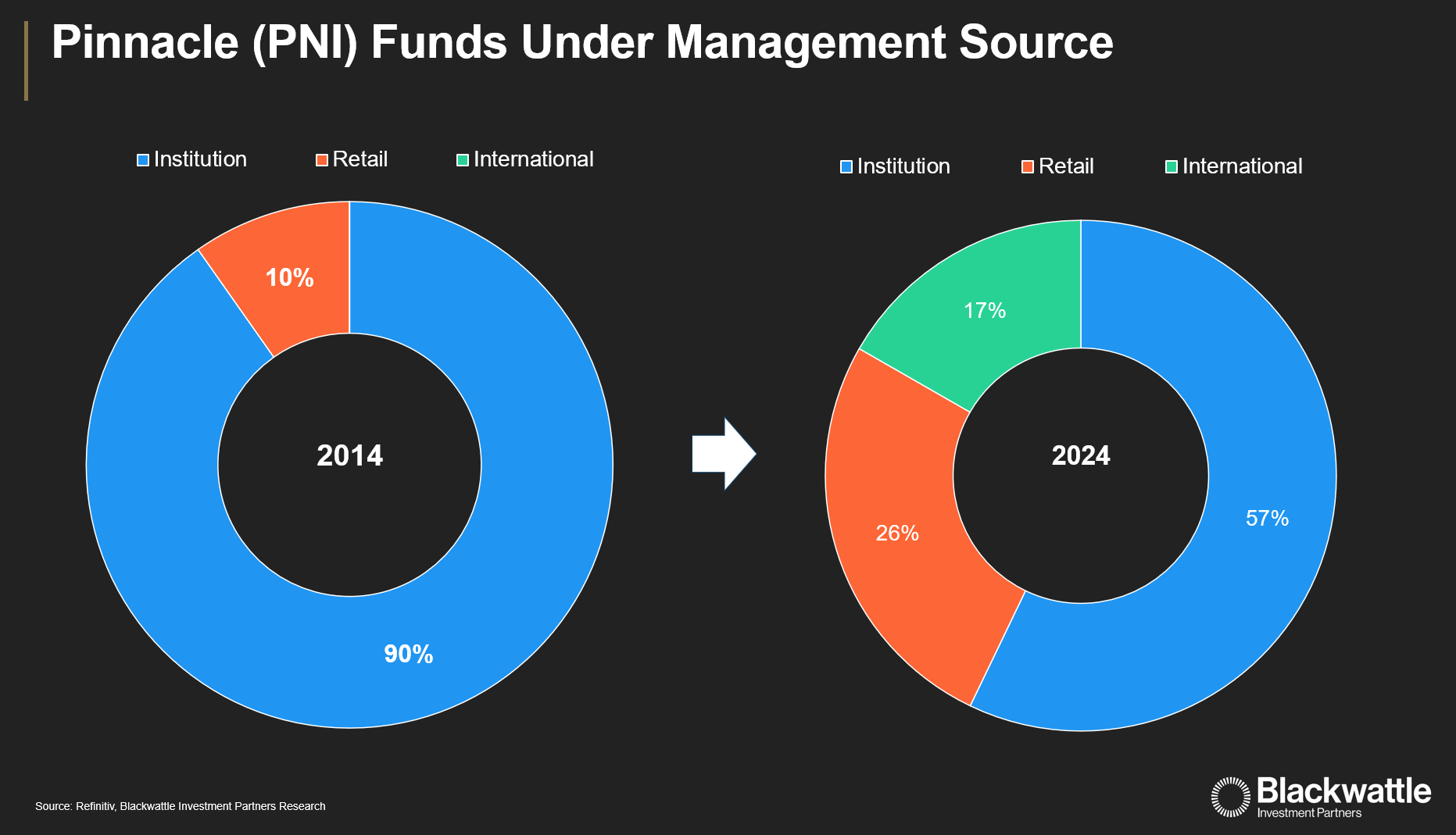

Macoun's’ founder-driven mentality has helped Pinnacle diversify across asset classes and international markets. Currently, 21% of Pinnacle’s strategies focus on private markets, while international assets have grown to $35 billion.

