Four wires that caught my eye

Get the best of Livewire in your inbox each Saturday morning. Sign up for the Livewire Weekly here: (VIEW LINK)

Five ASX100 stocks to buy in September

Morgans’ monthly high conviction buys list always sees strong traffic on the Livewire platform. These are companies that they think can grow against a lacklustre economic environment. In addition to their updated views on the existing picks, there’s a very interesting new entry to the list from the healthcare space. Get the latest on large-caps here: (VIEW LINK)

Two hot thematics we’re avoiding

Outdoor advertising and Chinese consumer facing stocks have been hot topics recently, but Chris Stott, Chief Investment Officer of Wilson Asset Management, thinks the party could be over. Though the outlook for outdoor advertisers is holding up, Stott believes the sector looks fully priced. Chinese consumer stocks, however, face regulatory headwinds that could derail their high-growth plans. In this wide-ranging video, he shares his outlook for the overall market, and one stock he likes: (VIEW LINK)

Even insiders think yield stocks are overpriced

We recently spoke with Giselle Roux, Chief Investment Officer of Melbourne-based wealth manager, Escala Partners. The entire interview was fascinating, and you can see her in Trending on Livewire next week, but as a Livewire Weekly reader, you can get the first look here. Her comments really drive home the difficulty in finding returns in this market. So to get a different view on Australian banks, resources, ‘bond-like’ stocks, and growth stocks, check out the latest Livewire Exclusive: (VIEW LINK)

Nine quality LICs at a discount

Ever since the Federal Government enacted its Future of Financial Advice reforms in 2013, there has been a renewed interest in Listed Investment Companies (LICs). However, with so many options on the ASX these days, it can be difficult to know where to start. Peter Rae from Independent Investment Research has shared their monthly LIC report, and it’s essential reading for any LIC investor. This month, he takes a look at some LICs with a strong track record over three years but are trading at a discount to their net tangible assets: (VIEW LINK)

Chart of the week

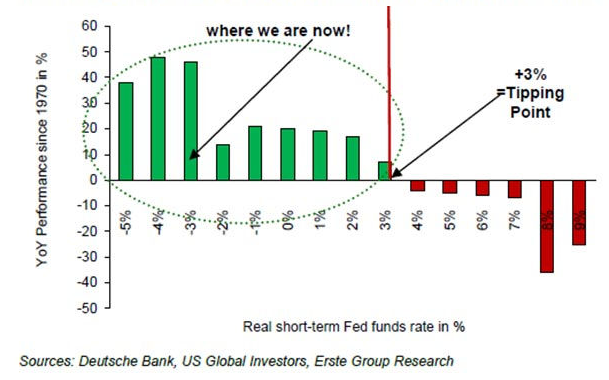

How far can the gold bull market run?

This chart demonstrates just how supportive current rates are for a robust gold price. It shows what the historical annual gold performance (y-axis) has been, during a range of different ‘real rate’ levels (x-axis). The chart infers that US real rates would need to be 600 basis points higher than they are now before gold would stop rising.

Get the best of Livewire in your inbox each Saturday morning. Sign up for the Livewire Weekly here: (VIEW LINK)

5 topics