Geopolitics, rate hikes and inflation: what’s driving gold?

Gold prices have started 2022 positively, rising by 5% to more than 1,900 US dollars and 2,600 Australian dollars per troy ounce (oz) in the first two months of the year.

The conflict between Russia and Ukraine is one factor behind the rise, while a 9% YTD decline in the S&P 500, a crash in cryptocurrencies (Bitcoin is -40% since its peak in November 2021), and continued inflationary pressures are also helping to boost gold.

Demand for precious metals has also increased, with bar and coin sales continuing to surge, while globally, gold ETFs are also seeing inflows (+2% YTD), a reversal of fortune compared to 2021, when holdings fell by 5%.

Australian investors, especially SMSF trustees, are part of this trend, with holdings in locally listed gold ETFs like Perth Mint Gold (ASX:PMGOLD) hitting all-time highs in 2022.

The role that gold can play in SMSF portfolios is a subject we address in The Perth Mint’s latest whitepaper The return of inflation: Why gold is one of the highest performing asset classes investors can own.

The whitepaper covers a range of topics, starting with the key reasons gold prices pulled back in 2021, including a combination of very strong equity markets, a rising USD, better than expected economic growth and rising real bond yields in the first part of last year).

This pullback, which needs to be put into context given gold rallied circa 70% between Q3 2018 and Q3 2020 in US dollar terms, was in many ways a healthy development, leaving the precious metal on more solid footing as this year begun.

Higher rates to kickstart next leg higher in gold bull market?

While the tragedy unfolding in the Ukraine may either delay or at a minimum slow the pace of rate hikes in parts of the developed world, the market is in little doubt that rates are heading higher in 2022.

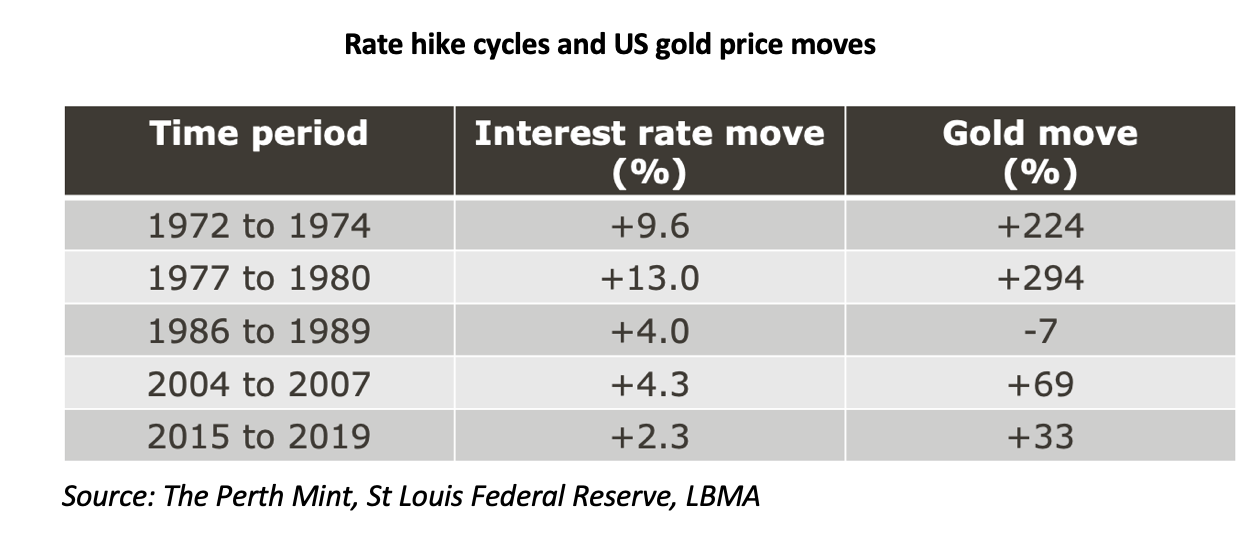

While many instinctively see rate hikes as a reason to be bearish on gold, history suggests rate hikes may prove a catalyst for higher, not lower gold prices. This is captured in the table below, which shows the performance of gold in previous rate hike cycles in the United States.

Volatility and the Australian dollar

The whitepaper also covers five strategic reasons to consider including gold in a portfolio, given its one of the few assets that has historically offered both protection when its needed most, as well as long-term growth.

That growth, which has seen prices rise by approximately 9% p.a. over the last 50 years, and by almost 20% in years real interest rates are 2% or lower, is often overlooked in the debate surrounding gold’s potential role in a portfolio, given its sometimes looked at purely as a tactical safe haven.