This diversification has cushioned industry headwinds faced by traditional managers, while capitalizing on the demand for alternative investments.

Sources of funds under management have also become more diversified, with growth increasingly skewing to international and retail investors, with wholesale sources reducing to approx. 57% of funds under management.

Sources of performance fee related strategies have also grown, defying industry trends, with 25 strategies having the ability to attract performance fees, representing 35% of FUM.

The ability to attract new managers has been one of the many successful attributes of Pinnacle, and an ever-growing source of value creation for shareholders. The model is highly scalable, without a proportionate increase in costs, and it’s rare for Pinnacle to pay to acquire talent, leading to high rates of return on capital for shareholders.

For Pinnacle shareholders, this has translated into EBIT growing from $12m in 2017 to over $97m in 2024, and strong cash generation.

Much of this comes down to Macoun’s track record of sourcing, developing and cultivating investment talent to create strong franchises, such as the recent signing of new international equity manager Lifecycle Investment Partners.

This impeccable track record has led to a strong share price performance, and premium enterprise value to EBIT valuation of 27x. However, if Macoun and the Pinnacle management team can replicate their historic success over the next decade, then this premium will be warranted.

To quote Ian Macoun

“We remain so confident of our company's ability to grow and prosper, which is our distinctive business model that was designed specifically to ensure sustained investment excellence. This is embodied in our DNA, call it our core ideology or fundamental beliefs, which are the basis on which our business was built, and which will endure and guide us for many years, hopefully, decades into the future. This is the source of our competitive advantage. The most talented and experienced investment professionals love it. Importantly, their clients love it. It delivers stability and sustainability of it, which traditional investment institutions are less able to facilitate. We are experts at the multi-affiliate model, which we have been successfully executing on for two decades. We execute on it better than others. “

3. Reece Limited (ASX: REH)

Reece Limited is an Australian supplier of plumbing, waterworks, and HVAC products, operating a network of over 660 stores in Australia and more than 240 stores in the USA. Led by CEO Peter Wilson and majority-owned by the Wilson family since the 1970s, Reece embodies a customer-centric business philosophy, known as the “Reece Way".

The philosophy is underscored by creating customers for life – delivering exceptional customer satisfaction and a focus on quality products and reliability.

This is achieved by empowering the branch manager to foster an entrepreneurial spirit, drive accountability and continuously innovate, with the branch owner directly controlling the branch profit and loss statement, and sharing in the profit.

To quote CEO Peter Wilson:

"Our blueprint guides what we do across our business. We are a purpose- and values-led organization, and our 2030 vision used to be our trades most valuable partner. Our three strategic priorities help bring our vision to life, and each of these elements come together to help us deliver on our promise of customized service. This long-term approach guides us in everything we do and enables us to build a stronger business."

