Four Key Charts for Residential Mortgage-Backed Securities

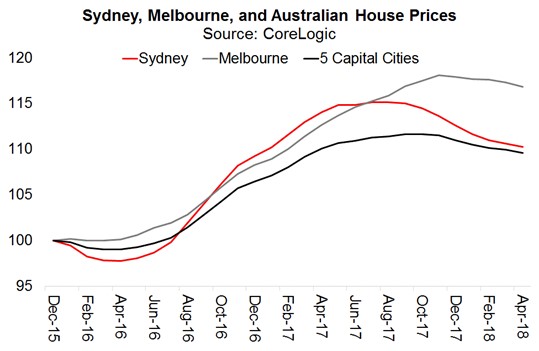

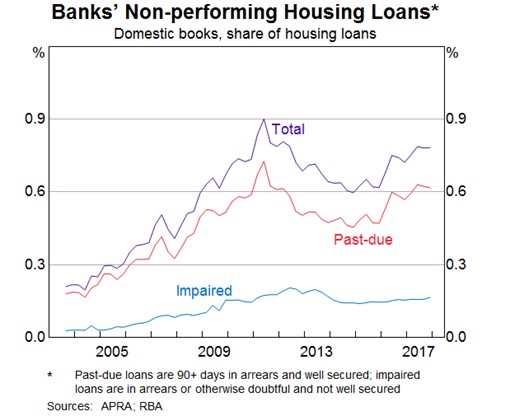

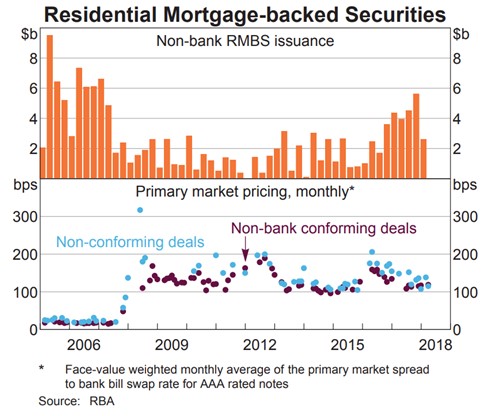

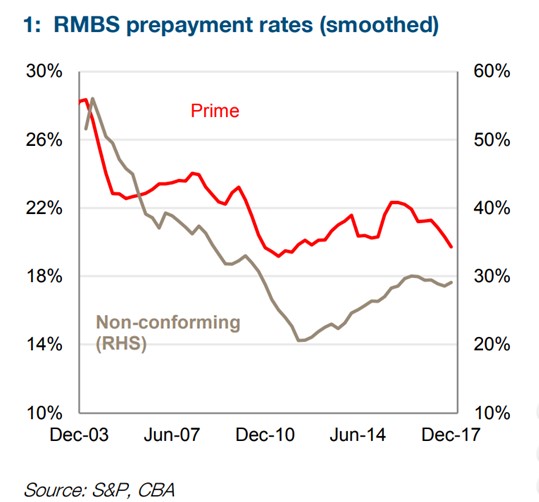

I've been asked by a few clients why we exited our circa $250m position in AAA rated RMBS, which was a modest ~10% portfolio exposure that had performed brilliantly over 2017. The four charts below summarise why: house prices are falling; default rates are rising; supply of RMBS has surged while spreads have fallen; and, finally, borrower prepayments are declining, which is blowing-out the weighted average life of these bonds and adversely affecting prices.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Chris co-founded Coolabah in 2011, which today runs over $8 billion with a team of 40 executives focussed on generating credit alpha from mispricings across fixed-income markets. In 2019, Chris was selected as one of FE fundinfo’s Top 10 “Alpha Managers” based on his risk-adjusted performance throughout his career across. He previously worked for Goldman Sachs in London and Sydney, the Reserve Bank of Australia, and founded the award‐winning research/investment group, Rismark. He has regularly advised governments, developing unique policy proposals. Chris graduated with the University Medal (Economics & Finance) from Sydney University. He studied in the PhD program at Cambridge University in 2002/03, leaving to set up his funds business.

2 topics

Comments

Comments

Sign In or Join Free to comment