Gold’s volatility is also addressed. While the precious metal has been slightly more volatile than equities over the long-run, there are three points worth remembering when it comes to this;

- Gold is typically negatively correlated to equities when equities are selling off, helping protect portfolios in periods of stress.

- Studies show blending equities and gold together will often result in a portfolio with lower volatility compared to the two asset classes.

- Gold’s volatility is driven more by sharp upside moves, relative to downside moves.

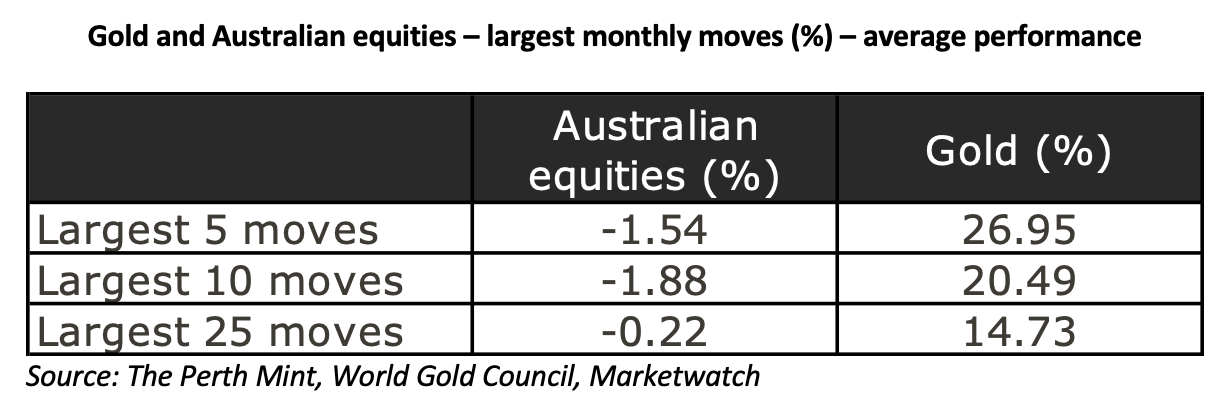

That final point is demonstrated in the below table, which shows the average performance for both gold and Australian equities in the largest five, 10 and 25 monthly performance moves (positive or negative) since the 1970s.

While the larger moves in equities tend to be to the downside, it’s the exact opposite for gold.

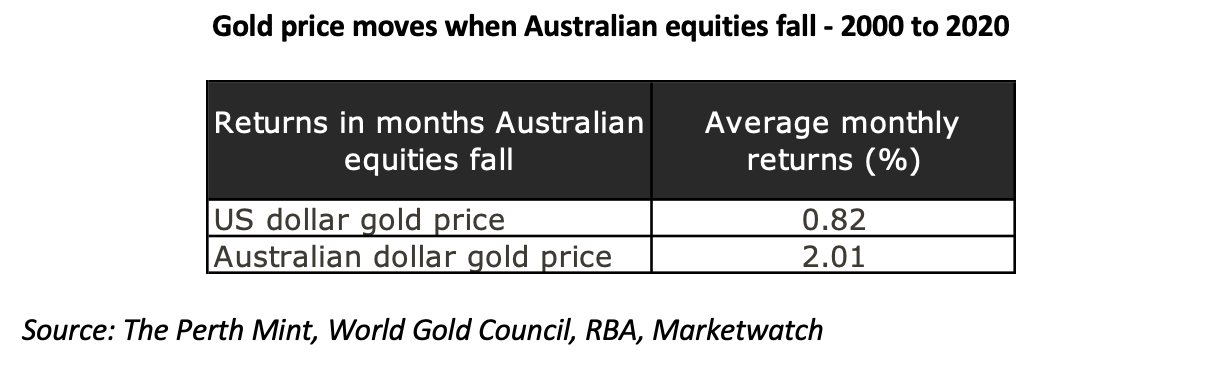

For Australian investors looking to hedge equity market risk, gold may prove to be particularly effective.

Since the turn of the century, the Australian dollar has fallen vs the US dollar 60% of the time the local equity market has seen a monthly decline, with an average decline of 3.5% for the currency in those months. In the 40% of times the Australian dollar has risen, its average increase was just 2.6%.

This currency effect has been worth almost 1.2% in terms of the enhanced portfolio returns Australian investors would get from holding gold in months equities have declined.

Finally, the whitepaper also takes a look at inflation dynamics in the market today, highlighting several reasons it could prove to be a major challenge to investors for most of the coming decade.

These include ongoing supply chain issues, and corporations looking to onshore, two trends that will only be exacerbated by the current geopolitical environment, while climate change/net-zero initiatives are also likely to put upward pressure for the foreseeable future.