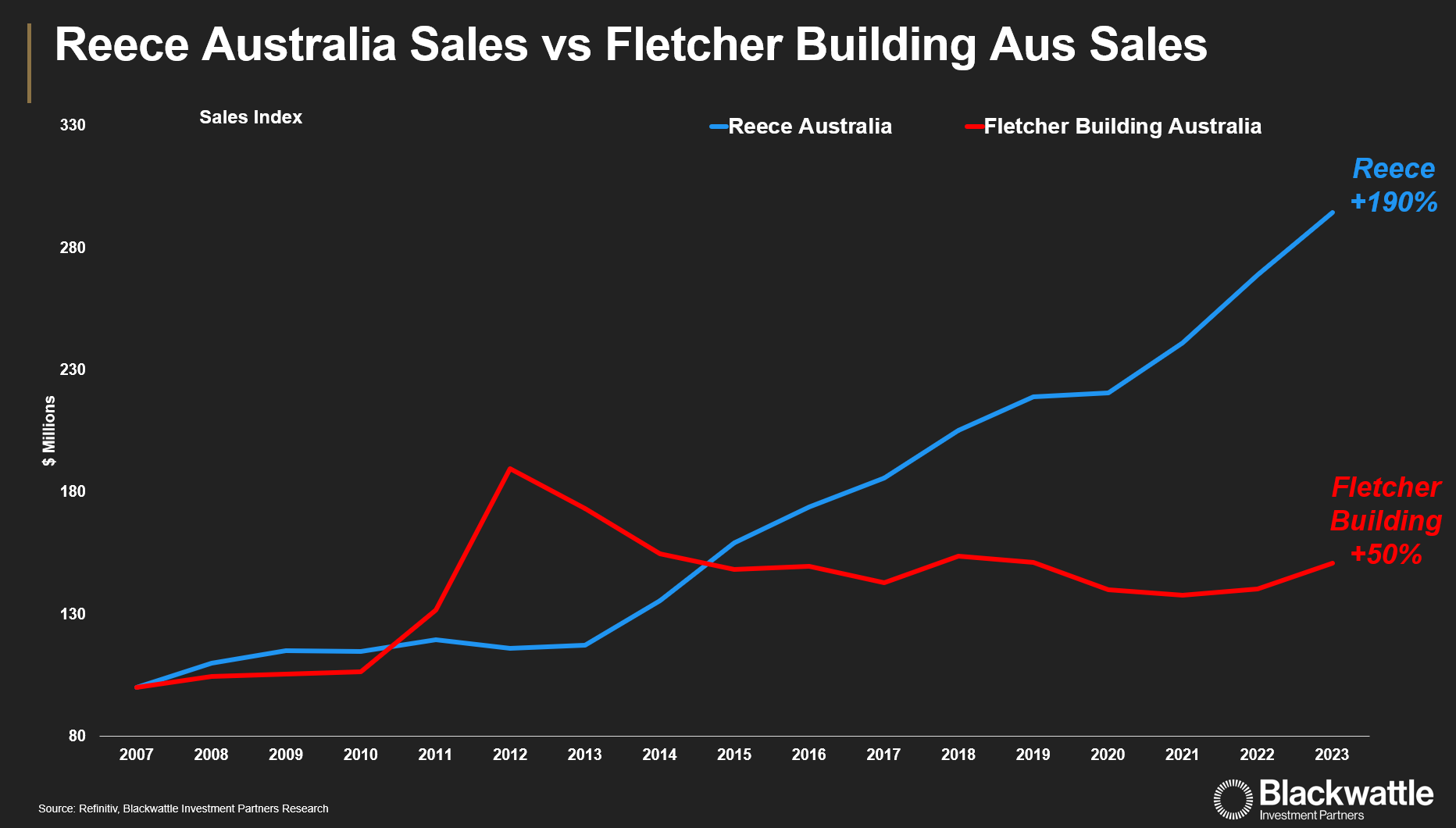

In Australia, Reece has grown its market share to over 50%, predominantly through organic growth. The combination of a dense branch network, leading industry service levels, wide product skews and technology that enables greater plumber productivity has increased the gap with competitors, most notably Tradelink, previously owned by Fletcher Building.

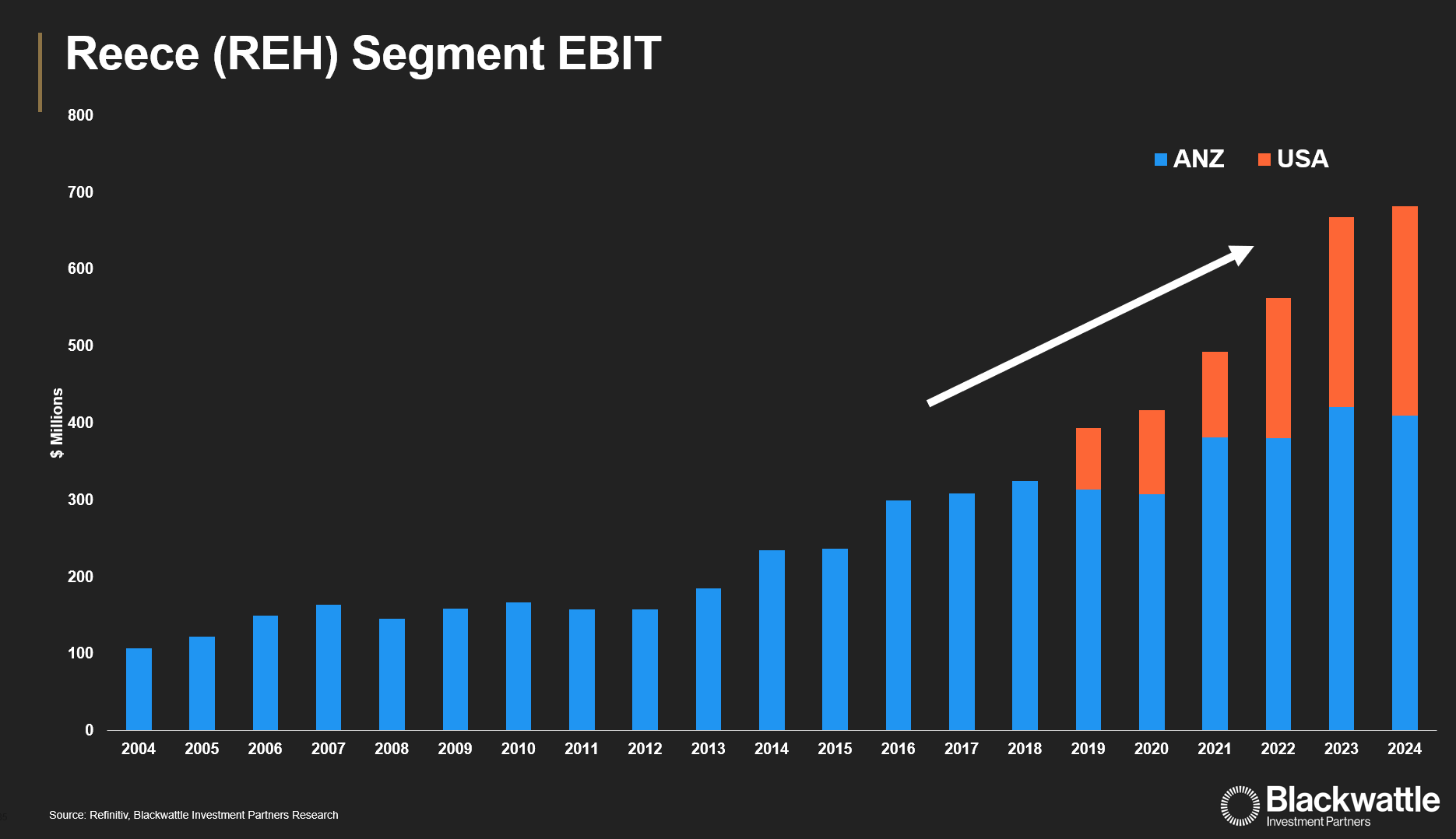

While Fletcher Building didn’t separately disclose Tradelink sales, indexing Reece Australia sales growth to the Fletcher Building Australian segment has shown Reece's significant outperformance. The recent sale of Tradelink also confirmed negligible earnings, while Reece Australia’s EBIT have grown from $157m in 2012 to $410m in 2024.

The acquisition of Morsco for $1.9bn in 2018 provided the Wilson family a springboard into the USA market. At the time of the acquisition, the Wilsons also contributed $300m of their own funds into the entitlement offer.

Since the acquisition was made, Reece has made substantial progress. Morsco has largely been rebranded as Reece, and management has embedded its operating culture and the 'Reece Way' of doing business, rolling out its technology platform across the network.