Lastly, markets move in cycles. For most of the last 40 years we’ve had declining rates of inflation, with average CPI rates in the United States for the decade to the end of 2020, their lowest in 70 years.

Given this backdrop, a sustained period of heightened inflationary pressure should be no great surprise, with the COVID pandemic, and the policy response to it representing an obvious turning point in this regard.

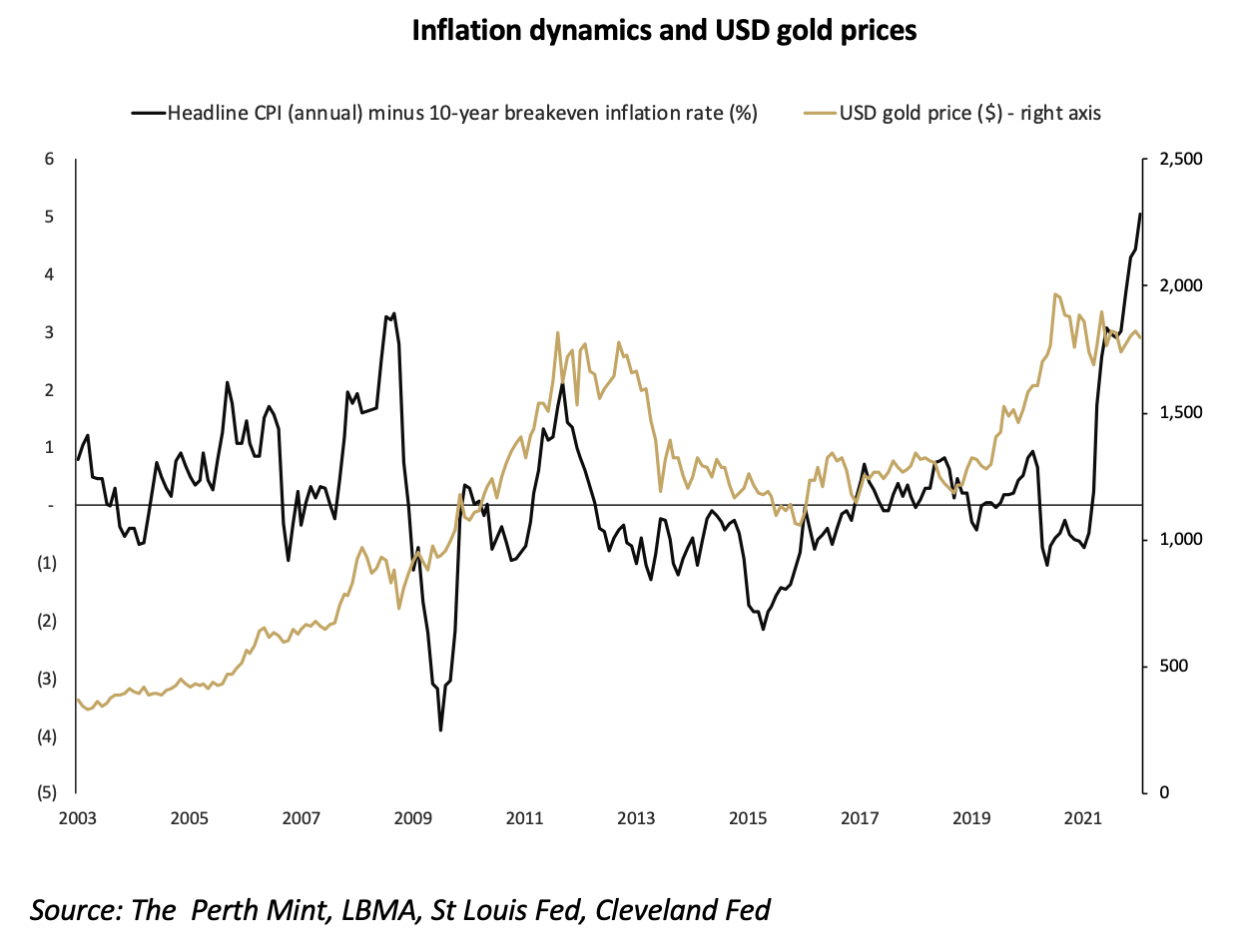

Going forward, higher rates of inflation may prove to be a powerful catalyst for gold, for the simple reason that markets have yet to price in meaningful long-term inflationary pressures.

This is seen in the chart below, which shows a record 5% gap between the headline annual inflation rate (7.5% in Jan 2022) and the 10-year breakeven inflation rate (2.44% at end January) in the United States.

.png)

You can download the full Perth Mint whitepaper here.

4 topics

1 stock mentioned

1 fund mentioned

.jpg)

.jpg)