The benefits of the "Reece Way" are becoming increasingly evident. USA sales have grown from $3bn in 2020 to over $5.2bn in 2024, representing a CAGR of 13%. EBIT has also grown from $109m in 2020 to $272m in 2024, with EBIT margin increasing 200pts over the same period.

Despite the improvement, there is further scope to increase profitability, as Reece’s USA EBIT margin of 5.2% is well below the Australian division of 10.7%, and low compared with USA giant Fergusons of 9.3%.

While at the time it did seem like Reece was paying a full price for Morsco, the growth in earnings since 2018 imply Morsco has been a very good acquisition.

While the USA market is dominated by Fergusons with over $28bn of sales, the market is still fragmented and is valued at $126bn, providing scope for market consolidation. For example, in 2023-24, Ferguson consolidated $850m of acquisitions, adding over $650m of revenue. For Reece, the long-term opportunity is to grow scale (+10 to +12 new branches pa) and increase market share.

Recently Reece has underperformed due to cyclical headwinds in both Australia and the USA. However, in our view, housing shortages and an aging housing stock are expected to be long-term growth drivers for Reece. While Reece’s premium valuation of 26x enterprise value to EBIT may be a limiting factor for some investors, we believe investors will use any de-rating as an opportunity to align themselves with the Wilson family given their strong track record of effective execution and the growth potential in the US market.

4. News Corp (ASX: NWS)

News Corp owns some of ASX’s highest-quality assets, including a 61% share in REA Group (REA), the Dow Jones media empire (which includes The Wall Street Journal), and HarperCollins, one of the world’s largest book publishers.

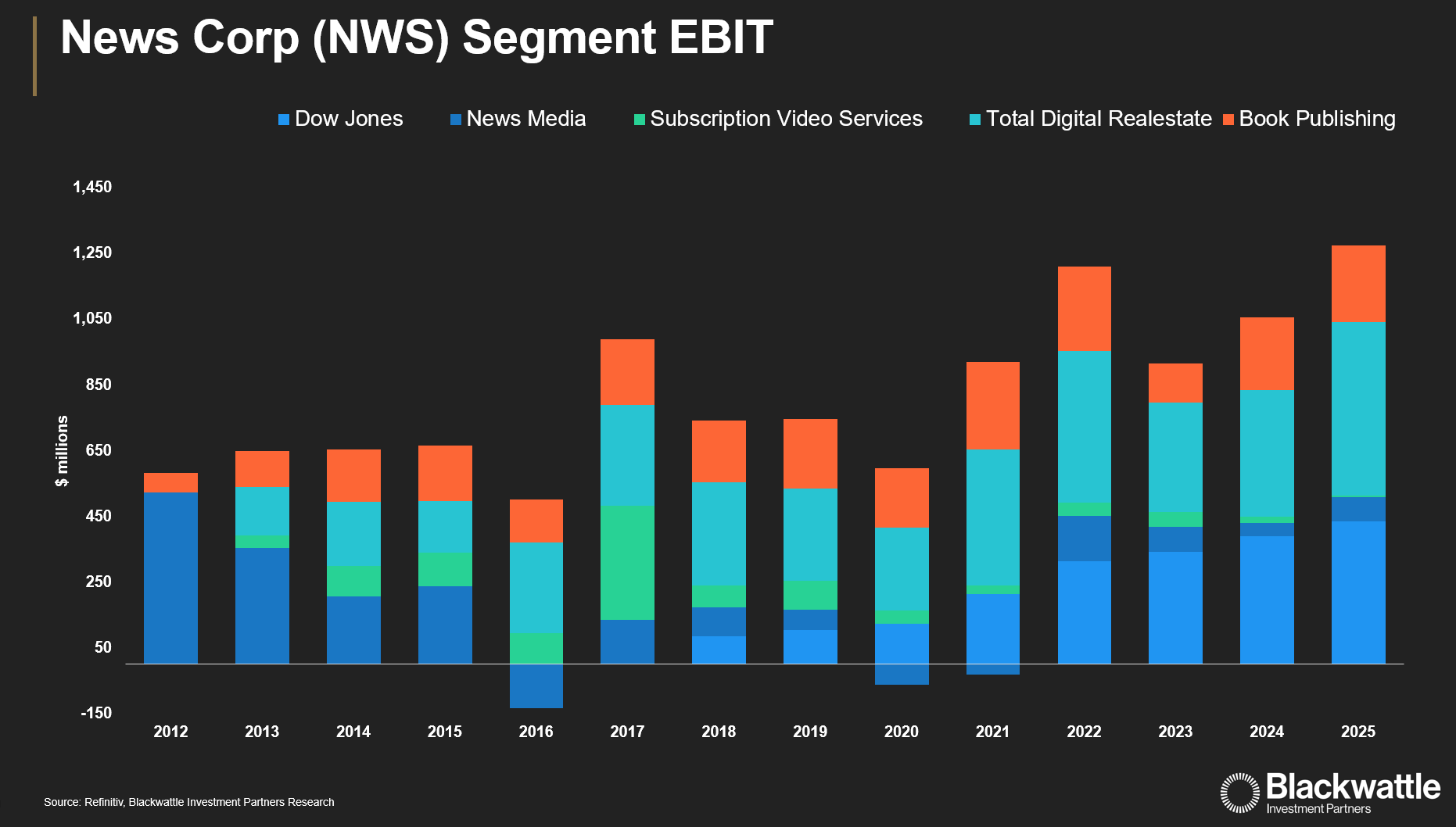

Under the leadership of Executive Chairman Lachlan Murdoch and CEO Robert Thomson, News Corp has evolved from a traditional media conglomerate into a company with rapidly growing digital assets, which now contribute over 70% of group EBIT.

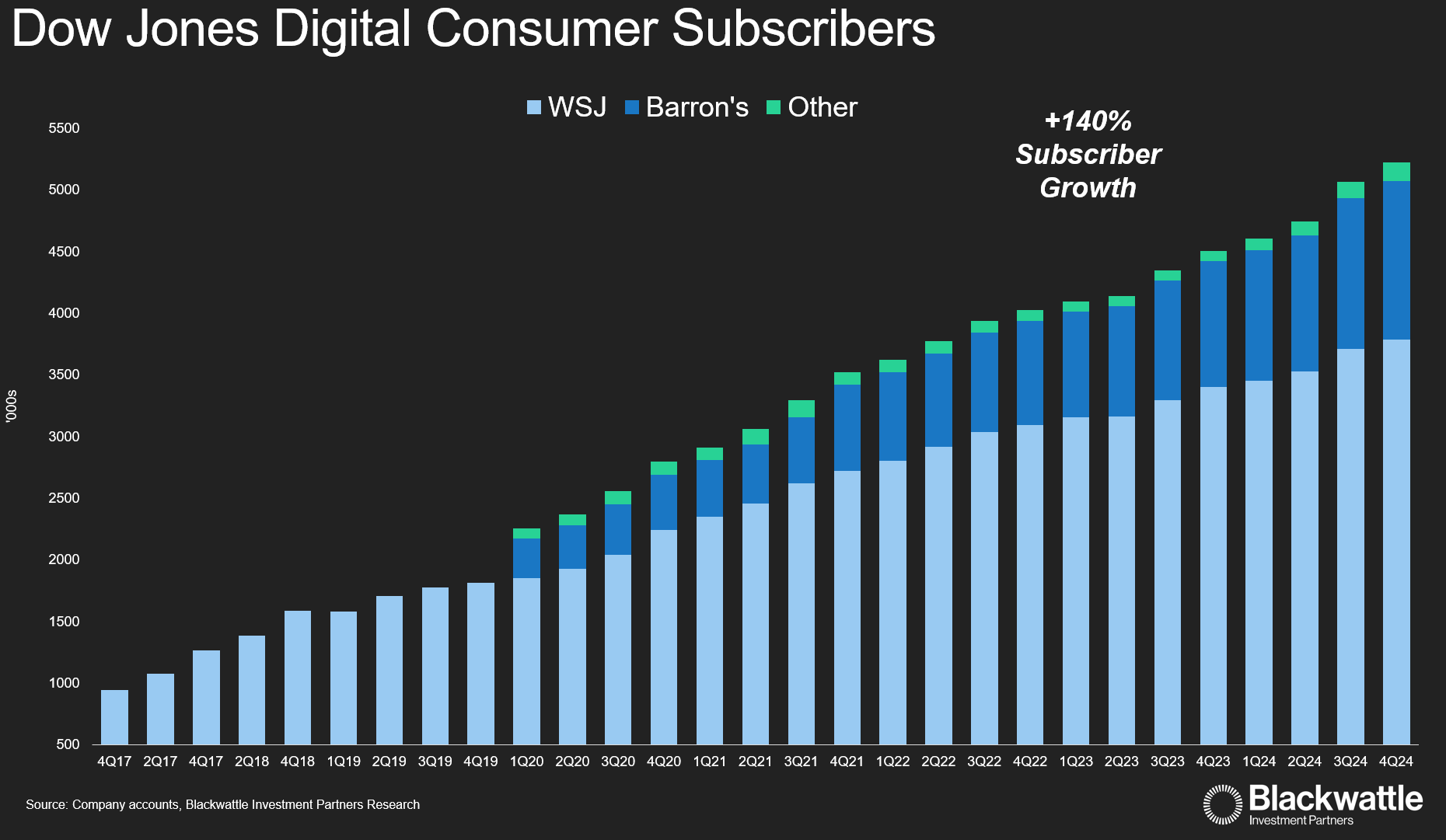

Digital subscriptions, particularly to The Wall Street Journal and Barron’s, have grown by 140% to over 5.2 million since 2019. The Dow Jones division is also benefiting from rising demand for data, essential to training AI platforms, with News Corp executing a licensing deal with OpenAI, valued at $250 million over five years.

News Corp’s 61% investment in REA Group, Australia’s leading property portal, remains a core asset which has significant pricing power. Realestate.com.au is a must-have for agents, and provides end-to-end agency solutions, property data, and digital tools.

The Murdoch Family Trust controls about 40% of voting shares, with a 14% economic interest. Governance risks such as a dual-class shareholding structure and Delaware domicile have led to a permanent embedded discount in News Corp’s valuation, frustrating investors including ourselves.

However, since Lachlan Murdoch ascended to the Chairman position, changes have been afoot. Management rhetoric has shifted to focus more on shareholder value creation, with steps taken to improve governance, including terminating the "poison pill" clause, capping the Murdoch family interest and initiating asset sales to unlock value.

According to CEO Robert Thomson:

“We believe the company’s prospects are patently propitious, and we are also continuing to review our portfolio with a view to maximising returns to shareholders… the strategic imperative is to transform the company and increase value for all shareholders. We are in the midst of an exponential digital revolution, and our own company has continued to change significantly and profitably”.

Conclusion

Recent events have highlighted that not all founder-led CEOs are alike, underscoring the importance of strong governance.

As Johnny Cash once said, “Everyone I know goes away in the end,” emphasizing that without checks, even the best entrepreneurial vision can be overshadowed by the need for sound governance. A strong board is essential for protecting shareholder interests, and founders should build aligned, capable management teams that can carry their vision forward.

These four ASX founder-led companies, each facing distinct challenges and operating under varying levels of established governance, demonstrate the benefits of founder leadership. They showcase how a long-term vision and strong alignment with shareholder interests make them worth watching closely.

3 topics

10 stocks mentioned